Exhibit 99.1

Hanmi Financial Corporation 14th Annual Financial Services Conference May 10, 2012

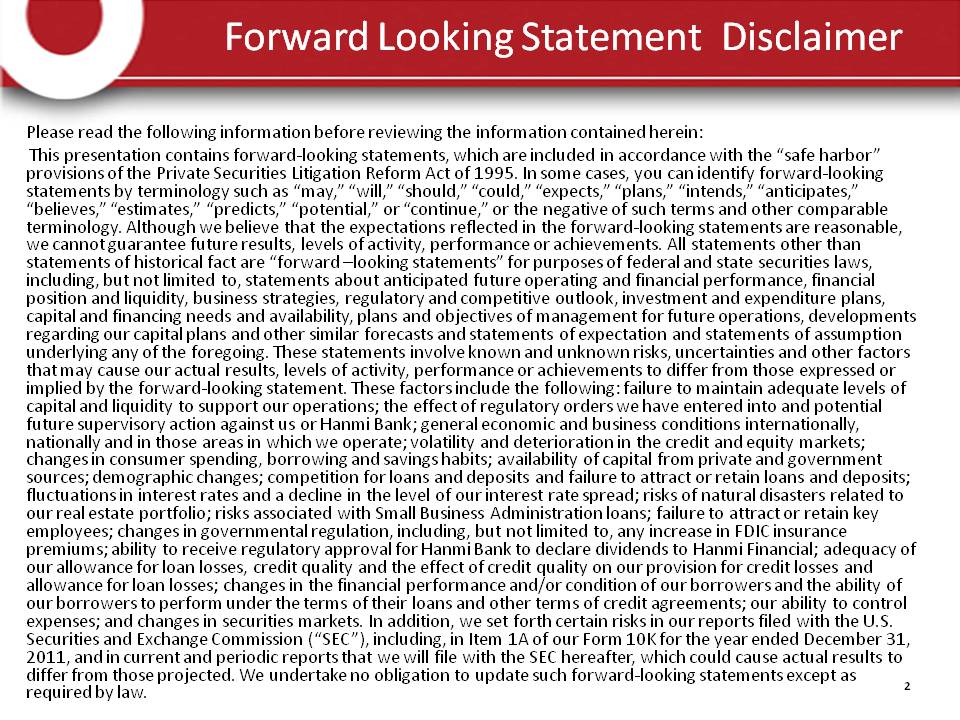

Forward Looking Statement Disclaimer Please read the following information before reviewing the information contained herein: This presentation contains forward‐looking statements, which are included in accordance with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward‐looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “plans,” “intends,” “anticipates,” believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of such terms and terminology. Although we believe that the expectations reflected in the forward‐looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. All statements other than statements of historical fact are “forward –looking statements” for purposes of federal and state securities laws, including, but not limited to, statements about anticipated future operating and financial performance, financial position and liquidity, business strategies, regulatory and competitive outlook, investment and expenditure plans, capital and financing needs and availability, plans and objectives of management for future operations, developments regarding our capital plans and other similar forecasts and statements of expectation and statements of assumption underlying any of the foregoing. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ from those expressed or implied by the forward‐looking statement. These factors include the following: failure to maintain adequate levels of capital and liquidity to support our operations; effect of regulatory orders we have entered into and potential the future supervisory action against us or Hanmi Bank; general economic and business conditions internationally, nationally and in those areas in which we operate; volatility and deterioration in the credit and equity markets; changes in consumer spending, borrowing and savings habits; availability of capital from private and government sources; demographic changes; competition for loans and deposits and failure to attract or retain loans and deposits; fluctuations in interest rates and a decline in the level of our interest rate spread; risks of natural disasters related to our real estate portfolio; risks associated with Small Business Administration loans; failure to attract or retain key employees; changes in governmental regulation, including, but not limited to, any increase in FDIC insurance premiums; ability to receive regulatory approval for Hanmi Bank to declare dividends to Hanmi Financial; adequacy of our allowance for loan losses, credit quality and the effect of credit quality on our provision for credit losses and allowance for loan losses; changes in the financial performance and/or condition of our borrowers and the ability of our borrowers to perform under the terms of their loans and other terms of credit agreements; our ability to control expenses; and changes in securities markets. In addition, we set forth certain risks in our reports filed with the U.S. Securities and Exchange Commission (“SEC”), including, in Item 1A of our Form 10K for the year ended December 31, 2011, and in current and periodic reports that we will file with the SEC hereafter, which could cause actual results to differ from those projected. We undertake no obligation to update such forward‐looking statements except as required by law. 2

Vision At Hanmi Bank we are committed to being regarded as the quality and market leader in the banking industry, thereby becoming the first choice of employees, customers and shareholders." Hanmi Bank Established in 1982, Hanmi Bank was founded to serve the Korean‐American Community. Since then, we have grown into one of the largest, premier Korean‐ American Banks in the United States. We believe in being a bank that gives happiness, a bank which makes contributions to the community, a bank that is loved, and a bank that is there for you. In other words, we will be the best bank, THE Bank of Choice." Hanmi Bank CHANGING THE WAY YOU LIVE Life gets better 3

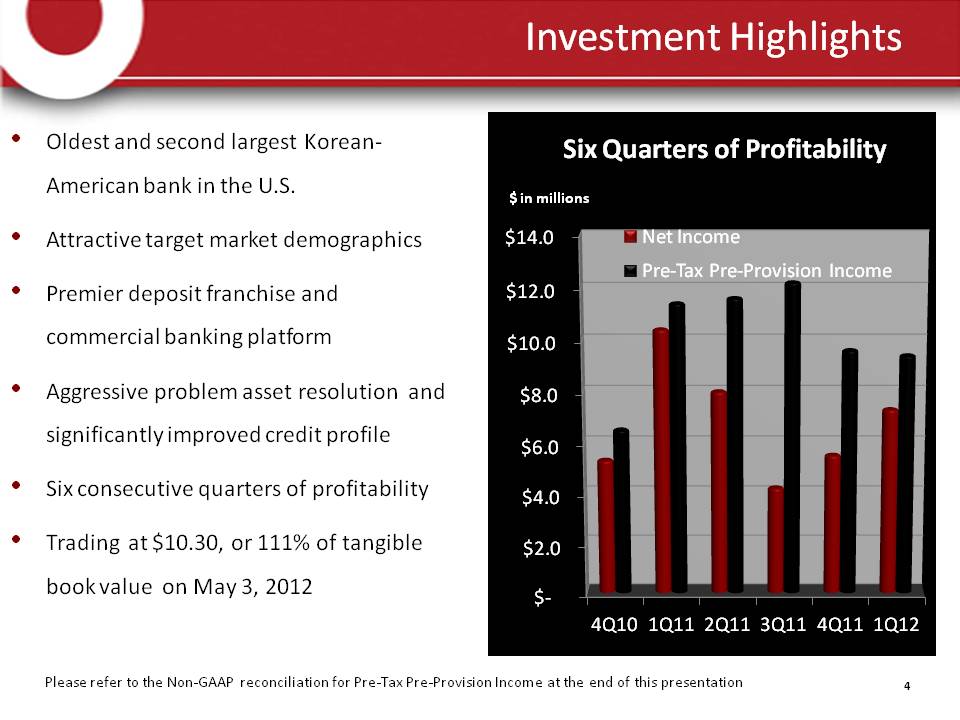

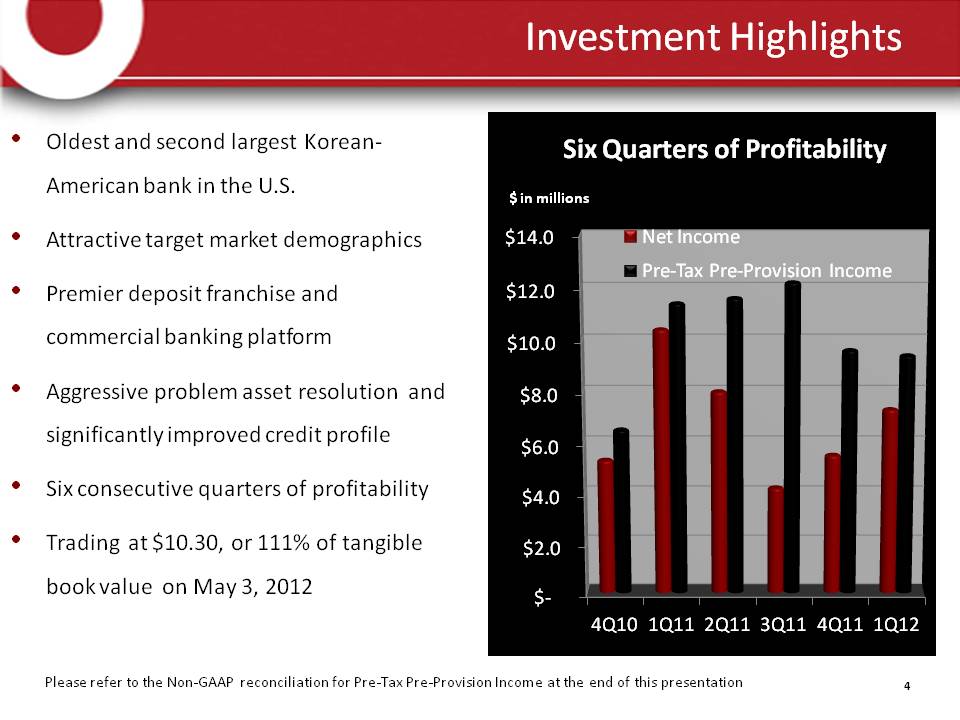

Investment Highlights Oldest and second largest Korean‐ American bank in the U.S. Attractive target market demographics Premier deposit franchise and commercial banking platform Aggressive problem asset resolution and significantly improved credit profile Six consecutive quarters of profitability Trading at $10.30, or 111% of tangible book value on May 3, 2012 Six Quarters of Profitability $ in millions Net Income Pre‐Tax Pre‐Provision Income $‐ $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 Please refer to the Non‐GAAP reconciliation for Pre‐Tax Pre‐Provision Income at the end of this presentation 4

