UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

HANMI FINANCIAL CORPORATION

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

HANMI FINANCIAL CORPORATION

3660 Wilshire Boulevard, Penthouse Suite A

Los Angeles, California 90010

(213) 382-2200

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 17, 2017

TO THE STOCKHOLDERS OF HANMI FINANCIAL CORPORATION:

NOTICE IS HEREBY GIVEN that the 2017 annual meeting of stockholders (the “Annual Meeting”) of Hanmi Financial Corporation (“Hanmi,” “the Company,” “we,” “us” or “our”) will be held at the Oxford Palace Hotel, located at 745 S. Oxford Ave., Los Angeles, California, on Wednesday, May 17, 2017 at 10:30 a.m., Pacific Time, for the following purposes:

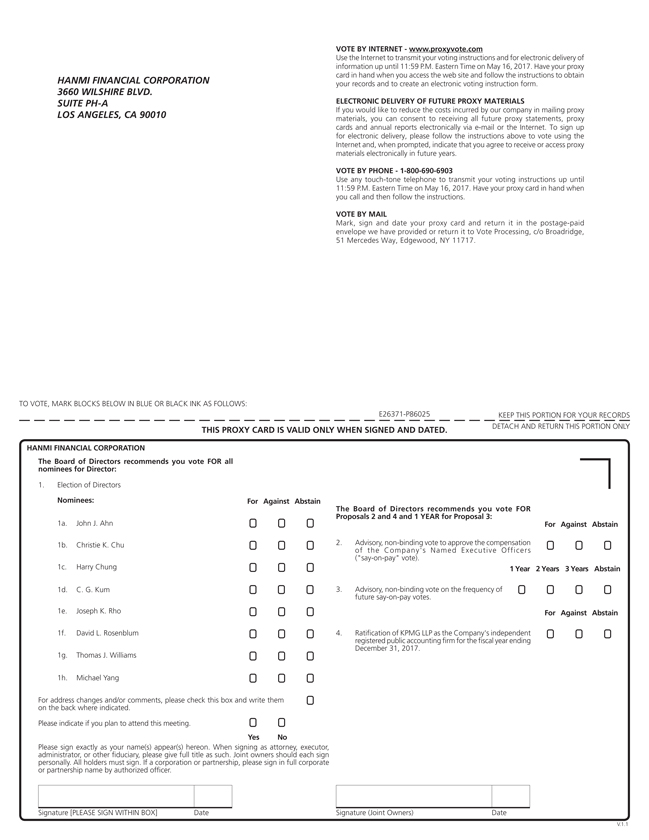

| 1. | To elect eight (8) directors to serve for terms expiring at the 2018 Annual Meeting of Stockholders and until their successors are elected and qualified; |

| 2. | To provide a non-binding advisory vote to approve the compensation of our Named Executive Officers (“Say-on-Pay” vote); |

| 3. | To provide a non-binding advisory vote to approve the frequency of future Say-on-Pay votes; |

| 4. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017; and |

| 5. | To consider any other business properly brought before the meeting. |

You are cordially invited to attend the Annual Meeting in person. Whether or not you plan to attend in person, please vote by signing, dating and returning the enclosed proxy card by mail. You may also vote by telephone or Internet. Any stockholder attending the Annual Meeting may vote in person even if he or she previously returned a proxy card.

| By Order of Our Board of Directors, |

|

|

| C. G. Kum |

| President and Chief Executive Officer |

Los Angeles, California

April 7, 2017

Important Notice Regarding the Availability of Proxy Materials for the

2017 Annual Meeting of Stockholders to be held on May 17, 2017: This Proxy Statement and the 2016 Annual Report on Form 10-K are available electronically at www.hanmi.com by clicking on “Investor Relations” and then “Proxy Materials.”

| 1 | ||||

| 1 | ||||

| Questions and Answers About These Proxy Materials and the Annual Meeting |

2 | |||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 18 | ||||

| 18 | ||||

| 20 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| Potential Payments upon Termination of Employment or Change in Control |

35 | |||

| 37 | ||||

| PROPOSAL NO. 2 NON-BINDING ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION (“SAY-ON-PAY” VOTE) |

38 | |||

| 38 | ||||

| 38 | ||||

| PROPOSAL NO. 3 NON-BINDING ADVISORY VOTE TO APPROVE FREQUENCY OF FUTURE SAY-ON-PAY VOTES |

39 | |||

| 39 | ||||

| 39 | ||||

i

ii

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 17, 2017

The Board of Directors (our “Board”) of HANMI FINANCIAL CORPORATION is soliciting your proxy for use at the 2017 Annual Meeting of Stockholders to be held at the Oxford Palace Hotel, located at 745 S. Oxford Ave., Los Angeles, California, on Wednesday, May 17, 2017, beginning at 10:30 a.m., Pacific Time, and at any adjournments or postponements thereof.

