Exhibit 99.1

Strategy and Governance Update August 26, 2024

Forward - Looking Statements Hanmi Financial Corporation (the “Company”) cautions investors that any statements contained herein that are not historical facts are forward - looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 , including, but not limited to, those statements regarding operating and financial performance, financial position and liquidity, business strategies, regulatory, economic and competitive outlook, investment and expenditure plans, capital and financing needs and availability, litigation, plans and objectives, merger or sale activity, financial condition and results of operations, and all other forecasts and statements of expectation or assumption underlying any of the foregoing . These statements involve known and unknown risks and uncertainties that are difficult to predict . Investors should not rely on any forward - looking statement and should consider risks, such as changes in governmental policy, legislation and regulations, economic uncertainty and changes in economic conditions, inflation, the continuing impact of the COVID - 19 pandemic on our business and results of operations, fluctuations in interest rate and credit risk, competitive pressures our ability to access cost - effective funding, the ability to enter into new markets successfully and capitalize on growth opportunities, balance sheet management, liquidity and sources of funding, the size and composition of our deposit portfolio, and the percentage of uninsured deposits in the portfolio, increased assessments by the Federal Deposit Insurance Corporation, risk of natural disasters, a failure in or breach of our operational or security systems or infrastructure, including cyberattacks, the adequacy of and changes in the methodology of calculating our allowance for credit losses, and other operational factors . Forward - looking statements are based upon the good faith beliefs and expectations of management as of this date only and are further subject to additional risks and uncertainties, including, but not limited to, the risk factors set forth in our earnings release dated July 23 , 2024 , including the section titled “Forward Looking Statements” and the Company’s most recent Form 10 - K, 10 - Q and other filings with the Securities and Exchange Commission (“SEC”) . The Company disclaims any obligation to update or revise the forward - looking statements herein . Non - GAAP Financial Information This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”) . These non - GAAP measures include tangible common equity to tangible assets, and tangible common equity per share . Management uses these “non - GAAP” measures in its analysis of the Company’s performance . Management believes these non - GAAP financial measures allow for better comparability of period to period operating performance . Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors . These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non - GAAP performance measures that may be presented by other companies . A reconciliation of the non - GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation . 2

Vivian Kim Vivian.Kim@Hanmi.com David Rosenblum DRosenblum75@gmail.com Executive Vice President, General Counsel, Corporate Secretary, and Chief People Officer at Hanmi Financial Corporation and Hanmi Bank . As the company’s chief legal officer, she oversees Hanmi’s legal affairs, including corporate governance, corporate sustainability, corporate transactions, and litigation . Ms . Kim is also responsible for the bank’s Human Capital Management strategy, including oversight of human resources, benefits, recruiting, learning, and development . Prior to joining Hanmi, she was with a national firm handling a wide range of complex business and IP litigation matters . Ms . Kim currently serves on the boards of the Korean American Bar Association of Southern California, where she was President in 2017 , and the Koreatown Youth + Community Center, currently serving as Treasurer . Ms . Kim received her B . A . and J . D . from UC Berkeley and is based in Los Angeles, CA . TODAY’S PRESENTERS A former Senior Principal at Deloitte Consulting LLP ( 1979 to 2013 ), where he was the National Managing Director of Consulting Corporate Development and a key leader of the Strategy & Operations practice . Mr . Rosenblum is a member of Sage Partners, LLC, a strategic advisory firm, and an operating partner of Interlock Equity LP, a private equity firm focused on mid - and lower - mid market business . He currently is a board member of Apply Digital, an Interlock Equity portfolio company . He is also a director of the Library Foundation of Los Angeles, where he chairs the Finance Committee and is a member of the Executive Committee . He is Chair - Emeritus of the Pacific Southwest Chapter of the National Association of Corporate Directors and previously served on the board of Deloitte Consulting, LLP and as a trustee of Wesleyan University . Mr . Rosenblum earned his B . A . degree in economics from Wesleyan University and his M . B . A . degree in finance from the Wharton School at the University of Pennsylvania . 3

hanmi.com Hanmi Hanmi wholly owned subsidiary of Corporation, serves diverse communities through a coast - to - coast network of branches and loan production offices . With over four decades of experience, the team has built expertise in empowering businesses to thrive in the United States . Specializing in real estate, commercial, SBA, and trade finance lending, Hanmi Bank stands as a trusted partner for achieving financial and business goals . NASDAQ:HAFC Bank, the Financial SUPPORTING THE AMERICAN DREAM FOR OVER 40 YEARS 4