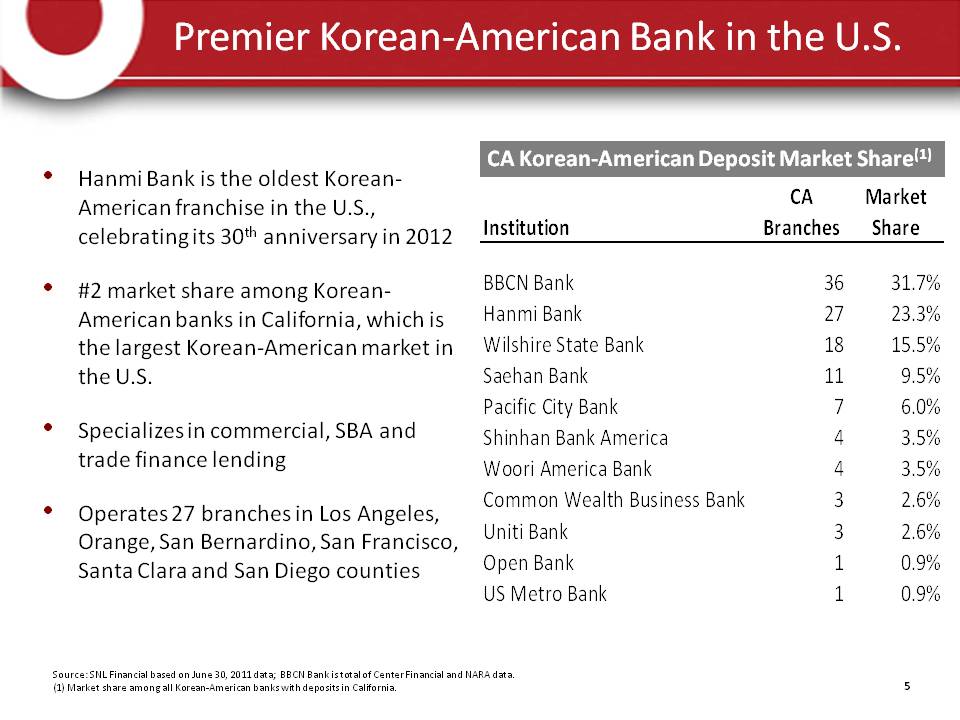

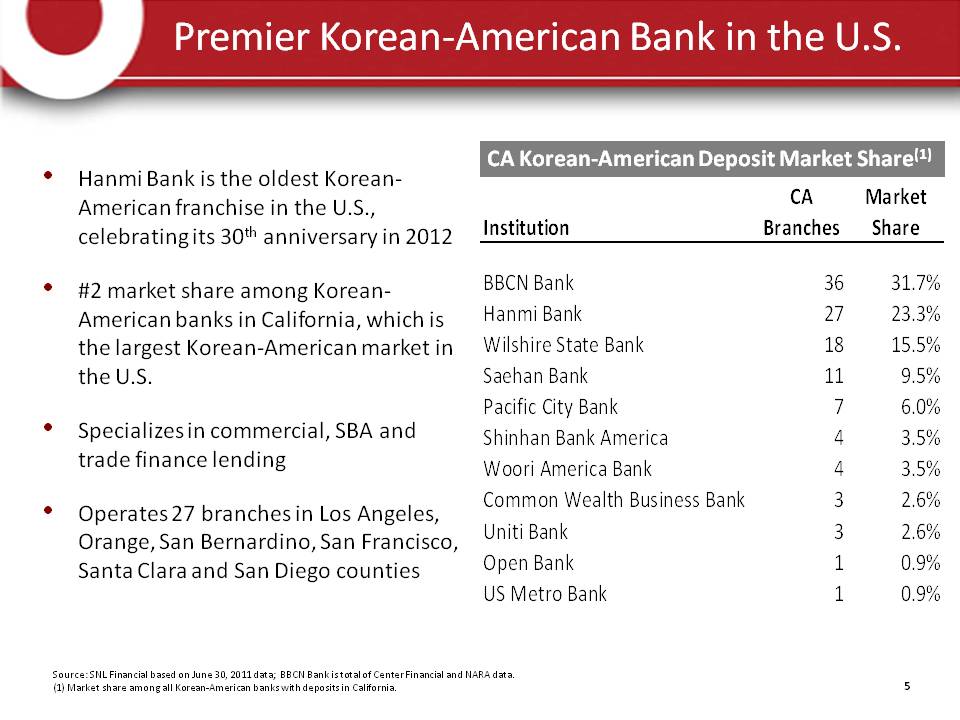

Premier Korean‐American Bank in the U.S. Hanmi Bank is the oldest Korean‐American franchise in the U.S., celebrating its 30th anniversary in 2012 #2 market share among Korean‐American banks in California, which is the largest Korean‐American market in the U.S. Specializes in commercial, SBA and trade finance lending Operates 27 branches in Los Angeles, Orange, San Bernardino, San Francisco, Santa Clara and San Diego counties CA Korean‐American Deposit Market Share(1) Institution CA Branches Market Share BBCN Bank 36 31.7% Hanmi Bank 27 23.3% Wilshire State Bank 18 15.5% Saehan Bank 11 9.5% Pacific City Bank 7 6.0% Shinhan Bank America 4 3.5% Woori America Bank 4 3.5% Common Wealth Business Bank 3 2.6% Uniti Bank 3 2.6% Open Bank 1 0.9% US Metro Bank 1 0.9% Source: SNL Financial based on June 30, 2011 data; BBCN Bank is total of Center Financial and NARA data. (1) Market share among all Korean‐American banks with deposits in California. 5

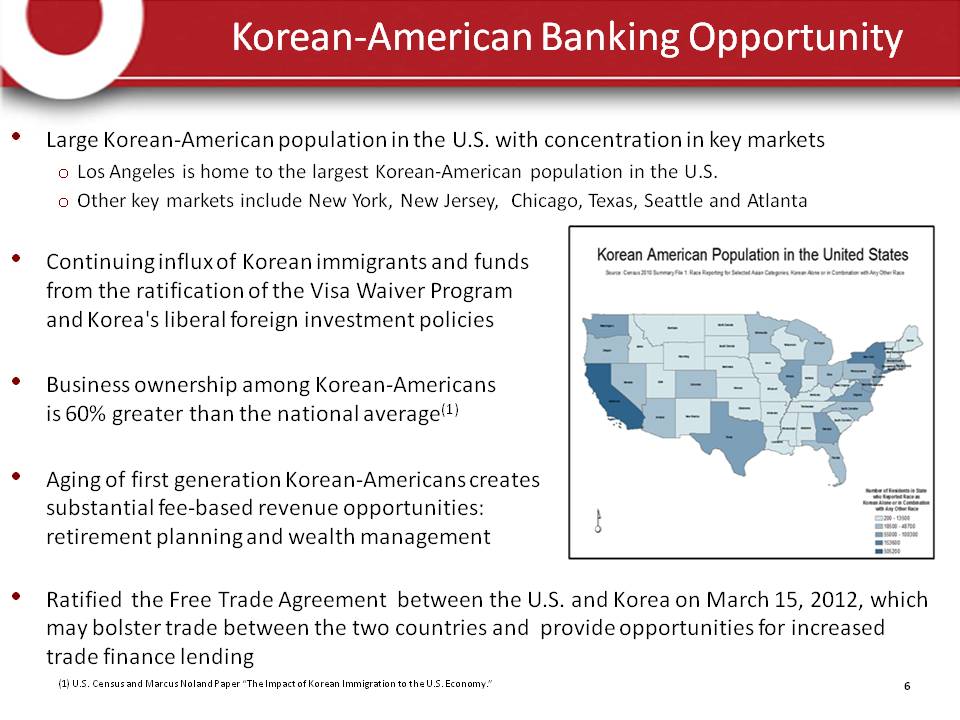

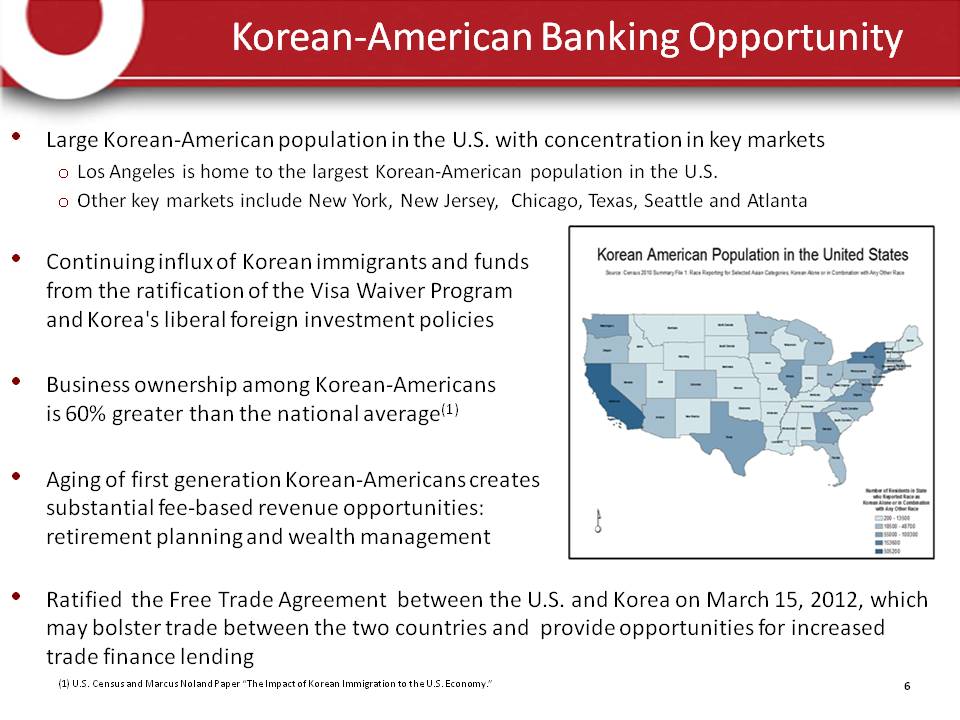

Korean‐American Banking Opportunity Large Korean‐American population in the U.S. with concentration in key markets Los Angeles is home to the largest Korean‐American population in the U.S. Other key markets include New York, New Jersey, Chicago, Texas, Seattle and Atlanta Continuing influx of Korean immigrants and funds from the ratification of the Visa Waiver Program and Korea's liberal foreign investment policies Business ownership among Korean‐Americans is 60% greater than the national average(1) Aging of first generation Korean‐Americans creates substantial fee‐based fee revenue opportunities: retirement planning and wealth management Ratified the Free Trade Agreement between the U.S. and Korea on March 15, 2012, which may bolster trade between the two countries and provide opportunities for increased trade finance lending (1) U.S. Census and Marcus Noland Paper “The Impact of Korean Immigration to the U.S. Economy.” 6

