Exhibit 99.2

2Q24 Earnings Supplemental Presentation July 23, 2024 Los Angeles New York/ New Jersey Virginia Chicago Dallas Houston San Francisco San Diego

Hanmi Financial Corporation (the “Company”) cautions investors that any statements contained herein that are not historical facts are forward - looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 , including, but not limited to, those statements regarding operating and financial performance, financial position and liquidity, business strategies, regulatory, economic and competitive outlook, investment and expenditure plans, capital and financing needs and availability, litigation, plans and objectives, merger or sale activity, financial condition and results of operations, and all other forecasts and statements of expectation or assumption underlying any of the foregoing . These statements involve known and unknown risks and uncertainties that are difficult to predict . Investors should not rely on any forward - looking statement and should consider risks, such as changes in governmental policy, legislation and regulations, economic uncertainty and changes in economic conditions, inflation, the continuing impact of the COVID - 19 pandemic on our business and results of operations, fluctuations in interest rate and credit risk, competitive pressures our ability to access cost - effective funding, the ability to enter into new markets successfully and capitalize on growth opportunities, balance sheet management, liquidity and sources of funding, the size and composition of our deposit portfolio, and the percentage of uninsured deposits in the portfolio, increased assessments by the Federal Deposit Insurance Corporation, risk of natural disasters, a failure in or breach of our operational or security systems or infrastructure, including cyberattacks, the adequacy of and changes in the methodology of calculating our allowance for credit losses, and other operational factors . Forward - looking statements are based upon the good faith beliefs and expectations of management as of this date only and are further subject to additional risks and uncertainties, including, but not limited to, the risk factors set forth in our earnings release dated July 23 , 2024 , including the section titled “Forward Looking Statements” and the Company’s most recent Form 10 - K, 10 - Q and other filings with the Securities and Exchange Commission (“SEC”) . The Company disclaims any obligation to update or revise the forward - looking statements herein . 2 Forward - Looking Statements

This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”) . These non - GAAP measures include tangible common equity to tangible assets, and tangible common equity per share . Management uses these “non - GAAP” measures in its analysis of the Company’s performance . Management believes these non - GAAP financial measures allow for better comparability of period to period operating performance . Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors . These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non - GAAP performance measures that may be presented by other companies . A reconciliation of the non - GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation . 3 Non - GAAP Financial Information

2Q24 Highlights Diluted EPS $0.48 ROAA 0.77% NIM 2.69% Efficiency Ratio 62.24% TBVPS (1) $22.99 Net Income $14.5M • Net income was $14.5 million, or $0.48 per diluted share, down 4.7% from $15.2 million, or $0.50 per diluted share, for the prior quarter » Net interest income was $48.6 million, down 4.0% from the prior quarter » Noninterest income was $8.1 million, up 4.2% from the prior quarter » Noninterest expense was $35.3 million, down 3.2% from the prior quarter » Efficiency ratio was 62.24%, compared with 62.42% for the prior quarter • Loans receivable were $6.18 billion, consistent with the prior quarter » Loan production was $273.9 million with a weighted average interest rate of 8.31% • Deposits were $6.33 billion, down 0.7% from the prior quarter, with noninterest - bearing demand deposits representing 31.0% of total deposits » Cost of interest - bearing deposits was 4.27%, up 11 basis points from the prior quarter • Credit loss expense was $1.0 million; allowance for credit losses to loans was 1.10% at June 30, 2024 • Tangible common equity to tangible assets (1) was 9.19%, Common equity tier 1 capital ratio was 12.11% and total capital ratio was 15.24% ROAE 7.50% (1) Non - GAAP financial measure; refer to the non - GAAP reconciliation slide 4

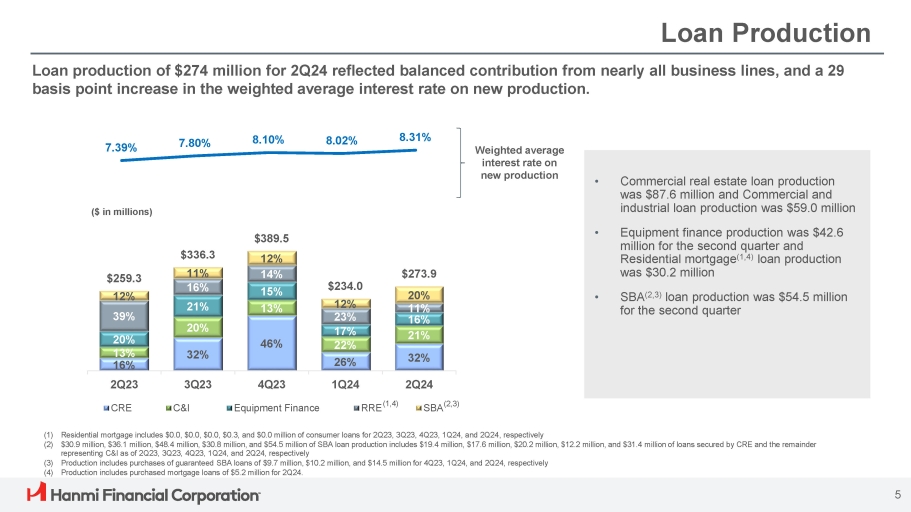

32% 46% 11% 16% 21% 20% $259.3 12% 39% 20% 13% 16% $336.3 $389.5 12% 14% 15% 13% $234.0 12% 23% 17% 22% 26% $273.9 20% 11% 16% 21% 32% 2Q23 3Q23 4Q23 1Q24 CRE C&I Equipment Finance RRE (1,4) 2Q24 SBA (2,3) 7.39% 7.80% 8.10% 8.02% 8.31% Loan Production • Commercial real estate loan production was $87.6 million and Commercial and industrial loan production was $59.0 million • Equipment finance production was $42.6 million for the second quarter and Residential mortgage (1,4) loan production was $30.2 million • SBA (2,3) loan production was $54.5 million for the second quarter Loan production of $274 million for 2Q24 reflected balanced contribution from nearly all business lines, and a 29 basis point increase in the weighted average interest rate on new production. Weighted average interest rate on new production (1) Residential mortgage includes $0.0, $0.0, $0.0, $0.3, and $0.0 million of consumer loans for 2Q23, 3Q23, 4Q23, 1Q24, and 2Q24, respectively (2) $30.9 million, $36.1 million, $48.4 million, $30.8 million, and $54.5 million of SBA loan production includes $19.4 million, $17.6 million, $20.2 million, $12.2 million, and $31.4 million of loans secured by CRE and the remainder representing C&I as of 2Q23, 3Q23, 4Q23, 1Q24, and 2Q24, respectively (3) Production includes purchases of guaranteed SBA loans of $9.7 million, $10.2 million, and $14.5 million for 4Q23, 1Q24, and 2Q24, respectively (4) Production includes purchased mortgage loans of $5.2 million for 2Q24. ($ in millions) 5

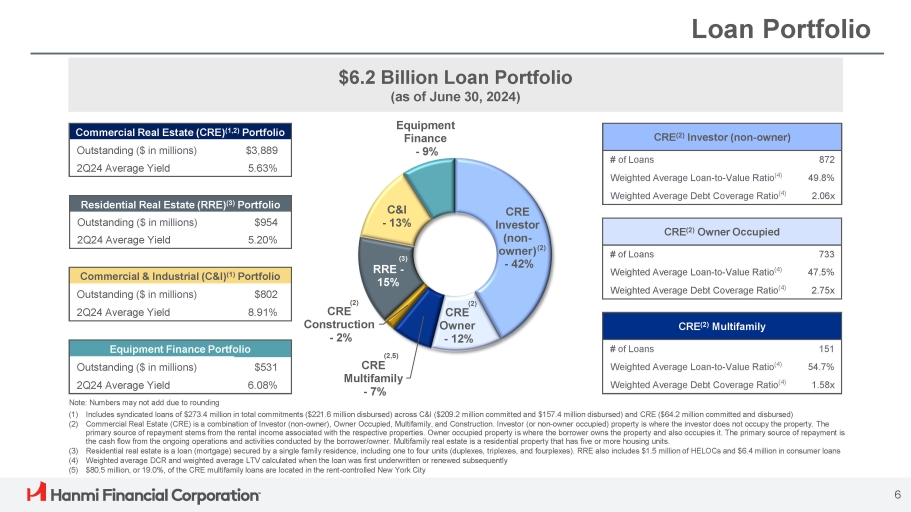

Loan Portfolio Commercial Real Estate (CRE) (1,2) Portfolio $3,889 Outstanding ($ in millions) 5.63% 2Q24 Average Yield $6.2 Billion Loan Portfolio (as of June 30, 2024) C&I - 13% 6 Equipment Finance - 9% CRE (2) Multifamily 151 # of Loans 54.7% Weighted Average Loan - to - Value Ratio (4) 1.58x Weighted Average Debt Coverage Ratio (4) CRE (2) Investor (non - owner) 872 # of Loans 49.8% Weighted Average Loan - to - Value Ratio (4) 2.06x Weighted Average Debt Coverage Ratio (4) CRE (2) Owner Occupied 733 # of Loans 47.5% Weighted Average Loan - to - Value Ratio (4) 2.75x Weighted Average Debt Coverage Ratio (4) Residential Real Estate (RRE) (3) Portfolio $954 Outstanding ($ in millions) 5.20% 2Q24 Average Yield Commercial & Industrial (C&I) (1) Portfolio $802 Outstanding ($ in millions) 8.91% 2Q24 Average Yield Equipment Finance Portfolio $531 Outstanding ($ in millions) 6.08% 2Q24 Average Yield Note: Numbers may not add due to rounding (1) Includes syndicated loans of $273.4 million in total commitments ($221.6 million disbursed) across C&I ($209.2 million committed and $157.4 million disbursed) and CRE ($64.2 million committed and disbursed) (2) Commercial Real Estate (CRE) is a combination of Investor (non - owner), Owner Occupied, Multifamily, and Construction. Investor (or non - owner occupied) property is where the investor does not occupy the property. The primary source of repayment stems from the rental income associated with the respective properties. Owner occupied property is where the borrower owns the property and also occupies it. The primary source of repayment is the cash flow from the ongoing operations and activities conducted by the borrower/owner. Multifamily real estate is a residential property that has five or more housing units. (3) Residential real estate is a loan (mortgage) secured by a single family residence, including one to four units (duplexes, triplexes, and fourplexes). RRE also includes $1.5 million of HELOCs and $6.4 million in consumer loans (4) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently (5) $80.5 million, or 19.0%, of the CRE multifamily loans are located in the rent - controlled New York City (2) CRE Construction - 2% (2,5) CRE Multifamily - 7% (2) CRE Owner - 12% CRE Investor (non - owner) (2) - 42% (3) RRE - 15%