STORY OF GROWTH Established in 1982 in Los Angeles, Hanmi Bank was originally founded to serve the underserved immigrant community in Koreatown . From our humble beginnings as the first Korean - American bank, Hanmi Bank has grown to embrace and support the dreams of all Americans . Today, we serve our customers in diverse markets through our coast - to - coast network of branches and loan production offices . Our mission is to provide quality financial services to support your American dream . We pride ourselves on being experts in business banking . As a trusted partner to small businesses and a supporter of strong local communities, we have dedicated ourselves to helping small businesses grow and thrive for four decades . Hanmi Bank offers a wide array of products and services to fit your needs, including SBA Lending, Commercial Real Estate Lending, Equipment Leasing, Specialty Lending, Treasury Management Services, and much more . From 24 / 7 mobile business banking to personalized, relationship - based service, Hanmi is with you every step of the way . 1982 5 1988 2001 2003 2005 2014 2016 2022 2024

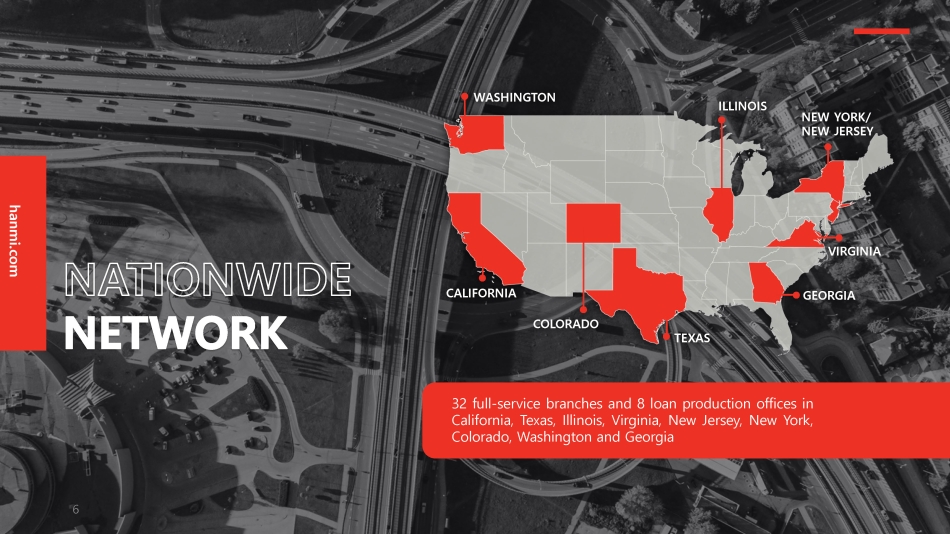

hanmi.com 32 full - service branches and 8 loan production offices in California, Texas, Illinois, Virginia, New Jersey, New York, Colorado, Washington and Georgia WASHINGTON CALIFORNIA COLORADO TEXAS GEORGIA VIRGINIA NEW YORK/ NEW JERSEY 6 ILLINOIS