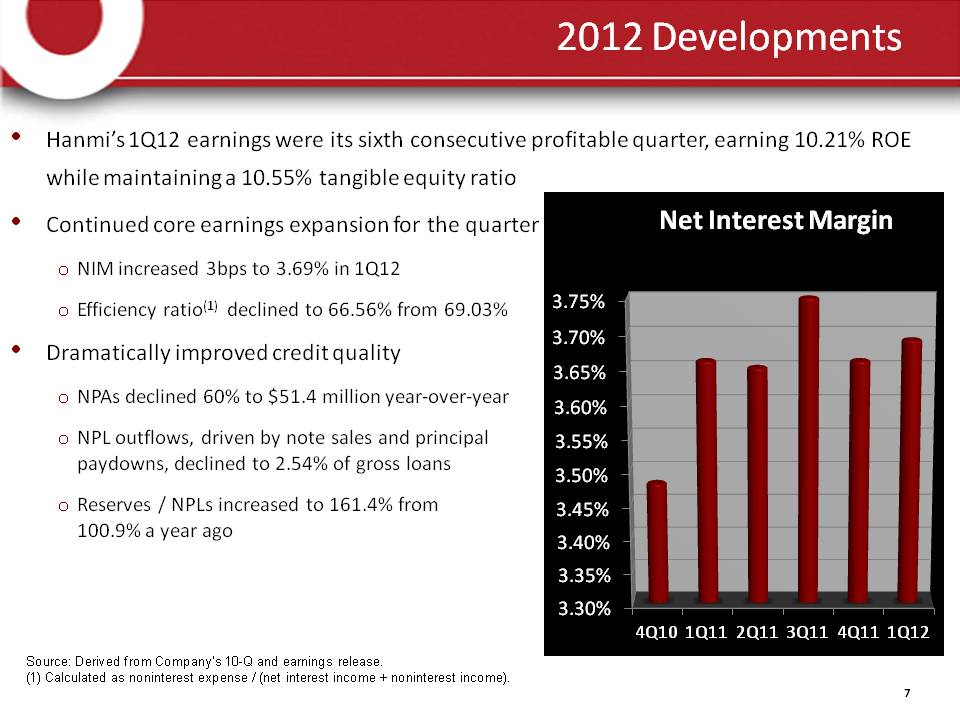

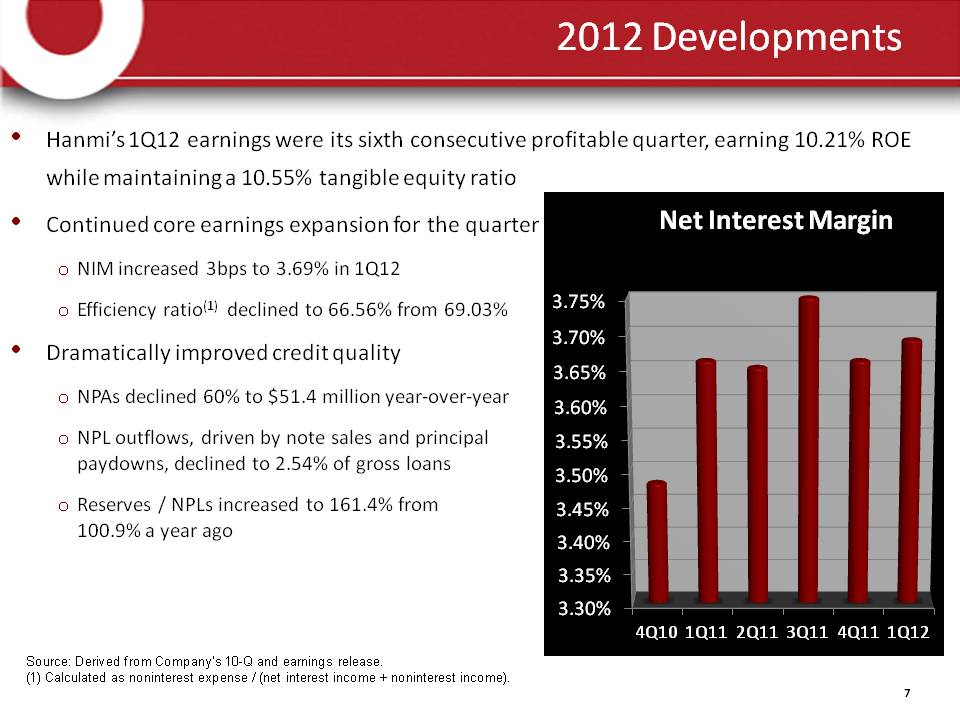

2012 Developments Hanmi’s 1Q12 earnings were its sixth consecutive profitable quarter, earning 10.21% ROE while maintaining a 10.55% tangible equity ratio Continued core earnings expansion for the quarter NIM increased 3bps to 3.69% in 1Q12 Efficiency ratio(1) declined to 66.56% from 69.03% Dramatically improved credit quality NPAs declined 60% to $51.4 million year‐over‐year NPL outflows, driven by note sales and principal paydowns, declined to 2.54% of gross loans Reserves / NPLs increased to 161.4% from 100.9% a year ago Net Interest Margin 3.75% 3.70% 3.65% 3.60% 3.55% 3.50% 3.45% 3.40% 3.35% 3.30% 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 Source: Derived from Company’s 10-Q and earnings release. (1) Calculated as noninterest expense / (net interest income + noninterest income). 7

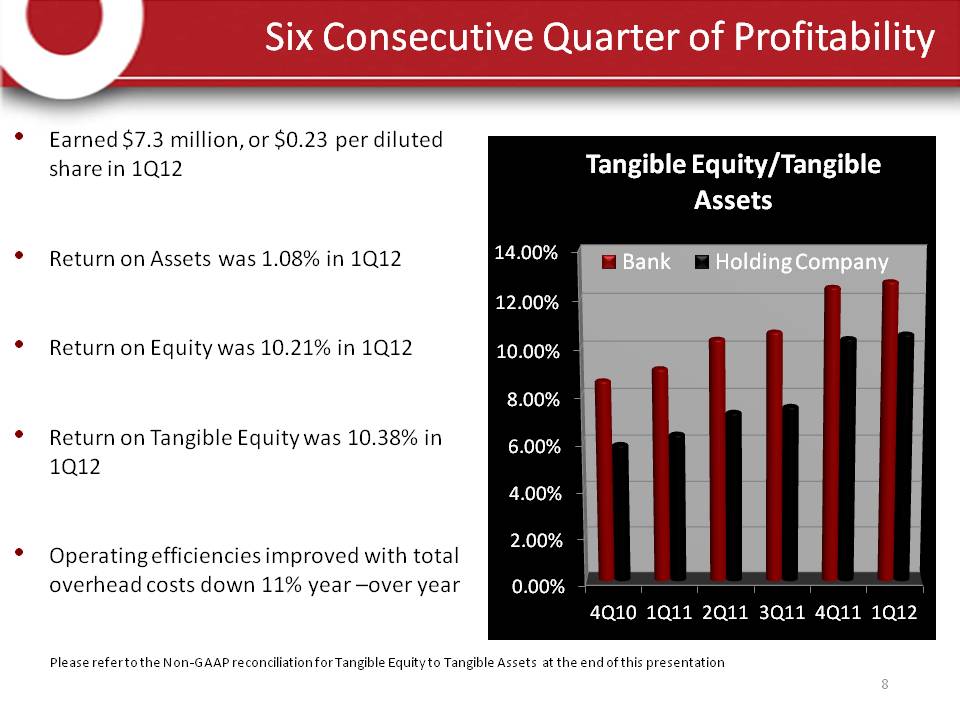

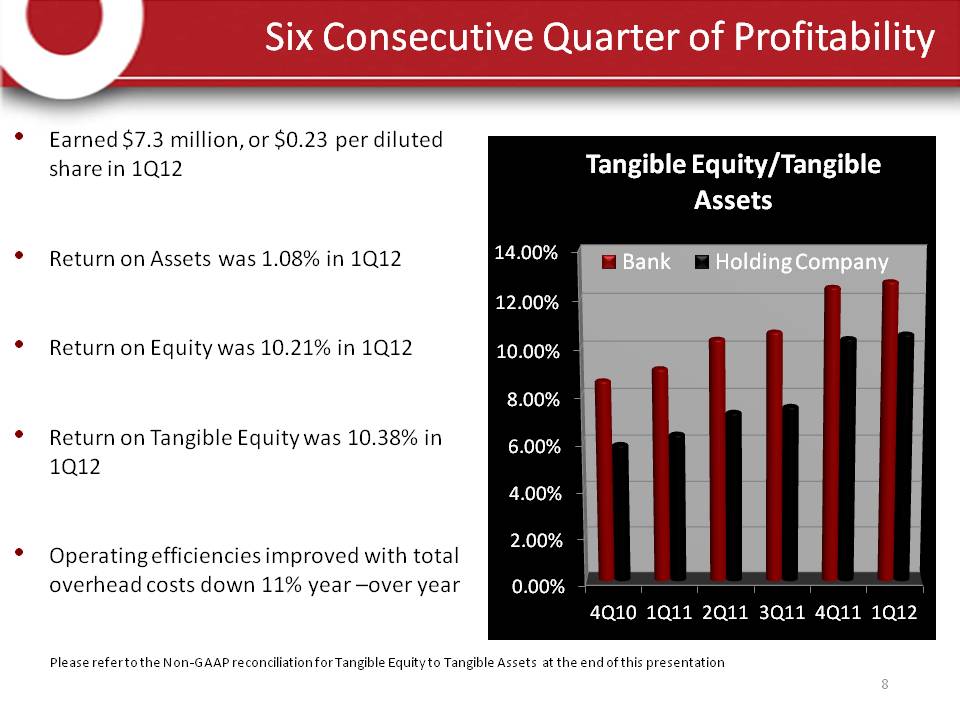

Six Consecutive Quarter of Profitability Earned $7.3 million, or $0.23 per diluted share in 1Q12 Return on Assets was 1.08% in 1Q12 Return on Equity was 10.21% in 1Q12 Return on Tangible Equity was 10.38% in 1Q12 Operating efficiencies improved with total overhead costs down 11% year –over year Tangible Equity/Tangible Assets Bank Holding Company 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 Please refer to the Non‐GAAP reconciliation for Tangible Equity to Tangible Assets at the end of this presentation 8