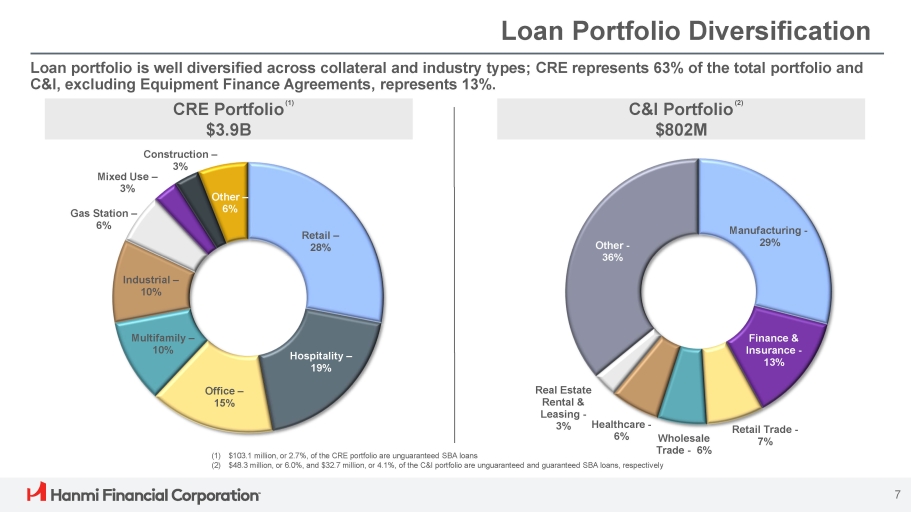

Loan Portfolio Diversification Loan portfolio is well diversified across collateral and industry types; CRE represents 63% of the total portfolio and C&I, excluding Equipment Finance Agreements, represents 13%. CRE Portfolio (1) $3.9B C&I Portfolio (2) $802M Retail – 28% Hospitality – 19% Office – 15% Multifamily – 10% Industrial – 10% Gas Station – 6% Construction – 3% Mixed Use – 3% Other – 6% Manufacturing - 29% 7 Finance & Insurance - 13% Retail Trade - 7% Wholesale Trade - 6% Healthcare - 6% Real Estate Rental & Leasing - 3% Other - 36% (1) $103.1 million, or 2.7%, of the CRE portfolio are unguaranteed SBA loans (2) $48.3 million, or 6.0%, and $32.7 million, or 4.1%, of the C&I portfolio are unguaranteed and guaranteed SBA loans, respectively

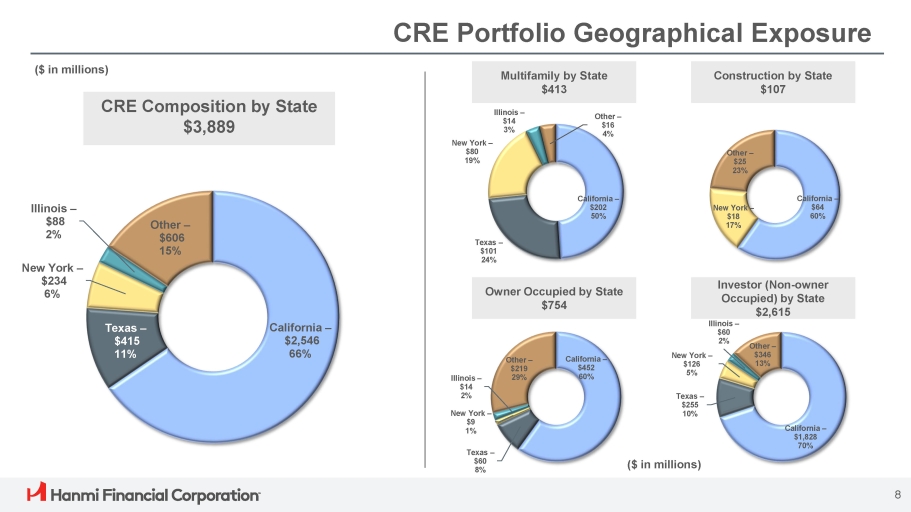

CRE Portfolio Geographical Exposure CRE Composition by State $3,889 Multifamily by State $413 Construction by State $107 Owner Occupied by State $754 Investor (Non - owner Occupied) by State $2,615 California – $2,546 66% Texas – $415 11% New York – $234 6% Illinois – $88 2% Other – $606 15% California – $202 50% Texas – $101 24% New York – $80 19% Illinois – $14 3% Other – $16 4% California – $64 60% New York – $18 17% Other – $25 23% Texas – $60 8% New York – $9 1% California – Other – $452 $219 60% 29% Illinois – $14 2% California – $1,828 70% 8 Texas – $255 10% Illinois – $60 2% New York – $126 5% Other – $346 13% ($ in millions) ($ in millions)

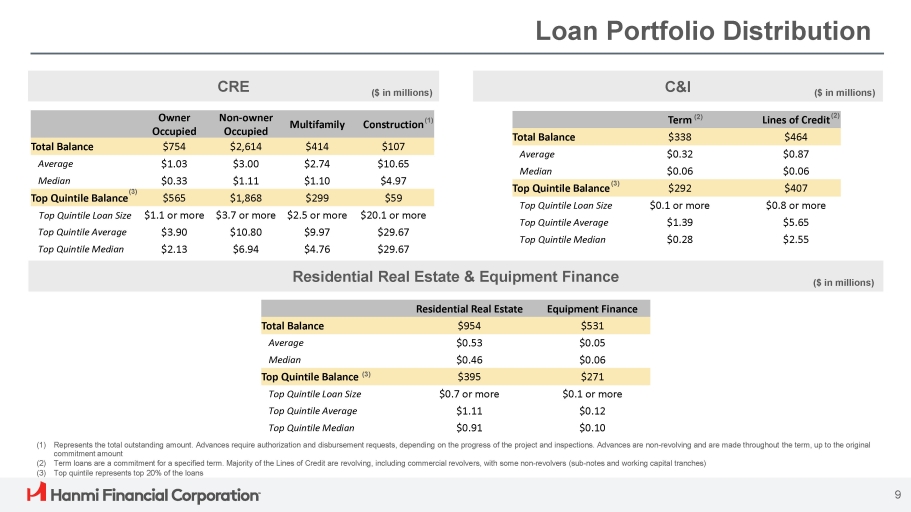

Loan Portfolio Distribution CRE C&I ($ in millions) ($ in millions) Construction (1) Multifamily Non - owner Occupied Owner Occupied $107 $414 $2,614 $754 Total Balance $10.65 $2.74 $3.00 $1.03 Average $4.97 $1.10 $1.11 $0.33 Median $59 $299 $1,868 $565 (3) Top Quintile Balance $20.1 or more $2.5 or more $3.7 or more $1.1 or more Top Quintile Loan Size $29.67 $9.97 $10.80 $3.90 Top Quintile Average $29.67 $4.76 $6.94 $2.13 Top Quintile Median Lines of Credit (2) Term (2) $464 $338 Total Balance $0.87 $0.32 Average $0.06 $0.06 Median $407 $292 Top Quintile Balance (3) $0.8 or more $0.1 or more Top Quintile Loan Size $5.65 $1.39 Top Quintile Average $2.55 $0.28 Top Quintile Median Residential Real Estate & Equipment Finance 9 Equipment Finance Residential Real Estate $531 $954 Total Balance $0.05 $0.53 Average $0.06 $0.46 Median $271 $395 Top Quintile Balance (3) $0.1 or more $0.7 or more Top Quintile Loan Size $0.12 $1.11 Top Quintile Average $0.10 $0.91 Top Quintile Median ($ in millions) (1) Represents the total outstanding amount. Advances require authorization and disbursement requests, depending on the progress of the project and inspections. Advances are non - revolving and are made throughout the term, up to the original commitment amount (2) Term loans are a commitment for a specified term. Majority of the Lines of Credit are revolving, including commercial revolvers, with some non - revolvers (sub - notes and working capital tranches) (3) Top quintile represents top 20% of the loans

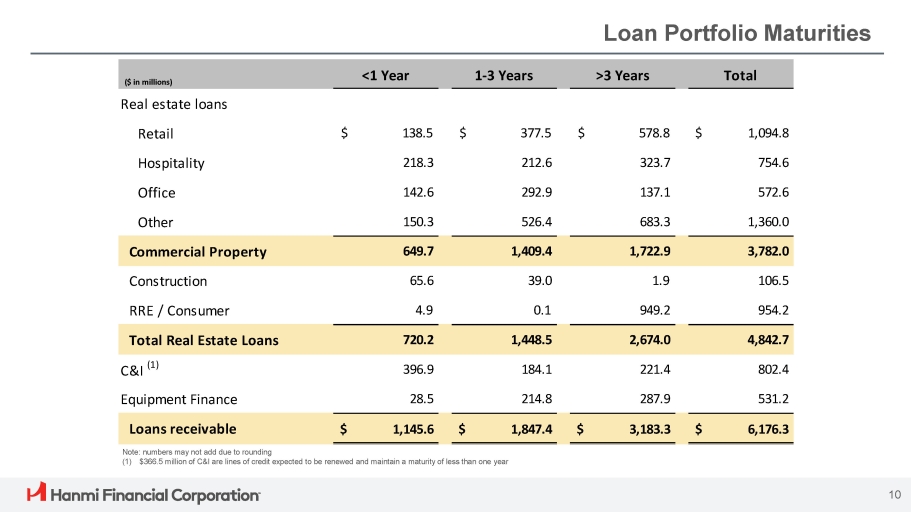

<1 Year 1 - 3 Years >3 Years Total Real estate loans $ 1,094.8 $ 578.8 $ 377.5 $ 138.5 Retail 754.6 323.7 212.6 218.3 Hospitality 572.6 137.1 292.9 142.6 Office 1,360.0 683.3 526.4 150.3 Other 3,782.0 1,722.9 1,409.4 649.7 Commercial Property 106.5 1.9 39.0 65.6 Construction 954.2 949.2 0.1 4.9 RRE / Consumer 4,842.7 2,674.0 1,448.5 720.2 Total Real Estate Loans 802.4 221.4 184.1 396.9 C&I (1) 531.2 287.9 214.8 28.5 Equipment Finance $ 6,176.3 $ 3,183.3 $ 1,847.4 $ 1,145.6 Loans receivable 10 Loan Portfolio Maturities ($ in millions) Note: numbers may not add due to rounding (1) $366.5 million of C&I are lines of credit expected to be renewed and maintain a maturity of less than one year