MATTERS TO BE CONSIDERED AND VOTE RECOMMENDATION

We are asking stockholders to vote on the following matters at the 2017 Annual Meeting of Stockholders:

| Proposal | Our Board’s Recommendation | |

| Item 1. Election of Directors (page 14) | ||

| The Board believes that the eight (8) director nominees possess the necessary qualifications to provide effective oversight of the Company’s business and quality advice and counsel to our management. | “FOR” each Director Nominee | |

| Item 2. Advisory Vote to Approve Executive Compensation (“Say-on-Pay” Vote) (page 38) | ||

| The Company seeks a non-binding advisory vote from its stockholders to approve the compensation of its Named Executive Officers (“NEOs”) for 2017 as described in the “Executive Compensation—Compensation Discussion and Analysis” section beginning on page 16. Because your vote is advisory, it will not be binding upon our Board and may not be construed as overruling any decision by our Board. However, the Compensation and Human Resources Committee may, in its sole discretion, take into account the outcome of the vote when considering future executive compensation arrangements. | “FOR” | |

| Item 3. Advisory Vote to Approve Frequency of Future Say-on-Pay Votes (page 39) | ||

| The Company seeks a non-binding advisory vote from its stockholders to approve the option of every 1 year as the frequency with which stockholders are provided a future Say-on-Pay vote. The Board values stockholders’ opinions and it will take into account the outcome of the advisory vote when considering the frequency of future Say-on-Pay votes. | Every “1 YEAR” | |

| Item 4. Ratification of Auditors (page 40) | ||

| The Audit Committee and the Board believe that the continued retention of KPMG, LLP to serve as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2017, is in the best interests of the Company and its stockholders. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee’s selection of the independent registered public accounting firm. If the stockholders do not ratify the selection by a majority vote of the present and voting shares, we will reconsider whether or not to retain KPMG. Even if the selection is ratified, we may, in our discretion, appoint a different independent registered public accounting firm at any time during the year if we determine that such a change would be in our and our stockholders’ best interests. | “FOR” | |

1

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND THE ANNUAL MEETING

Why did I receive this Proxy Statement?

You received this Proxy Statement and the enclosed proxy card because we are soliciting your vote at the Annual Meeting. Our Board is providing these proxy materials to you in connection with the Annual Meeting. As a stockholder of record of our common stock, you are invited to attend the Annual Meeting, and are entitled and requested to vote on the proposals described in this Proxy Statement. This Proxy Statement summarizes the information you need to know to cast an informed vote at the Annual Meeting. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card by mail. You may also vote by telephone or Internet.

We will begin posting this Proxy Statement, notice of the Annual Meeting, and the enclosed proxy card on or about April 7, 2017, to all stockholders entitled to vote. The record date for those entitled to vote is March 28, 2017.

Who is entitled to vote and how many votes do I have?

All stockholders who were stockholders of record of our common stock as of the close of business on March 28, 2017, and only those stockholders will be entitled to vote at the Annual Meeting. You have one vote for each share of our common stock you owned as of the close of business on the record date.

How many shares are eligible to be voted?

As of March 28, 2017, 32,355,668 shares of our common stock were outstanding. Each outstanding share of our common stock will entitle its holder to one vote on each matter to be voted on at the Annual Meeting.

What is the difference between holding shares as a “record” holder and in “street name”?

| • | Record Holders. If your shares of common stock are registered directly in your name on our stock records, you are considered the stockholder of record, or the “record holder” of those shares. As the record holder, you have the right to vote your shares in person or by proxy at the Annual Meeting. |

| • | Street Name Holders. If your shares of common stock are held in an account at a brokerage firm, bank, or other similar entity, then you are the beneficial owner of shares held in “street name.” The entity holding your account is considered the record holder for purposes of voting at the Annual Meeting. As the beneficial owner you have the right to direct this entity on how to vote the shares held in your account. However, as described below, you may not vote these shares in person at the Annual Meeting unless you obtain a legal proxy from the entity that holds your shares giving you the right to vote the shares at the Annual Meeting. |

What is the required quorum at the Annual Meeting?