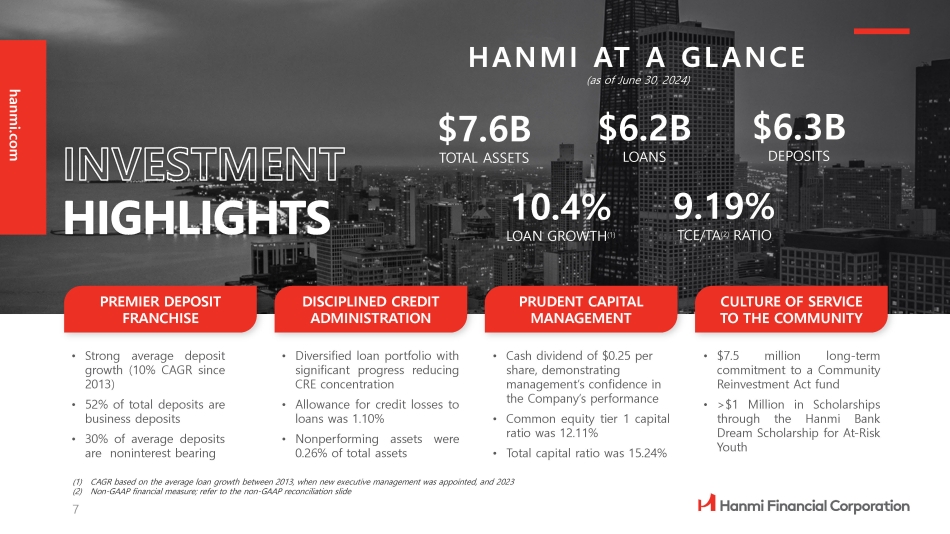

HANMI AT A GL ANCE (as of June 30, 2024) (1) CAGR based on the average loan growth between 2013, when new executive management was appointed, and 2023 (2) Non - GAAP financial measure; refer to the non - GAAP reconciliation slide $7.6B $6.2B TOTAL ASSETS LOANS $6.3B DEPOSITS 10.4% LOAN GROWTH (1) 9.19% TCE/TA (2) RATIO PREMIER DEPOSIT FRANCHISE DISCIPLINED CREDIT ADMINISTRATION PRUDENT CAPITAL MANAGEMENT CULTURE OF SERVICE TO THE COMMUNITY • Strong average deposit growth ( 10 % CAGR since 2013 ) • 52 % of total deposits are business deposits • 30 % of average deposits are noninterest bearing • Diversified loan portfolio with significant progress reducing CRE concentration • Allowance for credit losses to loans was 1 . 10 % • Nonperforming assets were 0 . 26 % of total assets • Cash dividend of $0.25 per share, demonstrating management’s confidence in the Company’s performance • Common equity tier 1 capital ratio was 12.11% • Total capital ratio was 15.24% • $ 7 . 5 million long - term commitment to a Community Reinvestment Act fund • > $ 1 Million in Scholarships through the Hanmi Bank Dream Scholarship for At - Risk Youth hanmi.com 7

(1) Non - GAAP financial measure, refer to 2Q24 Earnings Supplemental Presentation Net Income $14.5M Diluted EPS $0.48 ROAA 0.77% ROAE 7.50% NIM 2.69% Efficiency Ratio 62.24% TBVPS (1) $22.99 2Q 24 FINANCIALS 5.54 6.20 6.86 7.38 7.57 2019 2020 2021 2022 2023 FINANCIAL POSITION 4.70 5.28 5.79 6.17 6.28 2019 2020 2021 2022 2023 4.55 4.79 5.08 5.90 6.11 2019 2020 2021 2022 2023 32.79 42.20 98.68 101.39 80.04 2019 2020 2021 2022 2023 LONG - TERM STABILITY AND STRENGTH Total Assets $7.57 Billion Deposits $6.28 Billion Loans Receivable $6.11 Billion Net Income $80 Million hanmi.com 8

hanmi.com • Strong track record of growth • Strong asset quality metrics • Well capitalized, significantly above regulatory requirements • Founded in 1982 in Los Angeles as the first Korean - American bank • Focused on MSAs with high Asian - American and multi - ethnic populations • Premier community bank with 32 full - service branches and eight loan production offices across nine states • Best in class governance (ISS QualityScore, since 2022) • 90% independent directors • 70% ethnically diverse directors team has, 27 years • Management more than experience • Proven track on average, of banking record of creating on the shareholder value, focusing experience of all stakeholders • Continuing education and development opportunities for team members at all levels of the Company SOLID FINANCIAL PERFORMANCE STRONG BOARD GOVERNANCE EXPERIENCED BANKERS WITH DEEP COMMUNITY TIES ATTRACTIVE COAST - TO - COAST FRANCHISE 9