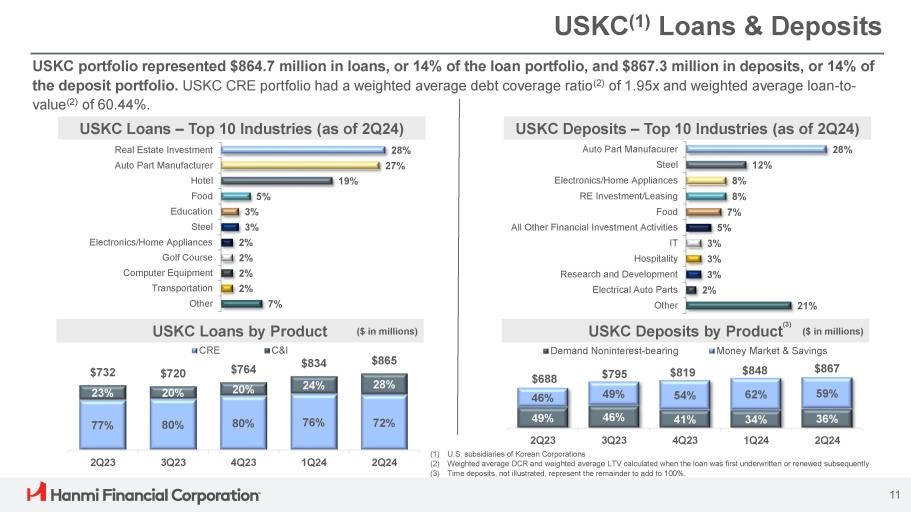

USKC (1) Loans & Deposits 28% 27% 19% 5% 3% 3% 2% 2% 2% 2% 7% Real Estate Investment Auto Part Manufacturer Hotel Food Education Steel Electronics/Home Appliances Golf Course Computer Equipment Transportation Other USKC portfolio represented $864.7 million in loans, or 14% of the loan portfolio, and $867.3 million in deposits, or 14% of the deposit portfolio. USKC CRE portfolio had a weighted average debt coverage ratio (2) of 1.95x and weighted average loan - to - value (2) of 60.44%. USKC Loans – Top 10 Industries (as of 2Q24) 72% 76% 80% 80% 77% 2Q24 1Q24 4Q23 3Q23 2Q23 USKC Loans by Product ($ in millions) $865 $834 C&I $764 CRE $720 $732 28% 24% 20% 20% 23% USKC Deposits – Top 10 Industries (as of 2Q24) 28% Auto Part Manufacurer 12% Steel 8% Electronics/Home Appliances 8% RE Investment/Leasing 7% Food 5% All Other Financial Investment Activities 3% IT 3% Hospitality 3% Research and Development 2% Electrical Auto Parts 21% Other $688 $795 $819 $848 $867 59% 62% 54% 49% 46% 36% 34% 41% 46% 49% 2Q24 1Q24 4Q23 3Q23 2Q23 Demand Noninterest - bearing Money Market & Savings USKC Deposits by Product 11 ($ in millions) (1) U.S. subsidiaries of Korean Corporations (2) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently (3) Time deposits, not illustrated, represent the remainder to add to 100%. (3)

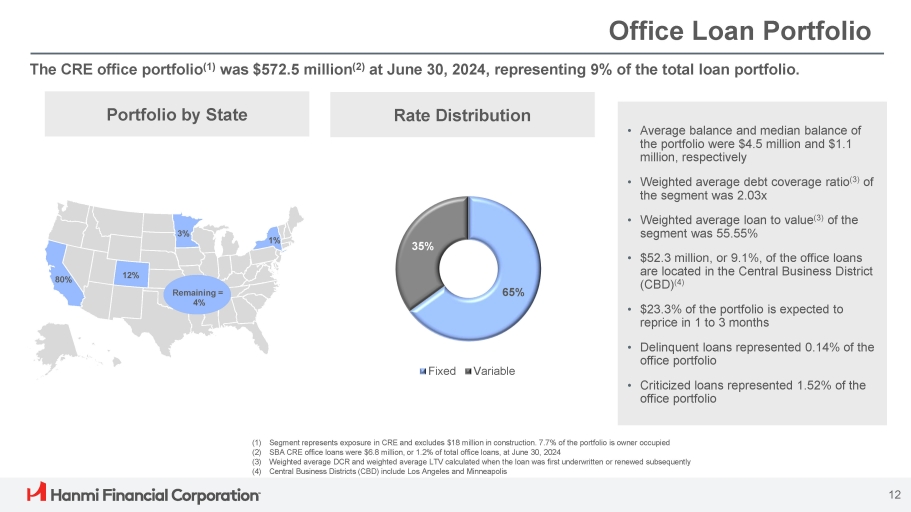

Office Loan Portfolio The CRE office portfolio (1) was $572.5 million (2) at June 30, 2024, representing 9% of the total loan portfolio. 80% 12% 3% Remaining = 4% 1% Portfolio by State • Average balance and median balance of the portfolio were $4.5 million and $1.1 million, respectively • Weighted average debt coverage ratio (3) of the segment was 2.03x • Weighted average loan to value (3) of the segment was 55.55% • $52.3 million, or 9.1%, of the office loans are located in the Central Business District (CBD) (4) • $23.3% of the portfolio is expected to reprice in 1 to 3 months • Delinquent loans represented 0.14% of the office portfolio • Criticized loans represented 1.52% of the office portfolio Rate Distribution (1) Segment represents exposure in CRE and excludes $18 million in construction. 7.7% of the portfolio is owner occupied (2) SBA CRE office loans were $6.8 million, or 1.2% of total office loans, at June 30, 2024 (3) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently (4) Central Business Districts (CBD) include Los Angeles and Minneapolis 65% 35% Fixed Variable 12

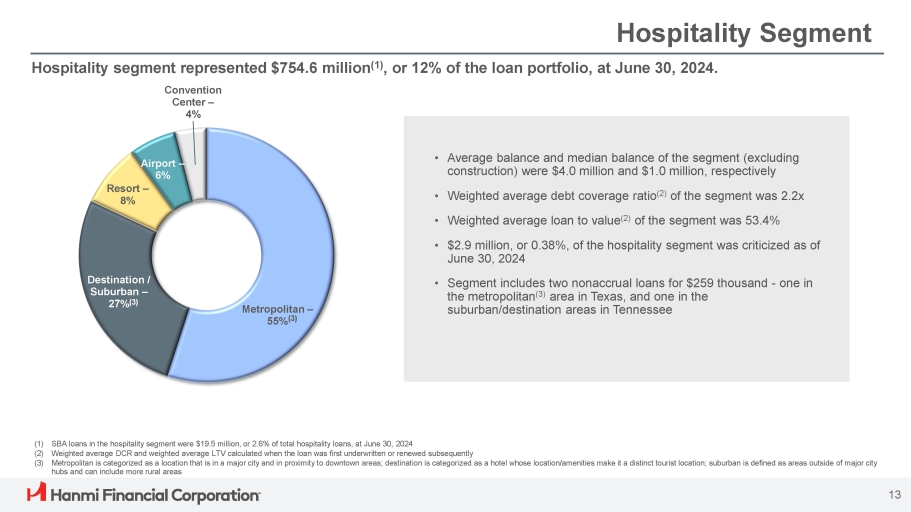

Airport – 6% Resort – 8% 13 Metropolitan – 55% (3) Destination / Suburban – 27% (3) Hospitality Segment Hospitality segment represented $754.6 million (1) , or 12% of the loan portfolio, at June 30, 2024. Convention Center – 4% (1) SBA loans in the hospitality segment were $19.5 million, or 2.6% of total hospitality loans, at June 30, 2024 (2) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently (3) Metropolitan is categorized as a location that is in a major city and in proximity to downtown areas; destination is categorized as a hotel whose location/amenities make it a distinct tourist location; suburban is defined as areas outside of major city hubs and can include more rural areas • Average balance and median balance of the segment (excluding construction) were $4.0 million and $1.0 million, respectively • Weighted average debt coverage ratio (2) of the segment was 2.2x • Weighted average loan to value (2) of the segment was 53.4% • $2.9 million, or 0.38%, of the hospitality segment was criticized as of June 30, 2024 • Segment includes two nonaccrual loans for $259 thousand - one in the metropolitan (3) area in Texas, and one in the suburban/destination areas in Tennessee

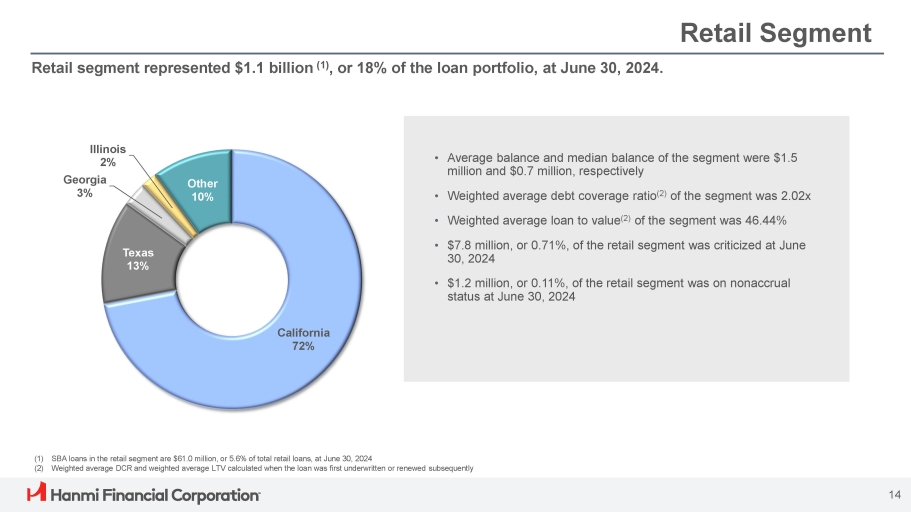

Retail Segment Retail segment represented $1.1 billion (1) , or 18% of the loan portfolio, at June 30, 2024. (1) SBA loans in the retail segment are $61.0 million, or 5.6% of total retail loans, at June 30, 2024 (2) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently • Average balance and median balance of the segment were $1.5 million and $0.7 million, respectively • Weighted average debt coverage ratio (2) of the segment was 2.02x • Weighted average loan to value (2) of the segment was 46.44% • $7.8 million, or 0.71%, of the retail segment was criticized at June 30, 2024 • $1.2 million, or 0.11%, of the retail segment was on nonaccrual status at June 30, 2024 California 72% 14 Texas 13% Illinois 2% Georgia 3% Other 10%

