EXHIBIT 99.1

1 Acquisition of SWNB Bancorp, Inc. May 21, 2018 Enhances Our Banking Platform in Vibrant Texas Markets

Safe Harbor This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . These forward - looking statements include, but are not limited to, statements about ( 1 ) the benefits of the merger between Hanmi Financial Corporation (“Hanmi”) and SWNB Bancorp, Inc . (“SWNB”), including anticipated future results, cost savings and accretion to reported earnings that may be realized from the merger ; ( 2 ) Hanmi and SWNB’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts ; and ( 3 ) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning . Forward - looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such statements . The following factors, among others, could cause actual results to differ materially from the anticipated results expressed in the forward - looking statements : the businesses of Hanmi and SWNB may not be combined successfully, or such combination may take longer than expected ; the cost savings from the merger may not be fully realized or may take longer than expected ; operating costs, customer loss and business disruption following the merger may be greater than expected ; governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger or otherwise ; the stockholders of SWNB may fail to approve the merger ; credit and interest rate risks associated with Hanmi’s and SWNB’s respective businesses ; and difficulties associated with achieving expected future financial results . Additional factors that could cause actual results to differ materially from those expressed in the forward - looking statements are discussed in Hanmi’s reports (such as the Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K) filed with the SEC and available at the SEC’s Internet website (www . sec . gov) . All subsequent written and oral forward - looking statements concerning the proposed transaction or other matters attributable to Hanmi or SWNB or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above . Except as required by law, Hanmi and SWNB do not undertake any obligation to update any forward - looking statement to reflect circumstances or events that occur after the date the forward - looking statement is made . Important Additional Information This communication is being made in respect of the proposed merger between Hanmi and SWNB . This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval . In connection with the proposed transaction, Hanmi intends to file a registration statement on Form S - 4 with the SEC, which will include a proxy statement of SWNB and a prospectus of Hanmi, and Hanmi and SWNB will file other documents regarding the proposed transaction with the SEC . Before making any voting or investment decision, investors and security holders of SWNB are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction . The documents filed by Hanmi with the SEC may be obtained free of charge at the SEC’s website at www . sec . gov . In addition, the documents filed by Hanmi may be obtained free of charge at its website at www . hanmi . com or by contacting Hanmi Financial Corporation, 3660 Wilshire Boulevard, Penthouse Suite A, Los Angeles, California 90010 , Attention : Richard Pimentel, Corporate Finance Officer, telephone ( 213 ) 427 - 3191 . Hanmi and SWNB and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies of SWNB’s shareholders in connection with the proposed transaction . Information about the directors and executive officers of Hanmi and their ownership of Hanmi common stock is set forth in the proxy statement for Hanmi’s 2018 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14 A on April 13 , 2018 . Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available . Free copies of this document may be obtained as described in the preceding paragraph . 2 Forward - Looking Statements

Compelling Strategic Rationale 3 x Significant expansion into the highly attractive Texas market ▪ The acquisition of SWNB Bancorp, Inc. (“SWNB”) significantly expands Hanmi’s presence in multiple Texas metro markets ▪ Branches are strategically located in Houston, Dallas, and Austin, all of which have large Asian - American focused communities with appealing demographic and economic profiles ▪ The growth opportunities in these metro Texas markets will allow Hanmi to lever and utilize its capital base x Solidifies Hanmi’s market share lead among Asian - American banks in Texas ▪ Hanmi will have the largest deposit market share among Asian - American banks in Dallas and Austin metros on a pro forma basis ▪ Second largest deposit market share among Asian - American banks in the Houston metro on a pro forma basis x Financially attractive transaction with conservative assumptions and effective utilization of capital ▪ Deployment of SWNB’s excess liquidity into loans provides Hanmi a clear opportunity to further enhance the economic merits of the transaction ▪ Compared to precedent metro Texas deals, valuation metrics are appealing to Hanmi