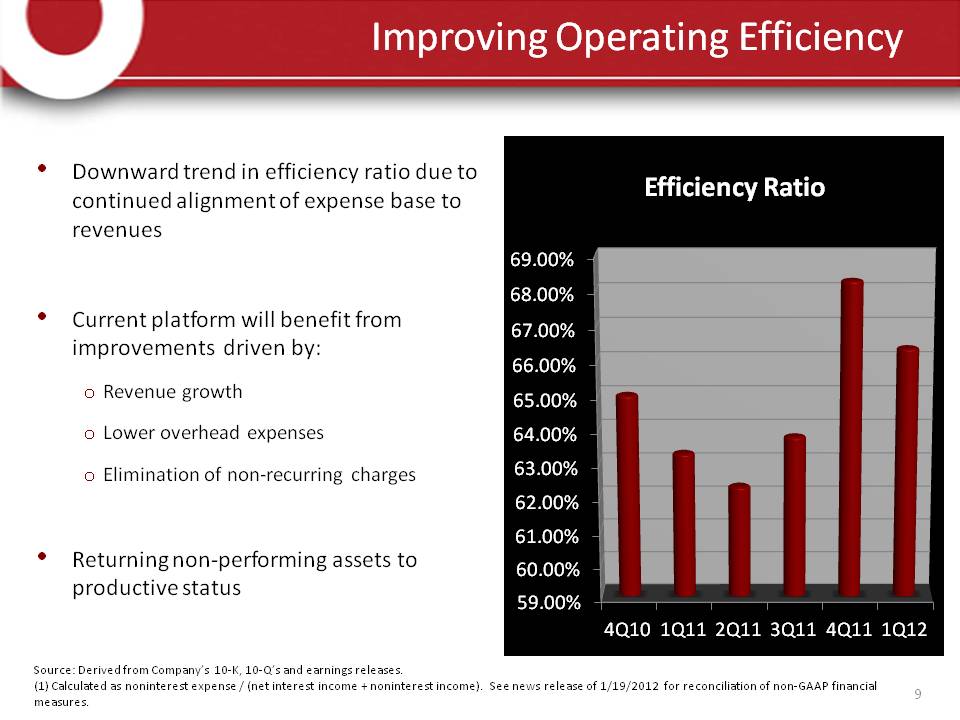

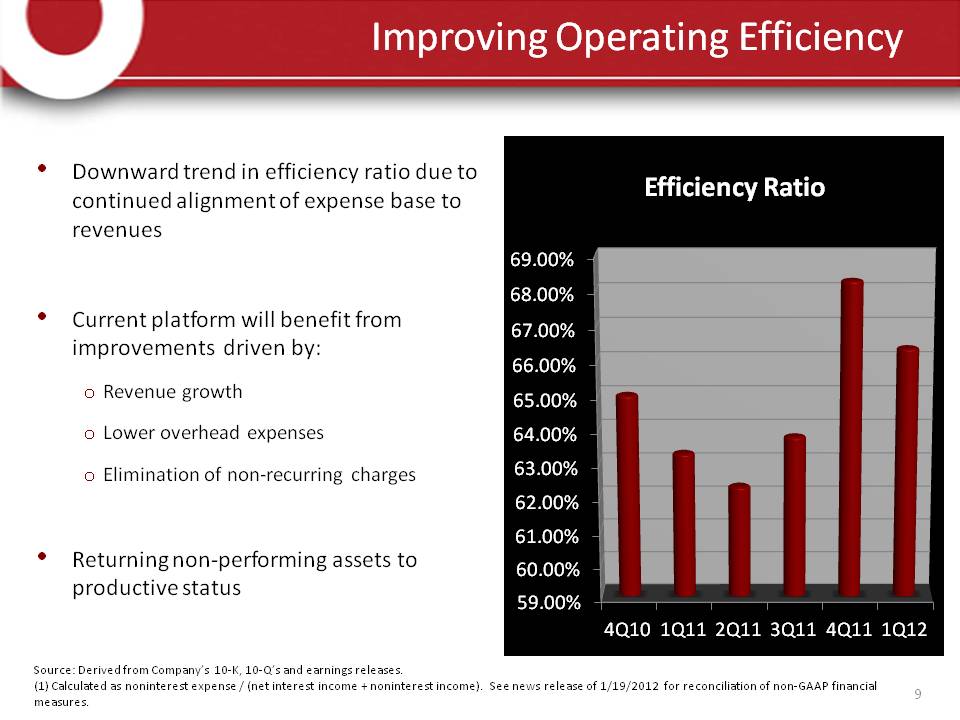

Improving Operating Efficiency Downward trend in efficiency ratio due to continued alignment of expense base to revenues Current platform will benefit from improvements driven by: Revenue growth Lower overhead expenses Elimination of non‐recurring charges Returning non‐performing assets to productive status Efficiency Ratio 69.00% 68.00% 67.00% 66.00% 65.00% 64.00% 63.00% 62.00% 61.00% 60.00% 59.00% 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 Source: Derived from Company’s 10‐K, 10‐Q’s and earnings releases. (1) Calculated as noninterest expense / (net interest income + noninterest income). See news release of 1/19/2012 for reconciliation of non‐GAAP financial measures. 9

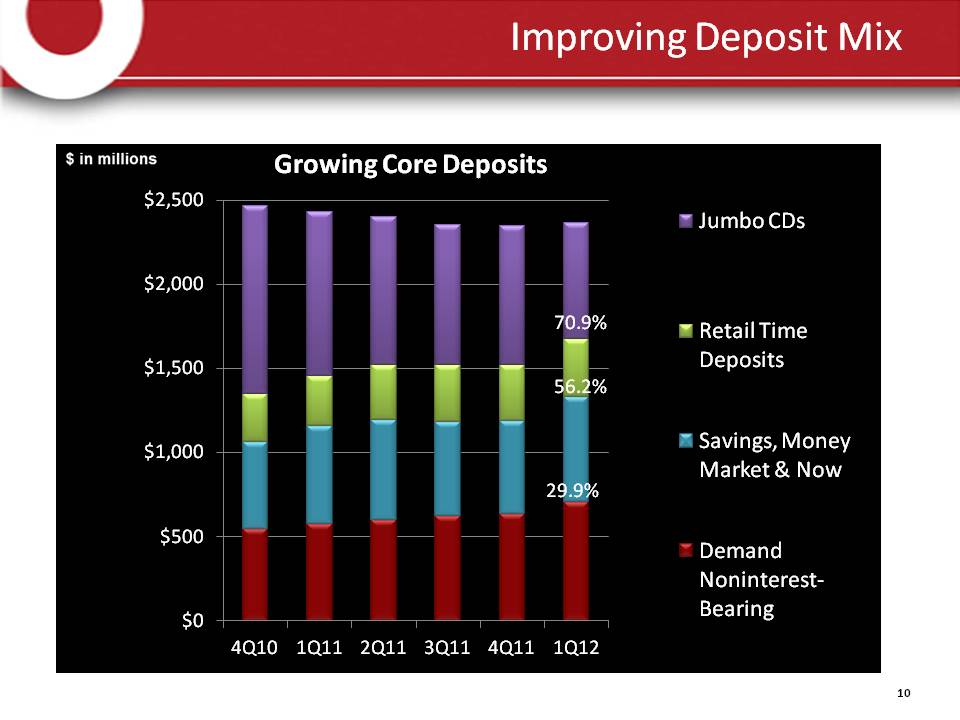

Improving Deposit Mix Growing Core Deposits $ in millions $2,500 $2,000 $1,500 $1,000 $500 $0 Jumbo CDs Retail Time Deposits Savings, Money Market & Now Demand Noninterest‐Bearing 29.9% 56.2% 70.9% 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 10

