Exhibit 99.1

Los Angeles New York/ New Jersey Virginia Chicago Dallas Houston San Francisco San Diego 3Q23 Investor Presentation November 6, 2023

Hanmi Financial Corporation (the “Company”) cautions investors that any statements contained herein that are not historical facts are forward - looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 , including, but not limited to, those statements regarding operating and financial performance, financial position and liquidity, business strategies, regulatory, economic and competitive outlook, investment and expenditure plans, capital and financing needs and availability, litigation, plans and objectives, merger or sale activity, the effects of COVID - 19 on our business, financial condition and results of operations, and all other forecasts and statements of expectation or assumption underlying any of the foregoing . These statements involve known and unknown risks and uncertainties that are difficult to predict . Investors should not rely on any forward - looking statement and should consider risks, such as changes in governmental policy, legislation and regulations, economic uncertainty and changes in economic conditions, inflation, the continuing impact of the COVID - 19 pandemic on our business and results of operations, fluctuations in interest rate and credit risk, competitive pressures, the ability to succeed in new markets, balance sheet management, liquidity and sources of funding, the size and composition of our deposit portfolio, a potential government shutdown, including the percentage of uninsured deposits in the portfolio, increased assessments by the Federal Deposit Insurance Corporation, and other operational factors . Forward - looking statements are based upon the good faith beliefs and expectations of management as of this date only and are further subject to additional risks and uncertainties, including, but not limited to, the risk factors set forth in our earnings release dated October 24 , 2023 , including the section titled “Forward Looking Statements and the Company’s most recent Form 10 - K, 10 - Q and other filings with the Securities and Exchange Commission (“SEC”) . Investors are urged to review our earnings release dated October 24 , 2023 , including the section titled “Forward Looking Statements and the Company’s SEC filings . The Company disclaims any obligation to update or revise the forward - looking statements herein . 2 Forward - Looking Statements

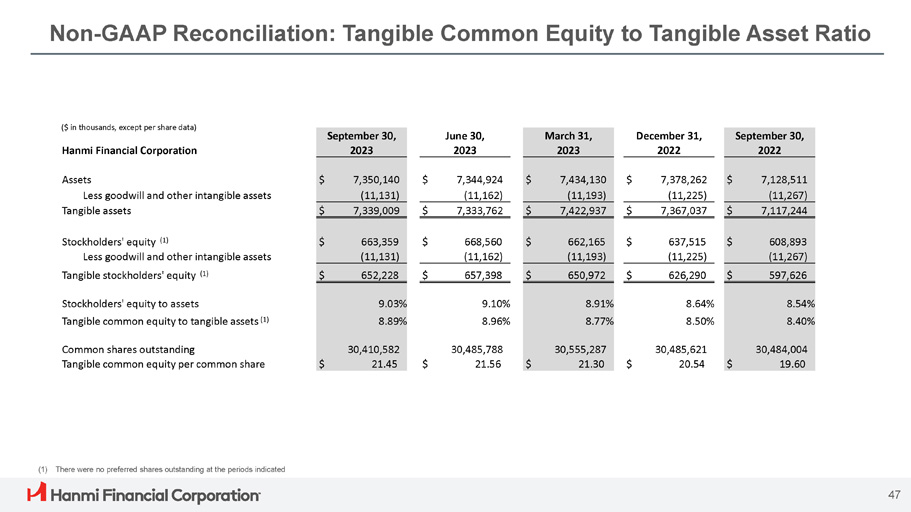

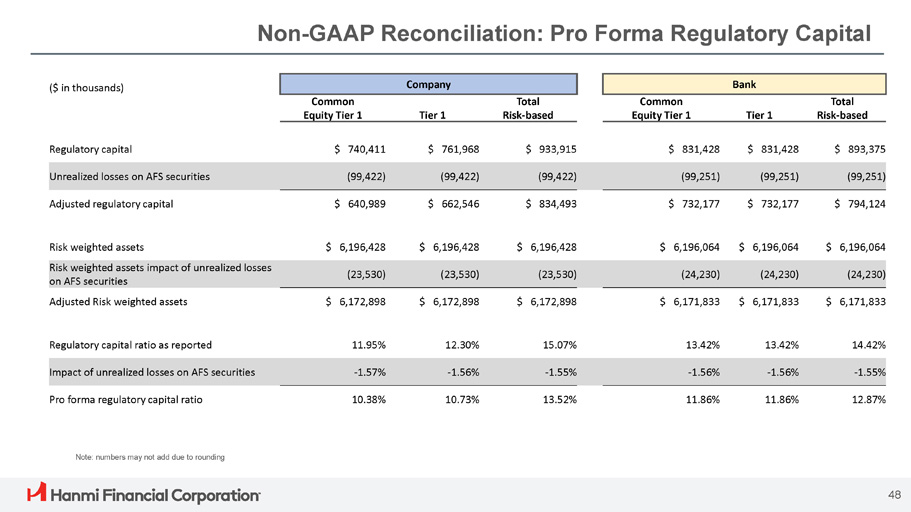

This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”) . These non - GAAP measures include tangible common equity to tangible assets, and tangible common equity per share . Management uses these “non - GAAP” measures in its analysis of the Company’s performance . Management believes these non - GAAP financial measures allow for better comparability of period to period operating performance . Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors . These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non - GAAP performance measures that may be presented by other companies . A reconciliation of the non - GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation . 3 Non - GAAP Financial Information

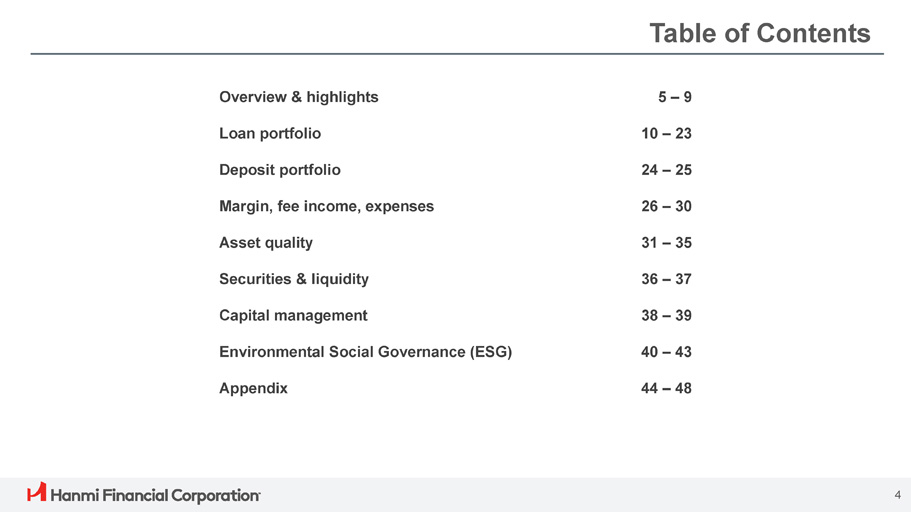

5 – 9 Overview & highlights 10 – 23 Loan portfolio 24 – 25 Deposit portfolio 26 – 30 Margin, fee income, expenses 31 – 35 Asset quality 36 – 37 Securities & liquidity 38 – 39 Capital management 40 – 43 Environmental Social Governance (ESG) 44 – 48 Appendix 4 Table of Contents

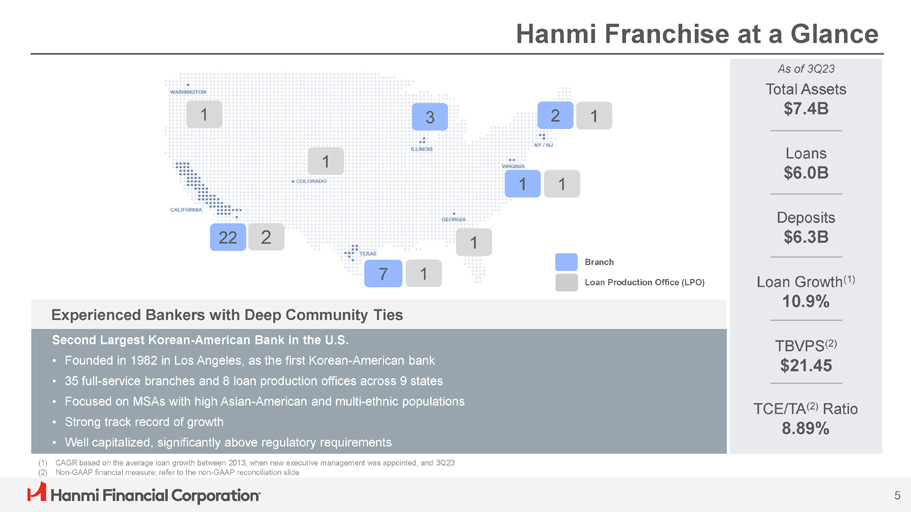

Hanmi Franchise at a Glance Loans $6.0B Deposits $6.3B TCE/TA (2) Ratio 8.89% Second Largest Korean - American Bank in the U.S. • Founded in 1982 in Los Angeles, as the first Korean - American bank • 35 full - service branches and 8 loan production offices across 9 states • Focused on MSAs with high Asian - American and multi - ethnic populations • Strong track record of growth • Well capitalized, significantly above regulatory requirements (1) CAGR based on the average loan growth between 2013, when new executive management was appointed, and 3Q23 (2) Non - GAAP financial measure; refer to the non - GAAP reconciliation slide Loan Growth (1) 10.9% TBVPS (2) $21.45 As of 3Q23 Total Assets $7.4B Experienced Bankers with Deep Community Ties 3 2 1 1 1 1 7 1 1 Branch Loan Production Office (LPO) 1 22 2 5

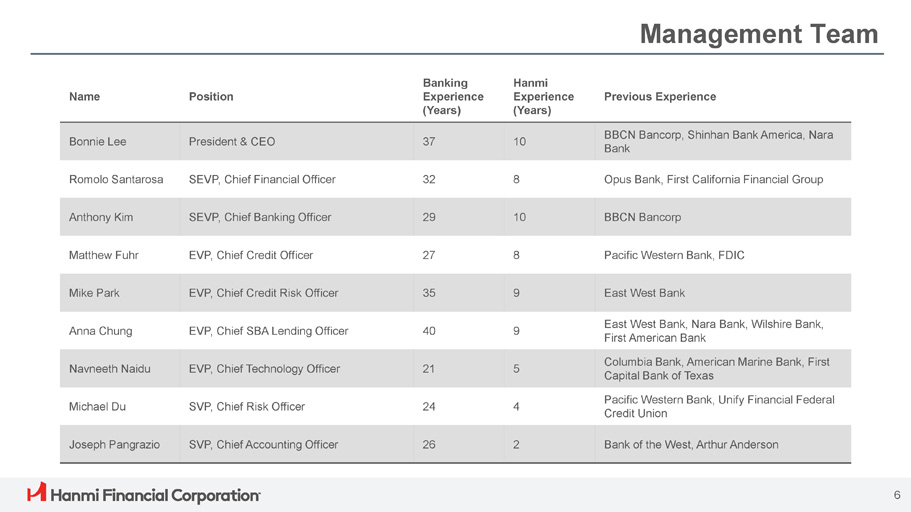

Previous Experience Hanmi Experience (Years) Banking Experience (Years) Position Name BBCN Bancorp, Shinhan Bank America, Nara Bank 10 37 President & CEO Bonnie Lee Opus Bank, First California Financial Group 8 32 SEVP, Chief Financial Officer Romolo Santarosa BBCN Bancorp 10 29 SEVP, Chief Banking Officer Anthony Kim Pacific Western Bank, FDIC 8 27 EVP, Chief Credit Officer Matthew Fuhr East West Bank 9 35 EVP, Chief Credit Risk Officer Mike Park East West Bank, Nara Bank, Wilshire Bank, First American Bank 9 40 EVP, Chief SBA Lending Officer Anna Chung Columbia Bank, American Marine Bank, First Capital Bank of Texas 5 21 EVP, Chief Technology Officer Navneeth Naidu Pacific Western Bank, Unify Financial Federal Credit Union 4 24 SVP, Chief Risk Officer Michael Du Bank of the West, Arthur Anderson 2 26 SVP, Chief Accounting Officer Joseph Pangrazio 6 Management Team

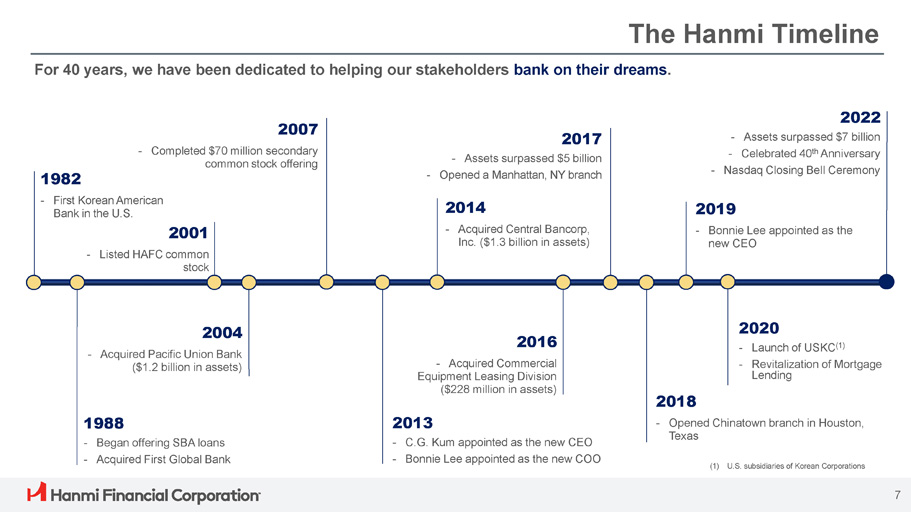

The Hanmi Timeline 1982 - First Korean American Bank in the U.S. 1988 - Began offering SBA loans - Acquired First Global Bank 2001 - Listed HAFC common stock 2004 - Acquired Pacific Union Bank ($1.2 billion in assets) 2007 - Completed $70 million secondary common stock offering 2013 - C.G. Kum appointed as the new CEO - Bonnie Lee appointed as the new COO 2014 - Acquired Central Bancorp, Inc. ($1.3 billion in assets) 2016 - Acquired Commercial Equipment Leasing Division ($228 million in assets) 2017 - Assets surpassed $5 billion - Opened a Manhattan, NY branch 2019 - Bonnie Lee appointed as the new CEO 2022 - Assets surpassed $7 billion - Celebrated 40 th Anniversary - Nasdaq Closing Bell Ceremony For 40 years, we have been dedicated to helping our stakeholders bank on their dreams . 7 2020 - Launch of USKC (1) - Revitalization of Mortgage Lending (1) U.S. subsidiaries of Korean Corporations 2018 - Opened Chinatown branch in Houston, Texas