Pro Forma Impact to Hanmi ▪ SWNB has $411 million in total assets, which increases Hanmi’s pro forma assets to approximately $5.7 billion (1) ▪ Hanmi will have $552.3 million in loans and $660.3 million in deposits in Texas pro forma (1) ▪ EPS accretion of 2.2% in 2019 (2) ▪ Approximately 1.5% dilutive to tangible book value per share at closing and TBV earnback period of ~3 years based on the crossover method (1) Excludes merger and purchase accounting adjustments. Financial information for SWNB is bank - level (2) Hanmi’s average EPS estimates for 2019 per S&P Global Market Intelligence. Excludes non - recurring merger - related expenses (3) Revenue enhancements were not included in the base pro forma modeling assumptions Attractive Pro Forma Metrics ▪ Significant opportunity exist for additional cost savings beyond baseline model and revenue enhancements by deploying excess capital (3) ▪ As of 3/31/2018, SWNB’s loan/deposit ratio was 75%, providing an opportunity to utilize excess deposits to fund strong loan demand in all markets ▪ Achieving a 100% loan/deposit ratio by year - end 2018 would result in EPS accretion of 4.4% in 2019 and reduce the TBV earnback period to ~2 years Significant Opportunity for Value Creation 4

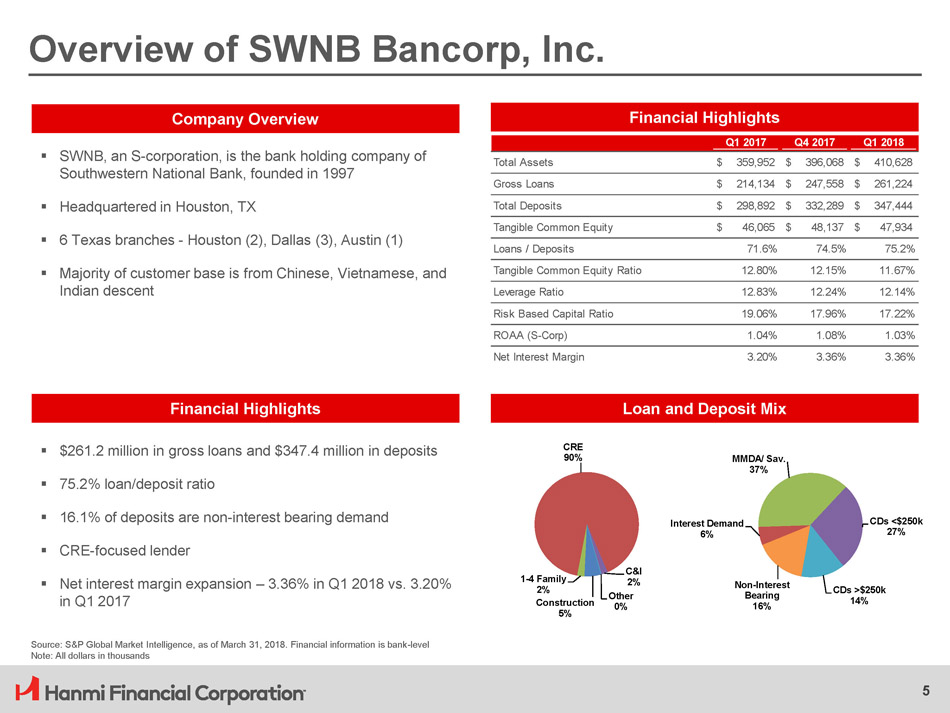

Q1 2017 Q4 2017 Q1 2018 Total Assets $ 359 , 95 2 $ 396 , 06 8 $ 410 , 62 8 Gross Loans $ 214 , 13 4 $ 247 , 55 8 $ 261 , 22 4 Total Deposits $ 298 , 89 2 $ 332 , 28 9 $ 347 , 44 4 Tangible Common Equity $ 46 , 06 5 $ 48 , 13 7 $ 47 , 93 4 Loans / Deposits 71 . 6 % 74 . 5 % 75 . 2 % Tangible Common Equity Ratio 12 . 80 % 12 . 15 % 11 . 67 % Leverage Ratio 12 . 83 % 12 . 24 % 12 . 14 % Risk Based Capital Ratio 19 . 06 % 17 . 96 % 17 . 22 % ROAA (S - Corp) 1 . 04 % 1 . 08 % 1 . 03 % Net Interest Margin 3 . 20 % 3 . 36 % 3 . 36 % N on - I n t erest Bearing 16% Interest Demand 6% MMDA/ Sav. 37% CDs <$250k 27% CDs >$250k 14% 1 - 4 Family 2% C ons t ru cti on 5% CRE 90% C&I 2% O t her 0% Overview of SWNB Bancorp, Inc. Note: All dollars in thousands 5 Source: S&P Global Market Intelligence, as of March 31, 2018. Financial information is bank - level ▪ SWNB, an S - corporation, is the bank holding company of Southwestern National Bank, founded in 1997 ▪ Headquartered in Houston, TX ▪ 6 Texas branches - Houston (2), Dallas (3), Austin (1) ▪ Majority of customer base is from Chinese, Vietnamese, and Indian descent Financial Highlights Company Overview Financial Highlights Loan and Deposit Mix ▪ $261.2 million in gross loans and $347.4 million in deposits ▪ 75.2% loan/deposit ratio ▪ 16.1% of deposits are non - interest bearing demand ▪ CRE - focused lender ▪ Net interest margin expansion – 3.36% in Q1 2018 vs. 3.20% in Q1 2017

