Exhibit 99.1

Janney Non - Deal Roadshow June 2022 Los Angeles New York/ New Jersey Virginia Chicago Dallas Houston San Francisco San Diego

Hanmi Financial Corporation (the “Company”) cautions investors that any statements contained herein that are not historical facts are forward - looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 , including, but not limited to, those statements regarding operating and financial performance, financial position and liquidity, business strategies, regulatory, economic and competitive outlook, investment and expenditure plans, capital and financing needs and availability, litigation, plans and objectives, merger or sale activity, the effects of COVID - 19 on our business, financial condition and results of operations, and all other forecasts and statements of expectation or assumption underlying any of the foregoing . These statements involve known and unknown risks and uncertainties that are difficult to predict . Investors should not rely on any forward - looking statement and should consider risks, such as changes in governmental policy, legislation and regulations, economic climate uncertainty, inflation, fluctuations in interest rate and credit risk, competitive pressures, the ability to succeed in new markets, balance sheet management, the ability to identify and remediate any material weakness in internal controls over financial reporting, and other operational factors . Further, given its ongoing and dynamic nature, it is difficult to predict the full impact of the COVID - 19 pandemic on our business, financial condition and results of operations . The extent of such impact will depend on future developments, which are highly uncertain, including when the coronavirus can be controlled and abated . As the result of the COVID - 19 pandemic and the related adverse local and national economic consequences, we could be subject to various risks, any of which could have a material, adverse effect on our business, financial condition, liquidity, and results of operations . Forward - looking statements are based upon the good faith beliefs and expectations of management as of this date only and are further subject to additional risks and uncertainties, including, but not limited to, the risk factors set forth in our earnings release dated April 26 , 2022 , including the section titled “Forward Looking Statements and the Company’s most recent Form 10 - K, 10 - Q and other filings with the Securities and Exchange Commission (“SEC”) . Investors are urged to review our earnings release dated April 26 , 2022 , including the section titled “Forward Looking Statements and the Company’s SEC filings . The Company disclaims any obligation to update or revise the forward - looking statements herein . 2 Forward - Looking Statements

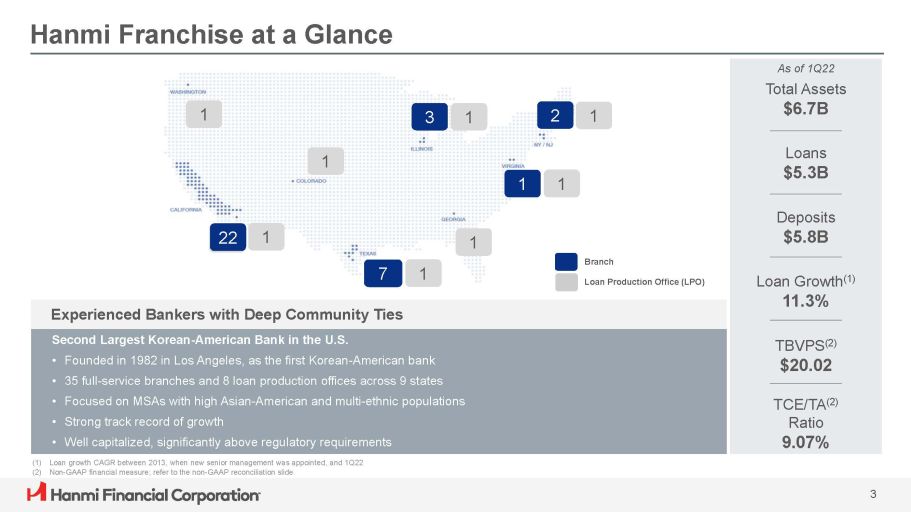

Hanmi Franchise at a Glance Loans $5.3B Deposits $5.8B TCE/TA (2) Ratio 9.07% Second Largest Korean - American Bank in the U.S. • Founded in 1982 in Los Angeles, as the first Korean - American bank • 35 full - service branches and 8 loan production offices across 9 states • Focused on MSAs with high Asian - American and multi - ethnic populations • Strong track record of growth • Well capitalized, significantly above regulatory requirements (1) Loan growth CAGR between 2013, when new senior management was appointed, and 1Q22 (2) Non - GAAP financial measure; refer to the non - GAAP reconciliation slide Loan Growth (1) 11.3% TBVPS (2) $20.02 As of 1Q22 Total Assets $6.7B Experienced Bankers with Deep Community Ties 2 1 3 1 1 1 1 7 1 1 Branch Loan Production Office (LPO) 1 2 2 2 1 3

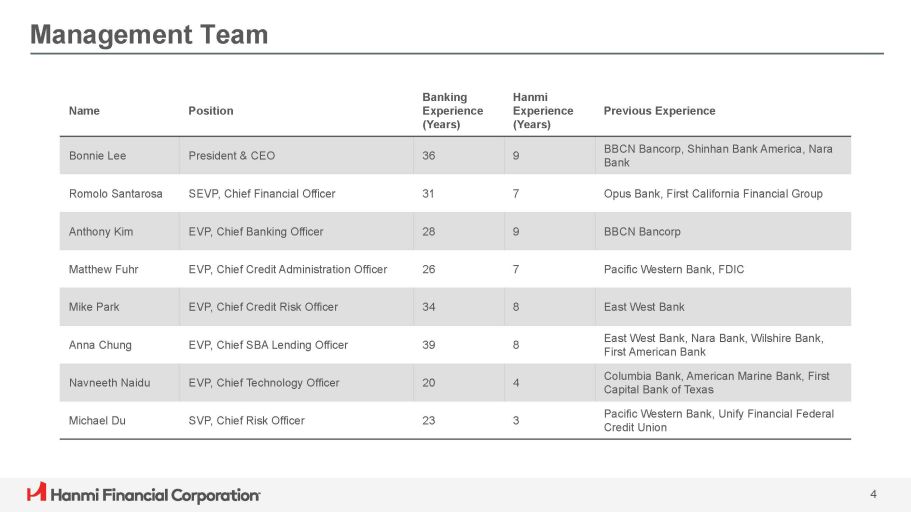

Name Position Banking Experience (Years) Hanmi Experience (Years) Previous Experience Bonnie Lee President & CEO 36 9 BBCN Bancorp, Shinhan Bank America, Nara Bank Romolo Santarosa SEVP, Chief Financial Officer 31 7 Opus Bank, First California Financial Group Anthony Kim EVP, Chief Banking Officer 28 9 BBCN Bancorp Matthew Fuhr EVP, Chief Credit Administration Officer 26 7 Pacific Western Bank, FDIC Mike Park EVP, Chief Credit Risk Officer 34 8 East West Bank Anna Chung EVP, Chief SBA Lending Officer 39 8 East West Bank, Nara Bank, Wilshire Bank, First American Bank Navneeth Naidu EVP, Chief Technology Officer 20 4 Columbia Bank, American Marine Bank, First Capital Bank of Texas Michael Du SVP, Chief Risk Officer 23 3 Pacific Western Bank, Unify Financial Federal Credit Union 4 Management Team

The Hanmi Story “For 40 years, we have been dedicated to helping our stakeholders bank on their dreams . Our close customer partnerships , along with our deep community ties , have enabled Hanmi to grow and flourish and position us exceptionally well for the next 40 years.” 1982 1988 2001 2004 Acquired Pacific Union Bank ($1.2B in assets acquired) 2016 Acquired Commercial Equipment Leasing Division (CELD) 2007 Completed $70 million secondary common stock offering First Korean American Bank in the U.S. Acquired Central Bancorp, Inc. ($1.3B in assets acquired) Began offering SBA loans; Listed HAFC common stock Acquired First Global Bank 2013 2014 2017 2018 2019 2020 5 Opened Chinatown branch in Houston, Texas Embarked on mortgage & digital banking initiatives Bonnie Lee appointed as the new CEO C.G. Kum appointed as the new CEO; Bonnie Lee appointed as the new COO Assets surpassed $5 billion; Opened a Manhattan, NY branch