Quorum for the transaction of business at the Annual Meeting requires the presence, in person or by proxy, of the holders of a majority of all shares entitled to vote at a meeting of stockholders. Abstentions and broker non-votes are treated as being present for purposes of establishing a quorum.

What vote is required to approve each proposal at the Annual Meeting?

| 1. | Election of Directors. Directors are elected by a majority of votes cast, in uncontested elections. In order to be elected to the Board, the votes cast “for” the nominee must exceed the number of votes cast “against” the nominee. Abstentions and broker non-votes will have no effect on the election of a director. |

| 2. | Advisory Vote on the Compensation of our NEOs. Approval, on an advisory basis, of the compensation of our NEOs requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote. |

2

| 3. | Advisory Vote on the Frequency of Future Say-on-Pay Votes. Our stockholders will have four options to choose from when voting on the advisory vote on the frequency of future advisory votes regarding NEO compensation: Every “1 YEAR”; “2 YEARS”; “3 YEARS”; or “ABSTAIN.” The option, if any, that receives the vote of a majority of the shares present in person or represented by proxy and entitled to vote will be the option selected by our stockholders. |

| 4. | Ratification of Selection of Auditors. Ratification of the selection of KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2017, requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote. |

What is the effect of broker non-votes and abstentions?

Abstentions and broker non-votes will be counted for purposes of determining a quorum. Your broker, however, will not be entitled to vote without your instruction on Proposals 1 through 3 on the election of Directors, and the advisory (non-binding) proposals to approve the compensation of our NEOs and the frequency of future Say-on-Pay votes.

Your broker will be authorized to vote your shares on the ratification of our independent registered public accounting firm even if it does not receive instructions from you, and accordingly, broker non-votes will have no effect on this proposal.

Abstentions will have no effect on the election of Directors in Proposal 1, but will have the effect of a vote AGAINST Proposals 2 through 4 for the advisory (non-binding) votes to approve the compensation of NEOs and the frequency of future Say-on-Pay votes, and the ratification of our independent registered public accounting firm, respectively.

How can I vote my shares?

If you hold your shares of common stock in your own name and not through a broker or another nominee, you may vote your shares of common stock by the following methods, subject to compliance with the applicable cutoff times and deadlines described below:

| • | By Telephone. If you hold your shares of common stock in your own name and not through a broker or another nominee, you can vote by dialing the toll-free telephone number printed on your proxy card. Telephone voting is available 24 hours a day until 11:59 p.m., Pacific Time, on May 16, 2017. If you vote by telephone, you do not need to return your proxy card. |

| • | By Internet. If you hold your shares of common stock in your own name and not through a broker or another nominee, you can choose to vote on the website printed on your proxy card. Internet voting is available 24 hours a day until 11:59 p.m., Pacific Time, on May 16, 2017. If you vote via the Internet, you do not need to return your proxy card. |

| • | By Mail. You can vote by mail by signing, dating and returning the proxy card in the postage-paid envelope sent concurrently therewith. Proxy cards sent by mail must be received by May 16, 2017. |

| • | In Person. By attending the Annual Meeting and voting in person. |

Whichever of these methods you select to transmit your instructions, the proxy holders will vote your shares of common stock in accordance with your instructions. If you give a proxy without specific voting instructions, your proxy will be voted by the proxy holders “FOR” each of the Director nominees named in this Proxy Statement, “FOR” the approval, on an advisory basis, of the compensation of our NEOs, “1 YEAR” for frequency of future Say-on-Pay votes, “FOR” the ratification of our independent registered public accounting firm, and at the proxy holders’ discretion on such other matters, if any, as may properly come before the Annual Meeting (including any proposal to adjourn the Annual Meeting).

3

Can I change or revoke my vote after I return my proxy card?

You may revoke a proxy at any time before the vote is taken at the Annual Meeting by filing with our Corporate Secretary a properly executed proxy of a later date by mail, telephone or Internet, or by attending the Annual Meeting and voting in person. Any such filing should be made to the attention of Corporate Secretary, Hanmi Financial Corporation, 3660 Wilshire Boulevard, Penthouse Suite A, Los Angeles, California 90010. Attendance at the Annual Meeting will not by itself constitute revocation of a proxy.

How do I vote in person?

If you plan to attend the Annual Meeting and vote in person, we will give you a ballot form when you arrive. However, if your shares of common stock are held in the name of your broker, bank or other nominee, you must bring a legal proxy from your broker, bank or other nominee to vote your shares of common stock at the Annual Meeting.