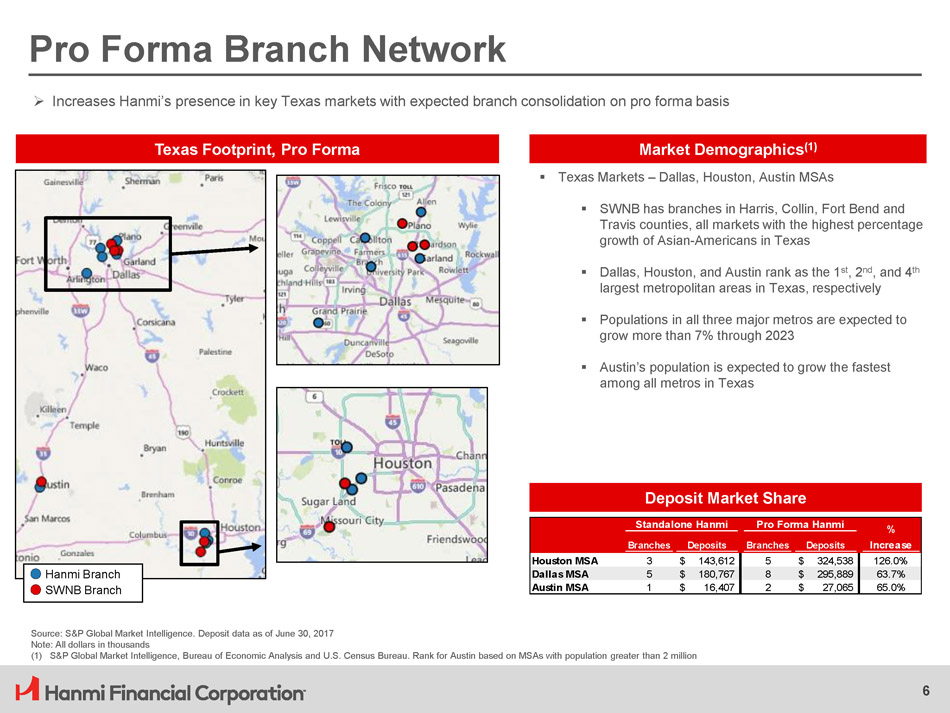

Standalone Hanmi Pro Forma Hanmi % Branches Deposits Branches Deposits Increase Houston MSA 3 $ 143,612 5 $ 324,538 126.0% Dallas MSA 5 $ 180,767 8 $ 295,889 63.7% Austin MSA 1 $ 16,407 2 $ 27 , 06 5 65.0% Pro Forma Branch Network Source: S&P Global Market Intelligence. Deposit data as of June 30, 2017 Note: All dollars in thousands Texas Footprint, Pro Forma Deposit Market Share Hanmi Branch SWNB Branch Market Demographics (1) ▪ Texas Markets – Dallas, Houston, Austin MSAs ▪ SWNB has branches in Harris, Collin, Fort Bend and Travis counties, all markets with the highest percentage growth of Asian - Americans in Texas ▪ Dallas, Houston, and Austin rank as the 1 st , 2 nd , and 4 th largest metropolitan areas in Texas, respectively ▪ Populations in all three major metros are expected to grow more than 7% through 2023 ▪ Austin’s population is expected to grow the fastest among all metros in Texas » Increases Hanmi’s presence in key Texas markets with expected branch consolidation on pro forma basis (1) S&P Global Market Intelligence, Bureau of Economic Analysis and U.S. Census Bureau. Rank for Austin based on MSAs with population greater than 2 million 6