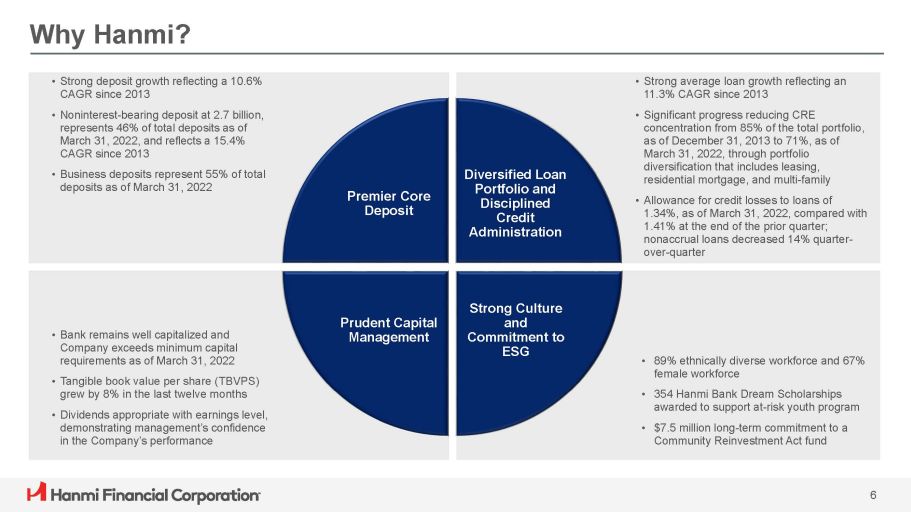

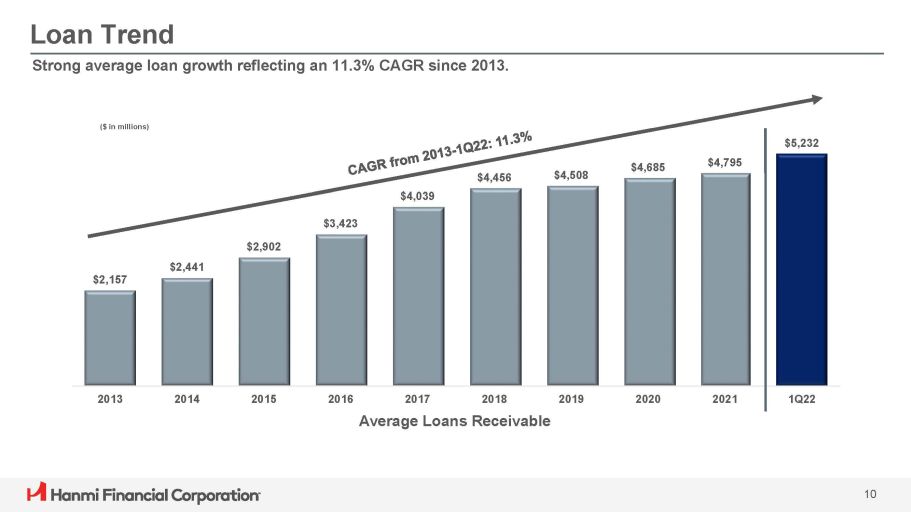

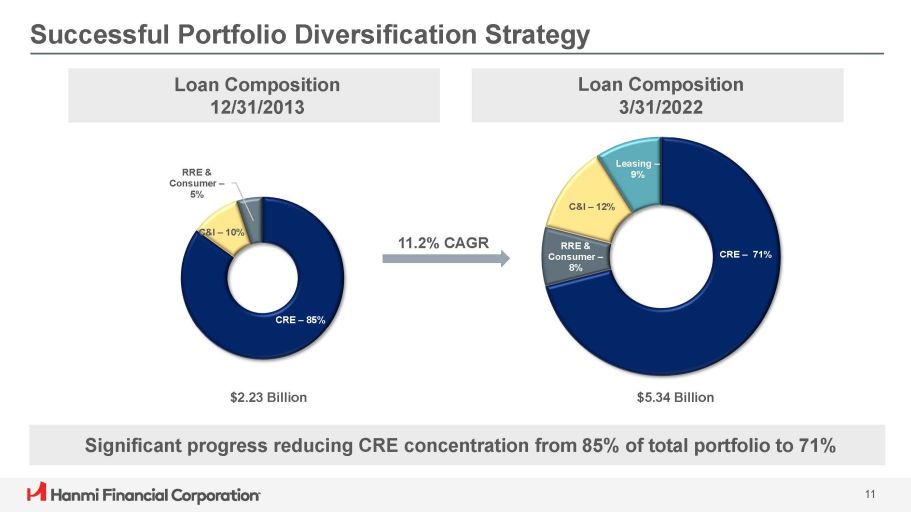

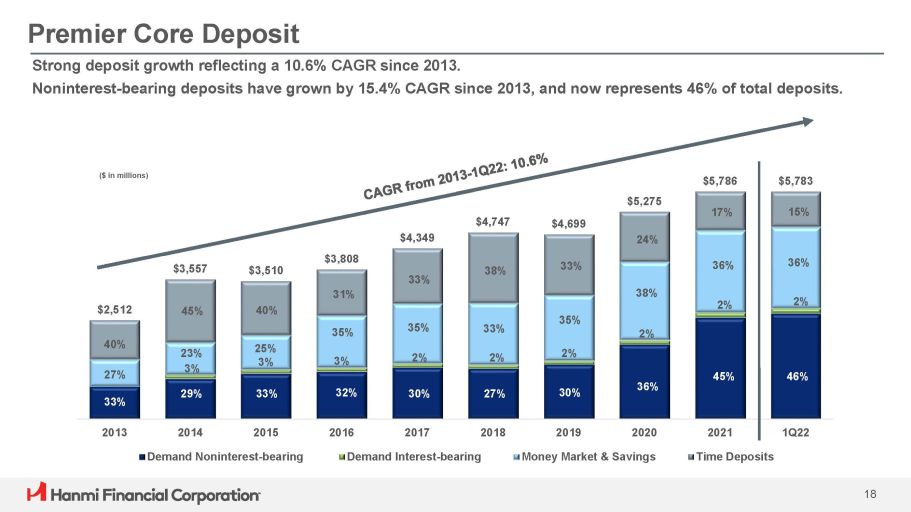

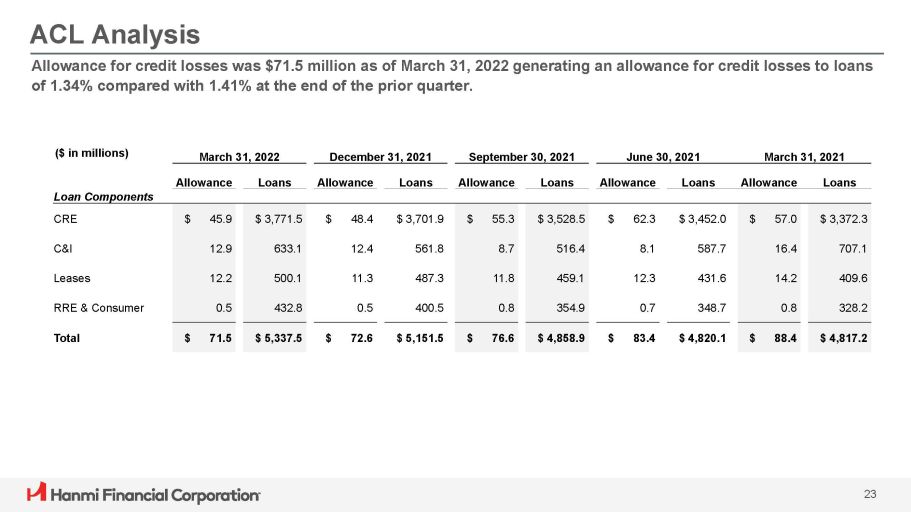

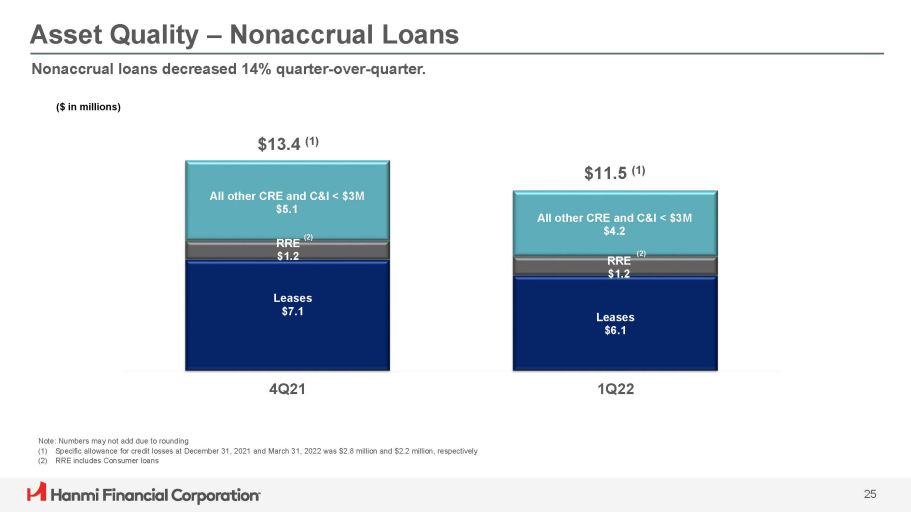

Why Hanmi? • Strong average loan growth reflecting an 11.3% CAGR since 2013 • Significant progress reducing CRE concentration from 85% of the total portfolio, as of December 31, 2013 to 71%, as of March 31, 2022, through portfolio diversification that includes leasing, residential mortgage, and multi - family • Allowance for credit losses to loans of 1.34%, as of March 31, 2022, compared with 1.41% at the end of the prior quarter; nonaccrual loans decreased 14% quarter - over - quarter • Strong deposit growth reflecting a 10.6% CAGR since 2013 • Noninterest - bearing deposit at 2.7 billion, represents 46% of total deposits as of March 31, 2022, and reflects a 15.4% CAGR since 2013 • Business deposits represent 55% of total deposits as of March 31, 2022 Premier Core Deposit Diversified Loan Portfolio and Disciplined Credit Administration 6 Strong Culture and Commitment to ESG Prudent Capital Management • Bank remains well capitalized and Company exceeds minimum capital requirements as of March 31, 2022 • Tangible book value per share (TBVPS) grew by 8% in the last twelve months • Dividends appropriate with earnings level, demonstrating management’s confidence in the Company’s performance • 89% ethnically diverse workforce and 67% female workforce • 354 Hanmi Bank Dream Scholarships awarded to support at - risk youth program • $7.5 million long - term commitment to a Community Reinvestment Act fund

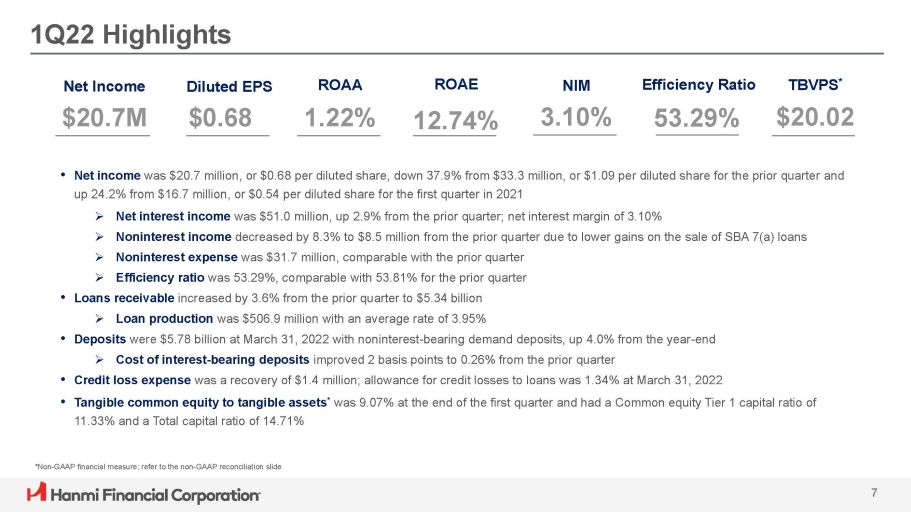

1Q22 Highlights Diluted EPS $0.68 ROAA 1.22% NIM 3.10% Efficiency Ratio 53.29% TBVPS * $20.02 Net Income $20.7M *Non - GAAP financial measure; refer to the non - GAAP reconciliation slide • Net income was $20.7 million, or $0.68 per diluted share, down 37.9% from $33.3 million, or $1.09 per diluted share for the prior quarter and up 24.2% from $16.7 million, or $0.54 per diluted share for the first quarter in 2021 » Net interest income was $51.0 million, up 2.9% from the prior quarter; net interest margin of 3.10% » Noninterest income decreased by 8.3% to $8.5 million from the prior quarter due to lower gains on the sale of SBA 7(a) loans » Noninterest expense was $31.7 million, comparable with the prior quarter » Efficiency ratio was 53.29%, comparable with 53.81% for the prior quarter • Loans receivable increased by 3.6% from the prior quarter to $5.34 billion » Loan production was $506.9 million with an average rate of 3.95% • Deposits were $5.78 billion at March 31, 2022 with noninterest - bearing demand deposits, up 4.0% from the year - end » Cost of interest - bearing deposits improved 2 basis points to 0.26% from the prior quarter • Credit loss expense was a recovery of $1.4 million; allowance for credit losses to loans was 1.34% at March 31, 2022 • Tangible common equity to tangible assets * was 9.07% at the end of the first quarter and had a Common equity Tier 1 capital ratio of 11.33% and a Total capital ratio of 14.71% ROAE 12.74% 7

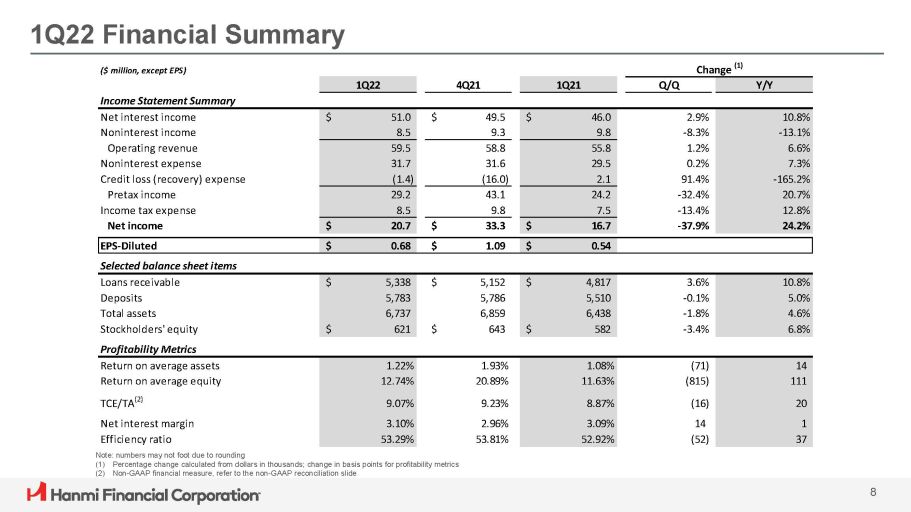

EPS - Diluted $ 0.68 $ 1.09 $ 0.54 ($ million, except EPS) Change (1) 1Q22 4Q21 1Q21 Q/Q Y/Y Income Statement Summary Net interest income $ 51.0 $ 49.5 $ 46.0 2.9% 10.8% Noninterest income 8.5 9.3 9.8 - 8.3% - 13.1% Operating revenue 59.5 58.8 55.8 1.2% 6.6% Noninterest expense 31.7 31.6 29.5 0.2% 7.3% Credit loss (recovery) expense (1.4) (16.0) 2.1 91.4% - 165.2% Pretax income 29.2 43.1 24.2 - 32.4% 20.7% Income tax expense 8.5 9.8 7.5 - 13.4% 12.8% Net income $ 20.7 $ 33.3 $ 16.7 - 37.9% 24.2% Selected balance sheet items Loans receivable $ 5,338 $ 5,152 $ 4,817 3.6% 10.8% Deposits 5,783 5,786 5,510 - 0.1% 5.0% Total assets 6,737 6,859 6,438 - 1.8% 4.6% Stockholders' equity $ 621 $ 643 $ 582 - 3.4% 6.8% Profitability Metrics Return on average assets 1.22% 1.93% 1.08% (71) 14 Return on average equity 12.74% 20.89% 11.63% (815) 111 TCE/TA (2) 9.07% 9.23% 8.87% (16) 20 Net interest margin 3.10% 2.96% 3.09% 14 1 Efficiency ratio 53.29% 53.81% 52.92% (52) 37 Note: numbers may not foot due to rounding (1) Percentage change calculated from dollars in thousands; change in basis points for profitability metrics (2) Non - GAAP financial measure, refer to the non - GAAP reconciliation slide 8 1Q22 Financial Summary