How will proxies be solicited?

In addition to soliciting proxies by mail, our officers, directors, and employees, without receiving any additional compensation, may solicit proxies by telephone, fax, in person, or by other means. Arrangements may also be made with brokerage firms and other custodians, nominees, and fiduciaries to forward proxy solicitation materials to the beneficial owners of our common stock held of record by such persons, and we will reimburse such brokerage firms, custodians, nominees, and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection therewith.

Will any other matters be considered at the Annual Meeting?

We are not aware of any matter to be presented at the Annual Meeting other than the proposals discussed in this Proxy Statement. If other matters are properly presented at the Annual Meeting, then the persons named as proxies will have the authority to vote all properly executed proxies in accordance with the direction of our Board, or, if no such direction is given, in accordance with the judgment of the persons holding such proxies on any such matter, including any proposal to adjourn or postpone the Annual Meeting.

Are there any rules regarding admission to the Annual Meeting?

Yes. You are entitled to attend the Annual Meeting only if you were a stockholder as of the record date, or you hold a valid legal proxy naming you to act for one of our stockholders on the record date. Before we admit you to the Annual Meeting, we must be able to confirm:

| • | Your identity by reviewing a valid form of photo identification, such as a driver’s license or passport; and |

| • | You were, or are validly acting for, a stockholder of record on the record date by: |

| ○ | Verifying your name and stock ownership against our list of registered stockholders, if you are the record holder of your shares; |

| ○ | Reviewing other evidence of your stock ownership, such as your most recent brokerage or bank statement, if you hold your shares in street name; or |

| ○ | Reviewing a written proxy that shows your name and is signed by the stockholder you are representing, in which case either the stockholder must be a registered stockholder of record or you must have a brokerage or bank statement for that stockholder as described above. |

4

If you do not have a valid form of photo identification and proof that you owned, or are legally authorized to act as proxy for someone who owned, shares of our common stock on March 28, 2017, you will not be admitted into the Annual Meeting.

Is my vote confidential?

Your vote will not be disclosed either within the Company or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation of votes and certification of the vote, or to facilitate a successful proxy solicitation.

Where can I find the voting results of the Annual Meeting?

We intend to disclose voting results on a Current Report on Form 8-K to be filed with the U.S. Securities and Exchange Commission (the “SEC”) within four business days after the Annual Meeting.

5

CORPORATE GOVERNANCE AND BOARD MATTERS

The following table provides summary information about our current directors as of April 7, 2017.

| Name | Age | Director Since |

Principal Occupation | Committee Memberships | ||||||||||||||||||||||

| A | CHR | NCG | RCP | |||||||||||||||||||||||

| Joseph K. Rho (Chairman)* |

76 | 2000 | Retired (current and former Chairman of the Boards of Hanmi and Hanmi Bank) |

|

|

|

||||||||||||||||||||

| John J. Ahn* |

52 | 2014 | President of Great American Capital Partners, LLC |

|

|

|

||||||||||||||||||||

| Christie K. Chu* |

52 | 2015 | President & CEO of CKC Accountancy Corporation |

|

|

|||||||||||||||||||||

| Harry Chung*FE |

47 | 2016 | Chief Financial Officer of Breakwater Investment Management |

|

||||||||||||||||||||||

| Paul Seon-Hong Kim*FE |

73 | 2009 | Retired (former President & CEO of Center Financial Corp/Center Bank) |

|

|

|

||||||||||||||||||||

| C. G. Kum |

62 | 2013 | President & CEO of Hanmi and Hanmi Bank |

|

||||||||||||||||||||||

| Joon Hyung Lee* |

73 | 2000 | President of Root-3 Corporation |

|

|

|||||||||||||||||||||

| David L. Rosenblum*FE |

64 | 2014 | Retired (former senior Principal at Deloitte Consulting LLP) |

|

|

|

|

|||||||||||||||||||

| Thomas J. Williams* |

54 | 2016 | Retired (former Senior Vice President & Chief Risk Officer of BofI Federal Bank) |

|

|

|||||||||||||||||||||

| Michael Yang* |

55 | 2016 | Founder and CEO of MSY LLC |

|

|

|

||||||||||||||||||||

Chairperson

Chairperson

Member

Member

Committees: A = Audit; CHR = Compensation and Human Resources; NCG = Nominating and Corporate Governance;

RCP = Risk, Compliance and Planning

* = Independent Director; FE = Audit Committee Financial Expert

Hanmi is committed to sound corporate governance principles and adopted formal Corporate Governance Guidelines. Hanmi has also adopted a Code of Business Conduct and Ethics for employees, executive officers and Directors. These Corporate Governance Guidelines, as well as Hanmi’s Code of Business Conduct and Ethics and other governance matters of interest to investors, are available through Hanmi’s website at www.hanmi.com on the “Investor Relations” page. Any amendments or waivers applicable to an executive officer or Director to the Code of Business and Ethics will also be posted on Hanmi’s website.