HANMI CULTURE AND GOVERNANCE INTEGRITY. TRANSPARENCY. FAIRNESS. COLLABORATION. TO BE THE LEADING NATIONWIDE COMMUNITY BANK. 68% Female Workforce 10 93% Ethnically Diverse Workforce 60% Female Managers 90% Ethnically Diverse Managers 62% 3yr+ Workforce Tenure 48% 5yr+ Workforce Tenure All metrics as of June 30, 2024

HEALTH PAID TIME OFF WELLNESS ROBUST 401(k) MATCH LONG - TERM FAMILY LEAVE COMPETITIVE PAY INSURANCE INCENTIVES TRAINING & DISABILITY & BENEFITS DEVELOPMENT OUR TEAM IS OUR COMPETITIVE ADVANTAGE We strive to make Hanmi an inclusive, safe and healthy workplace, with robust opportunities for our employees to grow and develop in their careers . We offer competitive salaries and employee benefits to attract and retain superior talent . In addition to healthy base wages, we offer annual bonus opportunities, a company - matched 401 (k) Plan, healthcare and insurance benefits, flexible spending accounts, wellness incentives, long - term disability, paid time off, and employee assistance programs . We recognize that the success of our business is fundamentally connected to the well - being of our employees . We provide benefits that support their physical and mental health by providing tools and resources to help them improve or maintain their health status ; and that offer choice where possible so they can customize their benefits to meet their needs . 11

The Nomination and Corporate Governance Committee (NCGC) of the Board believes that the directors should encompass a broad range of talent, skill, knowledge, experience, diversity and expertise enabling it to provide sound guidance with respect to Hanmi’s operations and interests . Hanmi is committed to sound corporate governance principles and maintains formal Corporate Governance Guidelines and a Code of Business Conduct and Ethics for employees, executive officers and directors . The Corporate Governance Guidelines require NCGC to consider diversity when reviewing the qualifications of candidates to the Board . Our Board is diverse in a number of important areas, most notably : skills, gender, age, tenure and experiences . Board refreshment has been organic and new directors are identified with an eye to enhancing necessary skillsets on the Board . Annually, our directors participate in a Board Assessment through Nasdaq Board Advisory Services . Standing (left to right): Jim Marasco, Christie Chu, Michael Yang, Gloria Lee, John Ahn (Chairman) Seated (left to right): Tom Williams, Harry Chung, Bonnie Lee (CEO), David Rosenblum (Vice Chair), Gideon Yu STRENGTH THROUGH DIVERSITY 12

hanmi.com 30% Board Members Female 70% Board Members Ethnically Diverse 90% Board Members Independent We are proud that the majority of our Board is diverse with directors who also have a diverse set of complementary core competencies, including : broad experience in business, finance, accounting, risk management, strategic planning, marketing or administration ; familiarity with national and international business matters ; familiarity with the Company’s industry ; and the ability to understand the Company’s business . Yu Yang Williams Rosenblum Marasco G.Lee B.Lee Chung Chu Ahn S K I L L S & E X P E R T I S E ɿ ɿ ɿ ɿ ɿ ɿ ɿ ɿ ɿ ɿ Relevant Senior Leadership or Executive Officer Role ɿ ɿ ɿ ɿ ɿ ɿ ɿ ɿ ɿ Financial Expertise (Financial Reporting and Internal Controls) ɿ ɿ ɿ ɿ ɿ ɿ ɿ ɿ ɿ Knowledge of Company’s Business or Industry ɿ ɿ ɿ ɿ ɿ ɿ ɿ ɿ Social and Corporate Governance ɿ ɿ ɿ ɿ ɿ ɿ Risk Oversight and Management ɿ ɿ Information Technology, Cybersecurity and Privacy ɿ ɿ ɿ ɿ ɿ ɿ ɿ ɿ Capital Markets (Investments, Mergers & Acquisitions) 13

hanmi.com Number of Board and Committee Meetings Held in 2023: 9 Full Board 12 Audit Committee 7 Compensation & Human Resources Committee 4 Nomination & Corporate Governance Committee 8 Risk, Compliance & Planning Committee 4 Asset Liability Management Committee 6 Loan & Credit Policy Committee GOVERNANCE BY THE NUMBERS 14