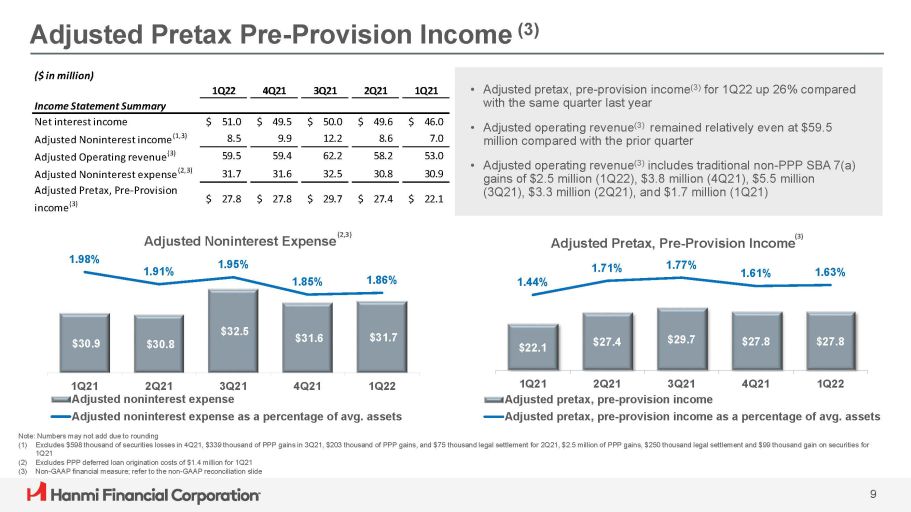

Adjusted Pretax Pre - Provision Income (3) • Adjusted pretax, pre - provision income (3) for 1Q22 up 26% compared with the same quarter last year • Adjusted operating revenue (3) remained relatively even at $59.5 million compared with the prior quarter • Adjusted operating revenue (3) includes traditional non - PPP SBA 7(a) gains of $2.5 million (1Q22), $3.8 million (4Q21), $5.5 million (3Q21), $3.3 million (2Q21), and $1.7 million (1Q21) (1) Excludes $598 thousand of securities losses in 4Q21, $339 thousand of PPP gains in 3Q21, $203 thousand of PPP gains, and $75 thousand legal settlement for 2Q21, $2.5 million of PPP gains, $250 thousand legal settlement and $99 thousand gain on securities for 1Q21 (2) Excludes PPP deferred loan origination costs of $1.4 million for 1Q21 (3) Non - GAAP financial measure; refer to the non - GAAP reconciliation slide Adjusted Noninterest Expense (2,3) (3) Adjusted Pretax, Pre - Provision Income $30.9 $30.8 $32.5 $31.6 $31.7 1.98% 1.91% 1.95% 1.85% 1.86% 1Q21 2Q21 3Q21 4Q21 1Q22 Adjusted noninterest expense Adjusted noninterest expense as a percentage of avg. assets Note: Numbers may not add due to rounding $22.1 $27.4 $29.7 $27.8 $27.8 1.44% 1.71% 1.77% 1.61% 1.63% 1Q21 2Q21 3Q21 4Q21 1Q22 Adjusted pretax, pre - provision income Adjusted pretax, pre - provision income as a percentage of avg. assets ($ in million) 1Q22 4Q21 3Q21 2Q21 1Q21 Income Statement Summary Net interest income $ 51.0 $ 49.5 $ 50.0 $ 49.6 $ 46.0 Adjusted Noninterest income (1,3) 8.5 9.9 12.2 8.6 7.0 Adjusted Operating revenue (3) 59.5 59.4 62.2 58.2 53.0 Adjusted Noninterest expense (2,3) 31.7 31.6 32.5 30.8 30.9 Adjusted Pretax, Pre - Provision income (3) $ 27.8 $ 27.8 $ 29.7 $ 27.4 $ 22.1 9

Loan Trend $4,039 $3,423 $2,902 $2,441 $2,157 $4,456 $4,508 $4,685 $4,795 $5,232 2013 2014 2015 2016 2019 2020 2021 1Q22 2017 2018 Average Loans Receivable Strong average loan growth reflecting an 11.3% CAGR since 2013. ($ in millions) 10

Successful Portfolio Diversification Strategy Loan Composition 3/31/2022 Loan Composition 12/31/2013 CRE – 85% C&I – 10% RRE & Consumer – 5% Significant progress reducing CRE concentration from 85% of total portfolio to 71% $2.23 Billion $5.34 Billion 11.2% CAGR CRE – 71% 11 RRE & Consumer – 8% C&I – 12% Leasing – 9%

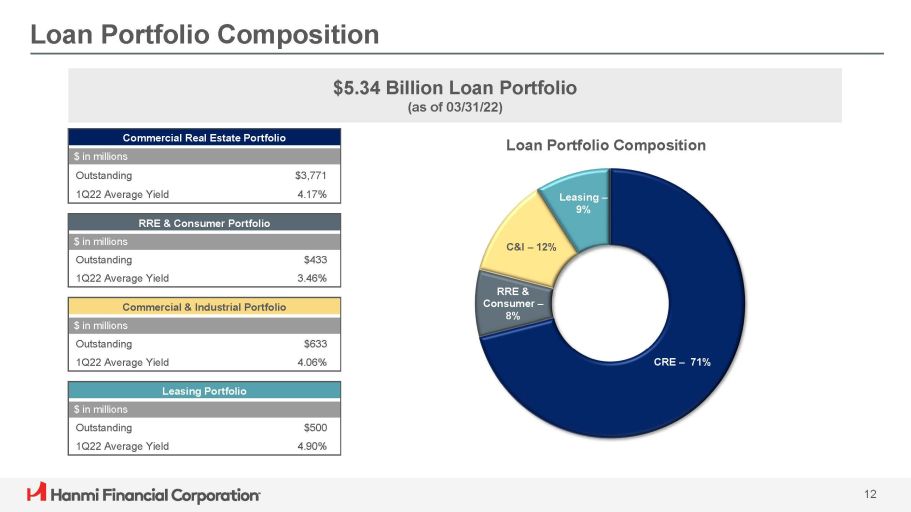

Loan Portfolio Composition RRE & Consumer Portfolio $ in millions Outstanding $433 1Q22 Average Yield 3.46% Commercial & Industrial Portfolio $ in millions Outstanding $633 1Q22 Average Yield 4.06% Commercial Real Estate Portfolio $ in millions Outstanding $3,771 1Q22 Average Yield 4.17% $5.34 Billion Loan Portfolio (as of 03/31/22) Loan Portfolio Composition CRE – 71% 12 RRE & Consumer – 8% Leasing – 9% C&I – 12% Leasing Portfolio $ in millions Outstanding $500 1Q22 Average Yield 4.90%

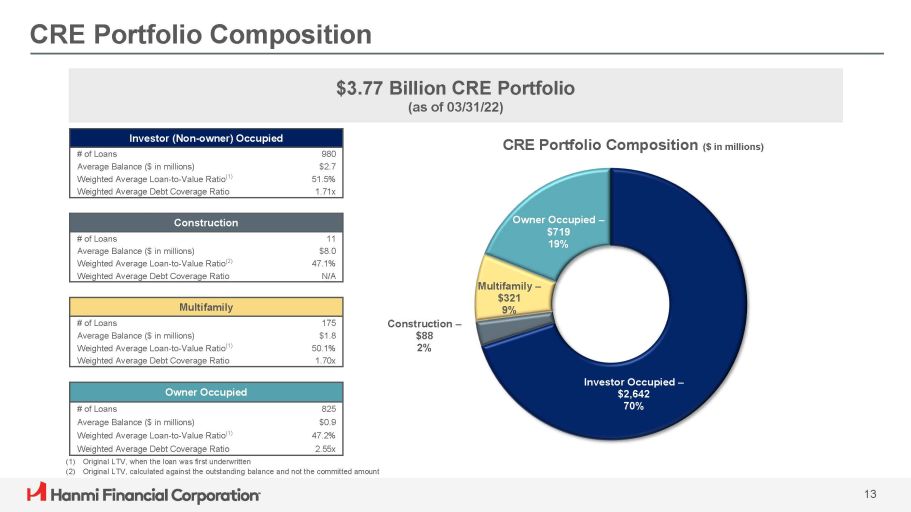

Owner Occupied – $719 19% Multifamily – $321 9% Construction – $88 2% Investor Occupied – $2,642 70% 13 CRE Portfolio Composition Construction # of Loans 11 Average Balance ($ in millions) $8.0 Weighted Average Loan - to - Value Ratio (2) 47.1% Weighted Average Debt Coverage Ratio N/A Multifamily # of Loans 175 Average Balance ($ in millions) $1.8 Weighted Average Loan - to - Value Ratio (1) 50.1% Weighted Average Debt Coverage Ratio 1.70x Investor (Non - owner) Occupied # of Loans 980 Average Balance ($ in millions) $2.7 Weighted Average Loan - to - Value Ratio (1) 51.5% Weighted Average Debt Coverage Ratio 1.71x (1) Original LTV, when the loan was first underwritten (2) Original LTV, calculated against the outstanding balance and not the committed amount $3.77 Billion CRE Portfolio (as of 03/31/22) CRE Portfolio Composition ($ in millions) Owner Occupied # of Loans 825 Average Balance ($ in millions) $0.9 Weighted Average Loan - to - Value Ratio (1) 47.2% Weighted Average Debt Coverage Ratio 2.55x

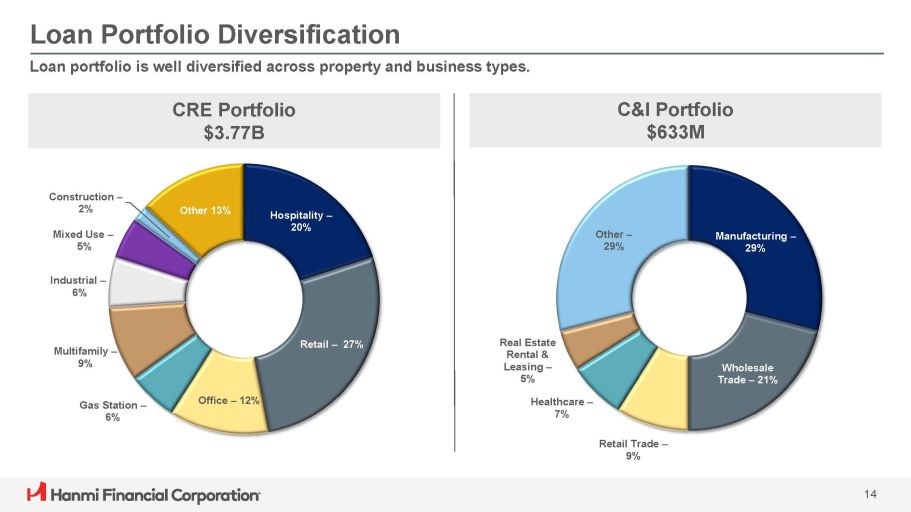

Loan Portfolio Diversification Loan portfolio is well diversified across property and business types. Hospitality – 20% Retail – 27% Office – 12% Gas Station – 6% Multifamily – 9% Industrial – 6% Mixed Use – 5% Construction – 2% Other 13% Manufacturing – 29% 14 Wholesale Trade – 21% Retail Trade – 9% Healthcare – 7% Real Estate Rental & Leasing – 5% Other – 29% C&I Portfolio $633M CRE Portfolio $3.77B