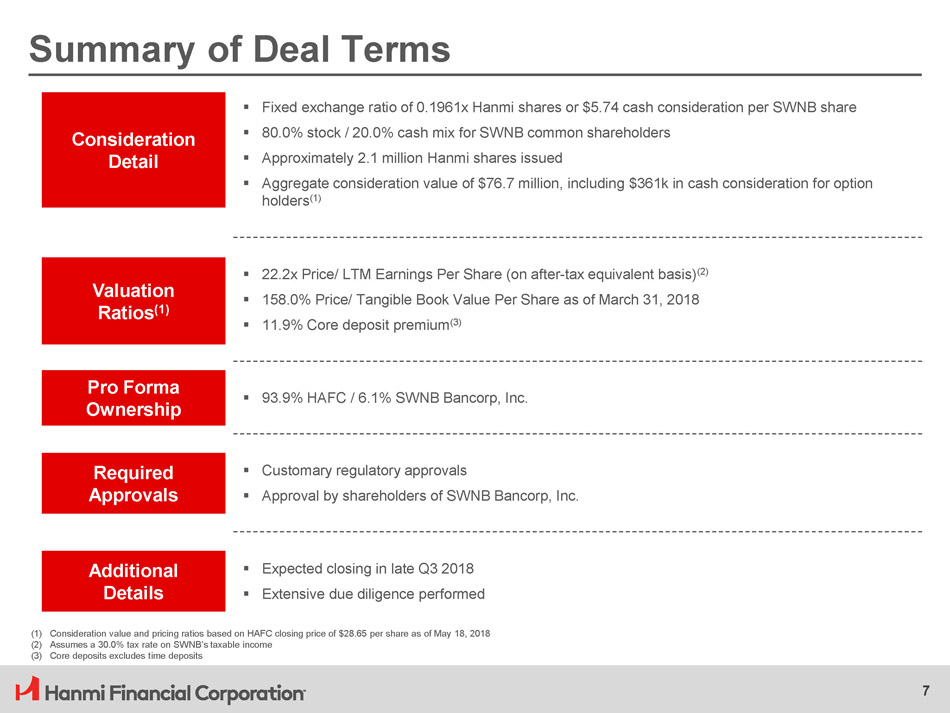

Summary of Deal Terms Con si d erati o n Detail Pro Forma O w n e r s hi p Required A pp r o v als V al u ati o n Ratios (1) A dd iti on al Details ▪ Fixed exchange ratio of 0.1961x Hanmi shares or $5.74 cash consideration per SWNB share ▪ 80.0% stock / 20.0% cash mix for SWNB common shareholders ▪ Approximately 2.1 million Hanmi shares issued ▪ Aggregate consideration value of $76.7 million, including $361k in cash consideration for option holders (1) ▪ 22.2x Price/ LTM Earnings Per Share (on after - tax equivalent basis) (2) ▪ 158.0% Price/ Tangible Book Value Per Share as of March 31, 2018 ▪ 11.9% Core deposit premium (3) ▪ Customary regulatory approvals ▪ Approval by shareholders of SWNB Bancorp, Inc. ▪ 93.9% HAFC / 6.1% SWNB Bancorp, Inc. ▪ Expected closing in late Q3 2018 ▪ Extensive due diligence performed (1) Consideration value and pricing ratios based on HAFC closing price of $28.65 per share as of May 18, 2018 (2) Assumes a 30.0% tax rate on SWNB’s taxable income (3) Core deposits excludes time deposits 7