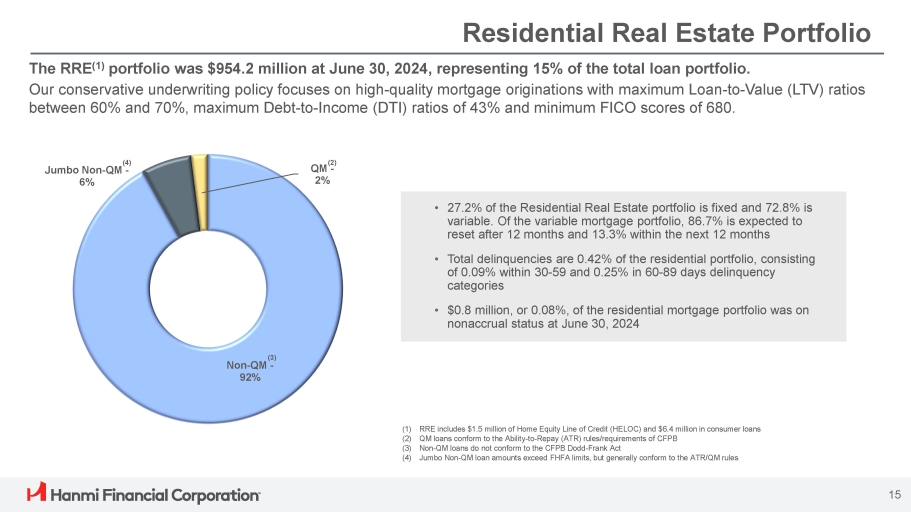

Residential Real Estate Portfolio QM - 2% 15 The RRE (1) portfolio was $954.2 million at June 30, 2024, representing 15% of the total loan portfolio. Our conservative underwriting policy focuses on high - quality mortgage originations with maximum Loan - to - Value (LTV) ratios between 60% and 70%, maximum Debt - to - Income (DTI) ratios of 43% and minimum FICO scores of 680. (1) RRE includes $1.5 million of Home Equity Line of Credit (HELOC) and $6.4 million in consumer loans (2) QM loans conform to the Ability - to - Repay (ATR) rules/requirements of CFPB (3) Non - QM loans do not conform to the CFPB Dodd - Frank Act (4) Jumbo Non - QM loan amounts exceed FHFA limits, but generally conform to the ATR/QM rules • 27.2% of the Residential Real Estate portfolio is fixed and 72.8% is variable. Of the variable mortgage portfolio, 86.7% is expected to reset after 12 months and 13.3% within the next 12 months • Total delinquencies are 0.42% of the residential portfolio, consisting of 0.09% within 30 - 59 and 0.25% in 60 - 89 days delinquency categories • $0.8 million, or 0.08%, of the residential mortgage portfolio was on nonaccrual status at June 30, 2024 (2) (3) Non - QM - 92% (4) Jumbo Non - QM - 6%

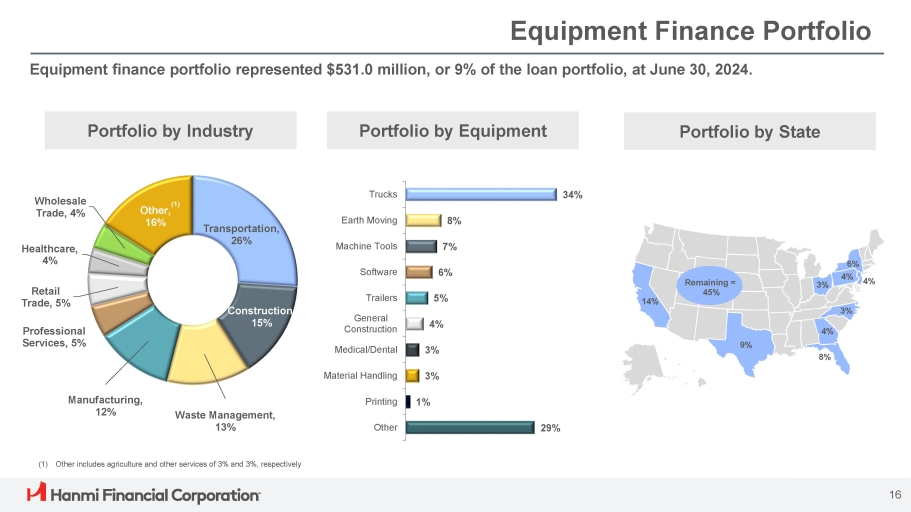

Equipment Finance Portfolio Equipment finance portfolio represented $531.0 million, or 9% of the loan portfolio, at June 30, 2024. Transportation, 26% Construction, 15% Waste Management, 13% Manufacturing, 12% Professional Services, 5% Retail Trade, 5% Healthcare, 4% Wholesale Trade, 4% Other, 16% 34% 8% 7% 6% 5% 4% 3% 3% 1% 29% Trucks Earth Moving Machine Tools Software Trailers General Construction Medical/Dental Material Handling Printing Other Portfolio by Industry Portfolio by Equipment Portfolio by State 14% 16 9% 4% 8% 6% 4% 3% 3% Remaining = 45% 4% (1) Other includes agriculture and other services of 3% and 3%, respectively (1)

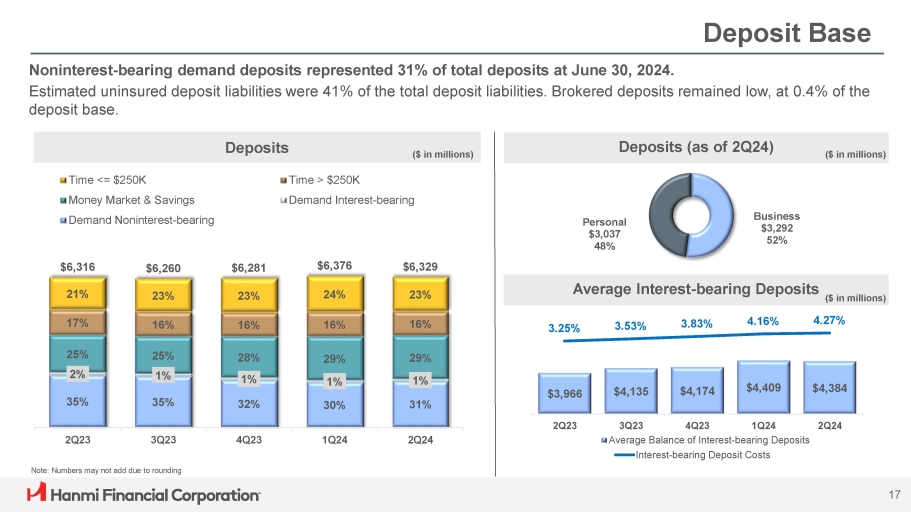

3.25% 3.53% 3.83% 4.16% 4.27% $3,966 $4,135 $4,174 $4,409 $4,384 3Q23 4Q23 1Q24 Average Balance of Interest - bearing Deposits Interest - bearing Deposit Costs 2Q23 2Q24 Deposit Base Noninterest - bearing demand deposits represented 31% of total deposits at June 30, 2024. Estimated uninsured deposit liabilities were 41% of the total deposit liabilities. Brokered deposits remained low, at 0.4% of the deposit base. Note: Numbers may not add due to rounding Deposits ($ in millions) Deposits (as of 2Q24) Average Interest - bearing Deposits ($ in millions) Business $3,292 52% Personal $3,037 48% ($ in millions) 32% 30% 31% 1% 1% 1% 25% 25% 1% 2% 35% 35% 28% 29% 29% $6,329 $6,376 $6,281 $6,260 $6,316 23% 24% 23% 23% 21% 16% 16% 16% 16% 17% 2Q23 3Q23 4Q23 1Q24 2Q24 Time <= $250K Money Market & Savings Demand Noninterest - bearing Time > $250K Demand Interest - bearing 17

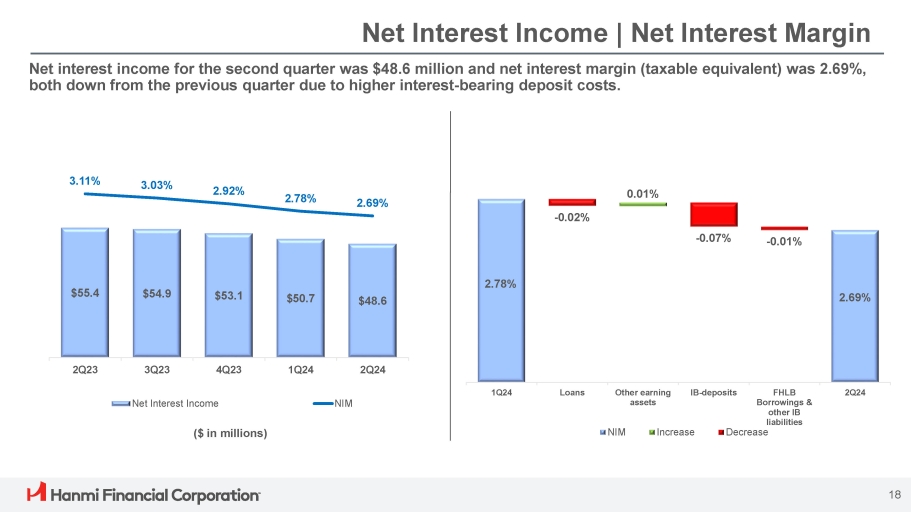

Net Interest Income | Net Interest Margin Net interest income for the second quarter was $48.6 million and net interest margin (taxable equivalent) was 2.69%, both down from the previous quarter due to higher interest - bearing deposit costs. ($ in millions) 2.78% - 0.02% 0.01% - 0.07% - 0.01% 2.69% 1Q24 Loans Other earning assets IB - deposits FHLB Borrowings & other IB liabilities Decrease 2Q24 NIM Increase $55.4 $54.9 $53.1 $50.7 $48.6 3.11% 3.03% 2.92% 2.78% 2.69% 2Q23 3Q23 4Q23 1Q24 2Q24 Net Interest Income NIM 18