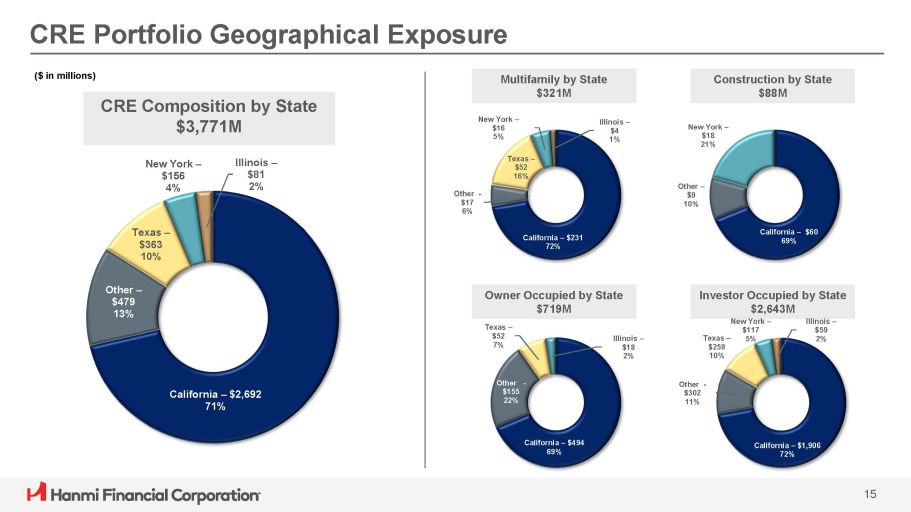

CRE Portfolio Geographical Exposure CRE Composition by State $3,771M Multifamily by State $321M Construction by State $88M Owner Occupied by State $719M Investor Occupied by State $2,643M ($ in millions) California – $2,692 71% Other – $479 13% Texas – $363 10% New York – $156 4% Illinois – $81 2% California – $231 72% Other - $17 6% Texas – $52 16% New York – $16 5% Illinois – $4 1% California – $60 69% Other – $9 10% New York – $18 21% California – $494 69% Other - $155 22% Texas – $52 7% Illinois – $18 2% California – $1,906 72% 15 Other - $302 11% New York – $117 Texas – 5% $259 10% Illinois – $59 2%

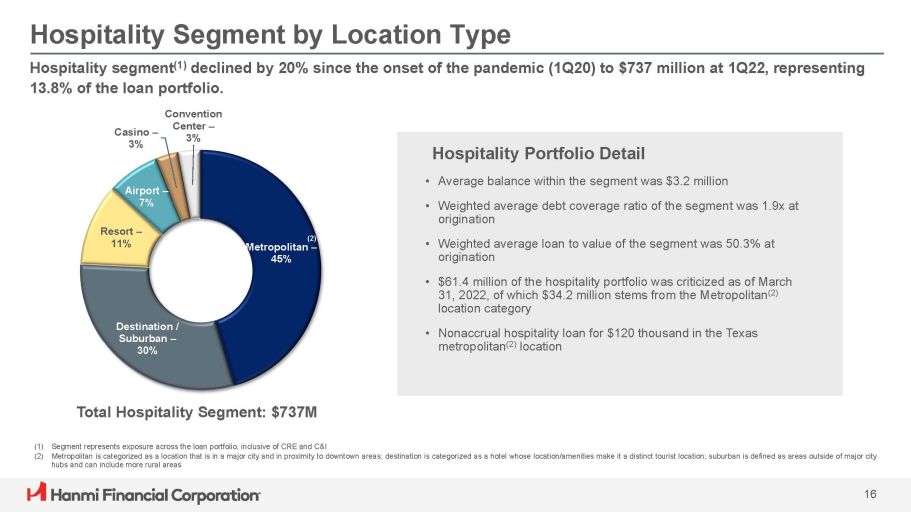

Hospitality Segment by Location Type Total Hospitality Segment: $737M (1) Segment represents exposure across the loan portfolio, inclusive of CRE and C&I (2) Metropolitan is categorized as a location that is in a major city and in proximity to downtown areas; destination is categorized as a hotel whose location/amenities make it a distinct tourist location; suburban is defined as areas outside of major city hubs and can include more rural areas Hospitality Portfolio Detail • Average balance within the segment was $3.2 million • Weighted average debt coverage ratio of the segment was 1.9x at origination • Weighted average loan to value of the segment was 50.3% at origination • $61.4 million of the hospitality portfolio was criticized as of March 31, 2022, of which $34.2 million stems from the Metropolitan (2) location category • Nonaccrual hospitality loan for $120 thousand in the Texas metropolitan (2) location Destination / Suburban – 30% 16 Resort – 11% Airport – 7% Casino – 3% Hospitality segment (1) declined by 20% since the onset of the pandemic (1Q20) to $737 million at 1Q22, representing 13.8% of the loan portfolio. Convention Center – 3% (2) Metropolitan – 45%

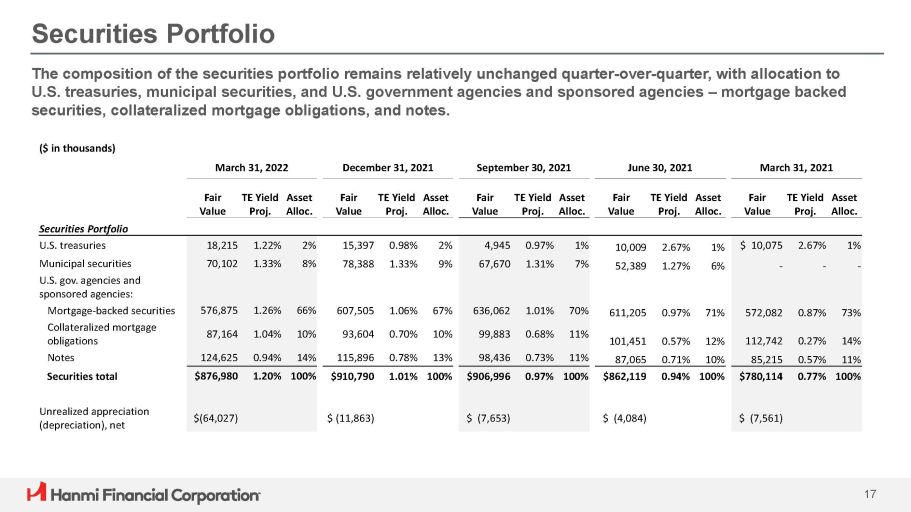

Securities Portfolio 17 The composition of the securities portfolio remains relatively unchanged quarter - over - quarter, with allocation to U.S. treasuries, municipal securities, and U.S. government agencies and sponsored agencies – mortgage backed securities, collateralized mortgage obligations, and notes. ($ in thousands) March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021 Fair Value TE Yield Proj. Asset Alloc. Fair Value TE Yield Proj. Asset Alloc. Fair Value TE Yield Proj. Asset Alloc. Fair Value TE Yield Proj. Asset Alloc. Fair Value TE Yield Proj. Asset Alloc. Securities Portfolio U.S. treasuries 18,215 1.22% 2% 15,397 0.98% 2% 4,945 0.97% 1% 10,009 2.67% 1% $ 10,075 2.67% 1% Municipal securities 70,102 1.33% 8% 78,388 1.33% 9% 67,670 1.31% 7% 52,389 1.27% 6% - - - U.S. gov. agencies and sponsored agencies: Mortgage - backed securities 576,875 1.26% 66% 607,505 1.06% 67% 636,062 1.01% 70% 611,205 0.97% 71% 572,082 0.87% 73% Collateralized mortgage obligations 87,164 1.04% 10% 93,604 0.70% 10% 99,883 0.68% 11% 101,451 0.57% 12% 112,742 0.27% 14% Notes 124,625 0.94% 14% 115,896 0.78% 13% 98,436 0.73% 11% 87,065 0.71% 10% 85,215 0.57% 11% Securities total $876,980 1.20% 100% $910,790 1.01% 100% $906,996 0.97% 100% $862,119 0.94% 100% $780,114 0.77% 100% Unrealized appreciation (depreciation), net $(64,027) $ (11,863) $ (7,653) $ (4,084) $ (7,561)

$3,808 $4,349 $4,747 $4,699 $5,275 $5,786 $5,783 2013 2016 2017 2018 2021 1Q22 2014 2015 Demand Noninterest - bearing 2019 2020 Money Market & Savings Demand Interest - bearing Time Deposits 36% 2% Premier Core Deposit Strong deposit growth reflecting a 10.6% CAGR since 2013. Noninterest - bearing deposits have grown by 15.4% CAGR since 2013, and now represents 46% of total deposits. 18 15% 46% 2% 36% 17% 45% 24% 38% 2% 2% 35% 33% 40% 27% 38% 33% 2% 2% 35% 33% 3% 35% 25% 3% 23% 3% ($ in millions) $3,557 $3,510 $2,512 45% 40% 31% 36% 30% 33% 27% 30% 32% 33% 29%

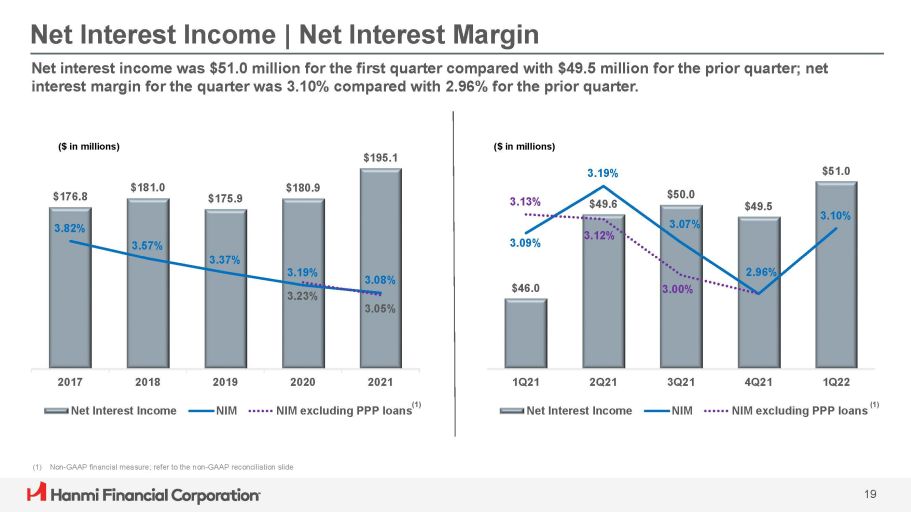

Net Interest Income | Net Interest Margin $176.8 $181.0 $175.9 $180.9 $195.1 3.82% 3.57% 3.37% 3.08% 3.19% 3.23% 3.05% 2019 2020 2021 2017 2018 Net Interest Income NIM NIM excluding PPP loans Net interest income was $51.0 million for the first quarter compared with $49.5 million for the prior quarter; net interest margin for the quarter was 3.10% compared with 2.96% for the prior quarter. ($ in millions) $46.0 $49.6 $50.0 $49.5 $51.0 3.09% 3.19% 3.07% 2.96% 3.10% 3.13% 3.12% 3.00% 3Q21 4Q21 1Q22 NIM excluding PPP loans 1Q21 2Q21 Net Interest Income NIM ($ in millions) 19 (1) Non - GAAP financial measure; refer to the non - GAAP reconciliation slide (1) (1)