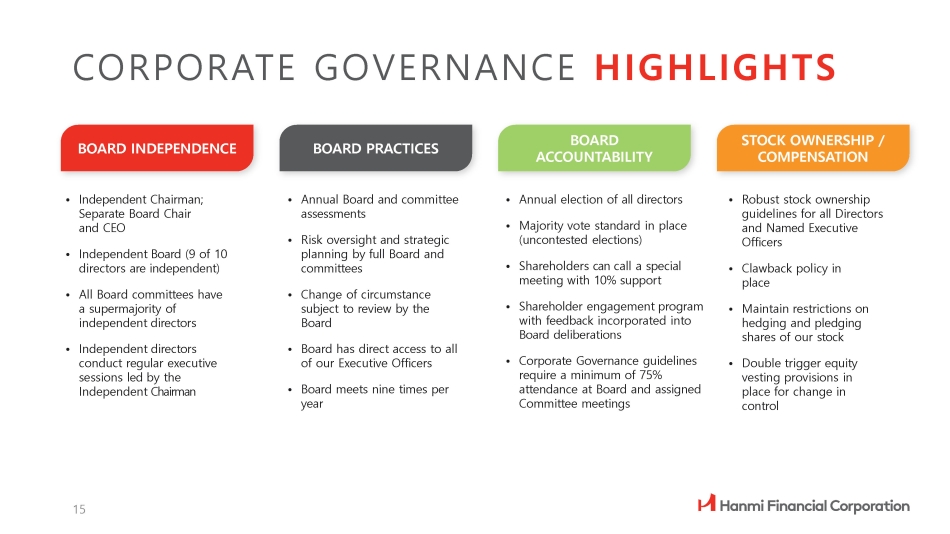

• Independent Chairman; Separate Board Chair and CEO • Independent Board (9 of 10 directors are independent) • All Board committees have a supermajority of independent directors • Independent directors conduct regular executive sessions led by the Independent Chairman • Annual Board and committee assessments • Risk oversight and strategic planning by full Board and committees • Change of circumstance subject to review by the Board • Board has direct access to all of our Executive Officers • Board meets nine times per year • Annual election of all directors • Majority vote standard in place (uncontested elections) • Shareholders can call a special meeting with 10% support • Shareholder engagement program with feedback incorporated into Board deliberations • Corporate Governance guidelines require a minimum of 75% attendance at Board and assigned Committee meetings • Robust stock ownership guidelines for all Directors and Named Executive Officers • Clawback policy in place • Maintain restrictions on hedging and pledging shares of our stock • Double trigger equity vesting provisions in place for change in control CORPORATE GOVERNANCE HIGHLIGHTS BOARD INDEPENDENCE BOARD PRACTICES BOARD ACCOUNTABILITY STOCK OWNERSHIP / COMPENSATION 15