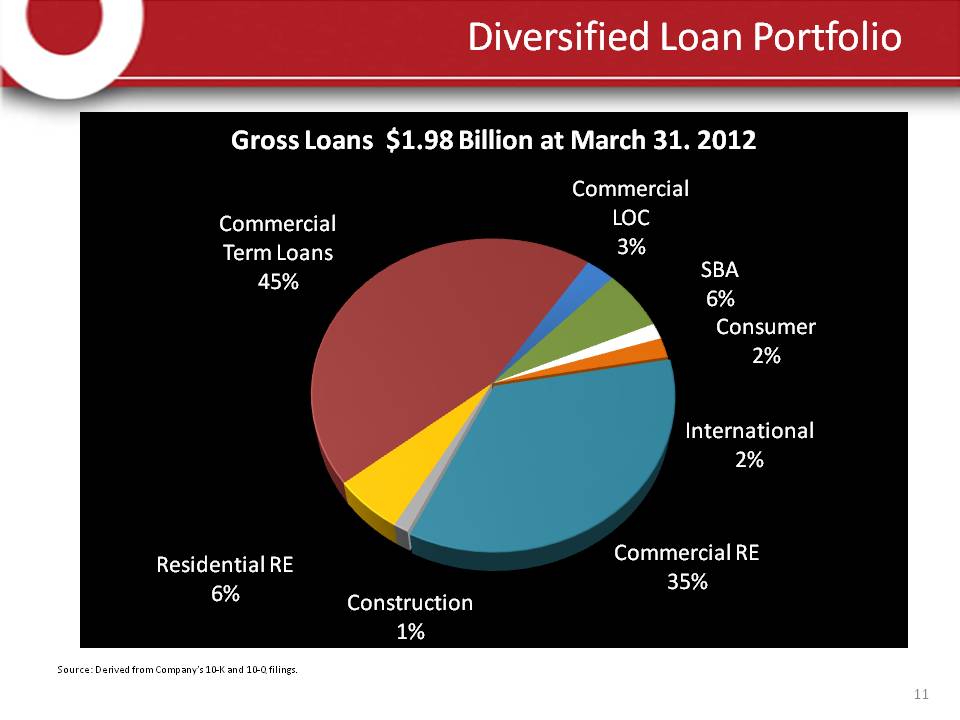

Diversified Loan Portfolio Gross Loans $1.98 Billion at March 31. 2012 Commercial Term Loans 45% Commercial LOC 3% SBA 6% Consumer 2% International 2% Commercial RE 35% Construction 1% Residential RE 6% Source: Derived from Company’s 10‐K and 10‐Q filings. 11

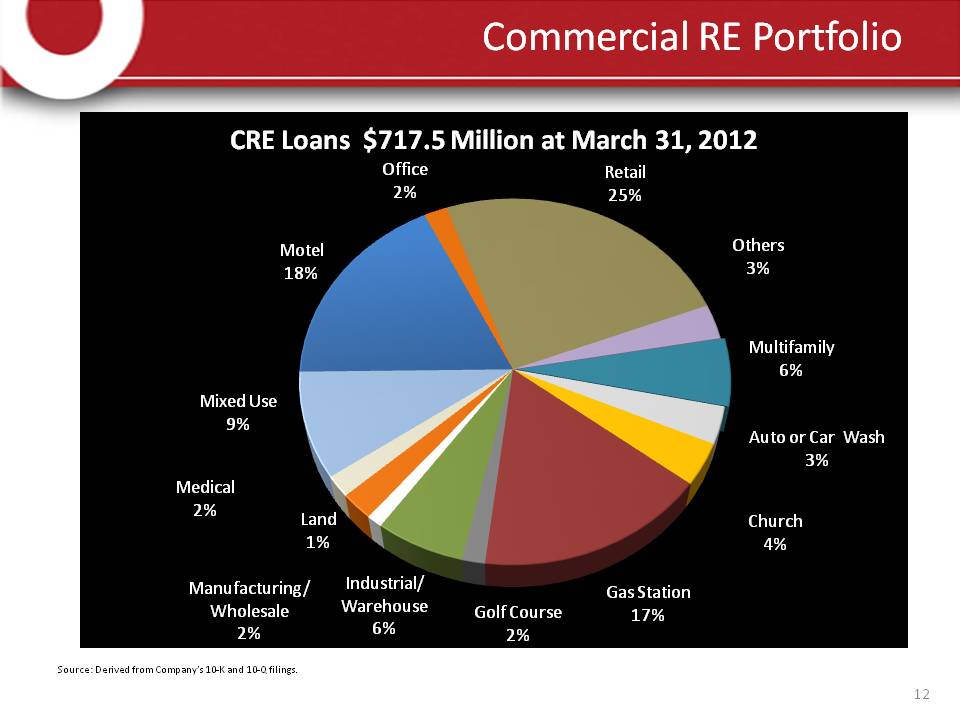

Commercial RE Portfolio CRE Loans $717.5 Million at March 31, 2012 Office 2% Retail 25% Motel 18% Others 3% Multifamily 6% Mixed Use 9% Auto or Car Wash 3% Church 4% Gas Station 17% Golf Course 2% Industrial/Warehouse 6% Land 1% Manufacturing/Wholesale 2% Medical 2% Source: Derived from Company’s 10‐K and 10‐Q filings. 12

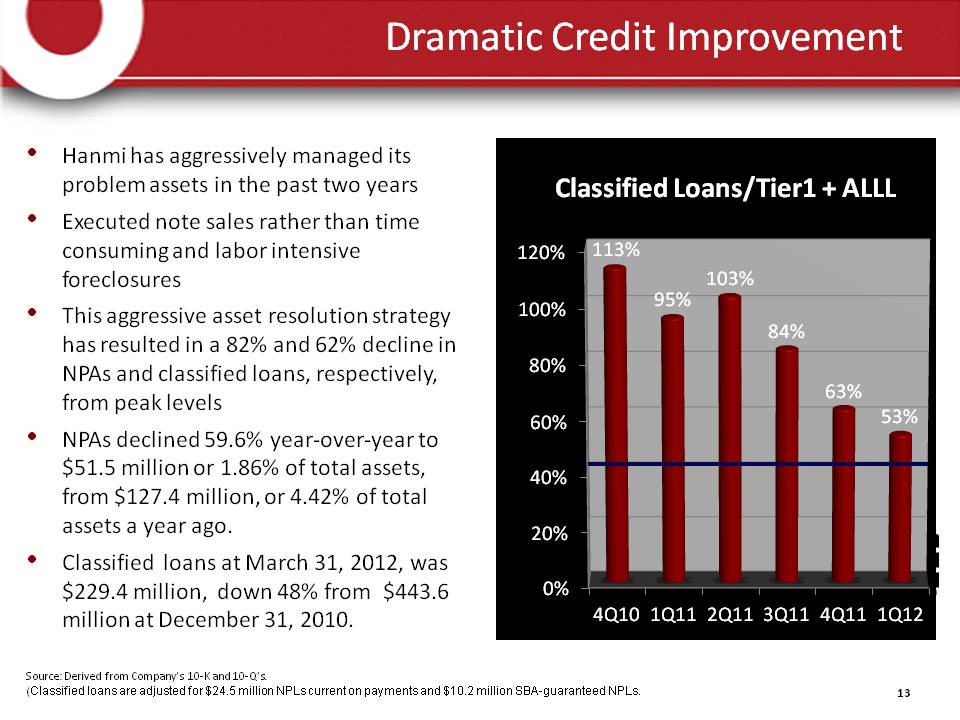

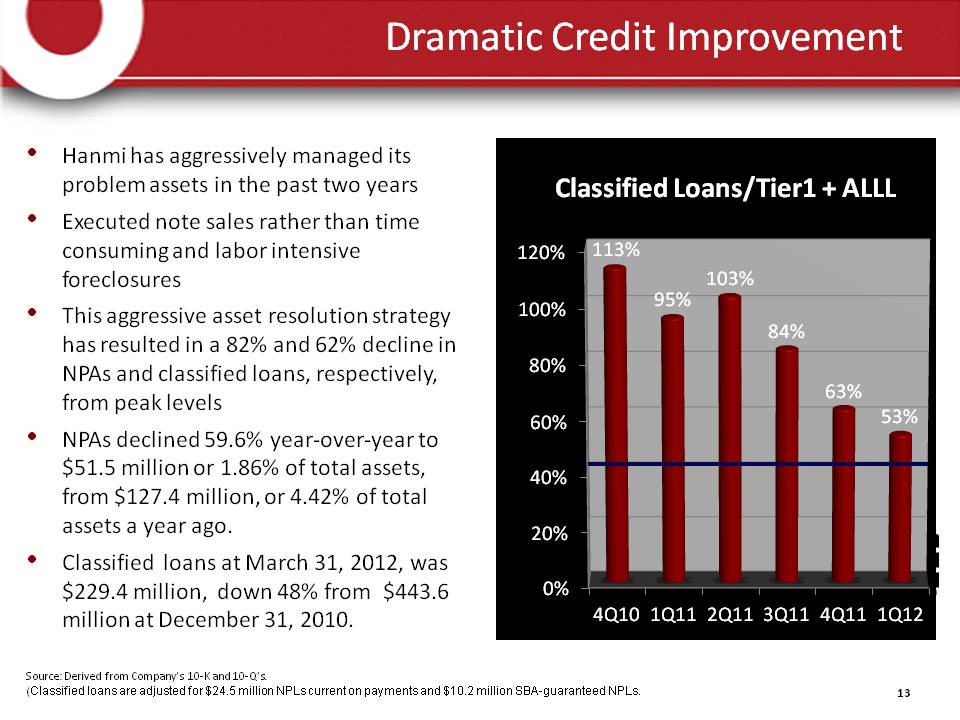

Dramatic Credit Improvement Hanmi has aggressively managed its problem assets in the past two years Executed note sales rather than time consuming and labor intensive foreclosures This aggressive asset resolution strategy has resulted in a 82% and 62% decline in NPAs and classified loans, respectively, from peak levels NPAs declined 59.6% year‐over‐year to $51.5 million or 1.86% of total assets, from $127.4 million, or 4.42% of total assets a year ago. Classified loans at March 31, 2012, was $229.4 million, down 48% from $443.6 million at December 31, 2010. Classified Loans/Tier1 + ALLL 120% 100% 80% 60% 40% 20% 0% 113% 95% 103% 84% 63% 53% 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 Source: Derived from Company’s 10‐K and 10‐Q’s. (Classified loans are adjusted for $24.5 million NPLs current on payments and $10.2 million SBA-guaranteed NPLs. 13