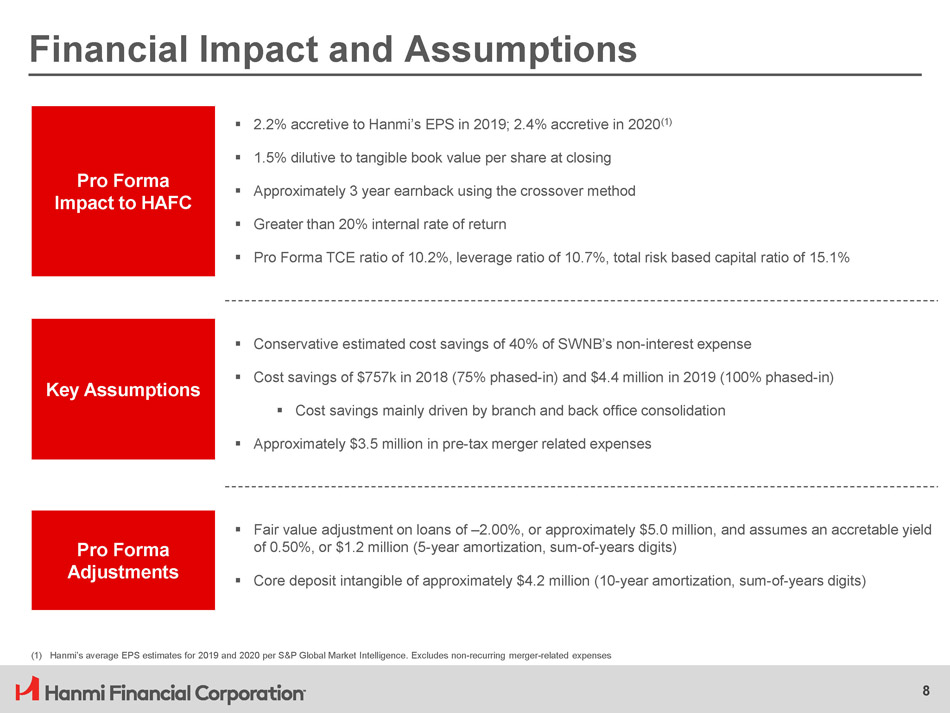

Financial Impact and Assumptions ▪ 2.2% accretive to Hanmi’s EPS in 2019; 2.4% accretive in 2020 (1) ▪ 1.5% dilutive to tangible book value per share at closing ▪ Approximately 3 year earnback using the crossover method ▪ Greater than 20% internal rate of return ▪ Pro Forma TCE ratio of 10.2%, leverage ratio of 10.7%, total risk based capital ratio of 15.1% Pro Forma Impact to HAFC Key Assumptions Pro Forma A d j u stme n ts ▪ Conservative estimated cost savings of 40% of SWNB’s non - interest expense ▪ Cost savings of $757k in 2018 (75% phased - in) and $4.4 million in 2019 (100% phased - in) ▪ Cost savings mainly driven by branch and back office consolidation ▪ Approximately $3.5 million in pre - tax merger related expenses ▪ Fair value adjustment on loans of – 2.00%, or approximately $5.0 million, and assumes an accretable yield of 0.50%, or $1.2 million (5 - year amortization, sum - of - years digits) ▪ Core deposit intangible of approximately $4.2 million (10 - year amortization, sum - of - years digits) (1) Hanmi’s average EPS estimates for 2019 and 2020 per S&P Global Market Intelligence. Excludes non - recurring merger - related expenses 8