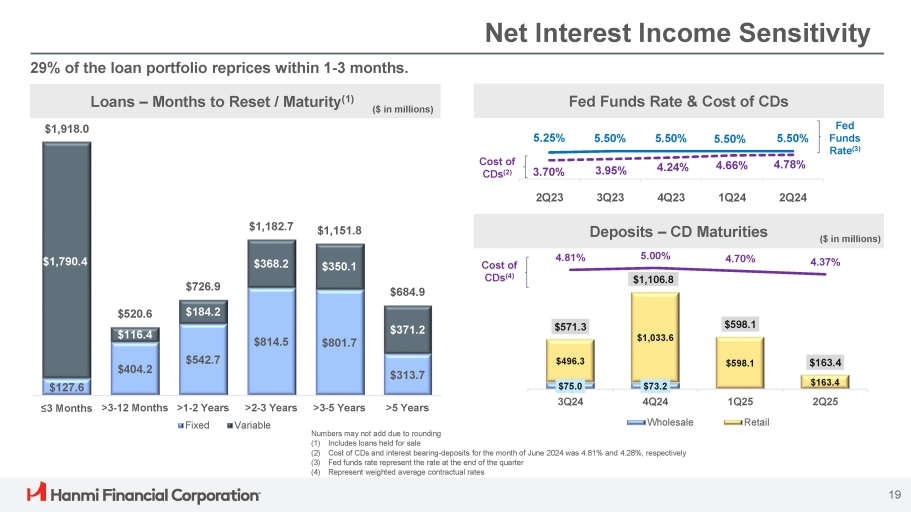

Deposits – CD Maturities Net Interest Income Sensitivity 29% of the loan portfolio reprices within 1 - 3 months. $127.6 $404.2 $542.7 $814.5 $801.7 $1,790.4 $184.2 $368.2 $350.1 $371.2 $520.6 $116.4 $1,918.0 $726.9 $1,182.7 $1,151.8 $684.9 $313.7 >3 - 5 Years >5 Years ≤3 Months >3 - 12 Months >1 - 2 Years Fixed >2 - 3 Years Variable Loans – Months to Reset / Maturity (1) ( . $ in millions) Fed Funds Rate & Cost of CDs $75.0 $73.2 $496.3 $1,033.6 $598.1 $163.4 $571.3 $1,106.8 $598.1 $163.4 4.81% 5.00% 4.70% 4.37% 3Q24 2Q25 4Q24 Wholesale 1Q25 Retail ($ in millions) Fed Funds Rate (3) 5.50% 5.50% 5.50% 5.50% 5.25% 4.78% 2Q24 4.66% 1Q24 4.24% 4Q23 3.95% 3Q23 Cost of CDs (2) 3.70% 2Q23 Cost of CDs (4) Numbers may not add due to rounding (1) Includes loans held for sale (2) Cost of CDs and interest bearing - deposits for the month of June 2024 was 4.81% and 4.28%, respectively (3) Fed funds rate represent the rate at the end of the quarter (4) Represent weighted average contractual rates 19

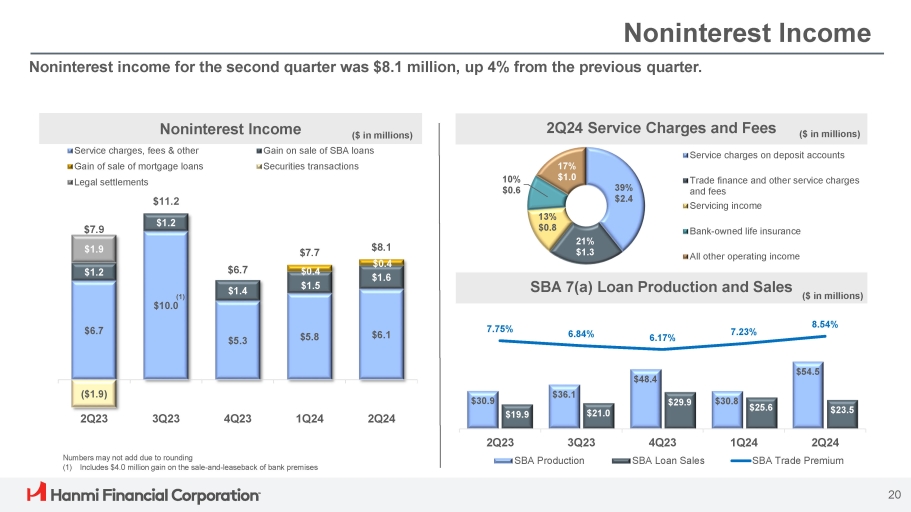

39% $2.4 21% $1.3 13% $0.8 10% $0.6 17% $1.0 Service charges on deposit accounts Trade finance and other service charges and fees Servicing income Bank - owned life insurance All other operating income Noninterest Income SBA 7(a) Loan Production and Sales ($ in millions) $30.9 $36.1 $48.4 $30.8 $54.5 $19.9 $21.0 $29.9 $25.6 $23.5 7.75% 6.84% 6.17% 7.23% 8.54% 2Q23 3Q23 4Q23 SBA Loan Sales SBA Production 1Q24 2Q24 SBA Trade Premium Noninterest income for the second quarter was $8.1 million, up 4% from the previous quarter. Noninterest Income 2Q24 Service Charges and Fees ($ in millions) ($ in millions) $6.7 $5.3 $5.8 $6.1 $1.2 $1.2 $1.4 ($1.9) $7.9 $1.9 $6.7 $7.7 $0.4 $1.5 $8.1 $0.4 $1.6 2Q23 3Q23 4Q23 1Q24 2Q24 (1) $10.0 Gain on sale of SBA loans Securities transactions Service charges, fees & other Gain of sale of mortgage loans Legal settlements $11.2 Numbers may not add due to rounding (1) Includes $4.0 million gain on the sale - and - leaseback of bank premises 20

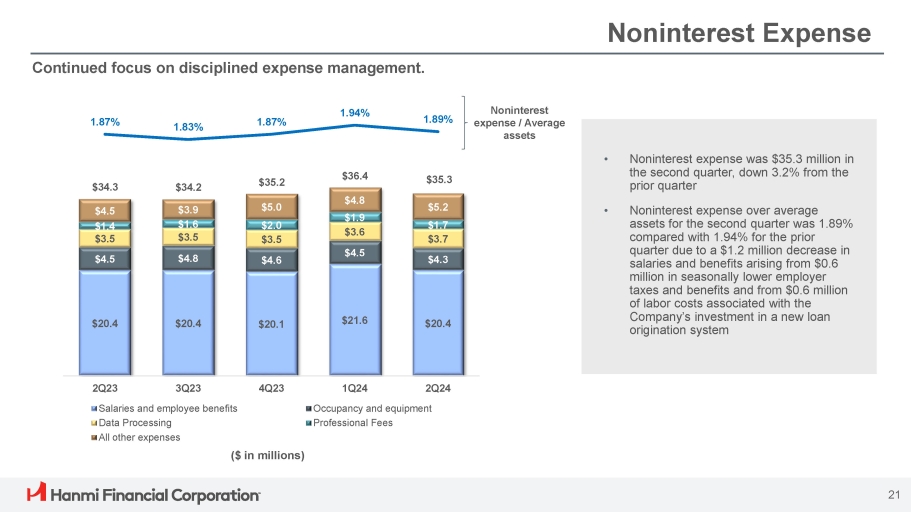

Noninterest Expense Continued focus on disciplined expense management. 1.83% Noninterest expense / Average assets 1.94% 1.89% 1.87% 1.87% Noninterest expense was $35.3 million in the second quarter, down 3.2% from the prior quarter • $35.3 $36.4 $35.2 $34.2 $34.3 Noninterest expense over average assets for the second quarter was 1.89% compared with 1.94% for the prior quarter due to a $1.2 million decrease in salaries and benefits arising from $0.6 million in seasonally lower employer taxes and benefits and from $0.6 million of labor costs associated with the Company’s investment in a new loan origination system • $5.2 $1.7 $3.7 $4.3 $20.4 $4.8 $1.9 $3.6 $4.5 $21.6 $5.0 $2.0 $3.5 $4.6 $20.1 $3.9 $1.6 $3.5 $4.8 $20.4 $4.5 $1.4 $3.5 $4.5 $20.4 1Q24 2Q24 Occupancy and equipment Professional Fees 2Q23 3Q23 4Q23 Salaries and employee benefits Data Processing All other expenses ($ in millions) 21

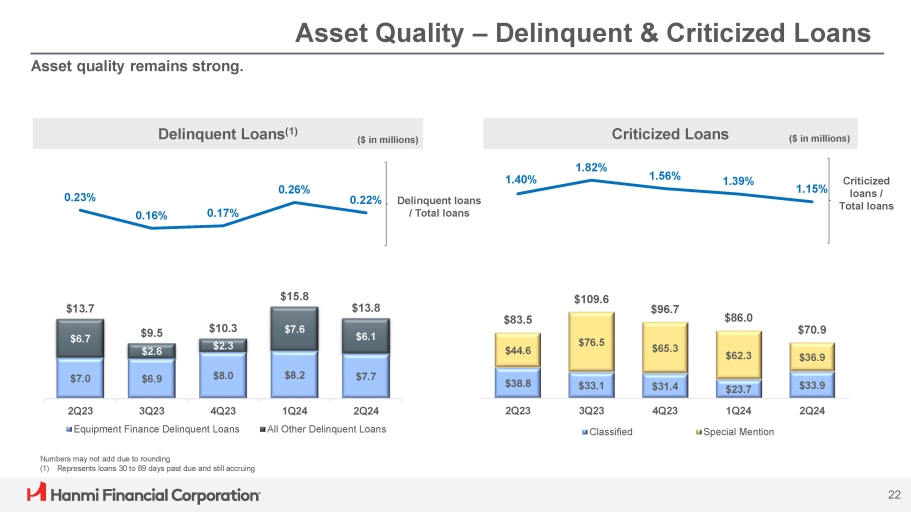

Asset Quality – Delinquent & Criticized Loans Delinquent loans / Total loans $38.8 $33.1 $31.4 $23.7 $33.9 $44.6 $76.5 $65.3 $62.3 $36.9 $83.5 $109.6 $96.7 $86.0 $70.9 1.40% 1.82% 1.56% 1.39% 1.15% 2Q23 3Q23 4Q23 1Q24 2Q24 Classified Special Mention Delinquent Loans (1) Criticized Loans Criticized loans / Total loans Asset quality remains strong. $7.0 $6.9 $8.0 $8.2 $7.7 $6.7 $7.6 $6.1 $13.7 $9.5 $2.6 $10.3 $2.3 $15.8 $13.8 0.23% 0.16% 0.17% 0.26% 0.22% 2Q23 3Q23 4Q23 Equipment Finance Delinquent Loans 1Q24 2Q24 All Other Delinquent Loans ($ in millions) 22 ($ in millions) Numbers may not add due to rounding (1) Represents loans 30 to 89 days past due and still accruing