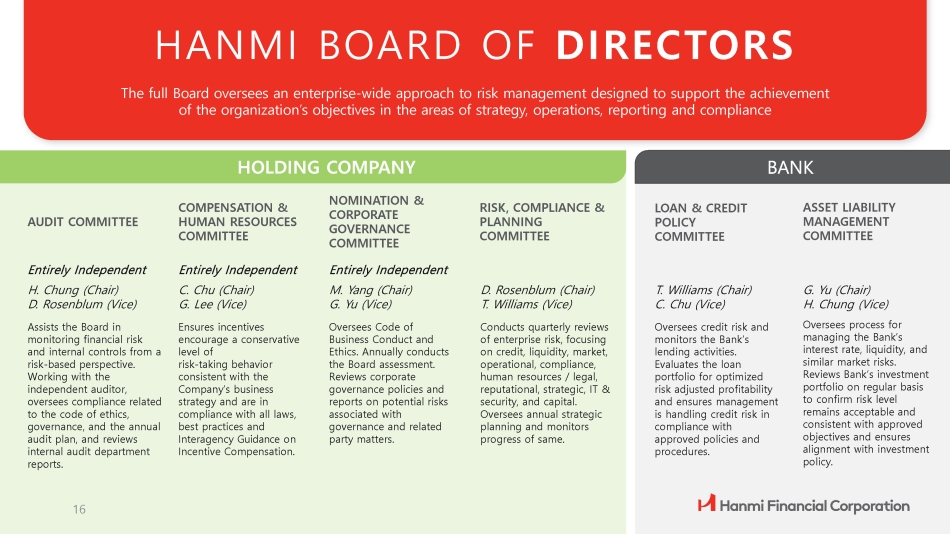

COMPENSATION & HUMAN RESOURCES COMMITTEE RISK, COMPLIANCE & PLANNING COMMITTEE AUDIT COMMITTEE HANMI BOARD OF DIRECTORS LOAN & CREDIT POLICY COMMITTEE ASSET LIABILITY MANAGEMENT COMMITTEE The full Board oversees an enterprise - wide approach to risk management designed to support the achievement of the organization’s objectives in the areas of strategy, operations, reporting and compliance HOLDING COMPANY Entirely Independent H. Chung (Chair) D. Rosenblum (Vice) Assists the Board in monitoring financial risk and internal controls from a risk - based perspective. Working with the independent auditor, oversees compliance related to the code of ethics, governance, and the annual audit plan, and reviews internal audit department reports. 16 Entirely Independent C. Chu (Chair) G. Lee (Vice) Ensures incentives encourage a conservative level of risk - taking behavior consistent with the Company’s business strategy and are in compliance with all laws, best practices and Interagency Guidance on Incentive Compensation. NOMINATION & CORPORATE GOVERNANCE COMMITTEE Entirely Independent M. Yang (Chair) G. Yu (Vice) Oversees Code of Business Conduct and Ethics. Annually conducts the Board assessment. Reviews corporate governance policies and reports on potential risks associated with governance and related party matters. D. Rosenblum (Chair) T. Williams (Vice) Conducts quarterly reviews of enterprise risk, focusing on credit, liquidity, market, operational, compliance, human resources / legal, reputational, strategic, IT & security, and capital. Oversees annual strategic planning and monitors progress of same. T. Williams (Chair) C. Chu (Vice) Oversees credit risk and monitors the Bank’s lending activities. Evaluates the loan portfolio for optimized risk adjusted profitability and ensures management is handling credit risk in compliance with approved policies and procedures. G. Yu (Chair) H. Chung (Vice) Oversees process for managing the Bank’s interest rate, liquidity, and similar market risks. Reviews Bank’s investment portfolio on regular basis to confirm risk level remains acceptable and consistent with approved objectives and ensures alignment with investment policy.

COMMITTEE OVERSIGHT ENTERPRISE RISK PILLAR ENTERPRISE RISK MANAGEMENT FRAMEWORK Financial Controls HR Risk Strategic Risk, Compliance/BSA Risk, IS/IT Risk, Operational Risk, Reputational Risk Credit Risk Capital Risk, Liquidity Risk, Market Sensitivity (IRR) Audit Committee Compensation & Human Resources Committee Risk, Compliance & Planning Committee Loan & Credit Policy Committee Asset Liability Management Committee 17