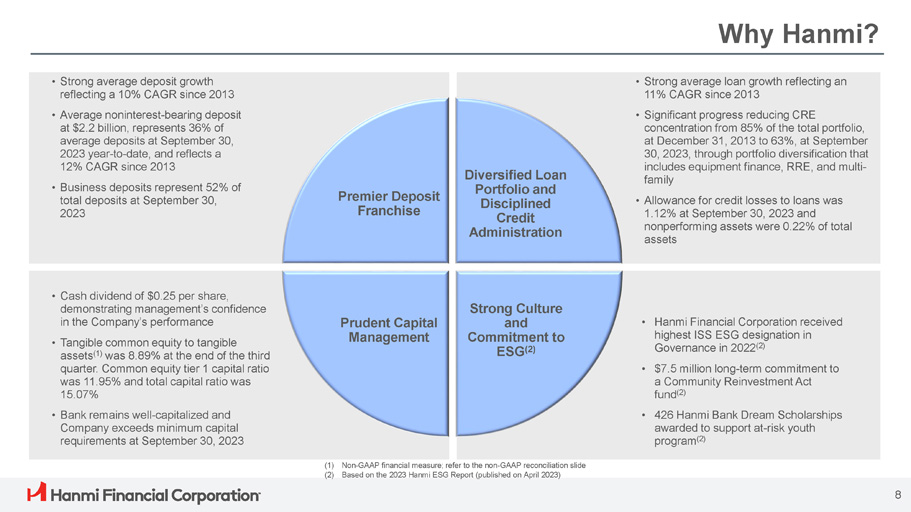

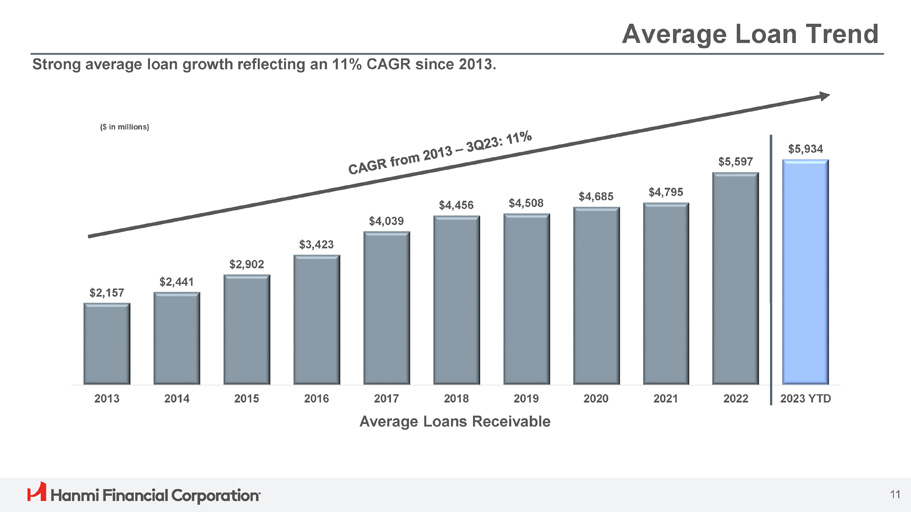

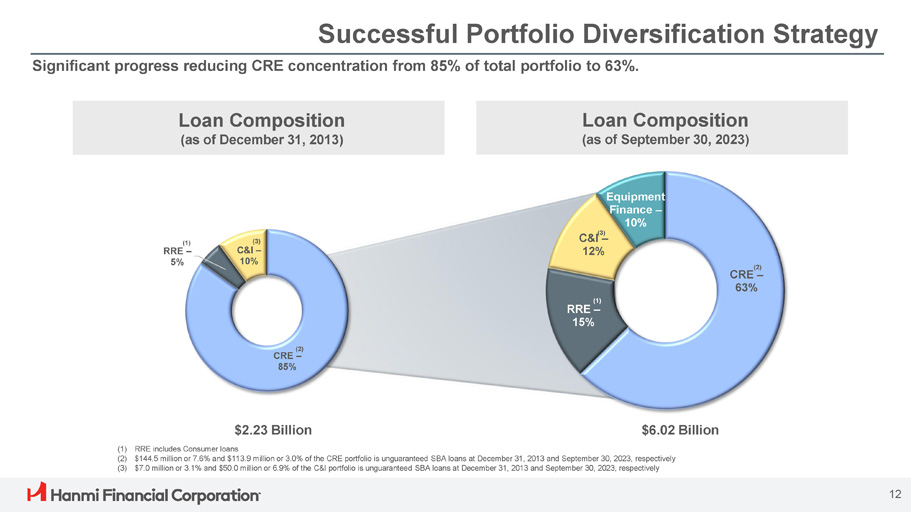

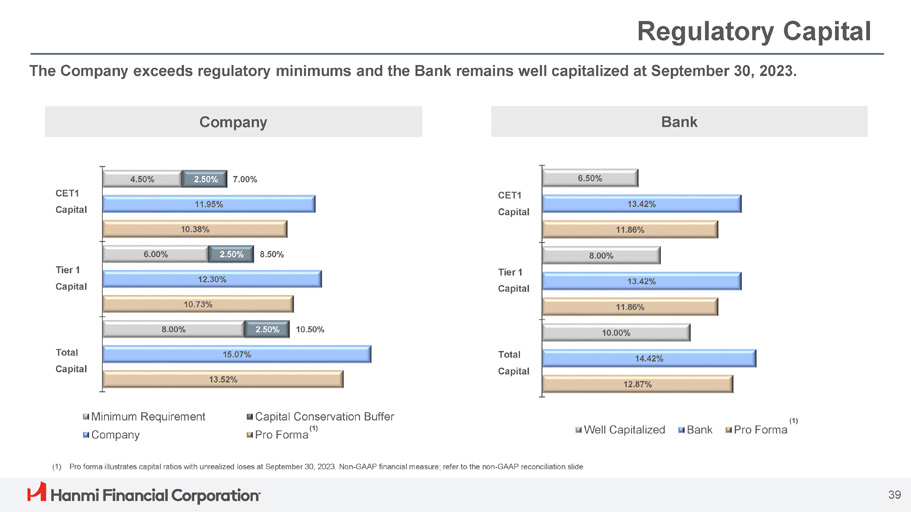

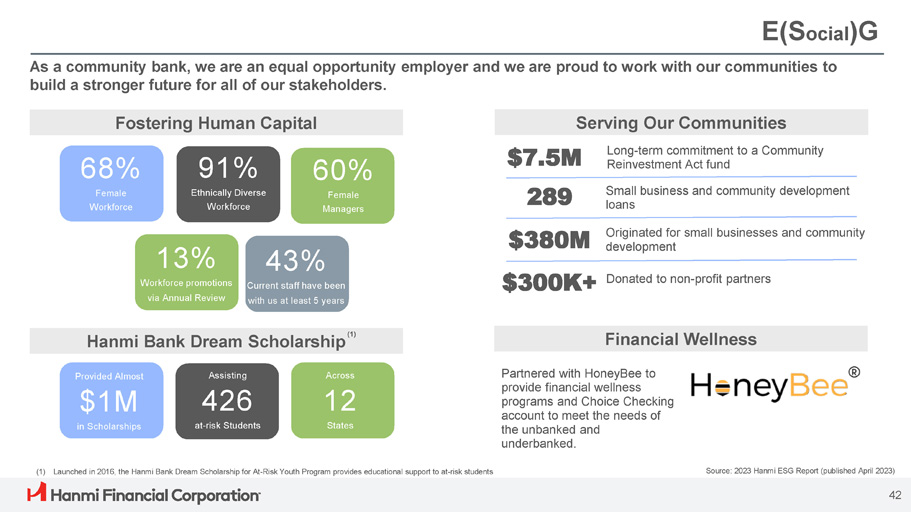

Why Hanmi? • Strong average loan growth reflecting an 11% CAGR since 2013 • Significant progress reducing CRE concentration from 85% of the total portfolio, at December 31, 2013 to 63%, at September 30, 2023, through portfolio diversification that includes equipment finance, RRE, and multi - family • Allowance for credit losses to loans was 1.12% at September 30, 2023 and nonperforming assets were 0.22% of total assets • Strong average deposit growth reflecting a 10% CAGR since 2013 • Average noninterest - bearing deposit at $2.2 billion, represents 36% of average deposits at September 30, 2023 year - to - date, and reflects a 12% CAGR since 2013 • Business deposits represent 52% of total deposits at September 30, 2023 Premier Deposit Franchise Diversified Loan Portfolio and Disciplined Credit Administration 8 Strong Culture and Commitment to ESG (2) Prudent Capital Management • Cash dividend of $0.25 per share, demonstrating management’s confidence in the Company’s performance • Tangible common equity to tangible assets (1) was 8.89% at the end of the third quarter. Common equity tier 1 capital ratio was 11.95% and total capital ratio was 15.07% • Bank remains well - capitalized and Company exceeds minimum capital requirements at September 30, 2023 • Hanmi Financial Corporation received highest ISS ESG designation in Governance in 2022 (2) • $7.5 million long - term commitment to a Community Reinvestment Act fund (2) • 426 Hanmi Bank Dream Scholarships awarded to support at - risk youth program (2) (1) Non - GAAP financial measure; refer to the non - GAAP reconciliation slide (2) Based on the 2023 Hanmi ESG Report (published on April 2023)

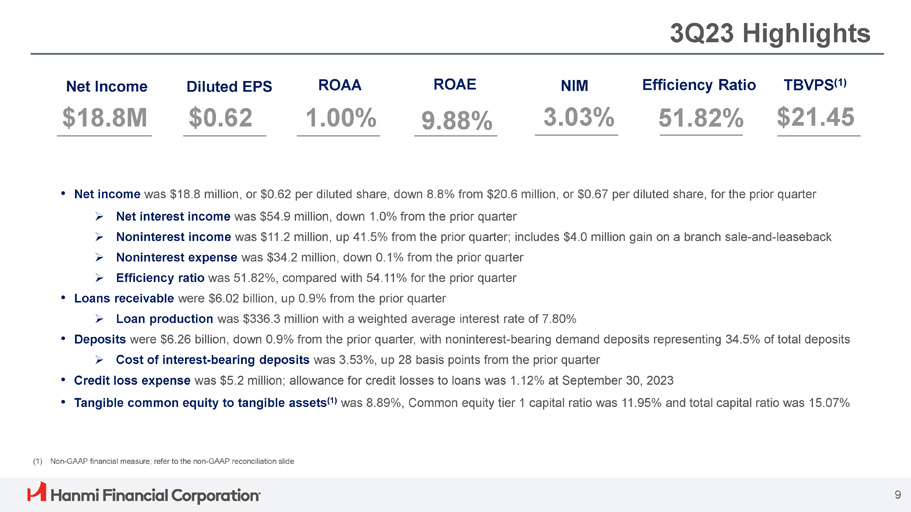

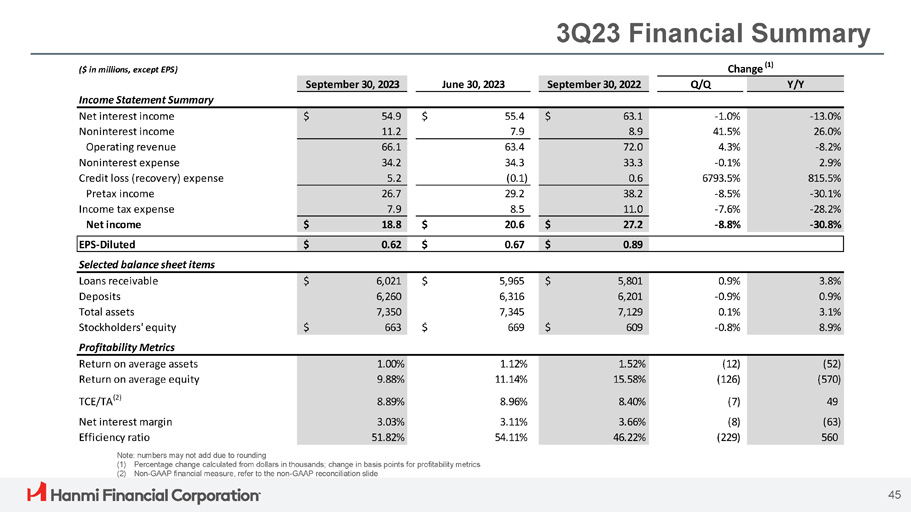

3Q23 Highlights Diluted EPS $0.62 ROAA 1.00% NIM 3.03% Efficiency Ratio 51.82% TBVPS (1) $21.45 Net Income $18.8M • Net income was $18.8 million, or $0.62 per diluted share, down 8.8% from $20.6 million, or $0.67 per diluted share, for the prior quarter » Net interest income was $54.9 million, down 1.0% from the prior quarter » Noninterest income was $11.2 million, up 41.5% from the prior quarter; includes $4.0 million gain on a branch sale - and - leaseback » Noninterest expense was $34.2 million, down 0.1% from the prior quarter » Efficiency ratio was 51.82%, compared with 54.11% for the prior quarter • Loans receivable were $6.02 billion, up 0.9% from the prior quarter » Loan production was $336.3 million with a weighted average interest rate of 7.80% • Deposits were $6.26 billion, down 0.9% from the prior quarter, with noninterest - bearing demand deposits representing 34.5% of total deposits » Cost of interest - bearing deposits was 3.53%, up 28 basis points from the prior quarter • Credit loss expense was $5.2 million; allowance for credit losses to loans was 1.12% at September 30, 2023 • Tangible common equity to tangible assets (1) was 8.89%, Common equity tier 1 capital ratio was 11.95% and total capital ratio was 15.07% ROAE 9.88% (1) Non - GAAP financial measure; refer to the non - GAAP reconciliation slide 9