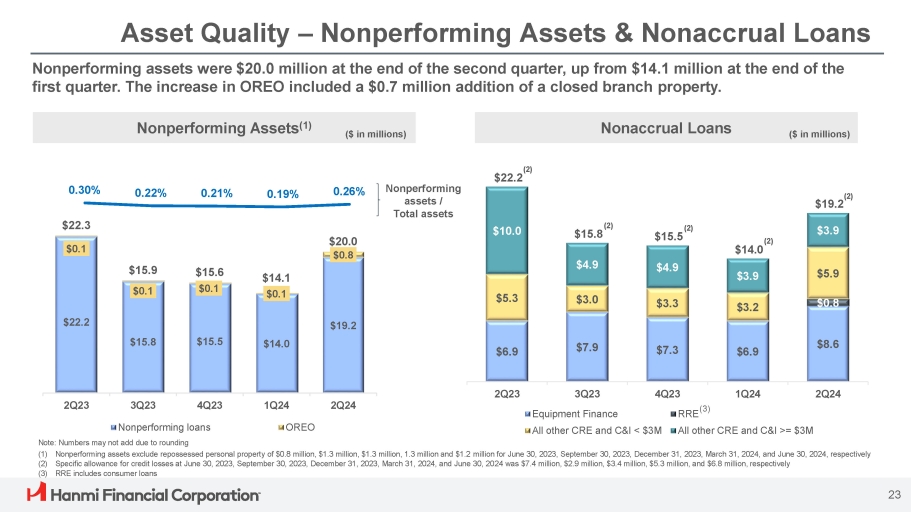

$22.2 $15.8 $15.5 $14.0 $19.2 $0.1 $0.1 $0.1 $0.1 $0.8 $22.3 $15.9 $15.6 $14.1 $20.0 1Q24 2Q24 2Q23 3Q23 4Q23 Nonperforming loans Note: Numbers may not add due to rounding OREO Asset Quality – Nonperforming Assets & Nonaccrual Loans 0.30% 0.22% 0.21% 0.19% 0.26% Nonperforming assets / Total assets Nonperforming Assets (1) Nonaccrual Loans Nonperforming assets were $20.0 million at the end of the second quarter, up from $14.1 million at the end of the first quarter. The increase in OREO included a $0.7 million addition of a closed branch property. ($ in millions) ($ in millions) (1) Nonperforming assets exclude repossessed personal property of $0.8 million, $1.3 million, $1.3 million, 1.3 million and $1.2 million for June 30, 2023, September 30, 2023, December 31, 2023, March 31, 2024, and June 30, 2024, respectively (2) Specific allowance for credit losses at June 30, 2023, September 30, 2023, December 31, 2023, March 31, 2024, and June 30, 2024 was $7.4 million, $2.9 million, $3.4 million, $5.3 million, and $6.8 million, respectively (3) RRE includes consumer loans $0.8 $5.3 $3.0 $3.3 $3.2 $5.9 $10.0 $4.9 $4.9 $3.9 $3.9 $22.2 $15.5 $14.0 $19.2 $8.6 $6.9 $7.3 $7.9 $6.9 2Q24 1Q24 4Q23 3Q23 2Q23 Equipment Finance All other CRE and C&I < $3M RRE (3) All other CRE and C&I >= $3M 23 (2) (2) (2) (2) $15.8 (2)

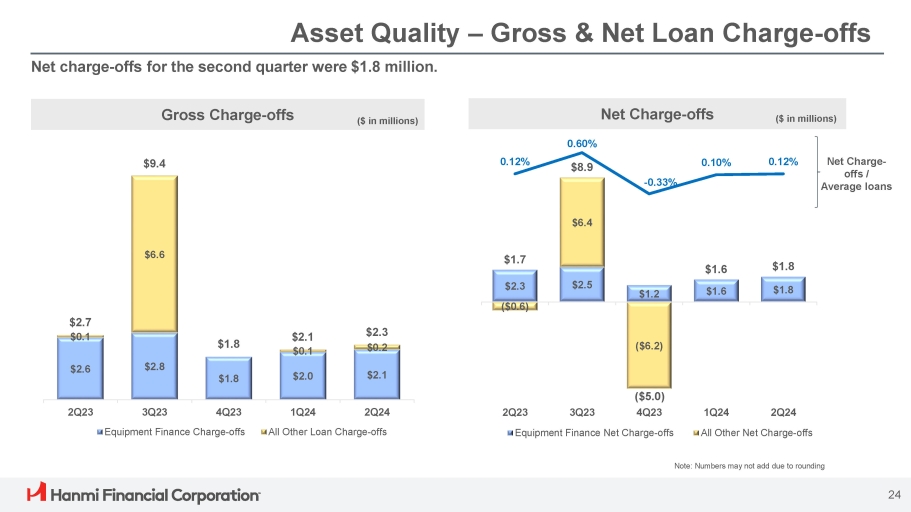

Asset Quality – Gross & Net Loan Charge - offs Gross Charge - offs Net Charge - offs Net Charge - offs / Average loans Net charge - offs for the second quarter were $1.8 million. ($ in millions) ($ in millions) $2.6 $2.8 $1.8 $2.0 $2.1 $6.6 $2.7 $0.1 $9.4 $1.8 $2.1 $0.1 $2.3 $0.2 2Q23 3Q23 4Q23 Equipment Finance Charge - offs 1Q24 2Q24 All Other Loan Charge - offs Note: Numbers may not add due to rounding $2.5 $1.2 $1.6 $1.8 $2.3 ($0.6) $6.4 ($6.2) $1.7 $8.9 $1.6 $1.8 0.12% 0.60% - 0.33% 0.10% 0.12% ($5.0) 4Q23 2Q23 3Q23 1Q24 2Q24 All Other Net Charge - offs Equipment Finance Net Charge - offs 24

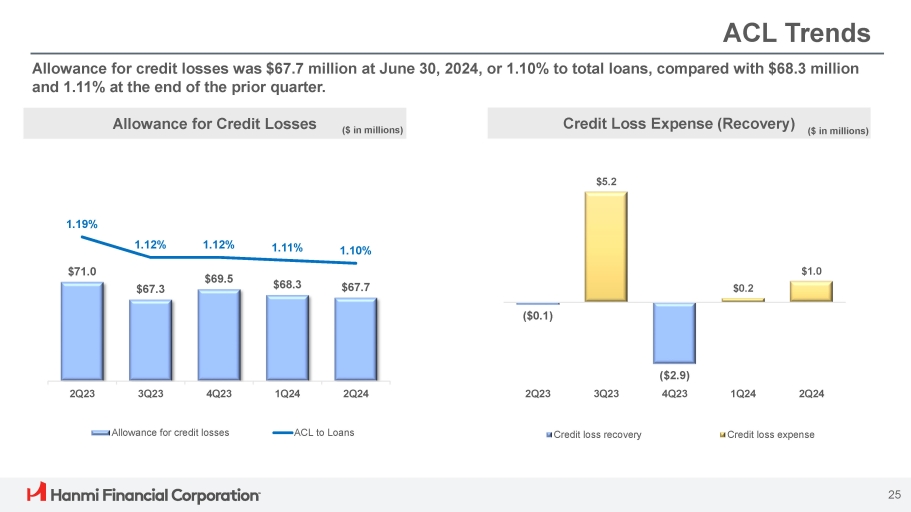

ACL Trends Allowance for credit losses was $67.7 million at June 30, 2024, or 1.10% to total loans, compared with $68.3 million and 1.11% at the end of the prior quarter. $71.0 $67.3 $69.5 $68.3 $67.7 1.19% 1.12% 1.12% 1.11% 1.10% 2Q23 3Q23 4Q23 1Q24 2Q24 Allowance for credit losses ACL to Loans ($0.1) $5.2 $0.2 $1.0 ($2.9) 4Q23 2Q23 3Q23 1Q24 2Q24 Credit loss recovery Credit loss expense Allowance for Credit Losses Credit Loss Expense (Recovery) 25 ($ in millions) ($ in millions)

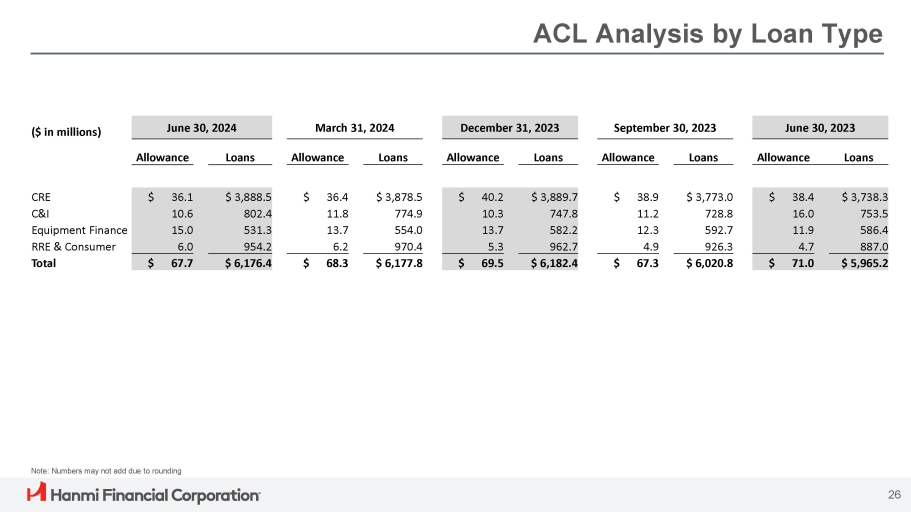

ACL Analysis by Loan Type June 30, 2023 September 30, 2023 December 31, 2023 March 31, 2024 June 30, 2024 ($ in millions) Loans Allowance Loans Allowance Loans Allowance Loans Allowance Loans Allowance $ 3,738.3 $ 38.4 $ 3,773.0 $ 38.9 $ 3,889.7 $ 40.2 $ 3,878.5 $ 36.4 $ 3,888.5 $ 36.1 CRE 753.5 16.0 728.8 11.2 747.8 10.3 774.9 11.8 802.4 10.6 C&I 586.4 11.9 592.7 12.3 582.2 13.7 554.0 13.7 531.3 15.0 Equipment Finance 887.0 4.7 926.3 4.9 962.7 5.3 970.4 6.2 954.2 6.0 RRE & Consumer $ 5,965.2 $ 71.0 $ 6,020.8 $ 67.3 $ 6,182.4 $ 69.5 $ 6,177.8 $ 68.3 $ 6,176.4 $ 67.7 Total Note: Numbers may not add due to rounding 26