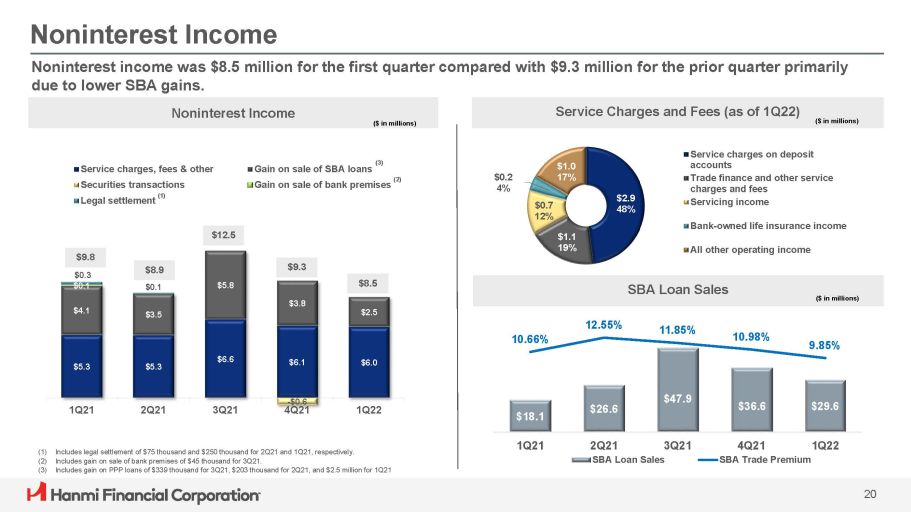

Noninterest Income Noninterest Income ($ in millions) Service Charges and Fees (as of 1Q22) ($ in millions) $18.1 $26.6 $47.9 $36.6 $29.6 10.66% 12.55% 11.85% 10.98% 9.85% 1Q21 2Q21 3Q21 1Q22 4Q21 SBA Trade Premium SBA Loan Sales Noninterest income was $8.5 million for the first quarter compared with $9.3 million for the prior quarter primarily due to lower SBA gains. (1) Includes legal settlement of $75 thousand and $250 thousand for 2Q21 and 1Q21, respectively. (2) Includes gain on sale of bank premises of $45 thousand for 3Q21. (3) Includes gain on PPP loans of $339 thousand for 3Q21, $203 thousand for 2Q21, and $2.5 million for 1Q21 (3) Gain on sale of SBA loans (2) Gain on sale of bank premises $5.3 $5.3 $6.6 $6.1 $6.0 $4.1 $3.5 $5.8 $3.8 $2.5 $0.3 $0.1 $0.1 1Q21 2Q21 3Q21 - $0.6 4Q21 1Q22 Service charges, fees & other Securities transactions Legal settlement (1) $12.5 $9.3 $8.9 $9.8 $8.5 $2.9 48% $1.1 19% $0.7 12% $0.2 4% $1.0 17% Service charges on deposit accounts Trade finance and other service charges and fees Servicing income Bank - owned life insurance income All other operating income SBA Loan Sales 20 ($ in millions)

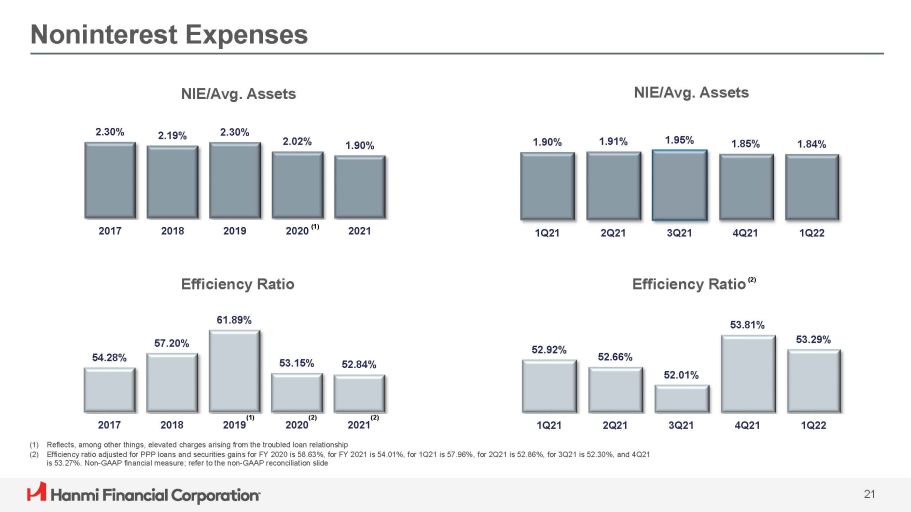

Noninterest Expenses 52.92% 52.66% 52.01% 53.81% 53.29% 3Q21 4Q21 1Q22 Efficiency Ratio (2) 2.30% 2.19% 2.30% 2.02% 1.90% 2017 2018 2019 2020 (1) 2021 NIE/Avg. Assets 54.28% 57.20% 61.89% 53.15% 52.84% 2017 2018 2019 (2) 2021 1Q21 2Q21 (2) 2020 Efficiency Ratio 1.90% 21 1.91% 1.95% 1.85% 1.84% 1Q21 2Q21 3Q21 4Q21 1Q22 NIE/Avg. Assets (1) Reflects, among other things, elevated charges arising from the troubled loan relationship (2) Efficiency ratio adjusted for PPP loans and securities gains for FY 2020 is 58.63%, for FY 2021 is 54.01%, for 1Q21 is 57.96%, for 2Q21 is 52.86%, for 3Q21 is 52.30%, and 4Q21 is 53.27%. Non - GAAP financial measure; refer to the non - GAAP reconciliation slide (1)

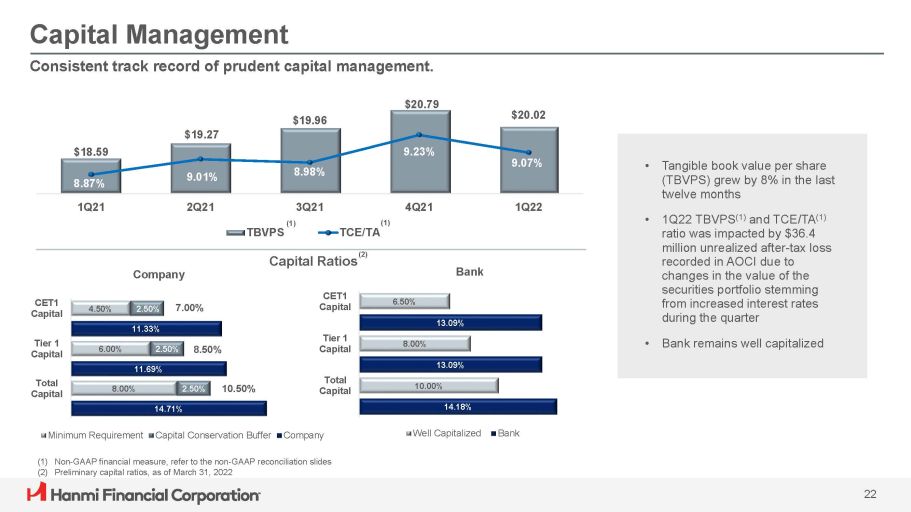

Capital Management • Tangible book value per share (TBVPS) grew by 8% in the last twelve months • 1Q22 TBVPS (1) and TCE/TA (1) ratio was impacted by $36.4 million unrealized after - tax loss recorded in AOCI due to changes in the value of the securities portfolio stemming from increased interest rates during the quarter • Bank remains well capitalized $18.59 $19.27 $19.96 Consistent track record of prudent capital management. $20.79 $20.02 8.87% 9.01% 8.98% 9.23% 9.07% 1Q21 2Q21 3Q21 4Q21 1Q22 TBVPS TCE/TA 8.00% 6.00% 4.50% 2.50% 2.50% 2.50% 11.69% 11.33% 10.50% 8.50% 7.00% Total Capital Tier 1 Capital CET1 Capital 14.71% Minimum Requirement Capital Conservation Buffer Company (1) Non - GAAP financial measure, refer to the non - GAAP reconciliation slides (2) Preliminary capital ratios, as of March 31, 2022 Capital Ratios Company 10.00% 8.00% 6.50% 14.18% 13.09% 13.09% Total Capital Tier 1 Capital CET1 Capital Well Capitalized Bank 22 Bank (1) (1) (2)

ACL Analysis Allowance for credit losses was $71.5 million as of March 31, 2022 generating an allowance for credit losses to loans of 1.34% compared with 1.41% at the end of the prior quarter. ($ in millions) 23 March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021 Allowance Loans Allowance Loans Allowance Loans Allowance Loans Allowance Loans Loan Components CRE $ 45.9 $ 3,771.5 $ 48.4 $ 3,701.9 $ 55.3 $ 3,528.5 $ 62.3 $ 3,452.0 $ 57.0 $ 3,372.3 C&I 12.9 633.1 12.4 561.8 8.7 516.4 8.1 587.7 16.4 707.1 Leases 12.2 500.1 11.3 487.3 11.8 459.1 12.3 431.6 14.2 409.6 RRE & Consumer 0.5 432.8 0.5 400.5 0.8 354.9 0.7 348.7 0.8 328.2 Total $ 71.5 $ 5,337.5 $ 72.6 $ 5,151.5 $ 76.6 $ 4,858.9 $ 83.4 $ 4,820.1 $ 88.4 $ 4,817.2

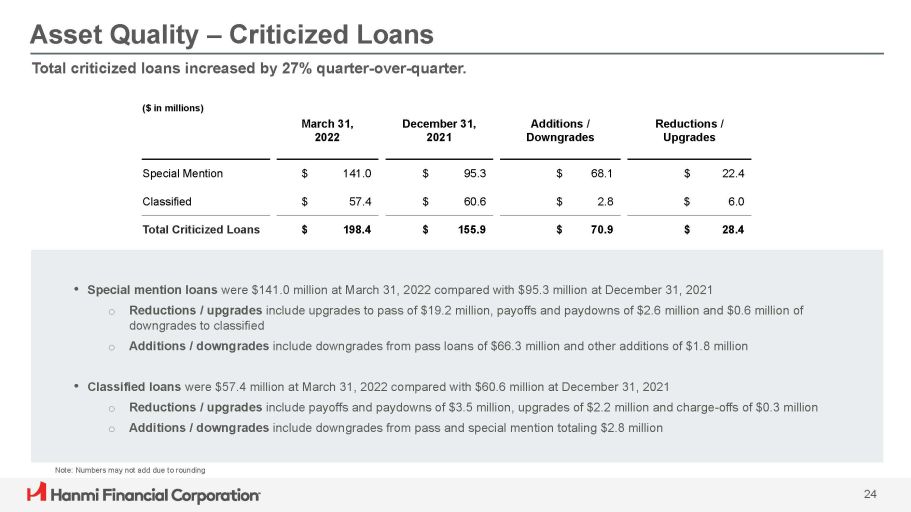

Asset Quality – Criticized Loans 24 Total criticized loans increased by 27% quarter - over - quarter. Note: Numbers may not add due to rounding • Special mention loans were $141.0 million at March 31, 2022 compared with $95.3 million at December 31, 2021 o Reductions / upgrades include upgrades to pass of $19.2 million, payoffs and paydowns of $2.6 million and $0.6 million of downgrades to classified o Additions / downgrades include downgrades from pass loans of $66.3 million and other additions of $1.8 million • Classified loans were $57.4 million at March 31, 2022 compared with $60.6 million at December 31, 2021 o Reductions / upgrades include payoffs and paydowns of $3.5 million, upgrades of $2.2 million and charge - offs of $0.3 million o Additions / downgrades include downgrades from pass and special mention totaling $2.8 million ($ in millions) March 31, 2022 December 31, 2021 Additions / Downgrades Reductions / Upgrades Special Mention $ 141.0 $ 95.3 $ 68.1 $ 22.4 Classified $ 57.4 $ 60.6 $ 2.8 $ 6.0 Total Criticized Loans $ 198.4 $ 155.9 $ 70.9 $ 28.4

Asset Quality – Nonaccrual Loans Nonaccrual loans decreased 14% quarter - over - quarter. ($ in millions) Note: Numbers may not add due to rounding (1) Specific allowance for credit losses at December 31, 2021 and March 31, 2022 was $2.8 million and $2.2 million, respectively (2) RRE includes Consumer loans Leases $7.1 25 Leases $6.1 RRE $1.2 All other CRE and C&I < $3M $5.1 All other CRE and C&I < $3M $4.2 4Q21 1Q22 $11.5 (1) $13.4 (1) (2) (2) RRE $1.2