Our common stock is listed on the NASDAQ Global Select Market (“NASDAQ”). Under NASDAQ rules, independent directors must comprise a majority of a listed company’s board of directors. In addition, the rules of NASDAQ require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees must be independent. Under these rules, a director is independent only if the board of directors of a company makes an affirmative determination that the director has no material relationship with the company that would impair his or her independence.

6

Our Board has undertaken a review of the independence of each director in accordance with NASDAQ rules and requirements of the U.S. Securities and Exchange Commission (the “SEC”). Based on this review, our Board has determined that all of its Directors are independent under the applicable listing standards of NASDAQ, except for C. G. Kum, who also serves as the President and Chief Executive Officer of Hanmi. In making this determination, our Board considered the relationships that each non-employee director has with us and all other facts and circumstances that the Board deemed relevant in determining their independence. See Board Meetings and Committees below for additional information regarding the Board’s independence determinations applicable to each of the committees.

During the fiscal year ended December 31, 2016, our Board held twelve (12) joint board meetings with the Board of Hanmi Bank (the “Bank”), the wholly-owned subsidiary of Hanmi and three (3) special board meetings, for a total of fifteen (15) board meetings. All Board members were present for more than 75% of the aggregate number of meetings of our Board and the committees on which he or she served. Hanmi’s policy is to encourage all Directors to attend all Annual and Special Meetings of Stockholders. Hanmi’s 2016 Annual Meeting of Stockholders was attended by all Directors, other than our new director Thomas J. Williams.

Our Board has four (4) standing committees: the Audit Committee, the Compensation and Human Resources Committee (the “CHR Committee”), the Nominating and Corporate Governance Committee (the “NCG Committee”), and the Risk, Compliance and Planning Committee (the “RCP Committee”). Each committee is governed by a charter, each of which is available through Hanmi’s website at www.hanmi.com on the “Investor Relations” page.

Audit Committee

The current members of Hanmi’s Audit Committee are Harry Chung, Paul Seon-Hong Kim, Joon Hyung Lee, Joseph K. Rho, David L. Rosenblum and Thomas J. Williams, with Mr. Kim serving as its Chairperson. Each member meets the independence requirements of the SEC, the Federal Deposit Insurance Corporation (the “FDIC”) and NASDAQ. Based on its review, the Board determined that Messrs. Kim, Chung and Rosenblum qualify as an “audit committee financial expert” as defined under the applicable SEC rules. The Audit Committee held fourteen (14) meetings during the fiscal year ended December 31, 2016. The Audit Committee operates under a charter adopted by the Board and is available on our website at www.hanmi.com on the “Investor Relations” page. The Audit Committee reports to the Board and is responsible for overseeing and monitoring financial accounting and reporting, the system of internal controls established by management and our audit process and policies. Through its oversight of the audit function, the Audit Committee ensures compliance with laws and regulations.

As outlined in its charter, the Audit Committee has the following responsibilities, among others:

| • | Assist the Board in fulfilling its oversight responsibilities for the financial reporting process, the system of internal control, the audit process, and Hanmi’s process for monitoring compliance with laws and regulations and the code of conduct; |

| • | Review the unaudited quarterly and audited annual financial statements; |

| • | Review the adequacy of internal control systems and financial reporting procedures with management and the independent auditor; |

| • | Review and approve the general scope of the annual audit and the fees charged by the independent registered public accounting firm; and |

| • | Review and approve the general scope of the annual internal audit plan and associated fees. |

Compensation and Human Resources Committee

The current members of the CHR Committee are John J. Ahn, Christie K. Chu, Joon Hyung Lee, Joseph K. Rho, David L. Rosenblum and Michael Yang, with Mr. Ahn serving as its Chairperson. Each member is an “outside director” (as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”)) and a “non-

7

employee director” (as defined in Section 16 of the Securities Exchange Act of 1934 (the “Exchange Act”) and meets the independence requirements of the SEC and NASDAQ. The CHR Committee held eight (8) meetings during the fiscal year ended December 31, 2016.