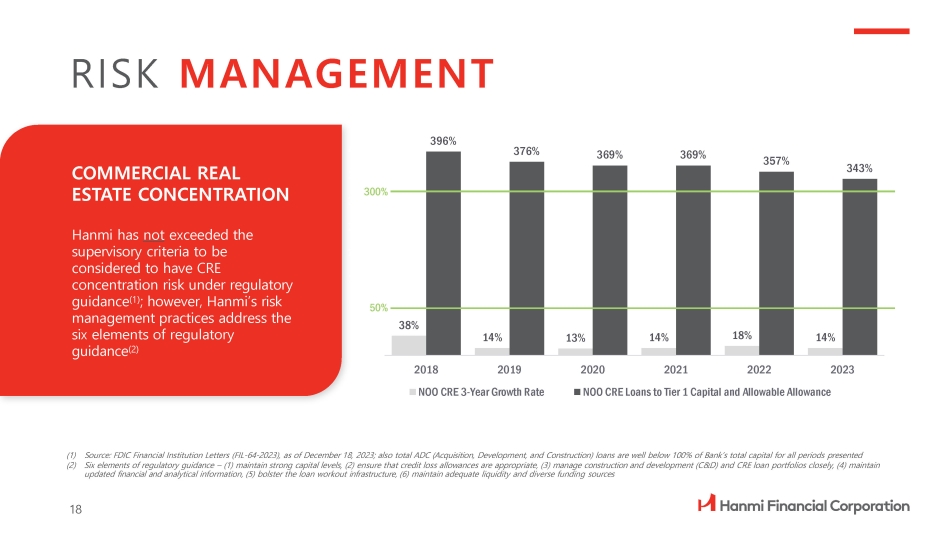

COMMERCIAL REAL ESTATE CONCENTRATION Hanmi has not exceeded the supervisory criteria to be considered to have CRE concentration risk under regulatory guidance (1) ; however, Hanmi’s risk management practices address the six elements of regulatory guidance (2) RISK MANAGEMENT (1) Source: FDIC Financial Institution Letters (FIL - 64 - 2023), as of December 18, 2023; also total ADC (Acquisition, Development, and Construction) loans are well below 100% of Bank’s total capital for all periods presented (2) Six elements of regulatory guidance – (1) maintain strong capital levels, (2) ensure that credit loss allowances are appropriate, (3) manage construction and development (C&D) and CRE loan portfolios closely, (4) maintain updated financial and analytical information, (5) bolster the loan workout infrastructure, (6) maintain adequate liquidity and diverse funding sources 38% 14% 13% 14% 18% 14% 396% 376% 369% 369% 357% 343% 2018 2019 NOO CRE 3 - Year Growth Rate 2020 2021 2022 2023 NOO CRE Loans to Tier 1 Capital and Allowable Allowance 300% 50% 18

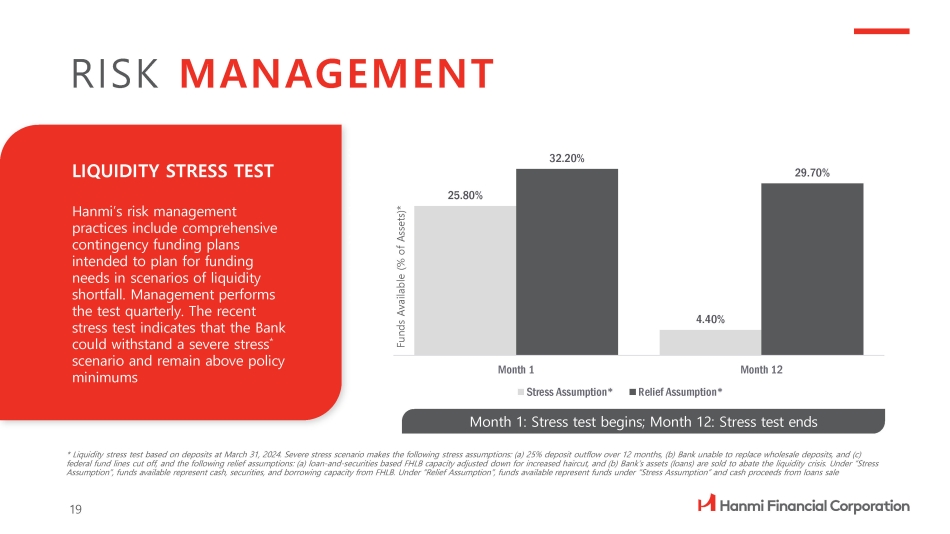

LIQUIDITY STRESS TEST Hanmi’s risk management practices include comprehensive contingency funding plans intended to plan for funding needs in scenarios of liquidity shortfall. Management performs the test quarterly. The recent stress test indicates that the Bank could withstand a severe stress * scenario and remain above policy minimums RISK MANAGEMENT * Liquidity stress test based on deposits at March 31, 2024. Severe stress scenario makes the following stress assumptions: (a) 25% deposit outflow over 12 months, (b) Bank unable to replace wholesale deposits, and (c) federal fund lines cut off, and the following relief assumptions: (a) loan - and - securities based FHLB capacity adjusted down for increased haircut, and (b) Bank’s assets (loans) are sold to abate the liquidity crisis. Under “Stress Assumption”, funds available represent cash, securities, and borrowing capacity from FHLB. Under “Relief Assumption”, funds available represent funds under “Stress Assumption” and cash proceeds from loans sale 25.80% 4.40% 32.20% 29.70% Month 12 Month 1 Stress Assumption* Relief Assumption* Month 1: Stress test begins; Month 12: Stress test ends Funds Available (% of Assets)* 19