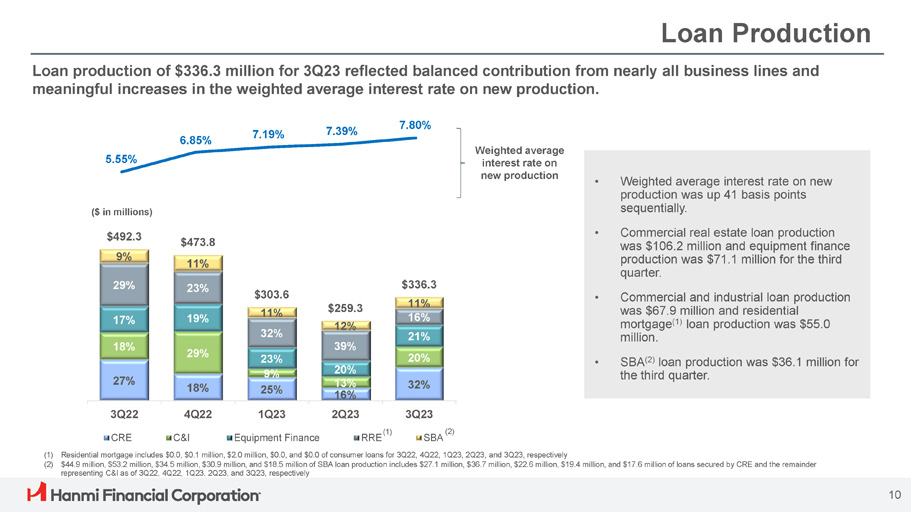

5.55% 6.85% 7.19% 7.39% 7.80% Loan Production 27% 18% 32% 18% 29% 17% 19% 23% 9% 25% 29% 23% $492.3 9% $473.8 11% $303.6 11% 32% $259.3 12% 39% 20% 13% 16% $336.3 11% 16% 21% 20% 3Q22 4Q22 1Q23 2Q23 CRE C&I Equipment Finance RRE (1) 3Q23 (2) SBA • Weighted average interest rate on new production was up 41 basis points sequentially. • Commercial real estate loan production was $106.2 million and equipment finance production was $71.1 million for the third quarter. • Commercial and industrial loan production was $67.9 million and residential mortgage (1) loan production was $55.0 million. • SBA (2) loan production was $36.1 million for the third quarter. Loan production of $336.3 million for 3Q23 reflected balanced contribution from nearly all business lines and meaningful increases in the weighted average interest rate on new production. Weighted average interest rate on new production (1) Residential mortgage includes $0.0, $0.1 million, $2.0 million, $0.0, and $0.0 of consumer loans for 3Q22, 4Q22, 1Q23, 2Q23, and 3Q23, respectively (2) $44.9 million, $53.2 million, $34.5 million, $30.9 million, and $18.5 million of SBA loan production includes $27.1 million, $36.7 million, $22.6 million, $19.4 million, and $17.6 million of loans secured by CRE and the remainder representing C&I as of 3Q22, 4Q22, 1Q23, 2Q23, and 3Q23, respectively ($ in millions) 10

Average Loan Trend $4,039 $3,423 $2,902 $2,441 $2,157 $4,456 $4,508 $4,685 $4,795 $5,934 $5,597 2013 2014 2015 2016 2020 2021 2022 2023 YTD 2017 2018 2019 Average Loans Receivable Strong average loan growth reflecting an 11% CAGR since 2013. ($ in millions) 11

Successful Portfolio Diversification Strategy 12 Loan Composition (as of September 30, 2023) Loan Composition (as of December 31, 2013) $2.23 Billion $6.02 Billion (1) RRE includes Consumer loans (2) $144.5 million or 7.6% and $113.9 million or 3.0% of the CRE portfolio is unguaranteed SBA loans at December 31, 2013 and September 30, 2023, respectively (3) $7.0 million or 3.1% and $50.0 million or 6.9% of the C&I portfolio is unguaranteed SBA loans at December 31, 2013 and September 30, 2023, respectively CRE – 63% Equipment Finance – 10% (1) RRE – 5% (1) RRE – 15% Significant progress reducing CRE concentration from 85% of total portfolio to 63%. (2) C& I ( 3 – ) 12% (2) CRE – 85% (3) C&I – 10%

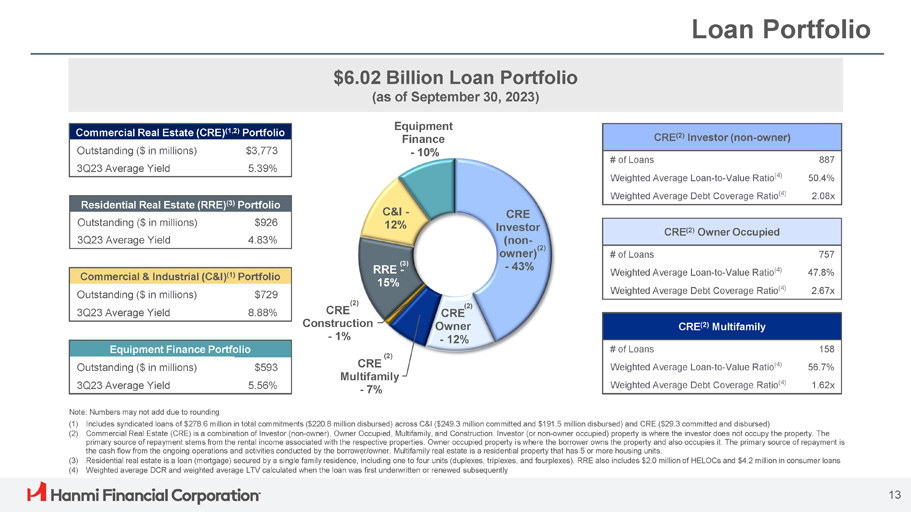

Loan Portfolio Commercial Real Estate (CRE) (1,2) Portfolio $3,773 Outstanding ($ in millions) 5.39% 3Q23 Average Yield $6.02 Billion Loan Portfolio (as of September 30, 2023) CRE 13 Owner - 12% CRE Multifamily - 7% C&I - 12% Equipment Finance - 10% (2) CRE Construction - 1% Note: Numbers may not add due to rounding (1) Includes syndicated loans of $278.6 million in total commitments ($220.8 million disbursed) across C&I ($249.3 million committed and $191.5 million disbursed) and CRE ($29.3 committed and disbursed) (2) Commercial Real Estate (CRE) is a combination of Investor (non - owner), Owner Occupied, Multifamily, and Construction. Investor (or non - owner occupied) property is where the investor does not occupy the property. The primary source of repayment stems from the rental income associated with the respective properties. Owner occupied property is where the borrower owns the property and also occupies it. The primary source of repayment is the cash flow from the ongoing operations and activities conducted by the borrower/owner. Multifamily real estate is a residential property that has 5 or more housing units. (3) Residential real estate is a loan (mortgage) secured by a single family residence, including one to four units (duplexes, triplexes, and fourplexes). RRE also includes $2.0 million of HELOCs and $4.2 million in consumer loans (4) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently CRE (2) Multifamily 158 # of Loans 56.7% Weighted Average Loan - to - Value Ratio (4) 1.62x Weighted Average Debt Coverage Ratio (4) CRE (2) Investor (non - owner) 887 # of Loans 50.4% Weighted Average Loan - to - Value Ratio (4) 2.08x Weighted Average Debt Coverage Ratio (4) CRE (2) Owner Occupied 757 # of Loans 47.8% Weighted Average Loan - to - Value Ratio (4) 2.67x Weighted Average Debt Coverage Ratio (4) Residential Real Estate (RRE) (3) Portfolio $926 Outstanding ($ in millions) 4.83% 3Q23 Average Yield Commercial & Industrial (C&I) (1) Portfolio $729 Outstanding ($ in millions) 8.88% 3Q23 Average Yield Equipment Finance Portfolio $593 Outstanding ($ in millions) 5.56% 3Q23 Average Yield (2) (2) CRE Investor (non - owner) (2) - 43% (3) RRE - 15%

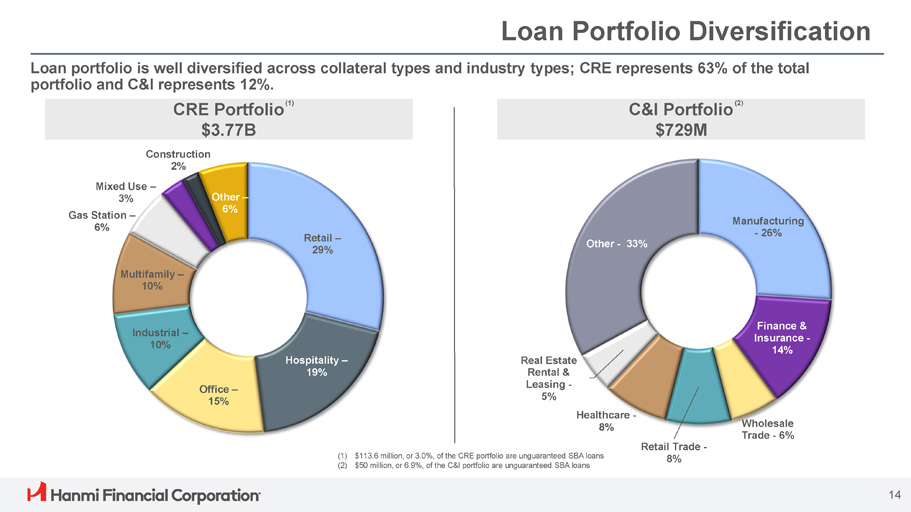

Loan Portfolio Diversification Loan portfolio is well diversified across collateral types and industry types; CRE represents 63% of the total portfolio and C&I represents 12%. CRE Portfolio (1) $3.77B C&I Portfolio (2) $729M Retail – 29% Hospitality – 19% Office – 15% Industrial – 10% Multifamily – 10% Construction 2% Mixed Use – 3% Gas Station – 6% Other – 6% Manufacturing - 26% 14 Finance & Insurance - 14% Wholesale Trade - 6% Retail Trade - 8% Real Estate Rental & Leasing - 5% Healthcare - 8% Other - 33% (1) $113.6 million, or 3.0%, of the CRE portfolio are unguaranteed SBA loans (2) $50 million, or 6.9%, of the C&I portfolio are unguaranteed SBA loans

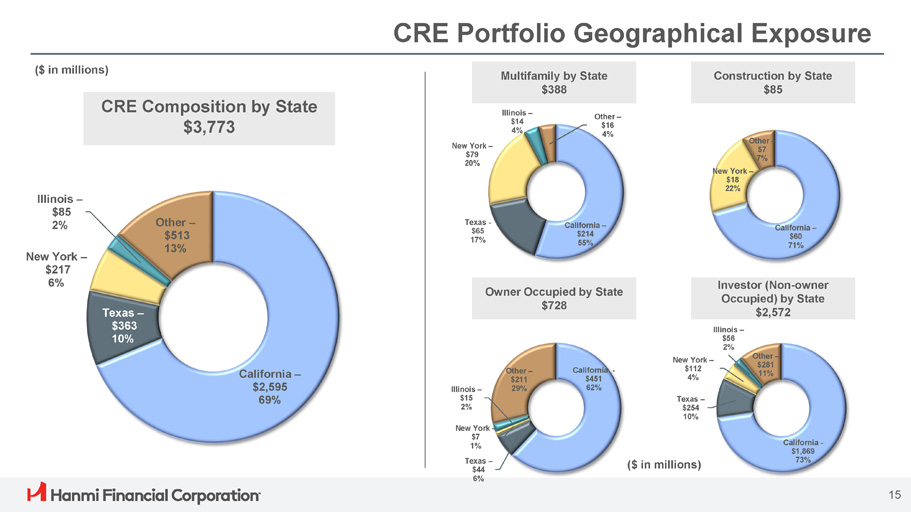

CRE Portfolio Geographical Exposure CRE Composition by State $3,773 Multifamily by State $388 Construction by State $85 Owner Occupied by State $728 Investor (Non - owner Occupied) by State $2,572 California – $2,595 69% Texas – $363 10% New York – $217 6% Illinois – $85 2% Other – $513 13% California – $214 55% Texas - $65 17% New York – $79 20% Illinois – $14 4% Other – $16 4% California – $60 71% Other – $7 7% New York – $18 22% California - $451 62% Texas – $44 6% New York – $7 1% Illinois – $15 2% Other – $211 29% California - $1,869 73% 15 Texas – $254 10% Illinois – $56 2% New York – $112 4% Other – $281 11% ($ in millions) ($ in millions)

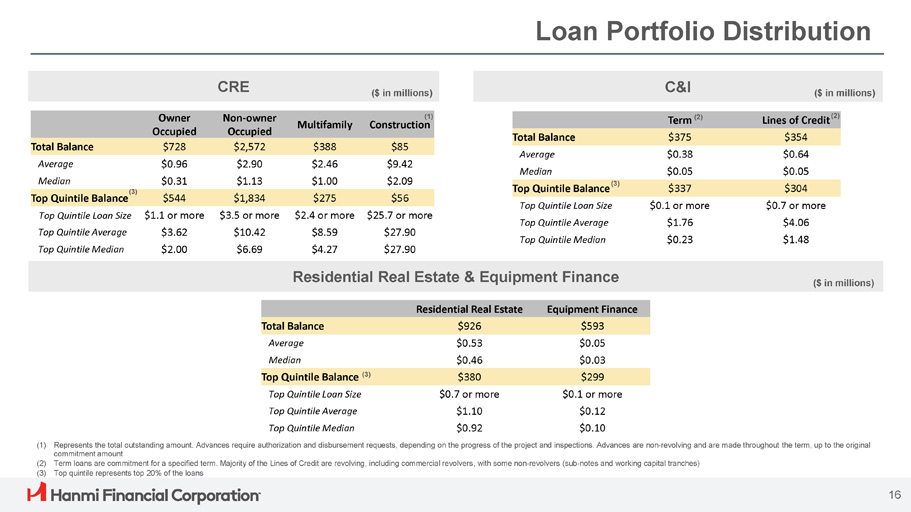

Loan Portfolio Distribution CRE C&I ($ in millions) ($ in millions) (1) Construction Multifamily Non - owner Occupied Owner Occupied $85 $388 $2,572 $728 Total Balance $9.42 $2.46 $2.90 $0.96 Average $2.09 $1.00 $1.13 $0.31 Median $56 $275 $1,834 $544 (3) Top Quintile Balance $25.7 or more $2.4 or more $3.5 or more $1.1 or more Top Quintile Loan Size $27.90 $8.59 $10.42 $3.62 Top Quintile Average $27.90 $4.27 $6.69 $2.00 Top Quintile Median Lines of Credit (2) Term (2) $354 $375 Total Balance $0.64 $0.38 Average $0.05 $0.05 Median $304 $337 Top Quintile Balance (3) $0.7 or more $0.1 or more Top Quintile Loan Size $4.06 $1.76 Top Quintile Average $1.48 $0.23 Top Quintile Median Residential Real Estate & Equipment Finance 16 Equipment Finance Residential Real Estate $593 $926 Total Balance $0.05 $0.53 Average $0.03 $0.46 Median $299 $380 Top Quintile Balance (3) $0.1 or more $0.7 or more Top Quintile Loan Size $0.12 $1.10 Top Quintile Average $0.10 $0.92 Top Quintile Median ($ in millions) (1) Represents the total outstanding amount. Advances require authorization and disbursement requests, depending on the progress of the project and inspections. Advances are non - revolving and are made throughout the term, up to the original commitment amount (2) Term loans are commitment for a specified term. Majority of the Lines of Credit are revolving, including commercial revolvers, with some non - revolvers (sub - notes and working capital tranches) (3) Top quintile represents top 20% of the loans