The CHR Committee assists the Board by overseeing the compensation of all of Hanmi’s executive officers, including Hanmi’s Chief Executive Officer, as well as administering Hanmi’s compensation plans. As outlined in its charter, the CHR Committee has the following responsibilities, among others:

| • | Review and approval of the Company’s overall compensation theory, plans and policies and programs as it relates to Directors, the Chief Executive Officer and Senior Officers; |

| • | Approve Directors overall compensation, policies and programs; |

| • | Oversee management development and management succession planning; |

| • | Review and approve Senior Officers separation plan or severance agreements; and |

| • | Lead the Board in its annual review of executive management’s performance as it relates to bonus metrics for bonus payouts. |

The CHR Committee also sets the compensation policy of the Company as more fully described below under Compensation Discussion and Analysis. To evaluate and administer the compensation programs of our NEOs, the CHR Committee meets at least four times a year. In addition, the CHR Committee also holds special meetings to discuss extraordinary items. At the end of a meeting, the CHR Committee may choose to meet in executive session, when necessary. The CHR Committee is also authorized to retain outside consultants to assist it in determining executive officer compensation.

Nominating and Corporate Governance Committee

The members of the NCG Committee are John J. Ahn, Christie K. Chu, Paul Seon-Hong Kim, Joseph K. Rho, David L. Rosenblum and Michael Yang, with Ms. Chu serving as its Chairperson. Each member meets the independence requirements of the SEC and NASDAQ. The NCG Committee held six (6) meetings during the fiscal year ended December 31, 2016.

As described in its charter, the NCG Committee assists the Board as follows, in addition to:

| • | Identify individuals qualified to become Directors; |

| • | Recommend to the Board nominees for the Board and its committees for the next Annual Meeting of Stockholders; |

| • | Develop, recommend, and implement a set of corporate governance principles applicable to Hanmi; and |

| • | Monitor the process to determine the effectiveness of the Board and its committees. |

See Consideration of Director Nominees below for additional information regarding the director nomination process. The NCG Committee is also authorized to retain outside consultants to assist it in fulfilling any of its duties, including Board and Director assessment and Board evaluation.

Risk, Compliance and Planning Committee

The current members of the RCP Committee are John J. Ahn, Paul Seon-Hong Kim, C. G. Kum, David L. Rosenblum, Thomas J. Williams and Michael Yang, with Mr. Rosenblum serving as its Chairperson. Except for

8

Mr. Kum, each member is an outside (or non-employee) Director and meets the independence requirements of the SEC and NASDAQ. The RCP Committee held eleven (11) meetings during the fiscal year ended December 31, 2016.

As outlined in its charter, the RCP Committee is responsible for providing oversight of the Enterprise Risk Management framework, including the strategies, policies, procedures and systems established by management to identify, assess, measure and manage the significant risks facing the Company. It also oversees strategic planning generally and recommends new lines of business, and the budget to our Board.

The Board is committed to having a sound governance structure that promotes the best interest of all Hanmi stockholders. Our leadership structure includes the following principles:

| • | We believe that yearly elections hold the Directors of the Board accountable to our stockholders, as each director is subject to re-nomination and re-election each year. |

| • | All of the Directors are independent, except for C. G. Kum, our President and Chief Executive Officer. The Board has affirmatively determined that the other seven (7) Directors nominated are independent under the SEC and NASDAQ corporate governance rules, as applicable. |

| • | We have separated the positions of the Chairman of the Board and Chief Executive Officer, in the Company’s Bylaws, to ensure the independence of the Chairman. The Chairman focuses on board oversight responsibilities, strategic planning and mentoring company officers. The Chairman also periodically represents the Bank at public functions. The Chief Executive Officer focuses on the development and execution of Company strategies. |

| • | We believe the Board structure serves the interests of the stockholders by balancing the practicalities of running the Company with the need for director accountability. |

BOARD’S ROLE IN RISK OVERSIGHT

The Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organization objectives in the areas of strategy, operations, reporting, and compliance. The Board recognizes that these objectives are important to improve and sustain long-term organizational performance and stockholder value. A fundamental part of risk management is not only identifying the risks the Company faces and the steps management is taking to manage those risks, but also determining what constitutes the appropriate level of risk based upon the Company’s activities and risk appetite.