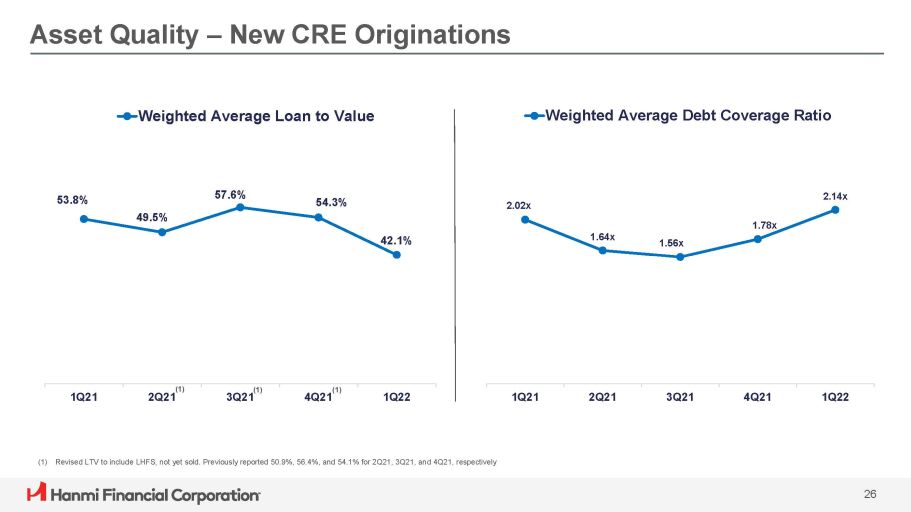

Asset Quality – New CRE Originations 53.8% 49.5% 57.6% 54.3% 42.1% 1Q21 2Q21 3Q21 4Q21 1Q22 Weighted Average Loan to Value 2.02x 1.64x 1.56x 1.78x 2.14x 1Q21 2Q21 3Q21 4Q21 1Q22 Weighted Average Debt Coverage Ratio (1) Revised LTV to include LHFS, not yet sold. Previously reported 50.9%, 56.4%, and 54.1% for 2Q21, 3Q21, and 4Q21, respectively 26 (1) (1) (1)

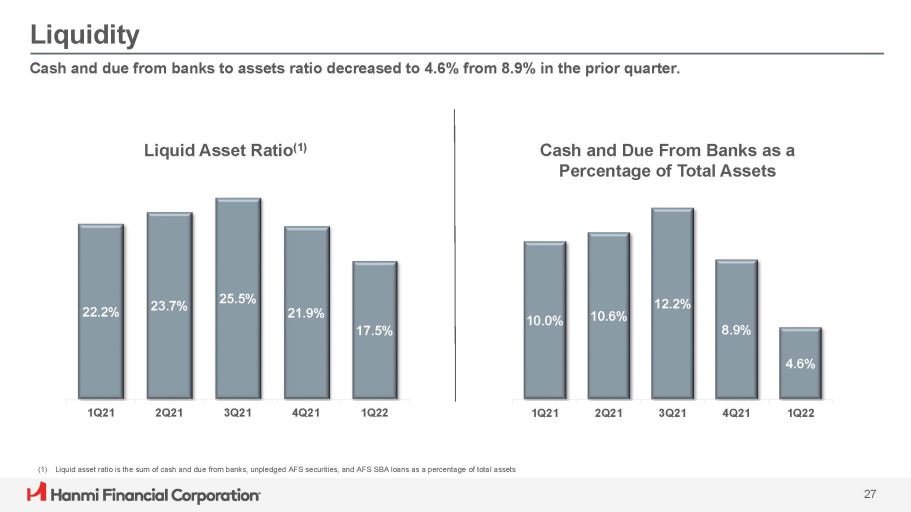

Liquidity Cash and due from banks to assets ratio decreased to 4.6% from 8.9% in the prior quarter. Liquid Asset Ratio (1) (1) Liquid asset ratio is the sum of cash and due from banks, unpledged AFS securities, and AFS SBA loans as a percentage of total assets Cash and Due From Banks as a Percentage of Total Assets 22.2% 23.7% 25.5% 21.9% 17.5% 1Q21 2Q21 3Q21 4Q21 1Q22 10.0% 10.6% 12.2% 8.9% 4.6% 1Q21 2Q21 3Q21 4Q21 1Q22 27

Strong Company Culture and ESG Commitment We are challenging ourselves to do more and lead the way to achieve our vision of the Company • Seasoned team with deep community ties • Close customer partnerships • Investments in talent and technology Strong Company Culture Commitment to ESG 67% Female ~89% Ethnically Diverse Workforce Workforce to support at - risk youth program $7.5M 354 Hanmi Bank Dream Scholarships awarded 28 Long - term commitment to a Community Reinvestment Act fund

Appendix 29

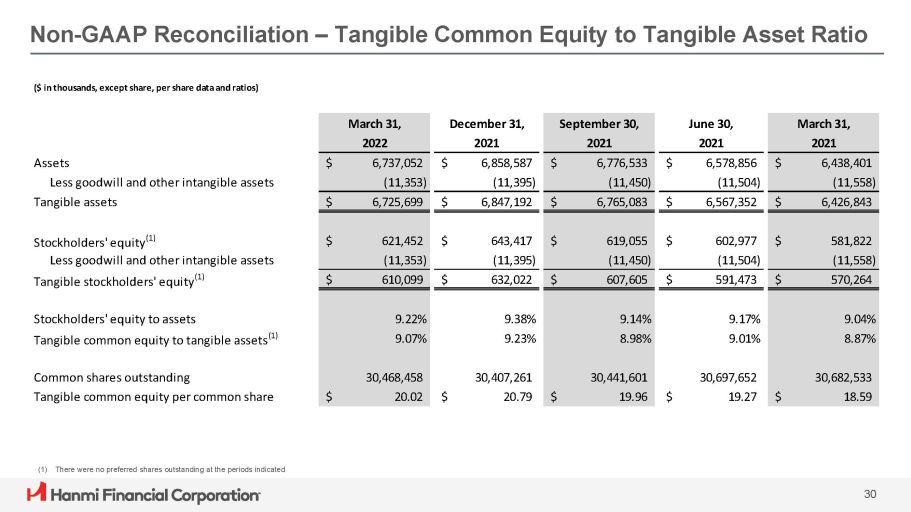

Non - GAAP Reconciliation – Tangible Common Equity to Tangible Asset Ratio March 31, 2022 $ 6,737,052 (11,353) $ 6,725,699 $ 621,452 (11,353) $ 610,099 9.22% 9.07% 30,468,458 $ 20.02 September 30, 2021 $ 6,776,533 (11,450) $ 6,765,083 $ 619,055 (11,450) $ 607,605 9.14% 8.98% 30,441,601 $ 19.96 March 31, 2021 $ 6,438,401 (11,558) $ 6,426,843 $ 581,822 (11,558) $ 570,264 9.04% 8.87% 30,682,533 $ 18.59 ($ in thousands, except share, per share data and ratios) December 31, 2021 June 30, 2021 Assets Less goodwill and other intangible assets Tangible assets $ 6,858,587 (11,395) $ 6,578,856 (11,504) $ 6,847,192 $ 6,567,352 Stockholders' equity (1) Less goodwill and other intangible assets Tangible stockholders' equity (1) 643,417 (11,395) $ 602,977 (11,504) $ $ 632,022 $ 591,473 Stockholders' equity to assets Tangible common equity to tangible assets (1) 9.38% 9.23% 9.17% 9.01% Common shares outstanding Tangible common equity per common share 30,407,261 20.79 30,697,652 19.27 $ $ (1) There were no preferred shares outstanding at the periods indicated 30

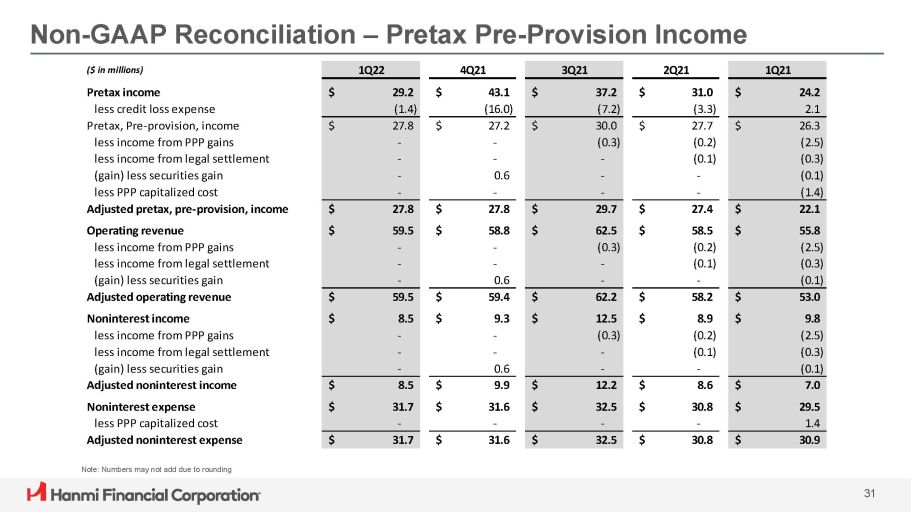

Non - GAAP Reconciliation – Pretax Pre - Provision Income ($ in millions) 1Q22 4Q21 3Q21 2Q21 1Q21 Pretax income $ 29.2 $ 43.1 $ 37.2 $ 31.0 $ 24.2 less credit loss expense (1.4) (16.0) (7.2) (3.3) 2.1 Pretax, Pre - provision, income $ 27.8 $ 27.2 $ 30.0 $ 27.7 $ 26.3 less income from PPP gains - - (0.3) (0.2) (2.5) less income from legal settlement - - - (0.1) (0.3) (gain) less securities gain - 0.6 - - (0.1) less PPP capitalized cost - - - - (1.4) Adjusted pretax, pre - provision, income $ 27.8 $ 27.8 $ 29.7 $ 27.4 $ 22.1 Operating revenue $ 59.5 $ 58.8 $ 62.5 $ 58.5 $ 55.8 less income from PPP gains - - (0.3) (0.2) (2.5) less income from legal settlement - - - (0.1) (0.3) (gain) less securities gain - 0.6 - - (0.1) Adjusted operating revenue $ 59.5 $ 59.4 $ 62.2 $ 58.2 $ 53.0 Noninterest income $ 8.5 $ 9.3 $ 12.5 $ 8.9 $ 9.8 less income from PPP gains - - (0.3) (0.2) (2.5) less income from legal settlement - - - (0.1) (0.3) (gain) less securities gain - 0.6 - - (0.1) Adjusted noninterest income $ 8.5 $ 9.9 $ 12.2 $ 8.6 $ 7.0 Noninterest expense $ 31.7 $ 31.6 $ 32.5 $ 30.8 $ 29.5 less PPP capitalized cost - - - - 1.4 Adjusted noninterest expense $ 31.7 $ 31.6 $ 32.5 $ 30.8 $ 30.9 Note: Numbers may not add due to rounding 31