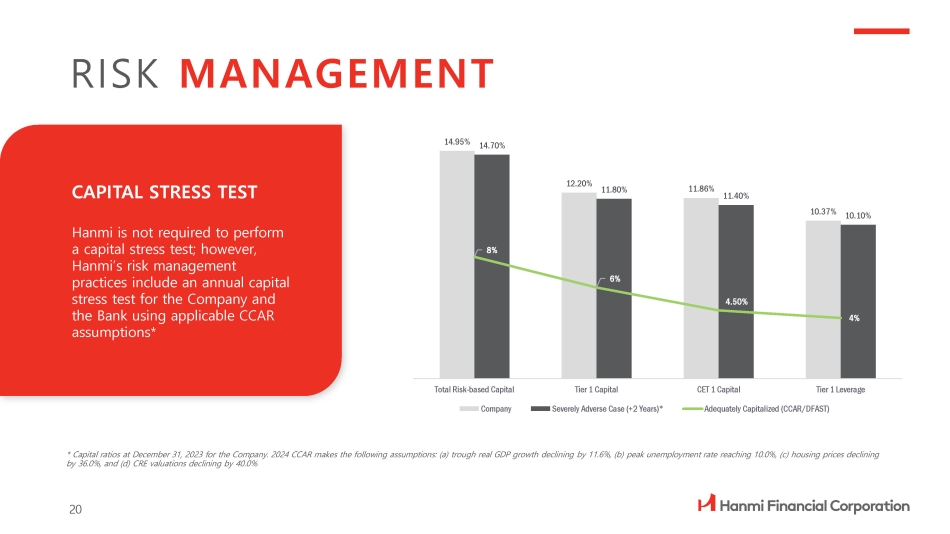

14.95% 12.20% 11.86% 10.37% 14.70% 11.80% 11.40% 10.10% 8% 6% 4.50% 4% Total Risk - based Capital Tier 1 Capital Company Severely Adverse Case (+2 Years)* CET 1 Capital Tier 1 Leverage Adequately Capitalized (CCAR/DFAST) CAPITAL STRESS TEST Hanmi is not required to perform a capital stress test; however, Hanmi’s risk management practices include an annual capital stress test for the Company and the Bank using applicable CCAR assumptions* RISK MANAGEMENT * Capital ratios at December 31, 2023 for the Company. 2024 CCAR makes the following assumptions: (a) trough real GDP growth declining by 11.6%, (b) peak unemployment rate reaching 10.0%, (c) housing prices declining by 36.0%, and (d) CRE valuations declining by 40.0% 20

hanmi.com Hanmi Financial Corporation and Hanmi Bank host information regarding our operations and key initiatives on our website : hanmi . com . Below are links to a selection of information that may be pertinent for our discussions . We welcome your feedback as part of our continuous process to improve our disclosures : Investor Website : https : //investors . hanmi . com Governance Documents: https://investors.hanmi.com/corporate - governance/governance - documents Corporate Sustainability: https://investors.hanmi.com/corporate - sustainability Annual Shareholder Letter: https://d1io3yog0oux5.cloudfront.net/_1c6b6a32597198f166462df72 cbdb09c/hanmi/files/pages/hanmi/db/922/description/2023_Hanmi - Shareholder - letter.pdf Proxy Statement: https://d1io3yog0oux5.cloudfront.net/_7b2a6b76a2f073ee314c0346 3a372916/hanmi/files/pages/hanmi/db/922/description/Proxy_2024. pdf Quarterly Financial Results (including Earnings Call Replay): https://investors.hanmi.com/financial - information/financial - results 21