The RCP Committee goes through an extensive review of the enterprise risk assessment on a quarterly basis with the guidance of the RCP Committee Chairperson and the Bank’s Chief Risk Officer. The quarterly risk assessment is also reviewed at the Board quarterly. In this process, risk is assessed throughout the Company by focusing on six (6) areas of risk, including risks relating to: credit, liquidity, market, operations, compliance / legal, and reputational. Risks that simultaneously affect different parts of the Company are identified, and an interrelated response is made. The Board provides ongoing oversight of enterprise-wide risks through a periodic enterprise risk assessment update.

While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the RCP Committee assists the Board in fulfilling its oversight responsibility with respect to regulatory, compliance, operational risk and enterprise risk management issues that affect the Company and works closely with the Company’s legal and risk departments. The RCP Committee also oversees risks associated with the planned short- and long-term direction of the Company and ensures ongoing board involvement and oversight of the Company’s strategic plan. The Audit Committee helps the Board monitor financial risk and internal controls from a risk-based perspective, oversees compliance and the annual audit plan. Reports from the Company’s internal audit department are also reviewed.

9

In overseeing compensation, the CHR Committee advocates for incentives that encourage a conservative level of risk-taking behavior consistent with the Company’s business strategy and in compliance with all laws and the Interagency Guidance on Incentive Compensation. The NCG Committee oversees the Code of Conduct and Business Ethics policies relating to employees and directors and conducts an annual assessment of corporate governance policies and any potential risk associated with governance and related party matters.

The Bank also has two board committees that oversee risk. The Loan and Credit Policy Committee oversees credit risk by identifying, monitoring, and controlling repayment risk associated with the Bank’s lending activities. The Asset Liability Committee oversees the implementation of an effective process for managing the Bank’s interest rate, liquidity, and similar market risks relating to the Bank’s balance sheet and associated activities.

CONSIDERATION OF DIRECTOR NOMINEES

The NCG Committee believes that the Board as a whole should encompass a range of talent, skill, diversity, and expertise enabling it to provide sound guidance with respect to Hanmi’s operations and interests. In addition to considering a candidate’s background and accomplishments, candidates are reviewed in the context of the current composition of the Board and the evolving needs of Hanmi’s business. Our Board has identified certain core competencies that its Directors should possess, including broad experience in business, finance, accounting, risk management, strategic planning, marketing or administration, familiarity with national and international business matters, familiarity with the Company’s industry and ability to understand the Company’s business. In addition to possessing one or more of these core competencies, the members of our Board should have and demonstrate personal qualities such as integrity, leadership, community prominence and reputation. The experience, skills and qualifications contributed by each of our Directors should diversify and complement the core competencies of our collective Board.

The NCG Committee seeks directors with strong reputations and experience in areas relevant to the strategy and operations of Hanmi’s business, particularly industries and growth segments that Hanmi operates in, such as the banking and financial services industry, as well as key geographic markets and customer segments where Hanmi operates. The NCG Committee annually reviews the individual skills and characteristics of the Directors, as well as the composition of the Board as a whole. This assessment includes a consideration of independence, diversity, age, skills, expertise and industry background in the context of the needs of the Board and Hanmi.

The Board conducts an annual evaluation to determine whether the Board and its committees are functioning effectively. The NCG Committee oversees the evaluation method and criteria for the Board’s annual evaluation of the composition, competence and performance of the Board and its committees. The NCG Committee may retain consultants or advisors to assess the performance and effectiveness of the Board as a whole, its committees and each individual director.

The results of any self-evaluations, peer evaluations, or evaluations by any consultant or advisor are submitted to the Board. The Board then takes appropriate action based on the Board’s findings regarding the assessment and performance evaluations. The Board and director evaluation process considers the best interests of Hanmi, its Board, its employees, its customers and the stockholders of the Company. The assessment includes director succession planning and expected future needs of the Board and the Company, so as to ensure that Board effectiveness is not diminished during periods of transition.

Board Diversity

The Board’s policy with regard to the consideration of diversity in identifying director nominees is contained within the Corporate Governance Guidelines. The Corporate Governance Guidelines require the NCG Committee to consider diversity when reviewing the qualifications of candidates to the board. Board member nominees are identified and considered on the basis of knowledge, experience, integrity, diversity, leadership, community prominence and reputation, and ability to understand the Company’s business.