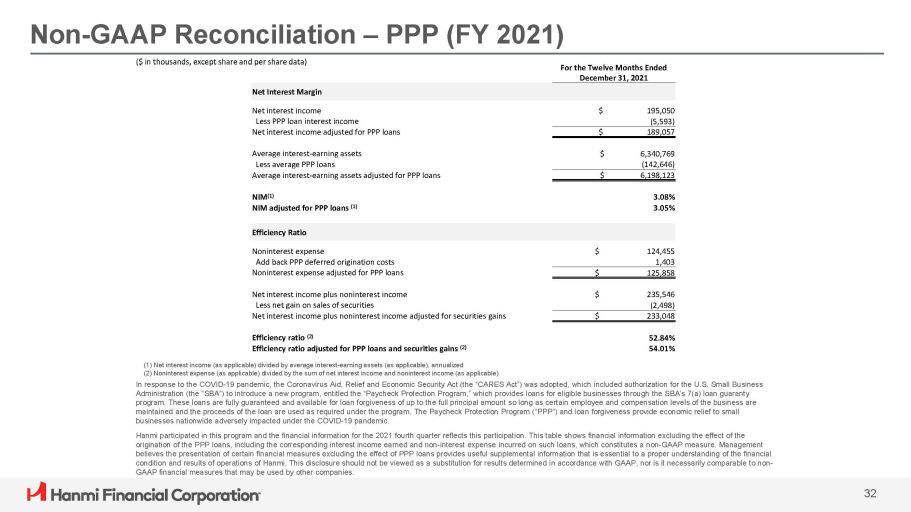

Non - GAAP Reconciliation – PPP (FY 2021) (1) Net interest income (as applicable) divided by average interest - earning assets (as applicable), annualized (2) Noninterest expense (as applicable) divided by the sum of net interest income and noninterest income (as applicable) In response to the COVID - 19 pandemic, the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”) was adopted, which included authorization for the U.S. Small Business Administration (the “SBA”) to introduce a new program, entitled the “Paycheck Protection Program,” which provides loans for eligible businesses through the SBA’s 7(a) loan guaranty program. These loans are fully guaranteed and available for loan forgiveness of up to the full principal amount so long as certain employee and compensation levels of the business are maintained and the proceeds of the loan are used as required under the program. The Paycheck Protection Program (“PPP”) and loan forgiveness provide economic relief to small businesses nationwide adversely impacted under the COVID - 19 pandemic. Hanmi participated in this program and the financial information for the 2021 fourth quarter reflects this participation. This table shows financial information excluding the effect of the origination of the PPP loans, including the corresponding interest income earned and non - interest expense incurred on such loans, which constitutes a non - GAAP measure. Management believes the presentation of certain financial measures excluding the effect of PPP loans provides useful supplemental information that is essential to a proper understanding of the financial condition and results of operations of Hanmi. This disclosure should not be viewed as a substitution for results determined in accordance with GAAP, nor is it necessarily comparable to non - GAAP financial measures that may be used by other companies. ($ in thousands, except share and per share data) For the Twelve Months Ended December 31, 2021 Net Interest Margin Net interest income $ 195,050 Less PPP loan interest income (5,593) Net interest income adjusted for PPP loans $ 189,057 Average interest - earning assets $ 6,340,769 Less average PPP loans (142,646) Average interest - earning assets adjusted for PPP loans $ 6,198,123 NIM (1) 3.08% NIM adjusted for PPP loans (1) 3.05% Efficiency Ratio Noninterest expense $ 124,455 Add back PPP deferred origination costs 1,403 Noninterest expense adjusted for PPP loans $ 125,858 Net interest income plus noninterest income $ 235,546 Less net gain on sales of securities (2,498) Net interest income plus noninterest income adjusted for securities gains $ 233,048 Efficiency ratio (2) 52.84% Efficiency ratio adjusted for PPP loans and securities gains (2) 54.01% 32

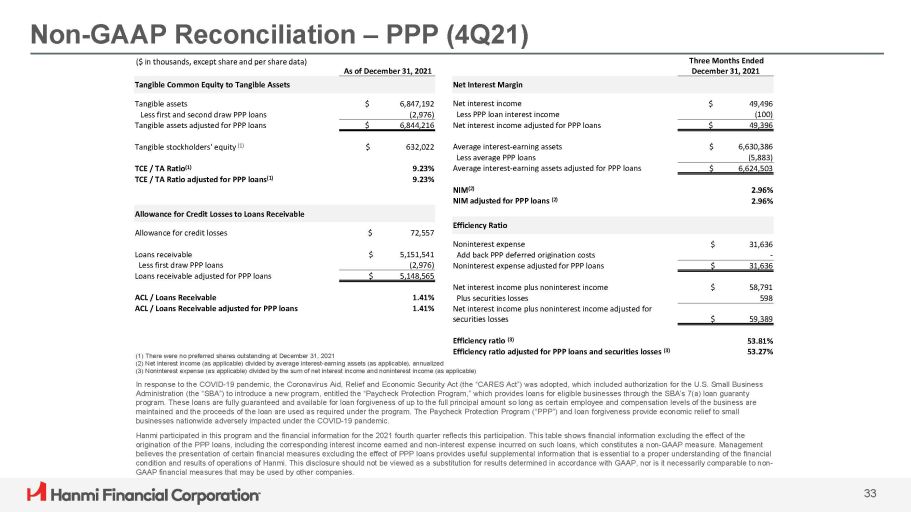

Non - GAAP Reconciliation – PPP (4Q21) As of December 31, 2021 Tangible Common Equity to Tangible Assets Tangible assets $ 6,847,192 Less first and second draw PPP loans (2,976) Tangible assets adjusted for PPP loans $ 6,844,216 Tangible stockholders' equity (1) $ 632,022 TCE / TA Ratio (1) 9.23% TCE / TA Ratio adjusted for PPP loans (1) 9.23% Allowance for Credit Losses to Loans Receivable Allowance for credit losses $ 72,557 Loans receivable $ 5,151,541 Less first draw PPP loans (2,976) Loans receivable adjusted for PPP loans $ 5,148,565 ACL / Loans Receivable 1.41% ACL / Loans Receivable adjusted for PPP loans 1.41% Three Months Ended December 31, 2021 (3) Noninterest expense (as applicable) divided by the sum of net interest income and noninterest income (as applicable) In response to the COVID - 19 pandemic, the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”) was adopted, which included authorization for the U.S. Small Business Administration (the “SBA”) to introduce a new program, entitled the “Paycheck Protection Program,” which provides loans for eligible businesses through the SBA’s 7(a) loan guaranty program. These loans are fully guaranteed and available for loan forgiveness of up to the full principal amount so long as certain employee and compensation levels of the business are maintained and the proceeds of the loan are used as required under the program. The Paycheck Protection Program (“PPP”) and loan forgiveness provide economic relief to small businesses nationwide adversely impacted under the COVID - 19 pandemic. Hanmi participated in this program and the financial information for the 2021 fourth quarter reflects this participation. This table shows financial information excluding the effect of the origination of the PPP loans, including the corresponding interest income earned and non - interest expense incurred on such loans, which constitutes a non - GAAP measure. Management believes the presentation of certain financial measures excluding the effect of PPP loans provides useful supplemental information that is essential to a proper understanding of the financial condition and results of operations of Hanmi. This disclosure should not be viewed as a substitution for results determined in accordance with GAAP, nor is it necessarily comparable to non - GAAP financial measures that may be used by other companies. 33 Net Interest Margin Net interest income Less PPP loan interest income Net interest income adjusted for PPP loans $ 49,496 (100) $ 49,396 Average interest - earning assets Less average PPP loans Average interest - earning assets adjusted for PPP loans $ 6,630,386 (5,883) $ 6,624,503 NIM (2) NIM adjusted for PPP loans (2) 2.96% 2.96% Efficiency Ratio Noninterest expense Add back PPP deferred origination costs Noninterest expense adjusted for PPP loans $ 31,636 - $ 31,636 $ 58,791 598 Net interest income plus noninterest income Plus securities losses Net interest income plus noninterest income adjusted for securities losses $ 59,389 Efficiency ratio (3) 53.81% Efficiency ratio adjusted for PPP loans and securities losses (3) 53.27% ($ in thousands, except share and per share data) (1) There were no preferred shares outstanding at December 31, 2021 (2) Net interest income (as applicable) divided by average interest - earning assets (as applicable), annualized

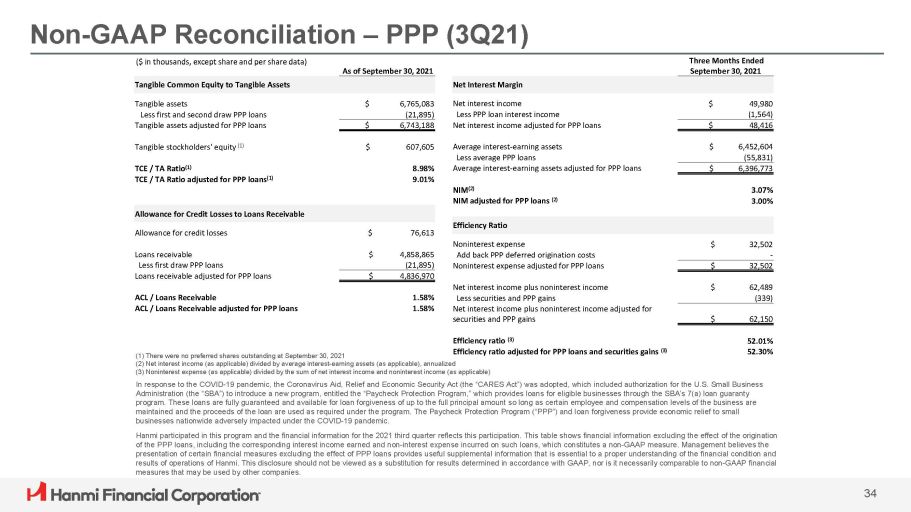

Non - GAAP Reconciliation – PPP (3Q21) As of September 30, 2021 Tangible Common Equity to Tangible Assets Tangible assets $ 6,765,083 Less first and second draw PPP loans (21,895) Tangible assets adjusted for PPP loans $ 6,743,188 Tangible stockholders' equity (1) $ 607,605 TCE / TA Ratio (1) 8.98% TCE / TA Ratio adjusted for PPP loans (1) 9.01% Allowance for Credit Losses to Loans Receivable Allowance for credit losses $ 76,613 Loans receivable $ 4,858,865 Less first draw PPP loans (21,895) Loans receivable adjusted for PPP loans $ 4,836,970 ACL / Loans Receivable 1.58% ACL / Loans Receivable adjusted for PPP loans 1.58% Three Months Ended September 30, 2021 measures that may be used by other companies. 34 Net Interest Margin Net interest income Less PPP loan interest income Net interest income adjusted for PPP loans $ 49,980 (1,564) $ 48,416 Average interest - earning assets Less average PPP loans Average interest - earning assets adjusted for PPP loans $ 6,452,604 (55,831) $ 6,396,773 NIM (2) NIM adjusted for PPP loans (2) 3.07% 3.00% Efficiency Ratio Noninterest expense Add back PPP deferred origination costs Noninterest expense adjusted for PPP loans $ 32,502 - $ 32,502 $ 62,489 (339) Net interest income plus noninterest income Less securities and PPP gains Net interest income plus noninterest income adjusted for securities and PPP gains $ 62,150 Efficiency ratio (3) 52.01% Efficiency ratio adjusted for PPP loans and securities gains (3) 52.30% (1) There were no preferred shares outstanding at September 30, 2021 (2) Net interest income (as applicable) divided by average interest - earning assets (as applicable), annualized (3) Noninterest expense (as applicable) divided by the sum of net interest income and noninterest income (as applicable) In response to the COVID - 19 pandemic, the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”) was adopted, which included authorization for the U.S. Small Business Administration (the “SBA”) to introduce a new program, entitled the “Paycheck Protection Program,” which provides loans for eligible businesses through the SBA’s 7(a) loan guaranty program. These loans are fully guaranteed and available for loan forgiveness of up to the full principal amount so long as certain employee and compensation levels of the business are maintained and the proceeds of the loan are used as required under the program. The Paycheck Protection Program (“PPP”) and loan forgiveness provide economic relief to small businesses nationwide adversely impacted under the COVID - 19 pandemic. Hanmi participated in this program and the financial information for the 2021 third quarter reflects this participation. This table shows financial information excluding the effect of the origination of the PPP loans, including the corresponding interest income earned and non - interest expense incurred on such loans, which constitutes a non - GAAP measure. Management believes the presentation of certain financial measures excluding the effect of PPP loans provides useful supplemental information that is essential to a proper understanding of the financial condition and results of operations of Hanmi. This disclosure should not be viewed as a substitution for results determined in accordance with GAAP, nor is it necessarily comparable to non - GAAP financial ($ in thousands, except share and per share data)