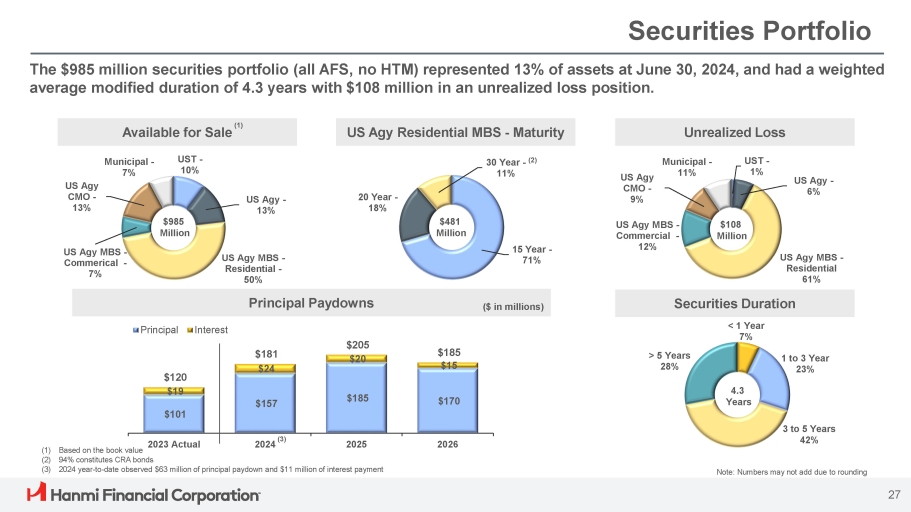

US Agy Residential MBS - Maturity 15 Year - 71% 20 Year - 18% Securities Portfolio The $985 million securities portfolio (all AFS, no HTM) represented 13% of assets at June 30, 2024, and had a weighted average modified duration of 4.3 years with $108 million in an unrealized loss position. Principal Paydowns ($ in millions) $101 $157 $185 $170 $120 $19 $181 $24 $205 $20 $185 $15 2025 2026 Principal Interest Unrealized Loss UST - 1% US Agy - 6% US Agy MBS - Residential 61% US Agy MBS - Commercial - 12% US Agy CMO - 9% Municipal - 11% Available for Sale UST - 10% US Agy - 13% US Agy MBS - Residential - 50% US Agy MBS - Commerical - 7% US Agy CMO - 13 % Municipal - 7% $985 Million Securities Duration < 1 Year 7% 1 to 3 Year 23% 3 to 5 Years 42% > 5 Years 28% 4.3 Years $481 Million 30 Year - (2) 11% $108 Million (1) Based on the book value 2023 Actual (3) 2024 year - to - date observed $63 million of principal paydown and $11 million of interest payment Note: Numbers may not add due to rounding 27 (2) 94% constitutes CRA bonds 2024 (3) (1)

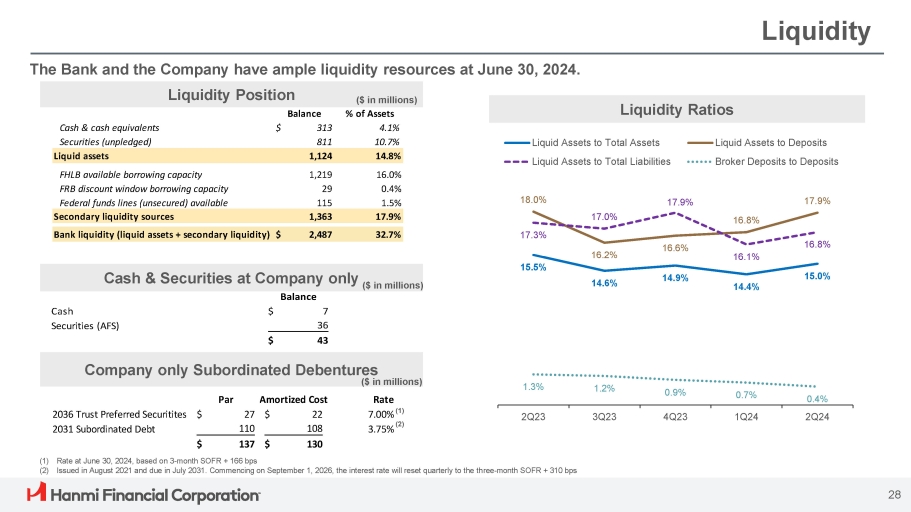

16.0% 1,219 FHLB available borrowing capacity 0.4% 29 FRB discount window borrowing capacity 1.5% 115 Federal funds lines (unsecured) available 17.9% 1,363 Secondary liquidity sources 4.1% $ 313 Cash & cash equivalents Liquid Assets to Deposits Liquid Assets to Total Assets 10.7% 811 Securities (unpledged) Broker Deposits to Deposits Liquid Assets to Total Liabilities 14.8% 1,124 Liquid assets Balance % of Assets Bank liquidity (liquid assets + secondary liquidity) $ 2,487 32.7% Liquidity The Bank and the Company have ample liquidity resources at June 30, 2024. (1) Rate at June 30, 2024, based on 3 - month SOFR + 166 bps (2) Issued in August 2021 and due in July 2031. Commencing on September 1, 2026, the interest rate will reset quarterly to the three - month SOFR + 310 bps Liquidity Position ($ in millions) 15.5% 14.6% 14.9% 14.4% 15.0% 18.0% 16.2% 16.6% 16.8% 17.9% 17.3% 17.0% 17.9% 16.1% 16.8% 1.3% 1.2% 0.9% 0.7% 0.4% 2Q23 3Q23 4Q23 1Q24 2Q24 Liquidity Ratios 28 Par Amortized Cost 2036 Trust Preferred Securitites $ 27 $ 22 Rate 7.00% (1) (2) 3.75% 108 110 2031 Subordinated Debt $ 130 $ 137 Company only Subordinated Debentures ($ in millions) Cash & Securities at Company only ($ in millions) Balance Cash $ 7 Securities (AFS) 36 $ 43

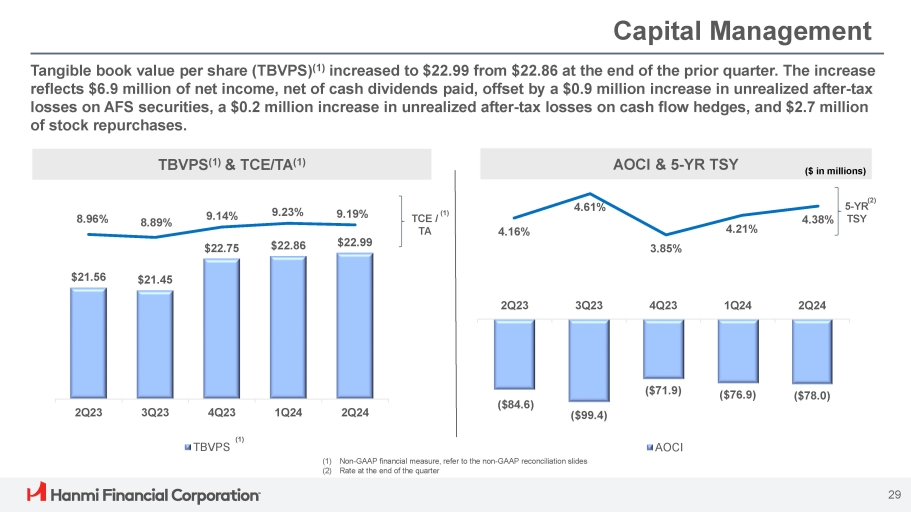

(1) Non - GAAP financial measure, refer to the non - GAAP reconciliation slides (2) Rate at the end of the quarter Capital Management Tangible book value per share (TBVPS) (1) increased to $22.99 from $22.86 at the end of the prior quarter. The increase reflects $6.9 million of net income, net of cash dividends paid, offset by a $0.9 million increase in unrealized after - tax losses on AFS securities, a $0.2 million increase in unrealized after - tax losses on cash flow hedges, and $2.7 million of stock repurchases. 4.16% 4.61% 3.85% 4.21% 4.38% ($84.6) ($99.4) ($71.9) ($76.9) ($78.0) 2Q23 3Q23 4Q23 1Q24 2Q24 AOCI $21.56 $21.45 $22.75 $22.86 $22.99 8.96% 8.89% 9.14% 9.23% 9.19% 2Q23 3Q23 4Q23 1Q24 2Q24 (1) TBVPS TBVPS (1) & TCE/TA (1) AOCI & 5 - YR TSY 5 - YR TSY (2) TCE / TA ($ in millions) (1) 29

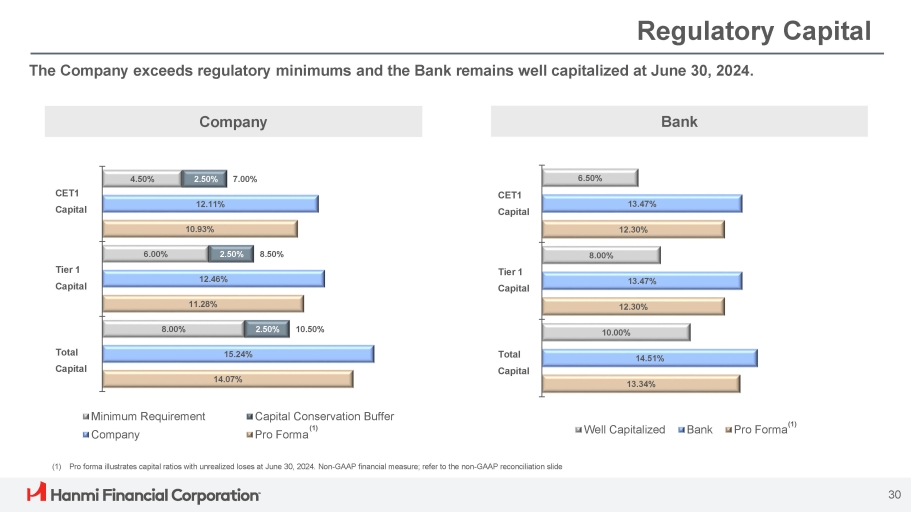

Regulatory Capital The Company exceeds regulatory minimums and the Bank remains well capitalized at June 30, 2024. 8.00% 6.00% 4.50% 2.50% 2.50% 2.50% 15.24% 12.46% 12.11% 14.07% 11.28% 10.93% 10.50% 8.50% 7.00% Minimum Requirement Capital Conservation Buffer Company Pro Forma 10.00% 8.00% 6.50% 14.51% 13.47% 13.47% 13.34% 12.30% 12.30% Well Capitalized Bank Pro Forma (1) 30 CET1 Capital Tier 1 Capital Total Capital Company Bank CET1 Capital Tier 1 Capital Total Capital (1) Pro forma illustrates capital ratios with unrealized loses at June 30, 2024. Non - GAAP financial measure; refer to the non - GAAP reconciliation slide (1)