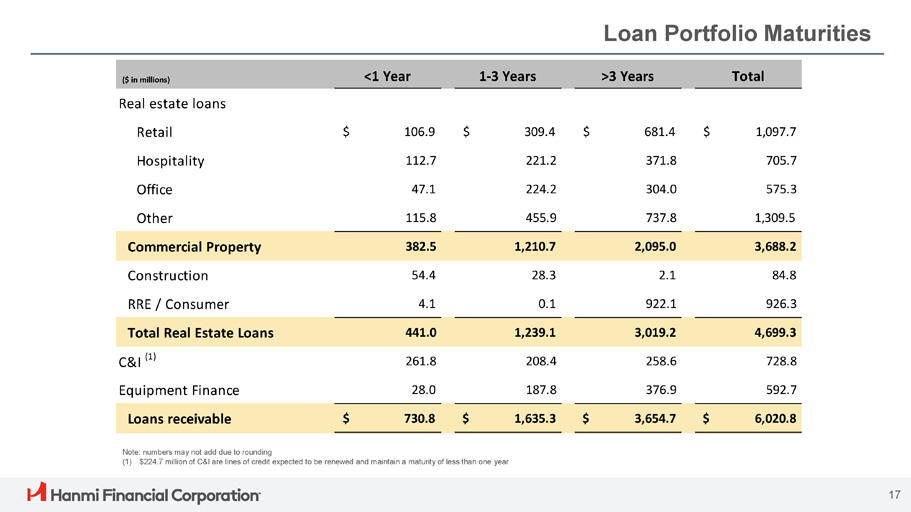

Total >3 Years 1 - 3 Years <1 Year ($ in millions) $ 1,097.7 $ 681.4 $ 309.4 $ 106.9 Real estate loans Retail 705.7 371.8 221.2 112.7 Hospitality 575.3 304.0 224.2 47.1 Office 1,309.5 737.8 455.9 115.8 Other 3,688.2 2,095.0 1,210.7 382.5 Commercial Property 84.8 2.1 28.3 54.4 Construction 926.3 922.1 0.1 4.1 RRE / Consumer 4,699.3 3,019.2 1,239.1 441.0 Total Real Estate Loans 728.8 258.6 208.4 261.8 C&I (1) 592.7 376.9 187.8 28.0 Equipment Finance $ 6,020.8 $ 3,654.7 $ 1,635.3 $ 730.8 Loans receivable Loan Portfolio Maturities 17 Note: numbers may not add due to rounding (1) $224.7 million of C&I are lines of credit expected to be renewed and maintain a maturity of less than one year

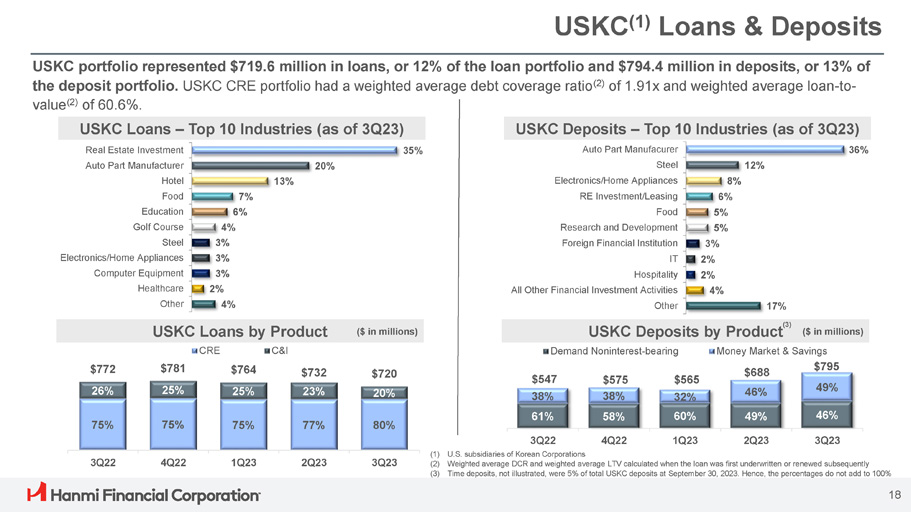

USKC (1) Loans & Deposits 35% 20% 13% 7% 6% 4% 3% 3% 3% 2% 4% Real Estate Investment Auto Part Manufacturer Hotel Food Education Golf Course Steel Electronics/Home Appliances Computer Equipment Healthcare Other USKC portfolio represented $719.6 million in loans, or 12% of the loan portfolio and $794.4 million in deposits, or 13% of the deposit portfolio. USKC CRE portfolio had a weighted average debt coverage ratio (2) of 1.91x and weighted average loan - to - value (2) of 60.6%. USKC Loans – Top 10 Industries (as of 3Q23) 20% 23% 25% 25% 26% 80% 77% 75% 75% 75% 3Q23 2Q23 1Q23 4Q22 3Q22 $772 $781 $764 $732 $720 USKC Loans by Product CRE C&I ($ in millions) USKC Deposits – Top 10 Industries (as of 3Q23) 36% Auto Part Manufacurer 12% Steel 8% Electronics/Home Appliances 6% RE Investment/Leasing 5% Food 5% Research and Development 3% Foreign Financial Institution 2% IT 2% Hospitality 4% All Other Financial Investment Activities 17% Other $795 49% $688 46% $565 32% $575 38% $547 38% 46% 49% 60% 58% 61% 3Q23 2Q23 1Q23 4Q22 3Q22 Demand Noninterest - bearing Money Market & Savings USKC Deposits by Product 18 ($ in millions) (1) U.S. subsidiaries of Korean Corporations (2) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently (3) Time deposits, not illustrated, were 5% of total USKC deposits at September 30, 2023. Hence, the percentages do not add to 100% (3)

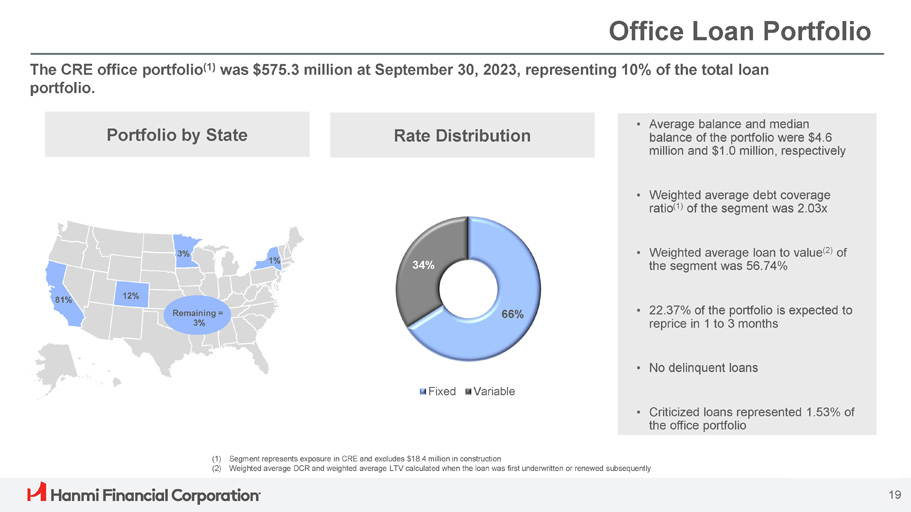

Office Loan Portfolio The CRE office portfolio (1) was $575.3 million at September 30, 2023, representing 10% of the total loan portfolio. 81% 12% 3% Remaining = 3% 1% Portfolio by State • Average balance and median balance of the portfolio were $4.6 million and $1.0 million, respectively • Weighted average debt coverage ratio (1) of the segment was 2.03x • Weighted average loan to value (2) of the segment was 56.74% • 22.37% of the portfolio is expected to reprice in 1 to 3 months • No delinquent loans • Criticized loans represented 1.53% of the office portfolio Rate Distribution (1) Segment represents exposure in CRE and excludes $18.4 million in construction (2) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently 66% 34% Fixed Variable 19

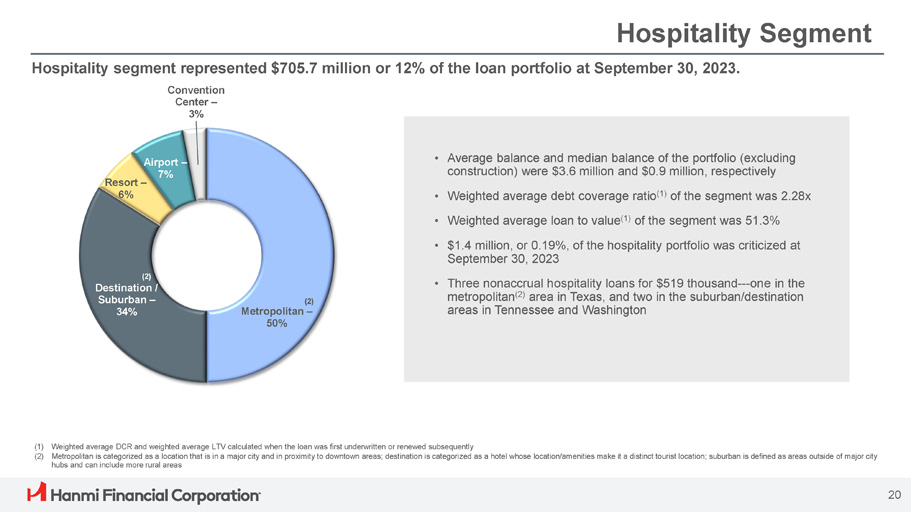

Resort – 6% 20 Airport – 7% (2) Metropolitan – 50% (2) Destination / Suburban – 34% Hospitality Segment Hospitality segment represented $705.7 million or 12% of the loan portfolio at September 30, 2023. Convention Center – 3% (1) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently (2) Metropolitan is categorized as a location that is in a major city and in proximity to downtown areas; destination is categorized as a hotel whose location/amenities make it a distinct tourist location; suburban is defined as areas outside of major city hubs and can include more rural areas • Average balance and median balance of the portfolio (excluding construction) were $ 3 . 6 million and $ 0 . 9 million, respectively • Weighted average debt coverage ratio (1) of the segment was 2.28x • Weighted average loan to value (1) of the segment was 51.3% • $ 1 . 4 million, or 0 . 19 % , of the hospitality portfolio was criticized at September 30 , 2023 • Three nonaccrual hospitality loans for $ 519 thousand --- one in the metropolitan ( 2 ) area in Texas, and two in the suburban/destination areas in Tennessee and Washington

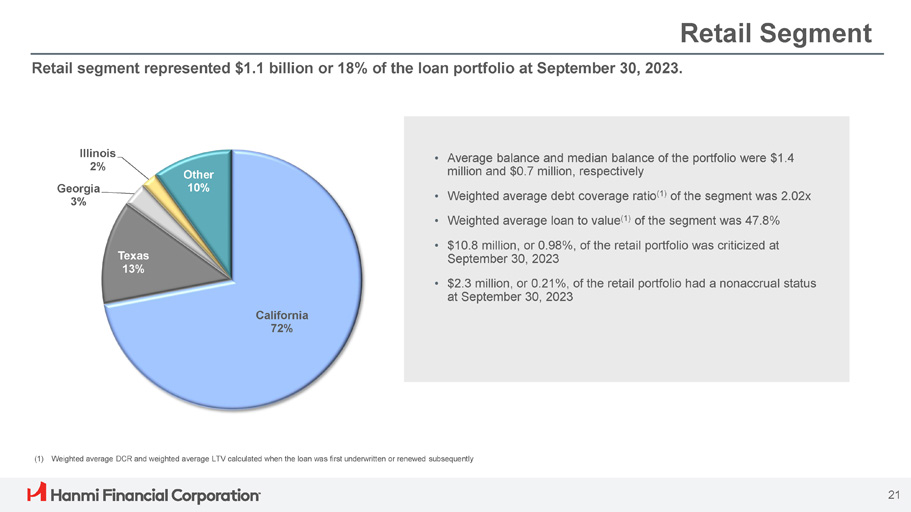

Retail Segment Retail segment represented $1.1 billion or 18% of the loan portfolio at September 30, 2023. (1) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently • Average balance and median balance of the portfolio were $1.4 million and $0.7 million, respectively • Weighted average debt coverage ratio (1) of the segment was 2.02x • Weighted average loan to value (1) of the segment was 47.8% • $10.8 million, or 0.98%, of the retail portfolio was criticized at September 30, 2023 • $2.3 million, or 0.21%, of the retail portfolio had a nonaccrual status at September 30, 2023 California 72% 21 Texas 13% Illinois 2% Georgia 3% Other 10%

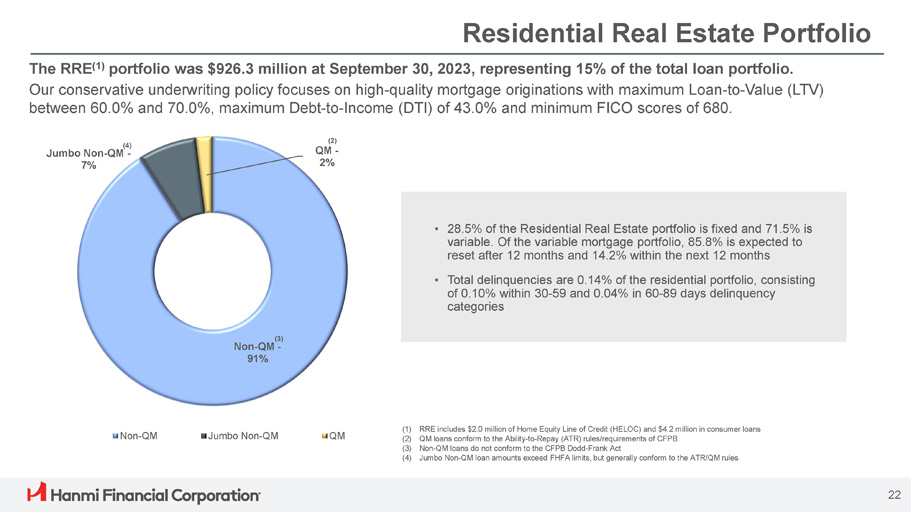

Residential Real Estate Portfolio (2) QM - 2% (3) Non - QM - 91% (4) Jumbo Non - QM - 7% Non - QM Jumbo Non - QM QM 22 The RRE (1) portfolio was $926.3 million at September 30, 2023, representing 15% of the total loan portfolio. Our conservative underwriting policy focuses on high - quality mortgage originations with maximum Loan - to - Value (LTV) between 60.0% and 70.0%, maximum Debt - to - Income (DTI) of 43.0% and minimum FICO scores of 680. (1) RRE includes $2.0 million of Home Equity Line of Credit (HELOC) and $4.2 million in consumer loans (2) QM loans conform to the Ability - to - Repay (ATR) rules/requirements of CFPB (3) Non - QM loans do not conform to the CFPB Dodd - Frank Act (4) Jumbo Non - QM loan amounts exceed FHFA limits, but generally conform to the ATR/QM rules • 28.5% of the Residential Real Estate portfolio is fixed and 71.5% is variable. Of the variable mortgage portfolio, 85.8% is expected to reset after 12 months and 14.2% within the next 12 months • Total delinquencies are 0.14% of the residential portfolio, consisting of 0.10% within 30 - 59 and 0.04% in 60 - 89 days delinquency categories