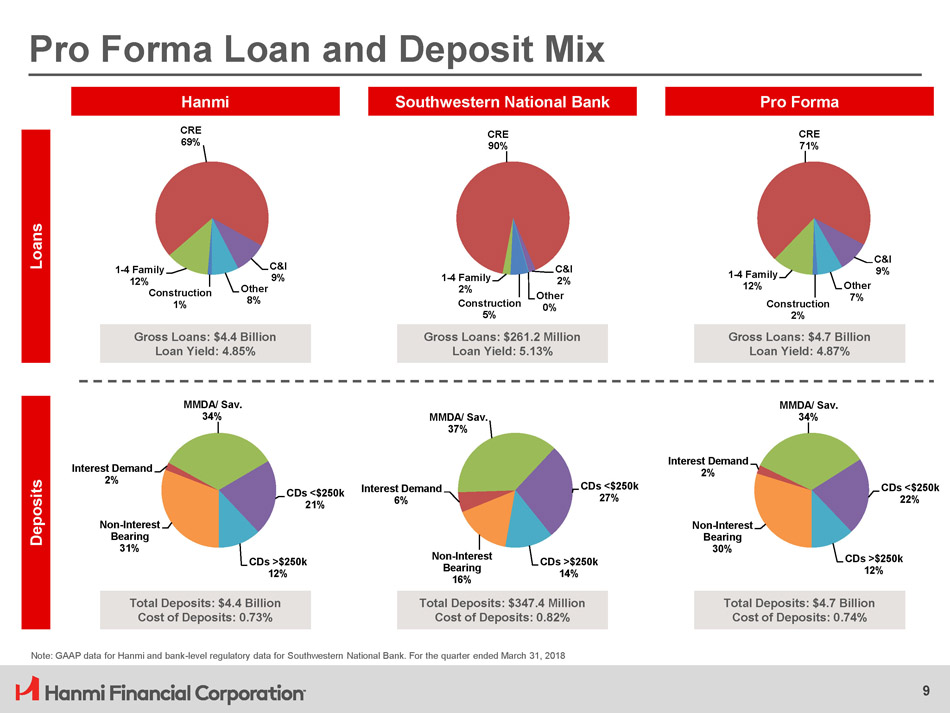

N on - I n t eres t Bearing 31% Interest Demand 2% MMDA/ Sav. 34% CDs <$250k 21% CDs >$250k 12% N on - I n t eres t Bearing 16% Interest Demand 6% MMDA/ Sav. 37% CDs <$250k 27% CDs >$250k 14% N on - I n t eres t Bearing 30% Interest Demand 2% MMDA/ Sav. 34% CDs <$250k 22% CDs >$250k 12% Cons t ru cti on 1% 1 - 4 Family 12% CRE 69% C&I 9% O t her 8% 1 - 4 Family 2% Cons t ru cti on 5% CRE 90% C&I 2% O t her 0% Cons t ru cti on 2% 1 - 4 Family 12% CRE 71% C&I 9% O t h er 7% Pro Forma Loan and Deposit Mix Hanmi Southwestern National Bank Pro Forma Loans Deposits Gross Loans: $4.4 Billion Loan Yield: 4.85% Note: GAAP data for Hanmi and bank - level regulatory data for Southwestern National Bank. For the quarter ended March 31, 2018 9 Gross Loans: $261.2 Million Loan Yield: 5.13% Gross Loans: $4.7 Billion Loan Yield: 4.87% Total Deposits: $4.4 Billion Cost of Deposits: 0.73% Total Deposits: $347.4 Million Cost of Deposits: 0.82% Total Deposits: $4.7 Billion Cost of Deposits: 0.74%