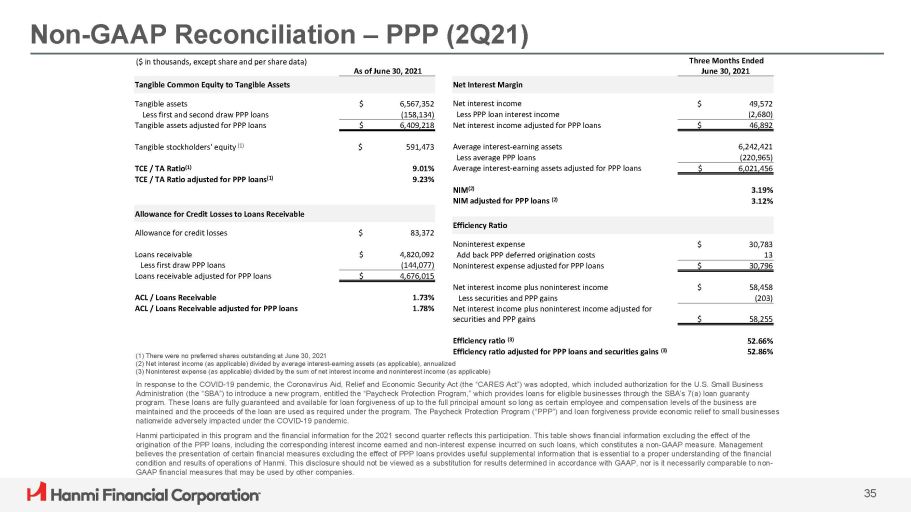

Non - GAAP Reconciliation – PPP (2Q21) GAAP financial measures that may be used by other companies. 35 As of June 30, 2021 Tangible Common Equity to Tangible Assets Tangible assets $ 6,567,352 Less first and second draw PPP loans (158,134) Tangible assets adjusted for PPP loans $ 6,409,218 Tangible stockholders' equity (1) $ 591,473 TCE / TA Ratio (1) 9.01% TCE / TA Ratio adjusted for PPP loans (1) 9.23% Allowance for Credit Losses to Loans Receivable Allowance for credit losses $ 83,372 Loans receivable $ 4,820,092 Less first draw PPP loans (144,077) Loans receivable adjusted for PPP loans $ 4,676,015 ACL / Loans Receivable 1.73% ACL / Loans Receivable adjusted for PPP loans 1.78% Three Months Ended June 30, 2021 Net Interest Margin Net interest income Less PPP loan interest income Net interest income adjusted for PPP loans $ 49,572 (2,680) $ 46,892 Average interest - earning assets Less average PPP loans Average interest - earning assets adjusted for PPP loans 6,242,421 (220,965) $ 6,021,456 NIM (2) NIM adjusted for PPP loans (2) 3.19% 3.12% Efficiency Ratio Noninterest expense Add back PPP deferred origination costs Noninterest expense adjusted for PPP loans $ 30,783 13 $ 30,796 $ 58,458 Net interest income plus noninterest income Less securities and PPP gains (203) Net interest income plus noninterest income adjusted for securities and PPP gains $ 58,255 Efficiency ratio (3) 52.66% Efficiency ratio adjusted for PPP loans and securities gains (3) 52.86% (1) There were no preferred shares outstanding at June 30, 2021 (2) Net interest income (as applicable) divided by average interest - earning assets (as applicable), annualized (3) Noninterest expense (as applicable) divided by the sum of net interest income and noninterest income (as applicable) In response to the COVID - 19 pandemic, the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”) was adopted, which included authorization for the U.S. Small Business Administration (the “SBA”) to introduce a new program, entitled the “Paycheck Protection Program,” which provides loans for eligible businesses through the SBA’s 7(a) loan guaranty program. These loans are fully guaranteed and available for loan forgiveness of up to the full principal amount so long as certain employee and compensation levels of the business are maintained and the proceeds of the loan are used as required under the program. The Paycheck Protection Program (“PPP”) and loan forgiveness provide economic relief to small businesses nationwide adversely impacted under the COVID - 19 pandemic. Hanmi participated in this program and the financial information for the 2021 second quarter reflects this participation. This table shows financial information excluding the effect of the origination of the PPP loans, including the corresponding interest income earned and non - interest expense incurred on such loans, which constitutes a non - GAAP measure. Management believes the presentation of certain financial measures excluding the effect of PPP loans provides useful supplemental information that is essential to a proper understanding of the financial condition and results of operations of Hanmi. This disclosure should not be viewed as a substitution for results determined in accordance with GAAP, nor is it necessarily comparable to non - ($ in thousands, except share and per share data)

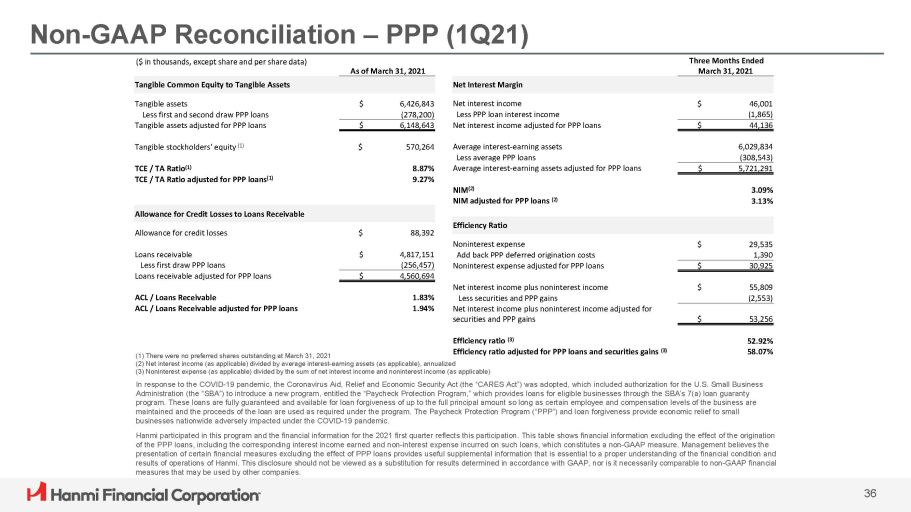

Non - GAAP Reconciliation – PPP (1Q21) As of March 31, 2021 Tangible Common Equity to Tangible Assets Tangible assets $ 6,426,843 Less first and second draw PPP loans (278,200) Tangible assets adjusted for PPP loans $ 6,148,643 Tangible stockholders' equity (1) $ 570,264 TCE / TA Ratio (1) 8.87% TCE / TA Ratio adjusted for PPP loans (1) 9.27% Allowance for Credit Losses to Loans Receivable Allowance for credit losses $ 88,392 Loans receivable $ 4,817,151 Less first draw PPP loans (256,457) Loans receivable adjusted for PPP loans $ 4,560,694 ACL / Loans Receivable 1.83% ACL / Loans Receivable adjusted for PPP loans 1.94% Three Months Ended March 31, 2021 measures that may be used by other companies. 36 Net Interest Margin Net interest income Less PPP loan interest income Net interest income adjusted for PPP loans $ 46,001 (1,865) $ 44,136 Average interest - earning assets Less average PPP loans Average interest - earning assets adjusted for PPP loans 6,029,834 (308,543) $ 5,721,291 NIM (2) NIM adjusted for PPP loans (2) 3.09% 3.13% Efficiency Ratio Noninterest expense Add back PPP deferred origination costs Noninterest expense adjusted for PPP loans $ 29,535 1,390 $ 30,925 $ 55,809 Net interest income plus noninterest income Less securities and PPP gains (2,553) Net interest income plus noninterest income adjusted for securities and PPP gains $ 53,256 Efficiency ratio (3) 52.92% Efficiency ratio adjusted for PPP loans and securities gains (3) 58.07% (1) There were no preferred shares outstanding at March 31, 2021 (2) Net interest income (as applicable) divided by average interest - earning assets (as applicable), annualized (3) Noninterest expense (as applicable) divided by the sum of net interest income and noninterest income (as applicable) In response to the COVID - 19 pandemic, the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”) was adopted, which included authorization for the U.S. Small Business Administration (the “SBA”) to introduce a new program, entitled the “Paycheck Protection Program,” which provides loans for eligible businesses through the SBA’s 7(a) loan guaranty program. These loans are fully guaranteed and available for loan forgiveness of up to the full principal amount so long as certain employee and compensation levels of the business are maintained and the proceeds of the loan are used as required under the program. The Paycheck Protection Program (“PPP”) and loan forgiveness provide economic relief to small businesses nationwide adversely impacted under the COVID - 19 pandemic. Hanmi participated in this program and the financial information for the 2021 first quarter reflects this participation. This table shows financial information excluding the effect of the origination of the PPP loans, including the corresponding interest income earned and non - interest expense incurred on such loans, which constitutes a non - GAAP measure. Management believes the presentation of certain financial measures excluding the effect of PPP loans provides useful supplemental information that is essential to a proper understanding of the financial condition and results of operations of Hanmi. This disclosure should not be viewed as a substitution for results determined in accordance with GAAP, nor is it necessarily comparable to non - GAAP financial ($ in thousands, except share and per share data)

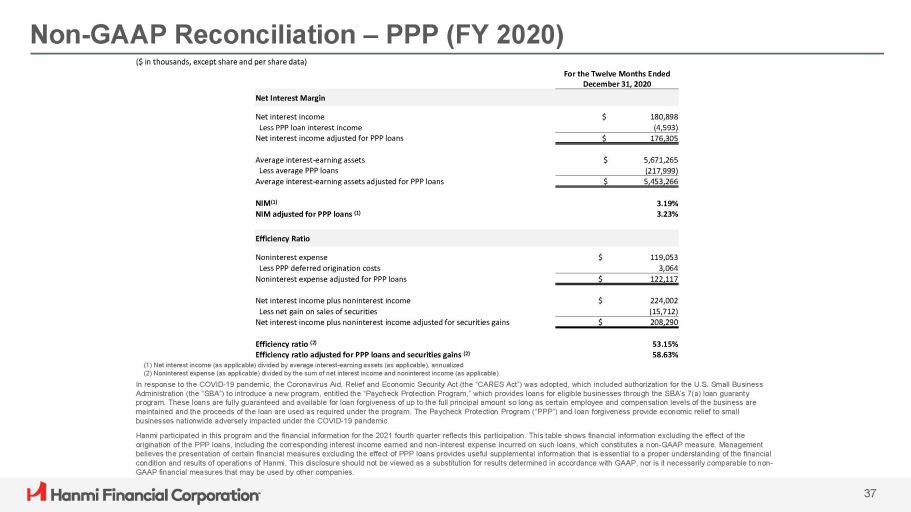

Non - GAAP Reconciliation – PPP (FY 2020) GAAP financial measures that may be used by other companies. 37 (1) Net interest income (as applicable) divided by average interest - earning assets (as applicable), annualized (2) Noninterest expense (as applicable) divided by the sum of net interest income and noninterest income (as applicable) In response to the COVID - 19 pandemic, the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”) was adopted, which included authorization for the U.S. Small Business Administration (the “SBA”) to introduce a new program, entitled the “Paycheck Protection Program,” which provides loans for eligible businesses through the SBA’s 7(a) loan guaranty program. These loans are fully guaranteed and available for loan forgiveness of up to the full principal amount so long as certain employee and compensation levels of the business are maintained and the proceeds of the loan are used as required under the program. The Paycheck Protection Program (“PPP”) and loan forgiveness provide economic relief to small businesses nationwide adversely impacted under the COVID - 19 pandemic. Hanmi participated in this program and the financial information for the 2021 fourth quarter reflects this participation. This table shows financial information excluding the effect of the origination of the PPP loans, including the corresponding interest income earned and non - interest expense incurred on such loans, which constitutes a non - GAAP measure. Management believes the presentation of certain financial measures excluding the effect of PPP loans provides useful supplemental information that is essential to a proper understanding of the financial condition and results of operations of Hanmi. This disclosure should not be viewed as a substitution for results determined in accordance with GAAP, nor is it necessarily comparable to non - ($ in thousands, except share and per share data) For the Twelve Months Ended December 31, 2020 Net Interest Margin Net interest income $ 180,898 Less PPP loan interest income (4,593) Net interest income adjusted for PPP loans $ 176,305 Average interest - earning assets $ 5,671,265 Less average PPP loans (217,999) Average interest - earning assets adjusted for PPP loans $ 5,453,266 NIM (1) 3.19% NIM adjusted for PPP loans (1) 3.23% Efficiency Ratio Noninterest expense $ 119,053 Less PPP deferred origination costs 3,064 Noninterest expense adjusted for PPP loans $ 122,117 Net interest income plus noninterest income $ 224,002 Less net gain on sales of securities (15,712) Net interest income plus noninterest income adjusted for securities gains $ 208,290 Efficiency ratio (2) 53.15% Efficiency ratio adjusted for PPP loans and securities gains (2) 58.63%