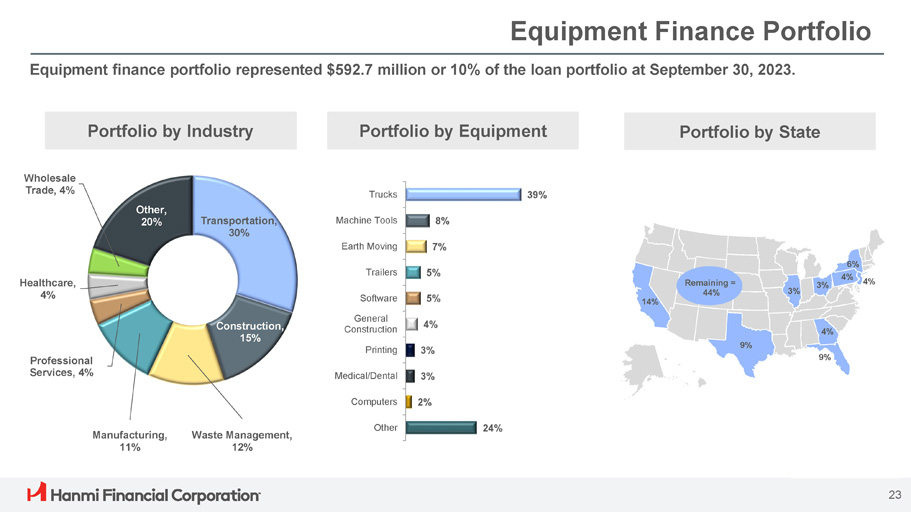

Equipment Finance Portfolio Equipment finance portfolio represented $592.7 million or 10% of the loan portfolio at September 30, 2023. Transportation, 30% Construction, 15% Waste Management, 12% Manufacturing, 11% Professional Services, 4% Healthcare, 4% Wholesale Trade, 4% Other, 20% 39% 8% 7% 5% 5% 4% General Construction 3% Printing 3% Medical/Dental 24% 2% Computers Other Trucks Machine Tools Earth Moving Trailers Software Portfolio by Industry Portfolio by Equipment Portfolio by State 14% 23 9% 4% 9% 6% 4% 3% 3% Remaining = 44% 4%

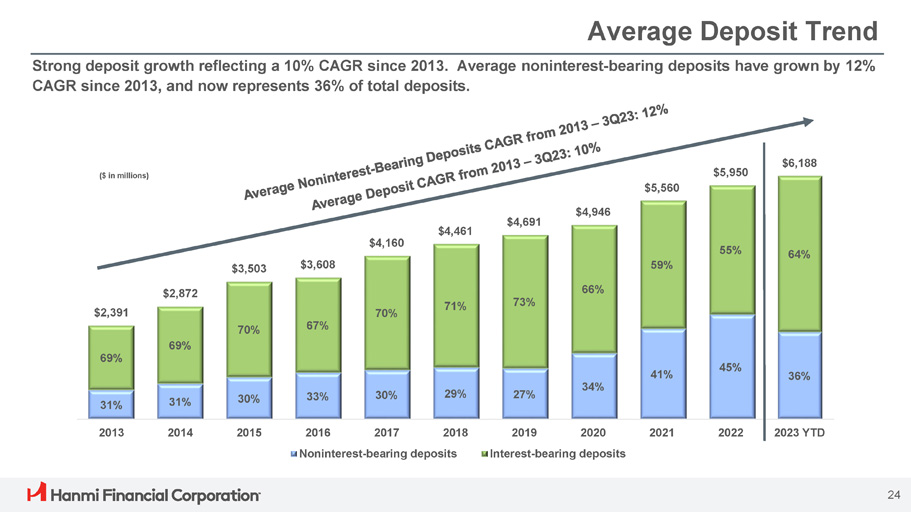

31% 31% 30% 33% 30% 29% 27% 34% 41% 45% 36% 69% 69% 70% 67% 70% 71% 73% 66% 59% 55% 64% $2,391 $2,872 $3,503 $3,608 $4,160 $4,461 $4,691 $5,560 $4,946 $5,950 $6,188 2013 2014 2015 2021 2022 2023 YTD 2016 2017 2018 Noninterest - bearing deposits 2019 2020 Interest - bearing deposits ($ in millions) Strong deposit growth reflecting a 10% CAGR since 2013. Average noninterest - bearing deposits have grown by 12% CAGR since 2013, and now represents 36% of total deposits. 24 Average Deposit Trend

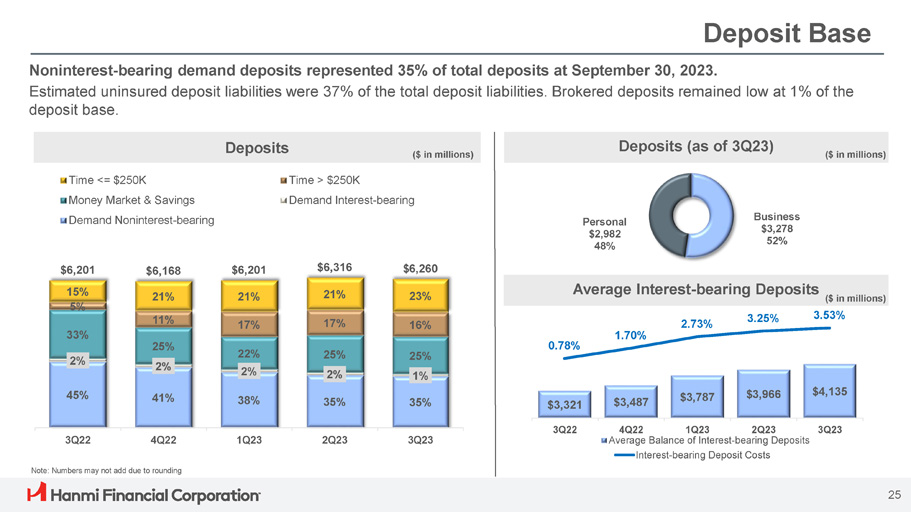

0.78% 1.70% 2.73% 3.25% 3.53% 4Q22 1Q23 2Q23 Average Balance of Interest - bearing Deposits Interest - bearing Deposit Costs $3,321 $3,487 $3,787 $3,966 $4,135 3Q22 3Q23 Deposit Base Noninterest - bearing demand deposits represented 35% of total deposits at September 30, 2023. Estimated uninsured deposit liabilities were 37% of the total deposit liabilities. Brokered deposits remained low at 1% of the deposit base. Note: Numbers may not add due to rounding Deposits ($ in millions) Deposits (as of 3Q23) Average Interest - bearing Deposits ($ in millions) Business $3,278 52% Personal $2,982 48% ($ in millions) 45% 41% 38% 35% 35% 2% 2% 2% 2% 1% 33% 25% 22% 25% 25% 17% 17% 16% 21% 11% 21% 21% 23% $6,201 15% 5% $6,168 $6,201 $6,316 $6,260 3Q22 4Q22 1Q23 2Q23 3Q23 Time <= $250K Money Market & Savings Demand Noninterest - bearing Time > $250K Demand Interest - bearing 25

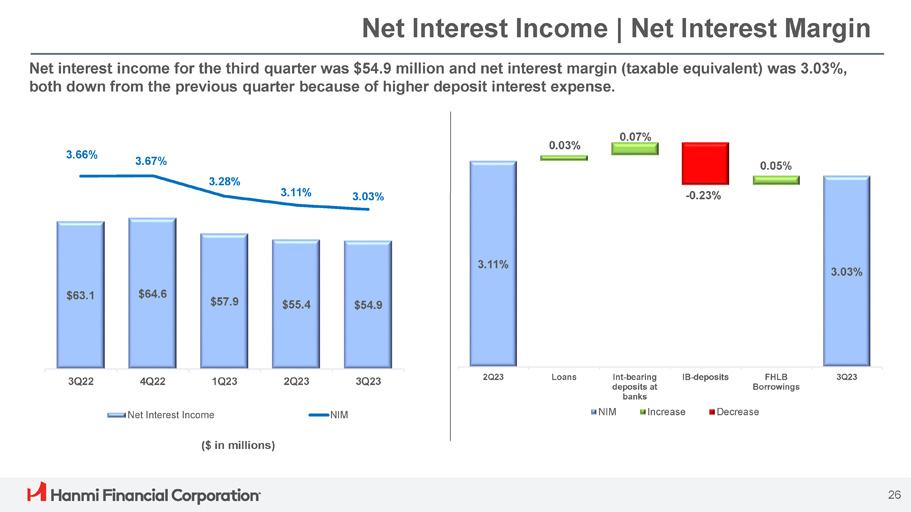

Net Interest Income | Net Interest Margin Net interest income for the third quarter was $54.9 million and net interest margin (taxable equivalent) was 3.03%, both down from the previous quarter because of higher deposit interest expense. $63.1 $64.6 $57.9 $55.4 $54.9 3.66% 3.67% 3.28% 3.11% 3.03% 3Q22 4Q22 1Q23 2Q23 3Q23 Net Interest Income NIM ($ in millions) 3.11% 3.03% 0.03% 0.07% 0.05% - 0.23% 2Q23 Loans Int - bearing deposits at banks IB - deposits FHLB Borrowings 3Q23 NIM Increase Decrease 26

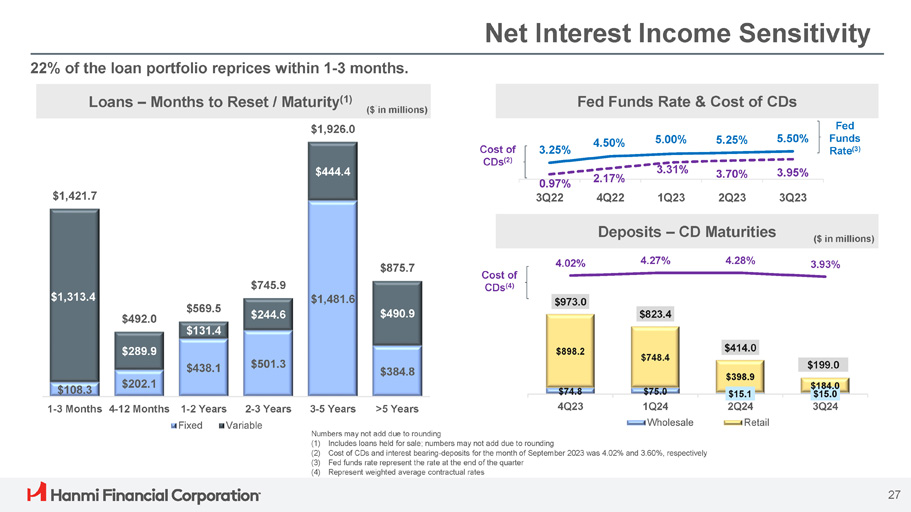

Net Interest Income Sensitivity 22% of the loan portfolio reprices within 1 - 3 months. $108.3 $202.1 $438.1 $501.3 $1,481.6 $384.8 $1,313.4 $289.9 $244.6 $444.4 $490.9 $1,421.7 $492.0 $569.5 $131.4 $745.9 $1,926.0 $875.7 1 - 3 Months 4 - 12 Months 1 - 2 Years 2 - 3 Years 3 - 5 Years >5 Years Fixed Variable Loans – Months to Reset / Maturity (1) ($ . in millions) Fed Funds Rate & Cost of CDs $74.8 $75.0 $15.1 $15.0 $898.2 $748.4 $398.9 $184.0 $973.0 $823.4 $414.0 $199.0 4.02% 3.93% 4Q23 3Q24 1Q24 Wholesale 2Q24 Retail ($ in millions) 4Q22 1Q23 2Q23 Deposits – CD Maturities 4.27% 4.28% 3.25% 4.50% 5.00% 5.25% 5.50% 2.17% 3.31% 3.70% 3.95% 0.97% 3Q22 3Q23 Fed Funds Rate (3) Cost of CDs (2) Cost of CDs (4) Numbers may not add due to rounding (1) Includes loans held for sale; numbers may not add due to rounding (2) Cost of CDs and interest bearing - deposits for the month of September 2023 was 4.02% and 3.60%, respectively (3) Fed funds rate represent the rate at the end of the quarter (4) Represent weighted average contractual rates 27