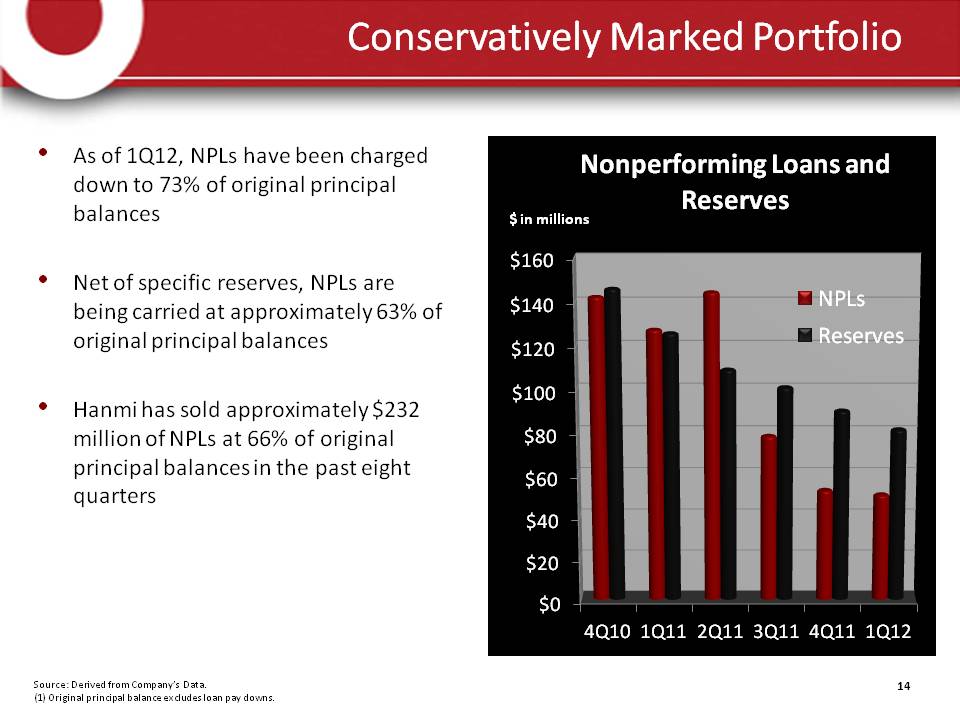

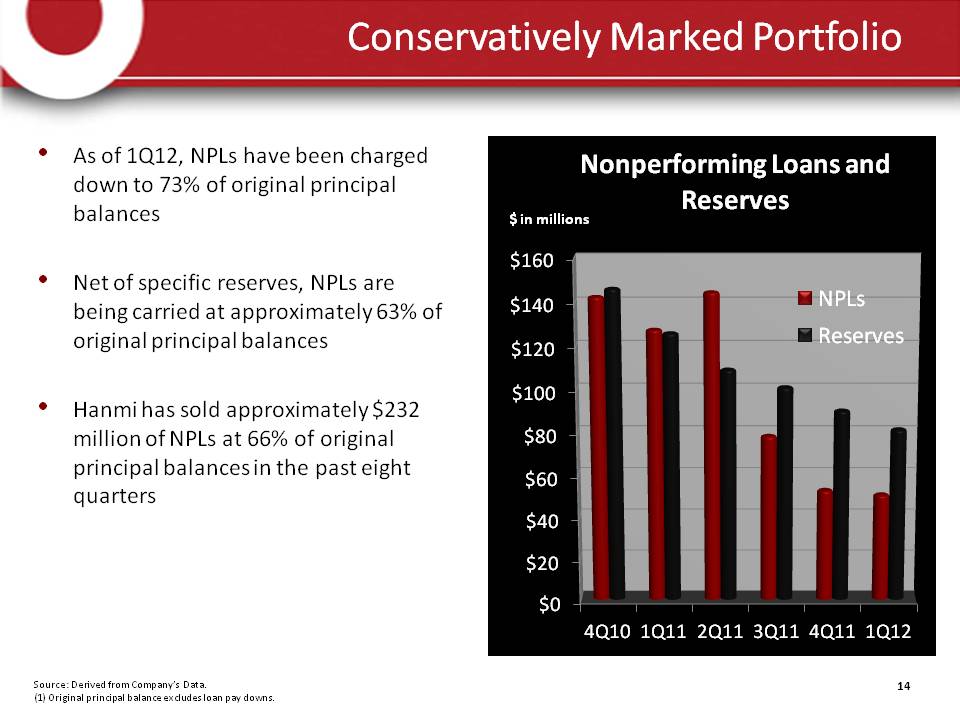

Conservatively Marked Portfolio As of 1Q12, NPLs have been charged down to 73% of original principal balances Net of specific reserves, NPLs are being carried at approximately 63% of original principal balances Hanmi has sold approximately $232 million of NPLs at 66% of original principal balances in the past eight quarters Nonperforming Loans and Reserves $ in millions NPLs Reserves $160 $140 $120 $100 $80 $60 $40 $20 $0 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 Source: Derived from Company’s Data. (1) Original principal balance excludes loan pay downs. 14

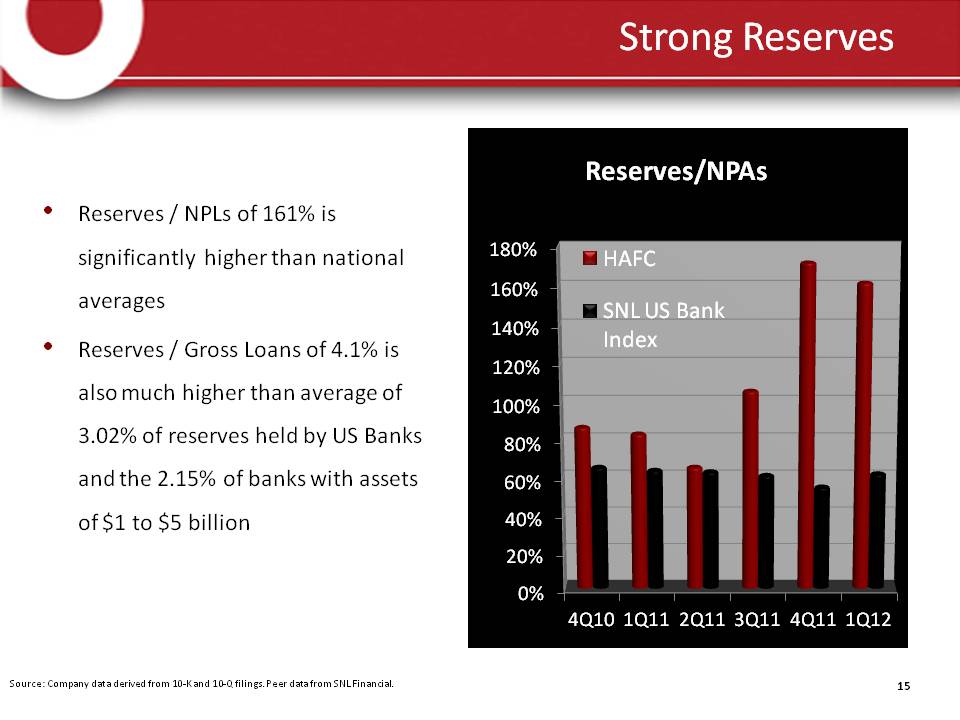

Strong Reserves Reserves NPLs of 161% is significantly higher than national averages Reserves / Gross Loans of 4.1% is also much higher than average of 3.02% of reserves held by US Banks and the 2.15% of banks with assets of $1 to $ 5 billion Reserves/NPAs HAFC SNL US Bank Index 180% 160% 140% 120% 100% 80% 60% 40% 20% 0% 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 Source: Company data derived from 10‐K and 10‐Q filings. Peer data from SNL Financial. 15

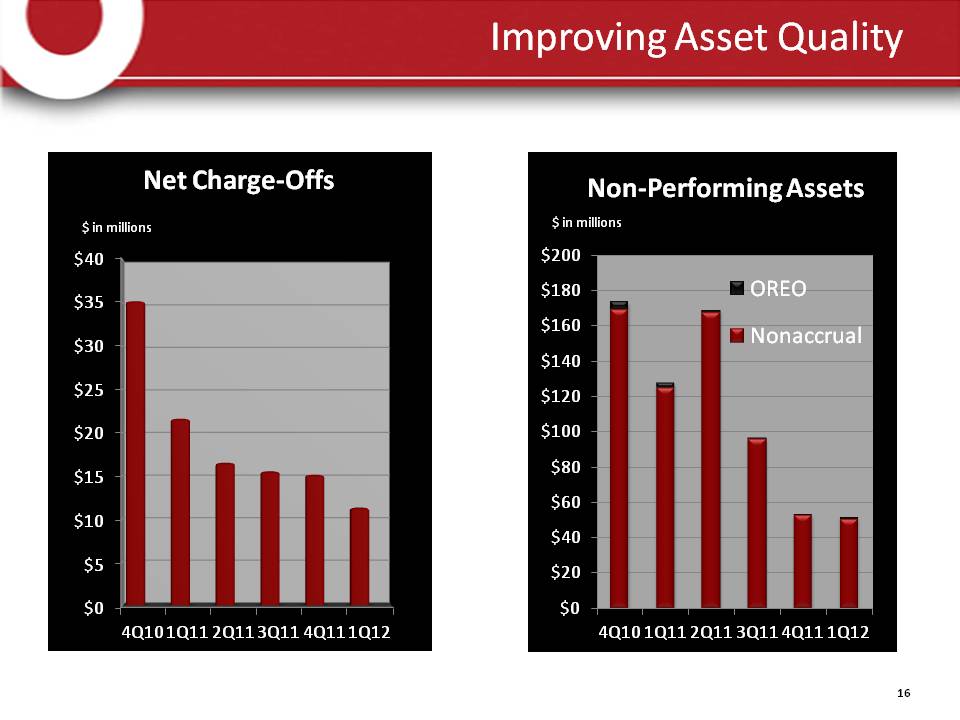

Improving Asset Quality Net Charge‐Offs $ in millions Non‐Performing Assets $ in millions OREO Nonaccrual $200 $180 $160 $140 $120 $100 $80 $60 $40 $20 $0 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 $40 $35 $30 $25 $20 $15 $10 $5 $0 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 16