Appendix 31

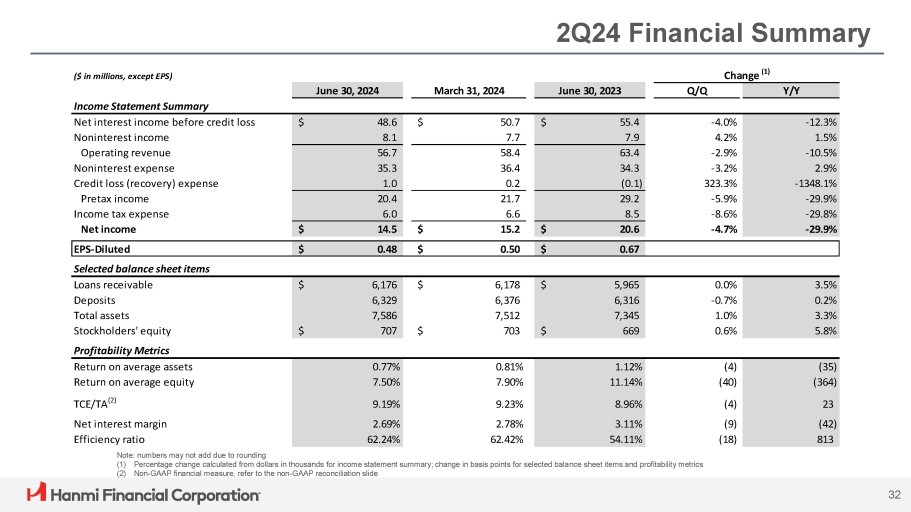

2Q24 Financial Summary Note: numbers may not add due to rounding (1) Percentage change calculated from dollars in thousands for income statement summary; change in basis points for selected balance sheet items and profitability metrics (2) Non - GAAP financial measure, refer to the non - GAAP reconciliation slide $ 0.67 $ 0.50 $ 0.48 EPS - Diluted ($ in millions, except EPS) Change (1) June 30, 2024 March 31, 2024 June 30, 2023 Q/Q Y/Y Income Statement Summary - 12.3% - 4.0% $ 55.4 $ 50.7 $ 48.6 Net interest income before credit loss 1.5% 4.2% 7.9 7.7 8.1 Noninterest income - 10.5% - 2.9% 63.4 58.4 56.7 Operating revenue 2.9% - 3.2% 34.3 36.4 35.3 Noninterest expense - 1348.1% 323.3% (0.1) 0.2 1.0 Credit loss (recovery) expense - 29.9% - 5.9% 29.2 21.7 20.4 Pretax income - 29.8% - 8.6% 8.5 6.6 6.0 Income tax expense - 29.9% - 4.7% $ 20.6 $ 15.2 $ 14.5 Net income Selected balance sheet items 3.5% 0.0% $ 5,965 $ 6,178 $ 6,176 Loans receivable 0.2% - 0.7% 6,316 6,376 6,329 Deposits 3.3% 1.0% 7,345 7,512 7,586 Total assets 5.8% 0.6% $ 669 $ 703 $ 707 Stockholders' equity Profitability Metrics (35) (4) 1.12% 0.81% 0.77% Return on average assets (364) (40) 11.14% 7.90% 7.50% Return on average equity 23 (4) 8.96% 9.23% 9.19% TCE/TA (2) (42) (9) 3.11% 2.78% 2.69% Net interest margin 813 (18) 54.11% 62.42% 62.24% Efficiency ratio 32

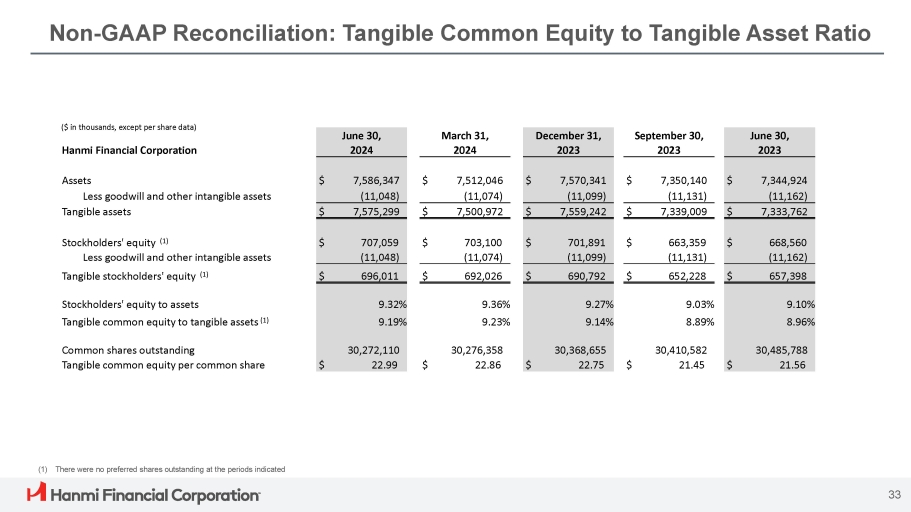

Non - GAAP Reconciliation: Tangible Common Equity to Tangible Asset Ratio 33 (1) There were no preferred shares outstanding at the periods indicated June 30, September 30, December 31, March 31, June 30, 2023 2023 2023 2024 2024 Hanmi Financial Corporation $ 7,344,924 $ 7,350,140 $ 7,570,341 $ 7,512,046 $ 7,586,347 Assets (11,162) (11,131) (11,099) (11,074) (11,048) Less goodwill and other intangible assets $ 7,333,762 $ 7,339,009 $ 7,559,242 $ 7,500,972 $ 7,575,299 Tangible assets $ 668,560 $ 663,359 $ 701,891 $ 703,100 $ 707,059 Stockholders' equity (1) (11,162) (11,131) (11,099) (11,074) (11,048) Less goodwill and other intangible assets $ 657,398 $ 652,228 $ 690,792 $ 692,026 $ 696,011 Tangible stockholders' equity (1) 9.10% 9.03% 9.27% 9.36% 9.32% Stockholders' equity to assets 8.96% 8.89% 9.14% 9.23% 9.19% Tangible common equity to tangible assets (1) 30,485,788 30,410,582 30,368,655 30,276,358 30,272,110 Common shares outstanding $ 21.56 $ 21.45 $ 22.75 $ 22.86 $ 22.99 Tangible common equity per common share ($ in thousands, except per share data)

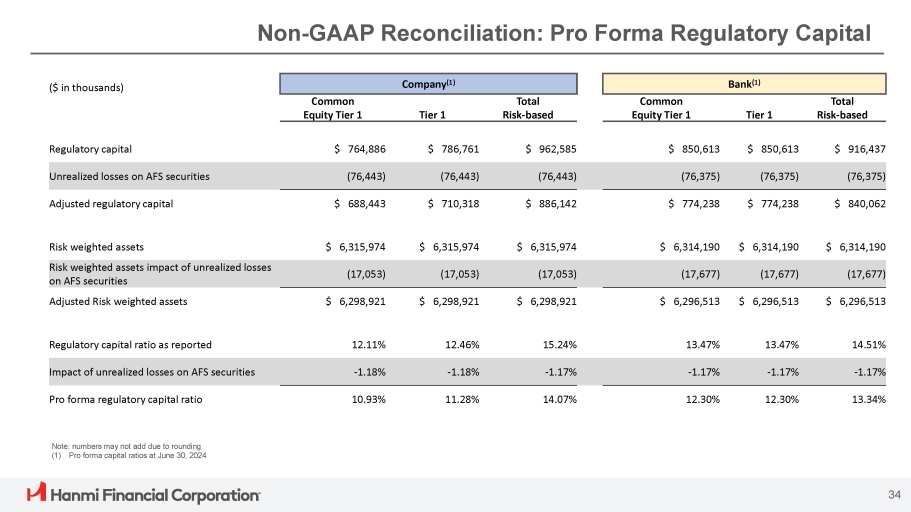

Non - GAAP Reconciliation: Pro Forma Regulatory Capital 34 Bank (1) Company (1) ($ in thousands) Total Risk - based Tier 1 Common Equity Tier 1 Total Risk - based Tier 1 Common Equity Tier 1 $ 916,437 $ 850,613 $ 850,613 $ 962,585 $ 786,761 $ 764,886 Regulatory capital (76,375) (76,375) (76,375) (76,443) (76,443) (76,443) Unrealized losses on AFS securities $ 840,062 $ 774,238 $ 774,238 $ 886,142 $ 710,318 $ 688,443 Adjusted regulatory capital $ 6,314,190 $ 6,314,190 $ 6,314,190 $ 6,315,974 $ 6,315,974 $ 6,315,974 Risk weighted assets (17,677) (17,677) (17,677) (17,053) (17,053) (17,053) Risk weighted assets impact of unrealized losses on AFS securities $ 6,296,513 $ 6,296,513 $ 6,296,513 $ 6,298,921 $ 6,298,921 $ 6,298,921 Adjusted Risk weighted assets 14.51% 13.47% 13.47% 15.24% 12.46% 12.11% Regulatory capital ratio as reported - 1.17% - 1.17% - 1.17% - 1.17% - 1.18% - 1.18% Impact of unrealized losses on AFS securities 13.34% 12.30% 12.30% 14.07% 11.28% 10.93% Pro forma regulatory capital ratio Note: numbers may not add due to rounding (1) Pro forma capital ratios at June 30, 2024