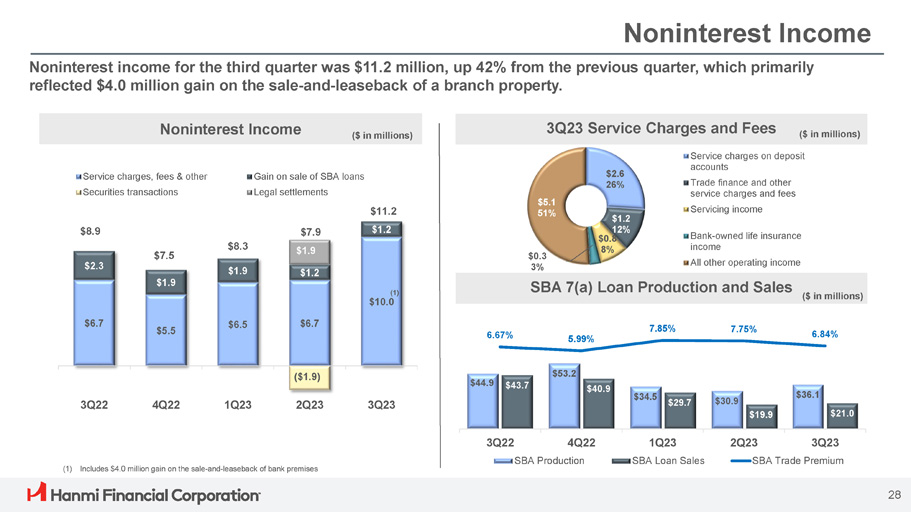

$2.6 26% $1.2 12% $0.8 8% $0.3 3% $5.1 51% Service charges on deposit accounts Trade finance and other service charges and fees Servicing income Bank - owned life insurance income All other operating income Noninterest Income SBA 7(a) Loan Production and Sales ($ in millions) $44.9 $53.2 $34.5 $30.9 $36.1 $43.7 $40.9 $29.7 $19.9 $21.0 6.67% 5.99% 7.85% 7.75% 6.84% 3Q22 4Q22 1Q23 SBA Loan Sales SBA Production 2Q23 3Q23 SBA Trade Premium Noninterest income for the third quarter was $11.2 million, up 42% from the previous quarter, which primarily reflected $4.0 million gain on the sale - and - leaseback of a branch property. Noninterest Income 3Q23 Service Charges and Fees ($ in millions) ($ in millions) $6.7 $5.5 $6.5 $6.7 $2.3 $1.9 $1.9 $1.2 $8.9 $7.5 $8.3 $11.2 $1.2 3Q22 4Q22 1Q23 2Q23 3Q23 Service charges, fees & other Securities transactions Gain on sale of SBA loans Legal settlements Total noninterest income ($1.9) 28 $7.9 $1.9 (1) $10.0 (1) Includes $4.0 million gain on the sale - and - leaseback of bank premises

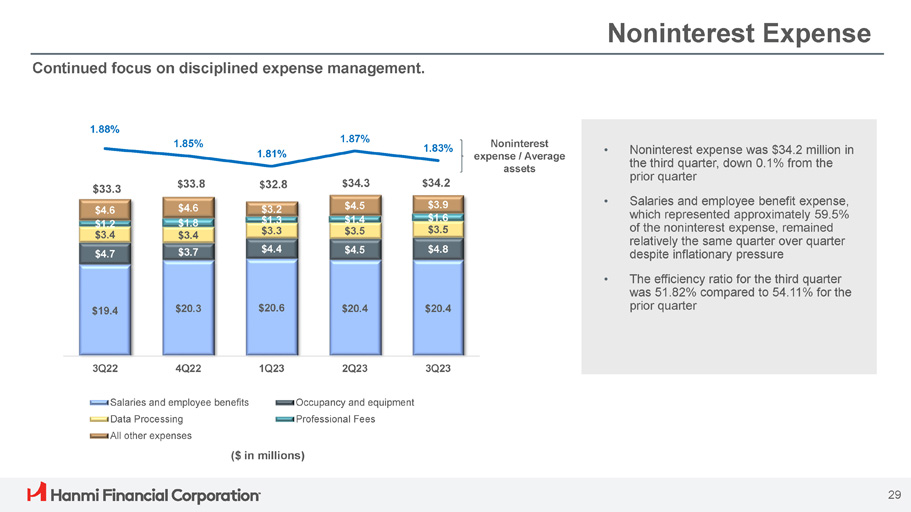

Noninterest Expense • Noninterest expense was $34.2 million in the third quarter, down 0.1% from the prior quarter • Salaries and employee benefit expense, which represented approximately 59.5% of the noninterest expense, remained relatively the same quarter over quarter despite inflationary pressure • The efficiency ratio for the third quarter was 51.82% compared to 54.11% for the prior quarter Continued focus on disciplined expense management. ($ in millions) Noninterest expense / Average assets $19.4 $20.3 $20.6 $20.4 $20.4 $3.2 $1.3 $3.3 $4.4 $ 33.8 $33.3 $4.6 $4.6 $1.8 $1.2 $3.4 $3.4 $3.7 $4.7 $ 34.3 $4.5 $1.4 $3.5 $4.5 $ 34.2 $3.9 $1.6 $3.5 $4.8 1.88% 1.85% 1.81% 1.87% 1.83% 1Q23 2Q23 3Q23 Occupancy and equipment Professional Fees 3Q22 4Q22 Salaries and employee benefits Data Processing All other expenses Noninterest expense/Average assets $ 32.8 29

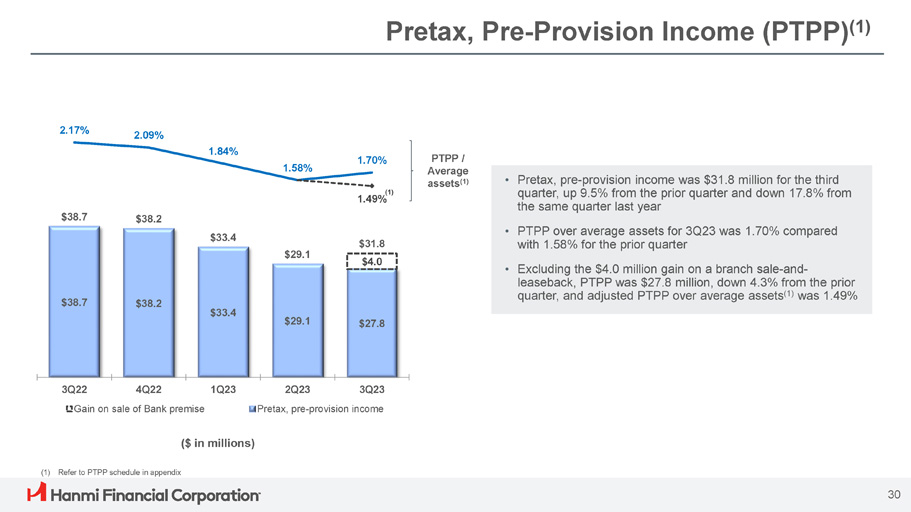

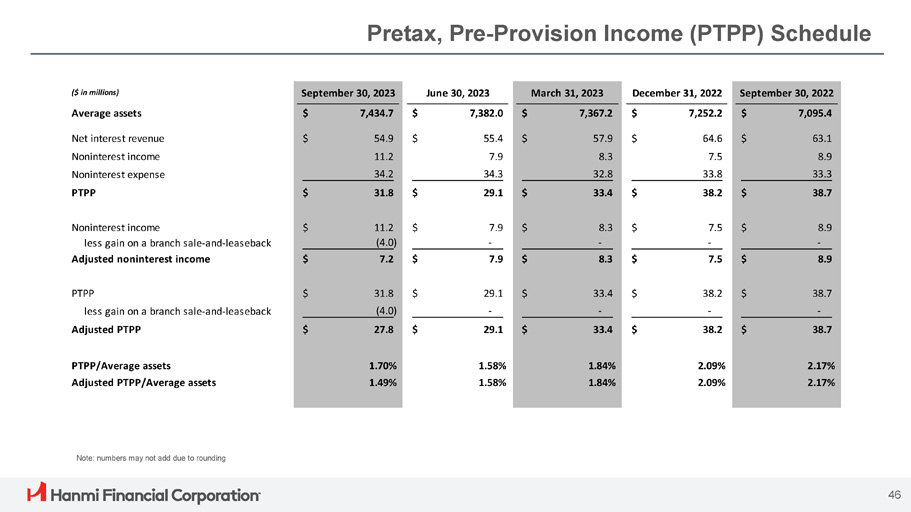

Pretax, Pre - Provision Income (PTPP) (1) $29.1 $27.8 2.17% 2.09% 1Q23 3Q22 4Q22 Gain on sale of Bank premise 2Q23 3Q23 Pretax, pre - provision income Average 30 Pretax, pre - provision income was $31.8 million for the third quarter, up 9.5% from the prior quarter and down 17.8% from the same quarter last year • PTPP / assets (1) 1.70% (1) 1.49% 1.58% 1.84% $38.2 $38.7 PTPP over average assets for 3Q23 was 1.70% compared with 1.58% for the prior quarter Excluding the $4.0 million gain on a branch sale - and - • • $31.8 $4.0 $29.1 $33.4 leaseback, PTPP was $27.8 million, down 4.3% from the prior quarter, and adjusted PTPP over average assets (1) was 1.49% $33.4 $38.2 $38.7 ($ in millions) (1) Refer to PTPP schedule in appendix

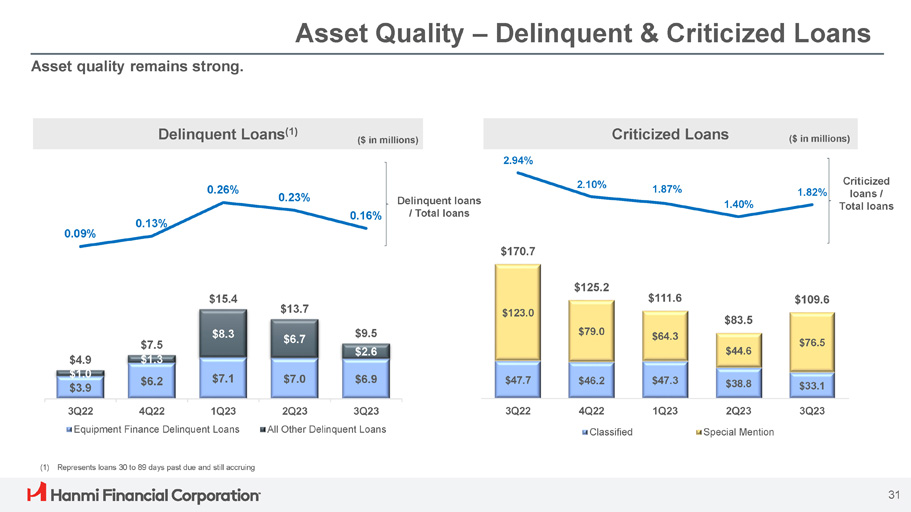

Asset Quality – Delinquent & Criticized Loans Delinquent loans / Total loans $47.7 $46.2 $47.3 $38.8 $33.1 $123.0 $79.0 $64.3 $44.6 $76.5 $170.7 $125.2 $111.6 $83.5 $109.6 2.94% 2.10% 1.87% 1.40% 1.82% 3Q22 4Q22 1Q23 2Q23 3Q23 Classified Special Mention Delinquent Loans (1) Criticized Loans Criticized loans / Total loans Asset quality remains strong. $7.1 $7.0 $6.9 $8.3 $6.7 $4.9 $1.0 $3.9 $7.5 $1.3 $6.2 $15.4 $13.7 $9.5 $2.6 0.09% 0.13% 0.26% 0.23% 0.16% 3Q22 4Q22 1Q23 Equipment Finance Delinquent Loans 2Q23 3Q23 All Other Delinquent Loans ($ in millions) 31 ($ in millions) (1) Represents loans 30 to 89 days past due and still accruing

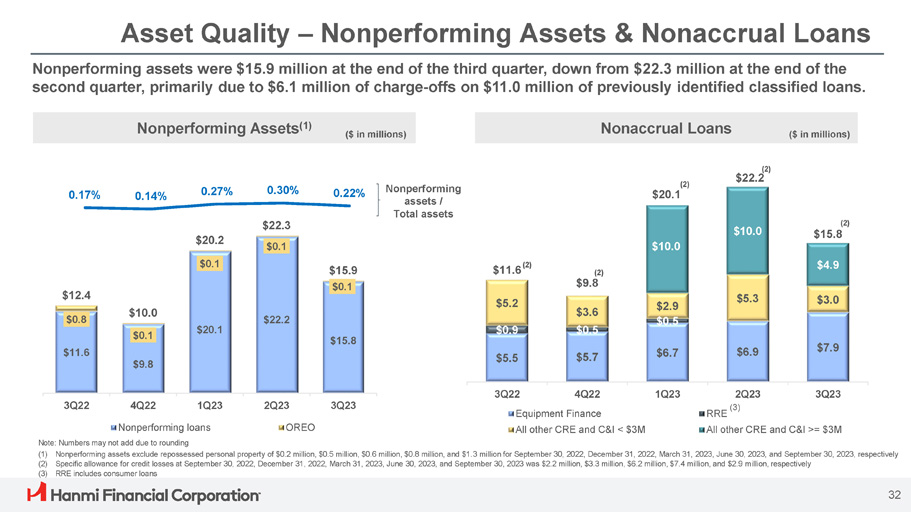

$11.6 $9.8 $20.1 $22.2 $15.8 $0.8 $0.1 $0.1 $0.1 $0.1 $12.4 $10.0 $20.2 $22.3 $15.9 2Q23 3Q23 3Q22 4Q22 1Q23 Nonperforming loans Note: Numbers may not add due to rounding OREO Asset Quality – Nonperforming Assets & Nonaccrual Loans 0.17% 0.14% 0.27% 0.30% 0.22% Nonperforming assets / Total assets Nonperforming Assets (1) Nonaccrual Loans Nonperforming assets were $15.9 million at the end of the third quarter, down from $22.3 million at the end of the second quarter, primarily due to $6.1 million of charge - offs on $11.0 million of previously identified classified loans. ($ in millions) ($ in millions) (1) Nonperforming assets exclude repossessed personal property of $0.2 million, $0.5 million, $0.6 million, $0.8 million, and $1.3 million for September 30, 2022, December 31, 2022, March 31, 2023, June 30, 2023, and September 30, 2023, respectively (2) Specific allowance for credit losses at September 30, 2022, December 31, 2022, March 31, 2023, June 30, 2023, and September 30, 2023 was $2.2 million, $3.3 million, $6.2 million, $7.4 million, and $2.9 million, respectively (3) RRE includes consumer loans $5.5 $5.7 $6.7 $6.9 $7.9 $0.9 $5.2 $3.6 $0.5 $2.9 $0.5 $5.3 $3.0 $10.0 $4.9 $11.6 (2) (2) $22.2 1Q23 2Q23 (3) (2) $9.8 (2) $15.8 (2) $20.1 3Q23 RRE 3Q22 4Q22 Equipment Finance All other CRE and C&I < $3M All other CRE and C&I >= $3M 32 $10.0