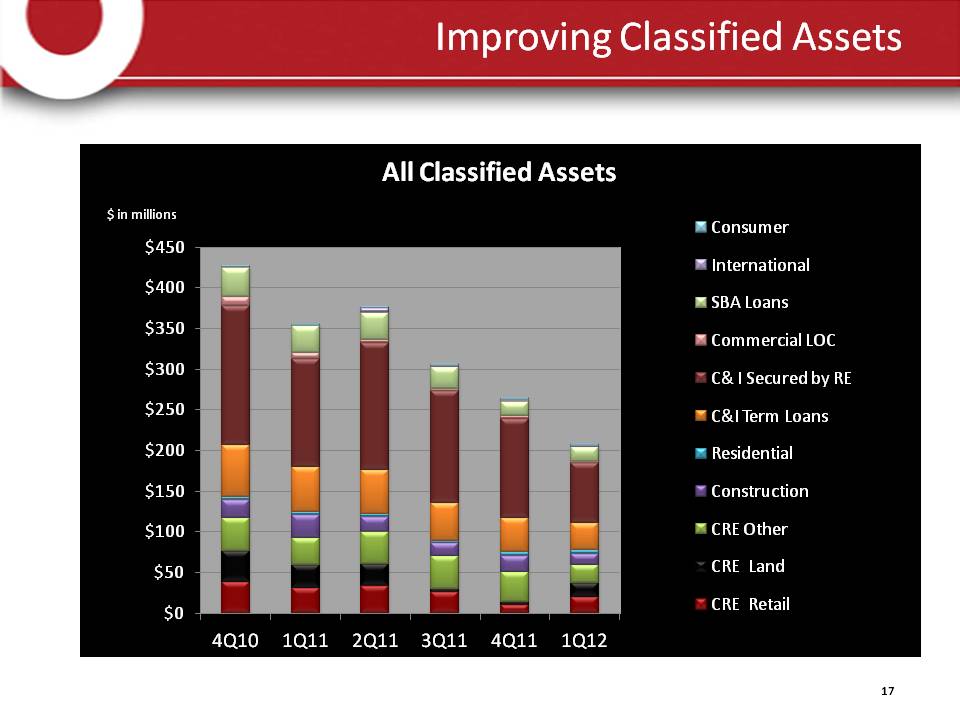

Improving Classified Assets All Classified Assets $ in millions $450 $400 $350 $300 $250 $200 $150 $100 $50 $0 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 Consumer International SBA Loans Commercial LOC C& I Secured by RE C&I Term Loans Residential Construction CRE Other CRE Land CRE Retail 17

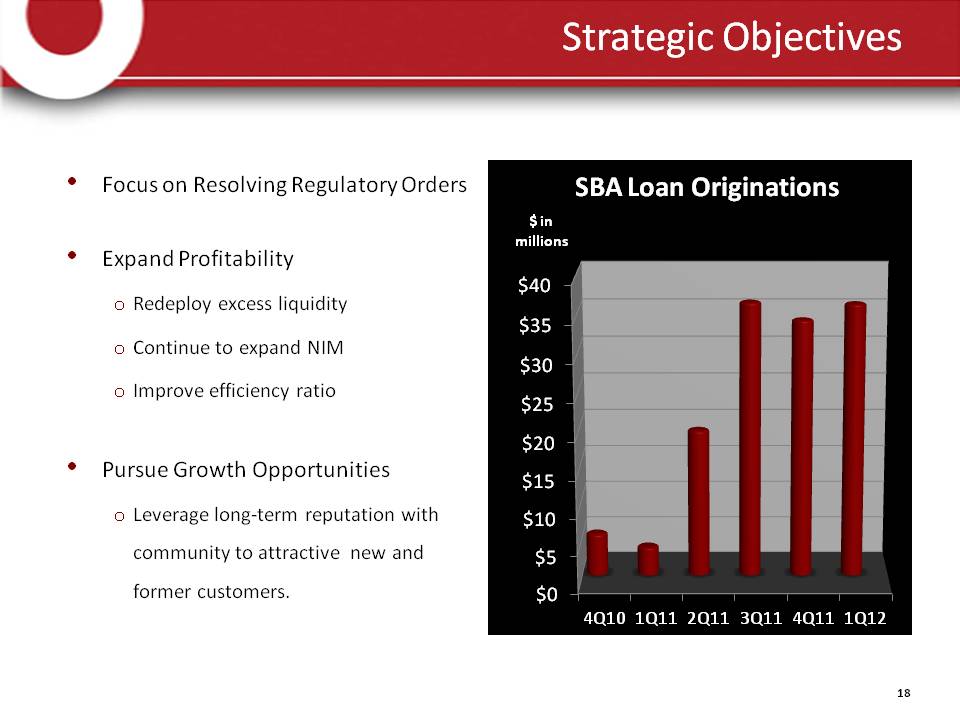

Strategic Objectives Focus on Resolving Regulatory Orders Expand Profitability Redeploy excess liquidity Continue to expand NIM Improve efficiency ratio Pursue Growth Opportunities Leverage long-term reputation with community to attractive new and former customers. SBA Loan Originations $ in millions $40 $35 $30 $25 $20 $15 $10 $5 $0 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 18

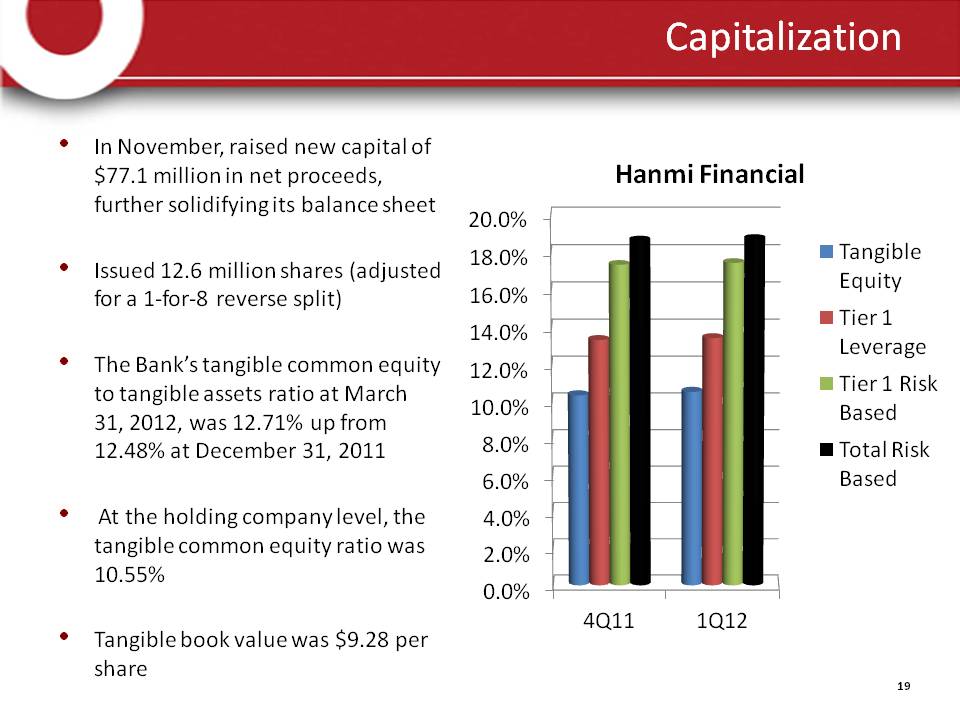

Capitalization In November, raised new capital of $77.1 million in net proceeds, further solidifying its balance sheet Issued 12.6 million shares (adjusted for a 1‐for‐8 reverse split) The Bank’s tangible common equity to tangible assets ratio at March 31, 2012, was 12.71% up from 12.48% at December 31, 2011 At the holding company level, the tangible common equity ratio was 10.55% Tangible book value was $9.28 per share Hanmi Financial 20.0% 18.0% 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% Tangible Equity Tier 1 Leverage Tier 1 Risk Based Total Risk Based 4Q11 1Q12 19

Investment Highlights Oldest and second largest Korean American bank in the U.S. Well positioned branch network in Southern California’s Korean American neighborhoods. Premier deposit franchise and commercial banking platform Aggressive problem asset resolution resulting in significantly improved credit profile Substantial capital position and reserves Six consecutive quarters of profitability Trading at $10.30, or 111% of tangible book value on May 3, 2012 Hanmi Bank CHANGING THE WAY YOU LIVE Life gets better Please refer to the Non‐GAAP reconciliation for Tangible Equity to Tangible Assets at the end of this presentation 20