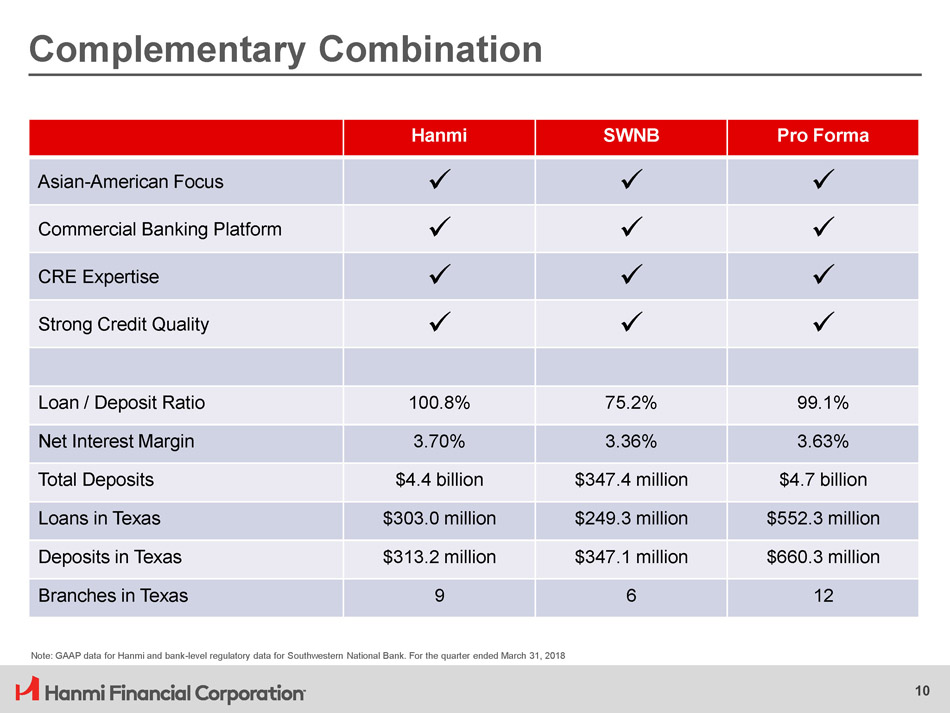

Complementary Combination Note: GAAP data for Hanmi and bank - level regulatory data for Southwestern National Bank. For the quarter ended March 31, 2018 10 Hanmi SWNB Pro Forma Asian - American Focus x x x Commercial Banking Platform x x x CRE Expertise x x x Strong Credit Quality x x x Loan / Deposit Ratio 100.8% 75.2% 99.1% Net Interest Margin 3.70% 3.36% 3.63% Total Deposits $4.4 billion $347.4 million $4.7 billion Loans in Texas $303.0 million $249.3 million $552.3 million Deposits in Texas $313.2 million $347.1 million $660.3 million Branches in Texas 9 6 12

Comprehensive Due Diligence Process 11 x Experienced Management Team ▪ Hanmi’s senior management team (including CEO, COO, and CFO) has extensive acquisition and integration experience x Thorough review of credit, regulatory, compliance, legal and operational risks ▪ Extensive credit due diligence performed, including internal & third - party loan reviews ▪ Broad coverage for third - party loan review of ~50% of total loans, including all classified assets x Detailed review of cost savings and revenue enhancement opportunities ▪ Conservative cost savings assumption given branch consolidation opportunities ▪ Increased scale in Texas branches will drive further operational efficiency ▪ Ability to deploy excess deposit funding from SWNB’s balance sheet

Compelling Acquisition Opportunity 12 x Strong Strategic Rationale ▪ Financially compelling acquisition which is in - line with Hanmi’s strategic goals ▪ Reasonable price compared to precedent transactions ▪ Significantly increases Hanmi’s deposit market share in key Texas markets and solidifies Hanmi’s position as the leading Asian - American banking franchise ▪ Pro forma company is well positioned to pursue organic growth opportunities and future acquisitions x Financially Attractive Transaction ▪ Minimally dilutive to tangible book value ▪ Effective use of capital, enhancing profitability and shareholder value ▪ Excess liquidity at SWNB to be deployed swiftly via Hanmi’s loan origination channels x Low execution risk