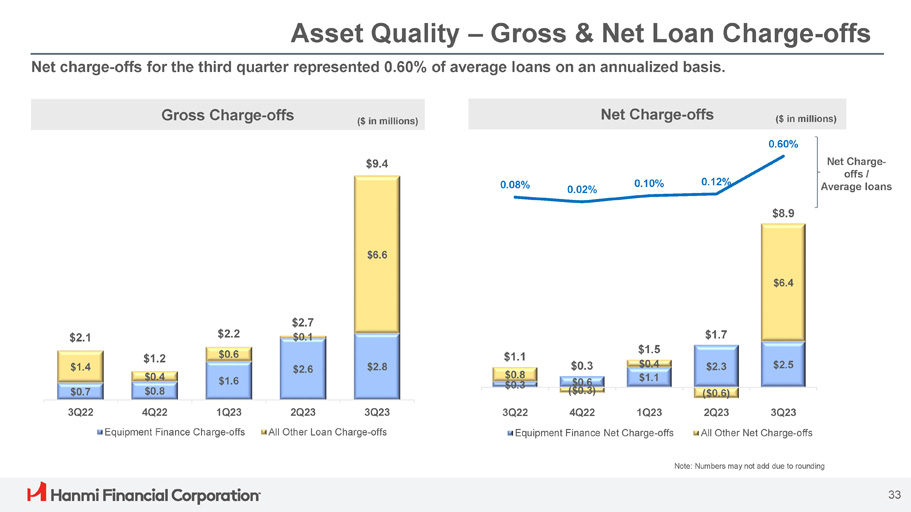

Asset Quality – Gross & Net Loan Charge - offs Gross Charge - offs Net Charge - offs Net Charge - offs / Average loans Net charge - offs for the third quarter represented 0.60% of average loans on an annualized basis. ($ in millions) ($ in millions) $1.6 $2.6 $2.8 $1.4 $0.6 $6.6 $2.1 $1.2 $0.4 $2.2 $2.7 $0.1 $9.4 Equipment Finance Charge - offs All Other Loan Charge - offs Note: Numbers may not add due to rounding $2.3 $2.5 $6.4 $1.1 $0.8 $0.3 $0.3 $0.6 $1.5 $0.4 $1.1 $1.7 ($0.6) ($0.3) $0.8 $0.7 3Q23 2Q23 1Q23 4Q22 3Q22 3Q23 2Q23 1Q23 4Q22 3Q22 $8.9 0.08% 0.02% 0.10% 0.12% 0.60% Equipment Finance Net Charge - offs All Other Net Charge - offs 33

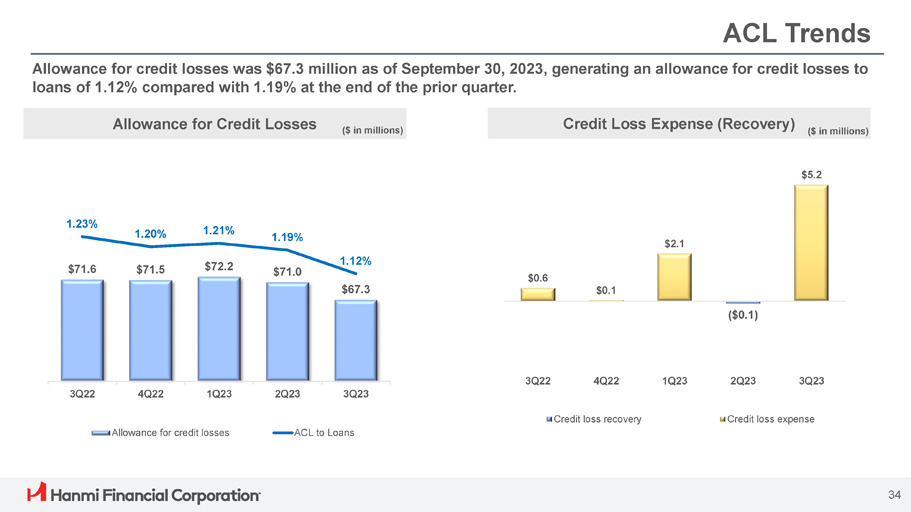

ACL Trends Allowance for credit losses was $67.3 million as of September 30, 2023, generating an allowance for credit losses to loans of 1.12% compared with 1.19% at the end of the prior quarter. $71.6 $71.5 $72.2 $71.0 $67.3 1.23% 1.20% 1.21% 1.19% 1.12% 3Q22 4Q22 1Q23 2Q23 3Q23 Allowance for credit losses ACL to Loans ($0.1) $0.6 $0.1 $2.1 $5.2 3Q22 4Q22 1Q23 2Q23 3Q23 Credit loss recovery Credit loss expense Allowance for Credit Losses Credit Loss Expense (Recovery) 34 ($ in millions) ($ in millions)

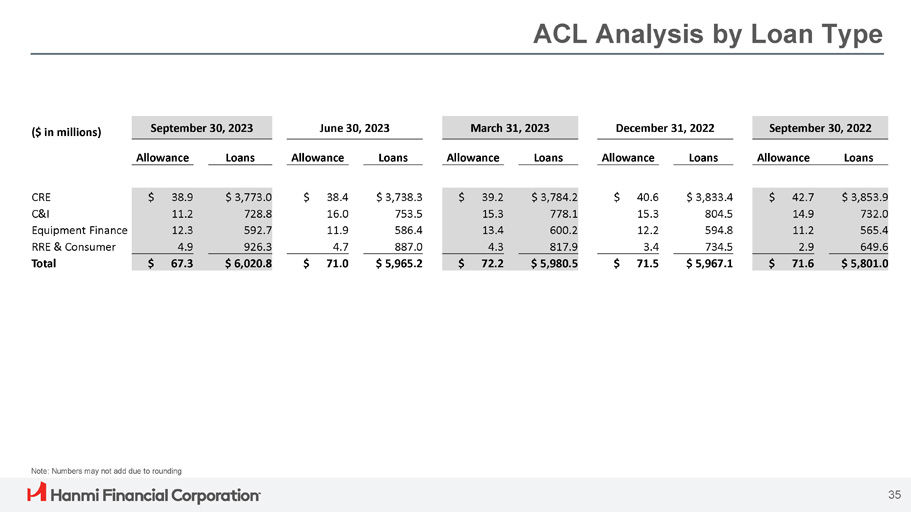

ACL Analysis by Loan Type September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 ($ in millions) Loans Allowance Loans Allowance Loans Allowance Loans Allowance Loans Allowance $ 3,853.9 $ 42.7 $ 3,833.4 $ 40.6 $ 3,784.2 $ 39.2 $ 3,738.3 $ 38.4 $ 3,773.0 $ 38.9 CRE 732.0 14.9 804.5 15.3 778.1 15.3 753.5 16.0 728.8 11.2 C&I 565.4 11.2 594.8 12.2 600.2 13.4 586.4 11.9 592.7 12.3 Equipment Finance 649.6 2.9 734.5 3.4 817.9 4.3 887.0 4.7 926.3 4.9 RRE & Consumer $ 5,801.0 $ 71.6 $ 5,967.1 $ 71.5 $ 5,980.5 $ 72.2 $ 5,965.2 $ 71.0 $ 6,020.8 $ 67.3 Total Note: Numbers may not add due to rounding 35

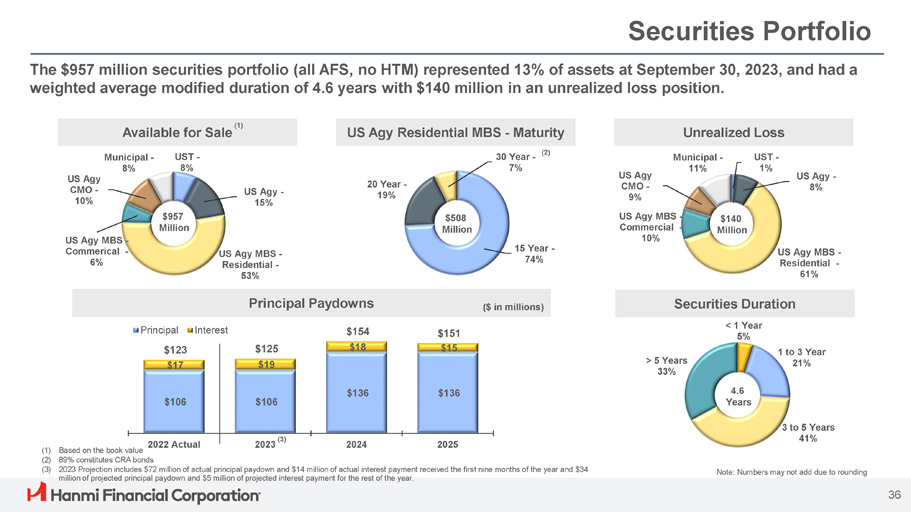

US Agy Residential MBS - Maturity 15 Year - 74% 20 Year - 19% Securities Portfolio The $957 million securities portfolio (all AFS, no HTM) represented 13% of assets at September 30, 2023, and had a weighted average modified duration of 4.6 years with $140 million in an unrealized loss position. Principal Paydowns ($ in millions) $106 $106 $136 $136 $125 $19 $154 $18 $151 $15 Principal $123 $17 Interest Note: Numbers may not add due to rounding Unrealized Loss UST - 1% US Agy - 8% US Agy MBS - Residential - 61% US Agy MBS - Commercial - 10% US Agy CMO - 9% Municipal - 11% Available for Sale UST - 8% US Agy - 15% US Agy MBS - Residential - 53% US Agy MBS - Commerical - 6% US Agy CMO - 10 % Municipal - 8% $957 Million Securities Duration < 1 Year 5% 1 to 3 Year 21% 3 to 5 Years 41% > 5 Years 33% 4.6 Years $508 Million 30 Year - (2) 7% $140 Million (1) Based on the book value 2022 Actual 36 (2) 89% constitutes CRA bonds (3) 2023 Projection includes $72 million of actual principal paydown and $14 million of actual interest payment received the first nine months of the year and $34 million of projected principal paydown and $5 million of projected interest payment for the rest of the year. 2023 (3) 2024 2025 (1)

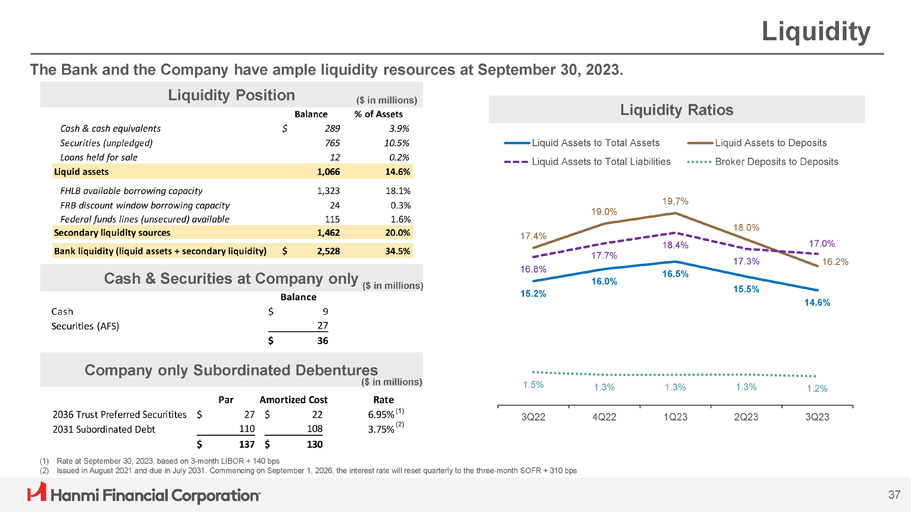

18.1% 1,323 FHLB available borrowing capacity 0.3% 24 FRB discount window borrowing capacity 1.6% 115 Federal funds lines (unsecured) available 20.0% 1,462 Secondary liquidity sources 34.5% $ 2,528 Bank liquidity (liquid assets + secondary liquidity) Cash & Securities at Company only ($ in millions) Balance 289 765 12 % of Assets 3.9% 10.5% 0.2% Cash & cash equivalents Securities (unpledged) Loans held for sale $ Liquid assets 1,066 14.6% Liquid Assets to Total Liabilities Liquidity The Bank and the Company have ample liquidity resources at September 30, 2023. (1) Rate at September 30, 2023, based on 3 - month LIBOR + 140 bps (2) Issued in August 2021 and due in July 2031. Commencing on September 1, 2026, the interest rate will reset quarterly to the three - month SOFR + 310 bps Liquidity Position ($ in millions) 15.2% 16.0% 16.5% 15.5% 14.6% 17.4% 19.7% 19.0% 18.0% 16.8% 17.7% 18.4% 17.3% 17.0% 16.2% 1.5% 1.3% 1.3% 1.3% 1.2% 3Q22 4Q22 1Q23 2Q23 3Q23 Liquid Assets to Total Assets Liquid Assets to Deposits Broker Deposits to Deposits Liquidity Ratios 37 Par Amortized Cost 2036 Trust Preferred Securitites $ 27 $ 22 Rate 6.95% (1) (2) 3.75% 108 110 2031 Subordinated Debt $ 130 $ 137 Company only Subordinated Debentures ($ in millions) Balance Cash Securities (AFS) $ 9 27 $ 36

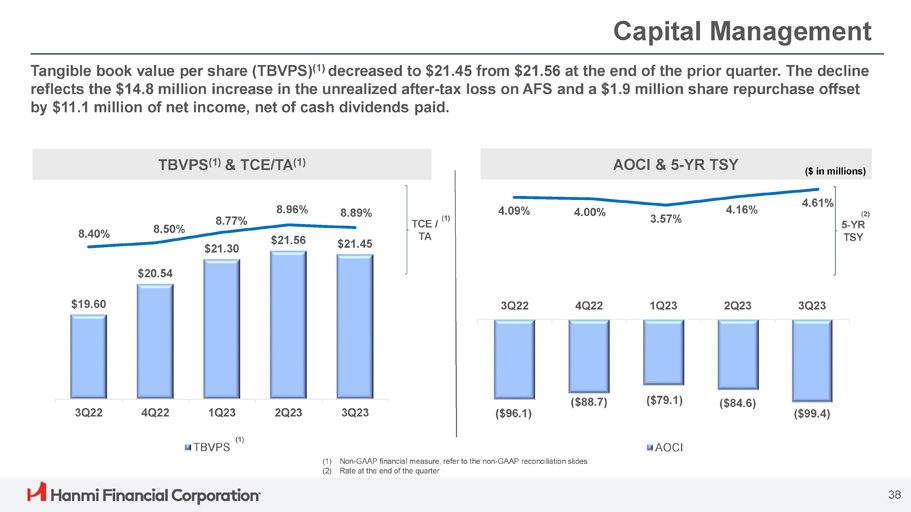

(1) Non - GAAP financial measure, refer to the non - GAAP reconciliation slides (2) Rate at the end of the quarter Capital Management Tangible book value per share (TBVPS) (1) decreased to $21.45 from $21.56 at the end of the prior quarter. The decline reflects the $14.8 million increase in the unrealized after - tax loss on AFS and a $1.9 million share repurchase offset by $11.1 million of net income, net of cash dividends paid. 4.09% 4.00% 3.57% 4.16% 4.61% ($96.1) ($88.7) ($79.1) ($84.6) ($99.4) 3Q22 4Q22 1Q23 2Q23 3Q23 AOCI $19.60 $20.54 $21.30 $21.56 $21.45 8.40% 8.50% 8.77% 8.96% 8.89% 3Q22 4Q22 1Q23 2Q23 3Q23 (1) TBVPS TBVPS (1) & TCE/TA (1) AOCI & 5 - YR TSY (2) 5 - YR TSY TCE / TA ($ in millions) (1) 38