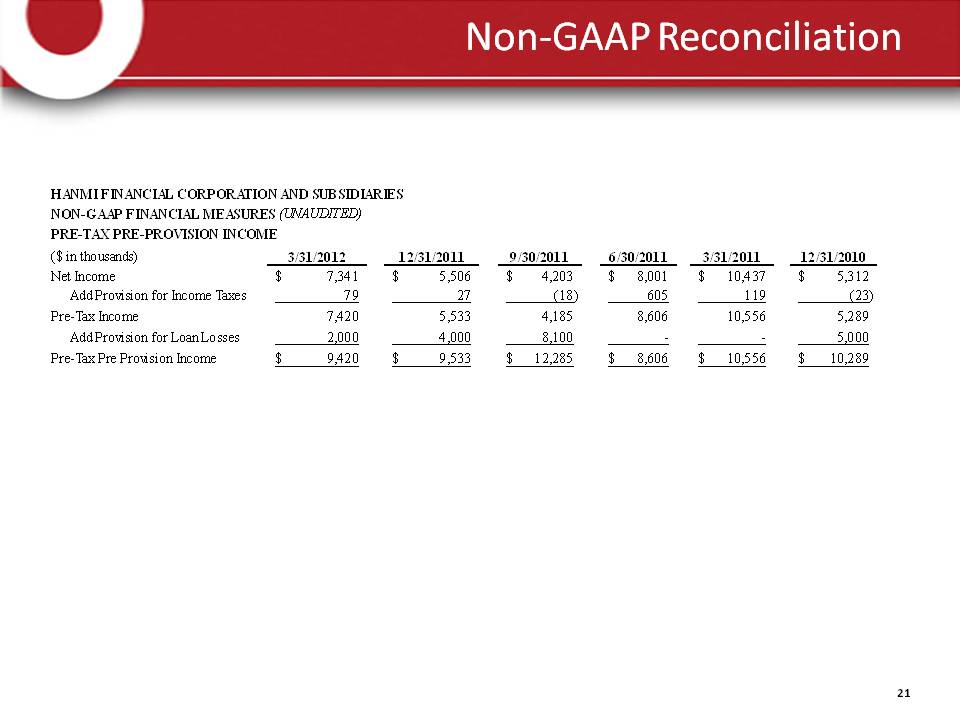

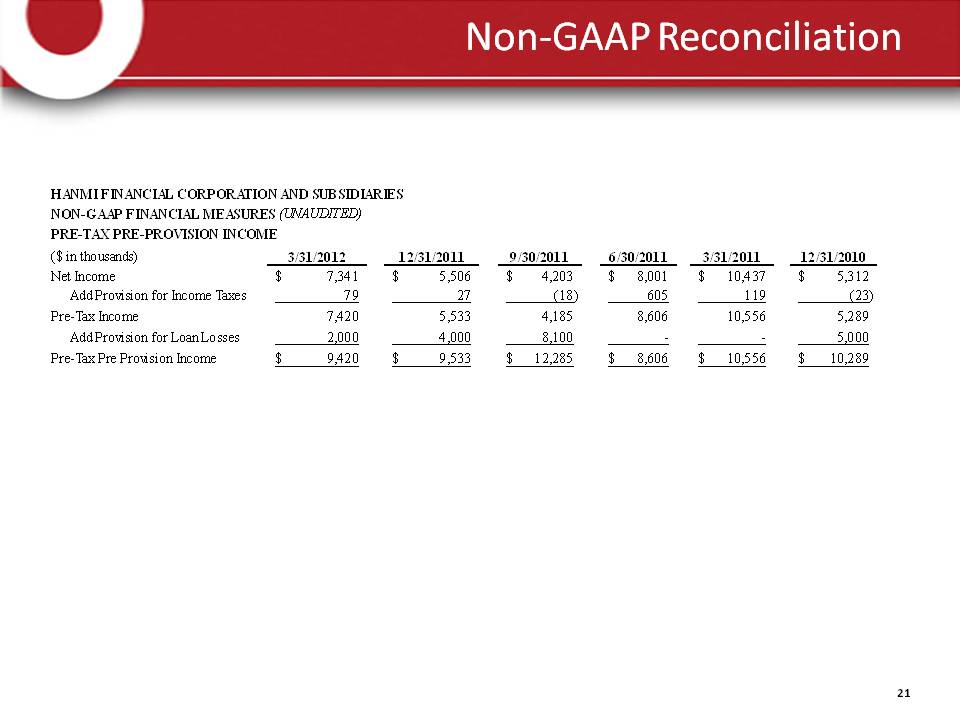

Non‐GAAP Reconciliation HANMI FINANCIAL CORPORATION AND SUBSIDIARIES NON-GAAP FINANCIAL MEASURES (UNAUDITED) PRE-TAX PRE-PROVISION INCOME ($ in thousands) 3/31/2012 12/31/2011 9/30/2011 6/30/2011 3/31/2011 12/31/2010 Net Income $ 7,341 $ 5,506 $ 4,203 $ 8,001 $ 10,437 $ 5,312 Add Provision for Income Taxes 79 27 (18) 605 119 (23) Pre-Tax Income 7,420 5,533 4,185 8,606 10,556 5,289 Add Provision for Loan Losses 2,000 4,000 8,100 - - 5,000 Pre-Tax Pre Provision Income $ 9,420 $ 9,533 $ 12,285 $ 8,606 $ 10,556 $ 10,289 21

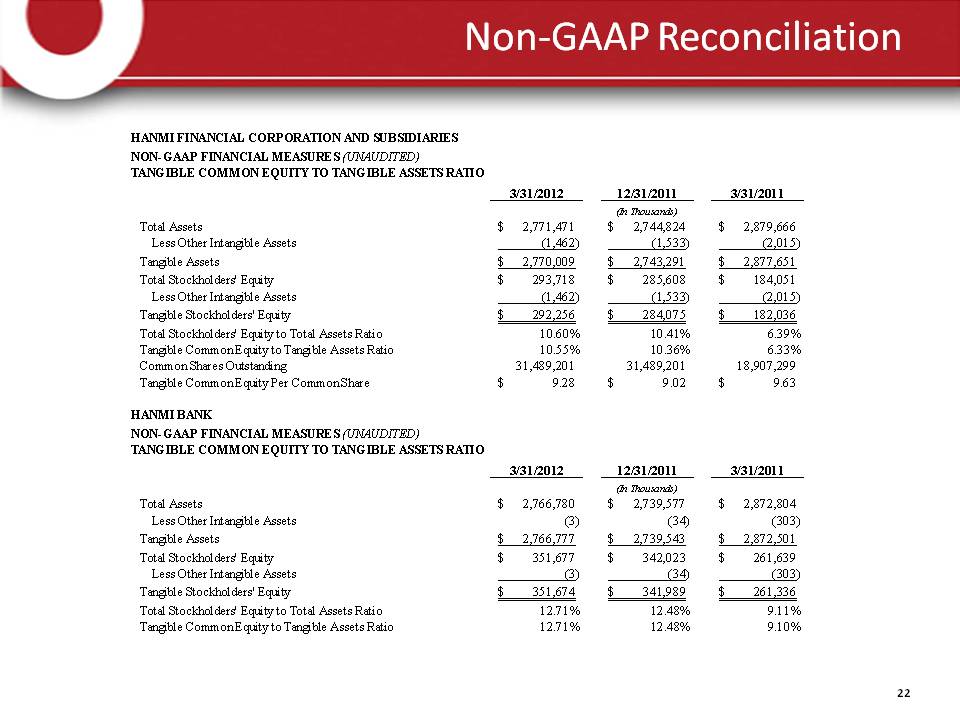

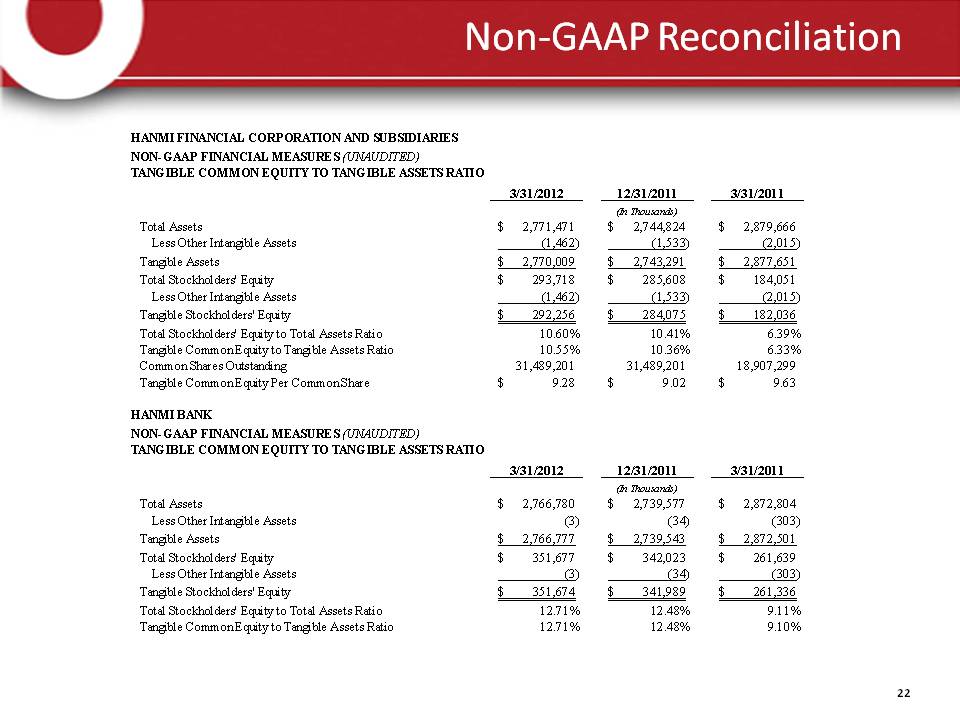

Non‐GAAP Reconciliation HANMI FINANCIAL CORPORATION AND SUBSIDIARIES NON-GAAP FINANCIAL MEASURES (UNAUDITED) TANGIBLE COMMON EQUITY TO TANGIBLE ASSETS RATIO 3/31/2012 12/31/2011 3/31/2011 (In Thousands) Total Assets $ 2,771,471 $ 2,744,824 $ 2,879,666 Less Other Intangible Assets (1,462) (1,533) (2,015) Tangible Assets $ 2,770,009 $ 2,743,291 $ 2,877,651 Total Stockholders' Equity $ 293,718 $ 285,608 $ 184,051 Less Other Intangible Assets (1,462) (1,533) (2,015) Tangible Stockholders' Equity $ 292,256 $ 284,075 $ 182,036 Total Stockholders' Equity to Total Assets Ratio 10.60% 10.41% 6.39% Tangible Common Equity to Tangible Assets Ratio 10.55% 10.36% 6.33% Common Shares Outstanding 31,489,201 31,489,201 18,907,299 Tangible Common Equity Per Common Share $ 9.28 $ 9.02 $ 9.63 HANMI BANK NON-GAAP FINANCIAL MEASURES (UNAUDITED) TANGIBLE COMMON EQUITY TO TANGIBLE ASSETS RATIO 3/31/2012 12/31/2011 3/31/2011 (In Thousands) Total Assets $ 2,766,780 $ 2,739,577 $ 2,872,804 Less Other Intangible Assets (3) (34) (303) Tangible Assets $ 2,766,777 $ 2,739,543 $ 2,872,501 Total Stockholders' Equity $ 351,677 $ 342,023 $ 261,639 Less Other Intangible Assets (3) (34) (303) Tangible Stockholders' Equity $ 351,674 $ 341,989 $ 261,336 Total Stockholders' Equity to Total Assets Ratio 12.71% 12.48% 9.11% Tangible Common Equity to Tangible Assets Ratio 12.71% 12.48% 9.10% 22