Regulatory Capital The Company exceeds regulatory minimums and the Bank remains well capitalized at September 30, 2023. 8.00% 6.00% 4.50% 2.50% 2.50% 2.50% 15.07% 12.30% 11.95% 13.52% 10.73% 10.38% 10.50% 8.50% 7.00% Minimum Requirement Company Capital Conservation Buffer (1) Pro Forma 10.00% 8.00% 6.50% 14.42% 13.42% 13.42% 12.87% 11.86% 11.86% Well Capitalized Bank Pro Forma 39 CET1 Capital Tier 1 Capital Total Capital Company Bank CET1 Capital Tier 1 Capital Total Capital (1) Pro forma illustrates capital ratios with unrealized loses at September 30, 2023. Non - GAAP financial measure; refer to the non - GAAP reconciliation slide (1)

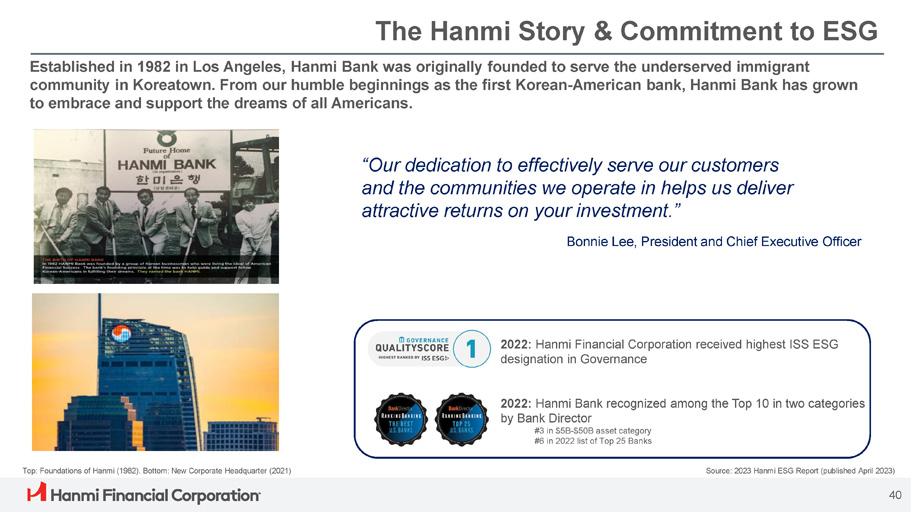

Top: Foundations of Hanmi (1982). Bottom: New Corporate Headquarter (2021) The Hanmi Story & Commitment to ESG Established in 1982 in Los Angeles, Hanmi Bank was originally founded to serve the underserved immigrant community in Koreatown. From our humble beginnings as the first Korean - American bank, Hanmi Bank has grown to embrace and support the dreams of all Americans. “Our dedication to effectively serve our customers and the communities we operate in helps us deliver attractive returns on your investment.” Bonnie Lee, President and Chief Executive Officer 2022: Hanmi Financial Corporation received highest ISS ESG designation in Governance 40 2022: Hanmi Bank recognized among the Top 10 in two categories by Bank Director #3 in $5B - $50B asset category #6 in 2022 list of Top 25 Banks Source: 2023 Hanmi ESG Report (published April 2023)

The board recognizes that sustainability broadly encompasses corporate activities that enhance the long - term value of the Company. (E nvironmental )SG Donated 40 solar panels to the Koreatown Senior and Community Center in Los Angeles. Source: 2023 Hanmi ESG Report (published April 2023) 41 Sustainability Enterprise Risk Management Committee (ERMC) In 2021, Hanmi Financial Corporation moved its headquarters to the Wilshire Grand Center, a LEED certified space furthering environmentally sustainable practices in Downtown Los Angeles. • The Bank’s Enterprise Risk Management Committee (ERMC) is a forum for management to engage in a collaborative discussion on the evolving risk positions of the bank, emerging risks, control gaps and mitigation strategies • The ERMC reviews ten risk pillars, including credit risk, in which management has begun discussions regarding climate risk to our loan portfolio

As a community bank, we are an equal opportunity employer and we are proud to work with our communities to build a stronger future for all of our stakeholders. E(S ocial )G Source: 2023 Hanmi ESG Report (published April 2023) Fostering Human Capital 68% Female Workforce 91% Ethnically Diverse Workforce 60% Female Managers 43% Current staff have been with us at least 5 years 13% Workforce promotions via Annual Review Hanmi Bank Dream Scholarship Provided Almost $1M in Scholarships Assisting 426 at - risk Students Across 12 States Serving Our Communities $7.5M Long - term commitment to a Community Reinvestment Act fund 289 Small business and community development loans Financial Wellness $380M Originated for small businesses and community development $300K+ Donated to non - profit partners Partnered with HoneyBee to provide financial wellness programs and Choice Checking account to meet the needs of the unbanked and underbanked. 42 (1) (1) Launched in 2016, the Hanmi Bank Dream Scholarship for At - Risk Youth Program provides educational support to at - risk students

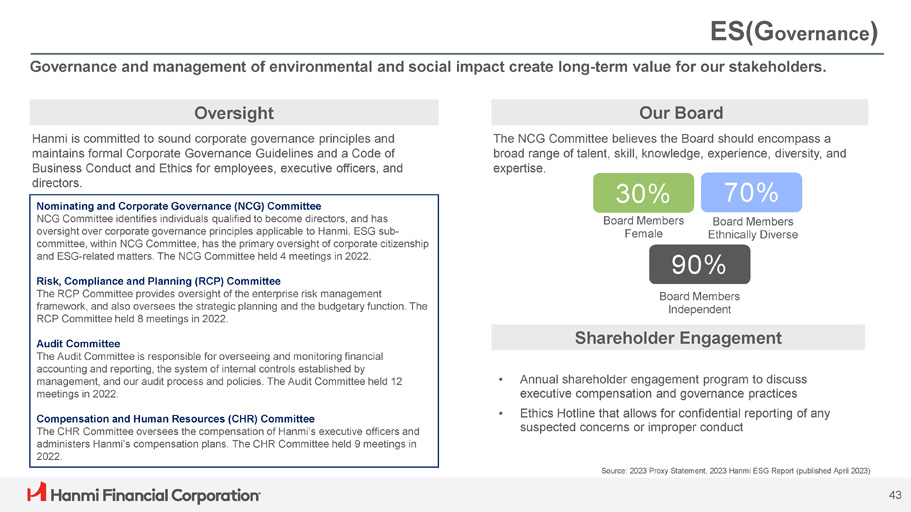

Governance and management of environmental and social impact create long - term value for our stakeholders. ES(G overnance ) Source: 2023 Proxy Statement, 2023 Hanmi ESG Report (published April 2023) Oversight Diverse Board Members Our Board Shareholder Engagement • Annual shareholder engagement program to discuss executive compensation and governance practices • Ethics Hotline that allows for confidential reporting of any suspected concerns or improper conduct The NCG Committee believes the Board should encompass a broad range of talent, skill, knowledge, experience, diversity, and expertise. Hanmi is committed to sound corporate governance principles and maintains formal Corporate Governance Guidelines and a Code of Business Conduct and Ethics for employees, executive officers, and directors. 70% Board Members Ethnically Diverse 43 30% Board Members Female 90% Board Members Independent Nominating and Corporate Governance (NCG) Committee NCG Committee identifies individuals qualified to become directors, and has oversight over corporate governance principles applicable to Hanmi. ESG sub - committee, within NCG Committee, has the primary oversight of corporate citizenship and ESG - related matters. The NCG Committee held 4 meetings in 2022. Risk, Compliance and Planning (RCP) Committee The RCP Committee provides oversight of the enterprise risk management framework, and also oversees the strategic planning and the budgetary function. The RCP Committee held 8 meetings in 2022. Audit Committee The Audit Committee is responsible for overseeing and monitoring financial accounting and reporting, the system of internal controls established by management, and our audit process and policies. The Audit Committee held 12 meetings in 2022. Compensation and Human Resources (CHR) Committee The CHR Committee oversees the compensation of Hanmi’s executive officers and administers Hanmi’s compensation plans . The CHR Committee held 9 meetings in 2022 .

Appendix 44

3Q23 Financial Summary Note: numbers may not add due to rounding (1) Percentage change calculated from dollars in thousands; change in basis points for profitability metrics (2) Non - GAAP financial measure, refer to the non - GAAP reconciliation slide $ 0.89 $ 0.67 $ 0.62 EPS - Diluted ($ in millions, except EPS) Change (1) September 30, 2023 June 30, 2023 September 30, 2022 Q/Q Y/Y Income Statement Summary - 13.0% - 1.0% $ 63.1 $ 55.4 $ 54.9 Net interest income 26.0% 41.5% 8.9 7.9 11.2 Noninterest income - 8.2% 4.3% 72.0 63.4 66.1 Operating revenue 2.9% - 0.1% 33.3 34.3 34.2 Noninterest expense 815.5% 6793.5% 0.6 (0.1) 5.2 Credit loss (recovery) expense - 30.1% - 8.5% 38.2 29.2 26.7 Pretax income - 28.2% - 7.6% 11.0 8.5 7.9 Income tax expense - 30.8% - 8.8% $ 27.2 $ 20.6 $ 18.8 Net income Selected balance sheet items 3.8% 0.9% $ 5,801 $ 5,965 $ 6,021 Loans receivable 0.9% - 0.9% 6,201 6,316 6,260 Deposits 3.1% 0.1% 7,129 7,345 7,350 Total assets 8.9% - 0.8% $ 609 $ 669 $ 663 Stockholders' equity Profitability Metrics (52) (12) 1.52% 1.12% 1.00% Return on average assets (570) (126) 15.58% 11.14% 9.88% Return on average equity 49 (7) 8.40% 8.96% 8.89% TCE/TA (2) (63) (8) 3.66% 3.11% 3.03% Net interest margin 560 (229) 46.22% 54.11% 51.82% Efficiency ratio 45

Pretax, Pre - Provision Income (PTPP) Schedule Note: numbers may not add due to rounding June 30, 2023 7,382.0 $ March 31, 2023 $ 7,367.2 September 30, 2022 $ 7,095.4 $ 55.4 $ 7.9 December 31, 2022 $ 7,252.2 57.9 $ 64.6 $ 8.3 7.5 63.1 8.9 34.3 $ 29.1 32.8 $ 33.4 33.8 $ 38.2 33.3 $ 38.7 $ 7.9 $ 8.3 $ 7.5 $ 8.9 - - - - $ 7.9 $ 8.3 $ 7.5 $ 8.9 $ 29.1 $ 33.4 $ 38.2 $ 38.7 - - - - $ 29.1 $ 33.4 $ 38.2 $ 38.7 1.58% 2.09% September 30, 2023 ($ in millions) $ 7,434.7 $ 54.9 11.2 34.2 $ 31.8 $ 11.2 (4.0 ) $ 7.2 $ 31.8 (4.0 ) $ 27.8 1.70% 1.49% Average assets Net interest revenue Noninterest income Noninterest expense PTPP Noninterest income less gain on a branch sale - and - leaseback Adjusted noninterest income PTPP less gain on a branch sale - and - leaseback Adjusted PTPP PTPP/Average assets Adjusted PTPP/Average assets 1.58% 1.84% 1.84% 2.09% 2.17% 2.17% 46

Non - GAAP Reconciliation: Tangible Common Equity to Tangible Asset Ratio 47 (1) There were no preferred shares outstanding at the periods indicated September 30, December 31, March 31, June 30, September 30, 2022 2022 2023 2023 2023 Hanmi Financial Corporation $ 7,128,511 $ 7,378,262 $ 7,434,130 $ 7,344,924 $ 7,350,140 Assets (11,267) (11,225) (11,193) (11,162) (11,131) Less goodwill and other intangible assets $ 7,117,244 $ 7,367,037 $ 7,422,937 $ 7,333,762 $ 7,339,009 Tangible assets $ 608,893 $ 637,515 $ 662,165 $ 668,560 $ 663,359 Stockholders' equity (1) (11,267) (11,225) (11,193) (11,162) (11,131) Less goodwill and other intangible assets $ 597,626 $ 626,290 $ 650,972 $ 657,398 $ 652,228 Tangible stockholders' equity (1) 8.54% 8.64% 8.91% 9.10% 9.03% Stockholders' equity to assets 8.40% 8.50% 8.77% 8.96% 8.89% Tangible common equity to tangible assets (1) 30,484,004 30,485,621 30,555,287 30,485,788 30,410,582 Common shares outstanding $ 19.60 $ 20.54 $ 21.30 $ 21.56 $ 21.45 Tangible common equity per common share ($ in thousands, except per share data)

Non - GAAP Reconciliation: Pro Forma Regulatory Capital 48 Note: numbers may not add due to rounding Bank Company ($ in thousands) Total Risk - based Tier 1 Common Equity Tier 1 Total Risk - based Tier 1 Common Equity Tier 1 $ 893,375 $ 831,428 $ 831,428 $ 933,915 $ 761,968 $ 740,411 Regulatory capital (99,251) (99,251) (99,251) (99,422) (99,422) (99,422) Unrealized losses on AFS securities $ 794,124 $ 732,177 $ 732,177 $ 834,493 $ 662,546 $ 640,989 Adjusted regulatory capital $ 6,196,064 $ 6,196,064 $ 6,196,064 $ 6,196,428 $ 6,196,428 $ 6,196,428 Risk weighted assets (24,230) (24,230) (24,230) (23,530) (23,530) (23,530) Risk weighted assets impact of unrealized losses on AFS securities $ 6,171,833 $ 6,171,833 $ 6,171,833 $ 6,172,898 $ 6,172,898 $ 6,172,898 Adjusted Risk weighted assets 14.42% 13.42% 13.42% 15.07% 12.30% 11.95% Regulatory capital ratio as reported - 1.55% - 1.56% - 1.56% - 1.55% - 1.56% - 1.57% Impact of unrealized losses on AFS securities 12.87% 11.86% 11.86% 13.52% 10.73% 10.38% Pro forma regulatory capital ratio