10

Stockholder Recommendations

The NCG Committee will consider stockholder recommendations for Director nominees. Such notices must be submitted in writing to the Hanmi Financial Corporation, 3660 Wilshire Boulevard, Penthouse Suite A, Los Angeles, California 90010, Attention: Corporate Secretary. Such notices also must comply with other requirements set forth in the Company’s Bylaws and be received by the Corporate Secretary within the deadlines provided below under “Stockholder Proposals for the 2018 Annual Meeting.”

In identifying and evaluating Director candidates, the NCG Committee will solicit and receive recommendations, and review qualifications of potential Director candidates. The NCG Committee also may use search firms to identify Director candidates when necessary. To enable the NCG Committee to effectively evaluate Director candidates, the NCG Committee also may conduct appropriate inquiries into the backgrounds and qualifications of Director candidates, including reference checks. As stated above, the NCG Committee will consider Director candidates recommended by stockholders utilizing the same criteria as candidates identified by the NCG Committee.

Our Board has a process for stockholders to send communications to Directors. Hanmi’s stockholders and interested parties may send communications to our Board by writing to our Board at Hanmi Financial Corporation, 3660 Wilshire Boulevard, Penthouse Suite A, Los Angeles, California 90010, Attention: Board of Directors. All such communications will be relayed directly to our Board. Any interested party wishing to communicate directly with Hanmi’s independent Directors regarding any matter may send such communication in writing to Hanmi’s independent Directors at Hanmi Financial Corporation, 3660 Wilshire Boulevard, Penthouse Suite A, Los Angeles, California 90010, Attention: Chairman of the Board. Any interested party wishing to communicate directly with the Audit Committee regarding any matter, including any accounting, internal accounting controls, or auditing matter, may submit such communication in writing to Hanmi Financial Corporation, 3660 Wilshire Boulevard, Penthouse Suite A, Los Angeles, California 90010, Attention: Chairperson of the Audit Committee.

Correspondence may be submitted on an anonymous basis and submissions of complaints or concerns will not be traced. Confidentiality is a priority, and all communications will be treated confidentially to the fullest extent possible. For submissions that are not anonymous, the sender may be contacted in order to confirm information or to obtain additional information. The Company reserves the right not to forward to Board members any abusive, threatening or otherwise inappropriate materials.

Each director is encouraged to own shares of common stock of the Company at a level that demonstrates a meaningful commitment to the Company and the Bank, and to better align the director’s interests with the Company’s stockholders. A director’s stock ownership will be one of the factors considered in deciding whether to nominate or appoint a director to the Board of Directors of the Company.

All directors should acquire (and thereafter maintain ownership of) at least 5,000 shares of the Company’s common stock. Directors are expected to meet the ownership standards set forth herein by January 2018 or within three years of their first day as a director, whichever is later. In addition to the stock ownership guidelines described above, each director who acquires shares of Company common stock through the exercise or vesting of a stock option, stock appreciation right or restricted stock will be required to retain 50% of the “net” shares acquired (net of tax impact that the exercise or vesting has on the individual) for at least 12 months following the date of exercise or vesting, or such earlier time if the individual ceases to be a member of the Board as a result of death, disability, illness, resignation, termination or other reason.

11

The following table sets forth certain information regarding compensation paid to persons who served as outside (or non-employee) Directors of Hanmi for the fiscal year ended December 31, 2016:

| Name |

Fees Earned or Paid in Cash |

Stock Awards |

Option Awards |

All Other Compensation |

Total | |||||||||||||||||||

| (3) | (4) | (5) | ||||||||||||||||||||||

| John J. Ahn |

$ | 60,800 | $ | 66,270 | $ | 100 | $ | 127,170 | ||||||||||||||||

| Christie K. Chu |

$ | 65,800 | $ | 66,270 | $ | 100 | $ | 132,170 | ||||||||||||||||

| Harry Chung (1) |

$ | 51,600 | $ | 66,270 | $ | 100 | $ | 117,970 | ||||||||||||||||

| John A. Hall (2) |

$ | 48,200 | 48,200 | |||||||||||||||||||||

| Paul Seon-Hong Kim |

$ | 65,050 | $ | 66,270 | $ | 100 | $ | 131,420 | ||||||||||||||||

| Joon Hyung Lee |

$ | 75,100 | $ | 66,270 | $ | 100 | $ | 141,470 | ||||||||||||||||

| Joseph K. Rho |

$ | 93,900 | $ | 66,270 | $ | 4,480 | $ | 164,650 | ||||||||||||||||

| David L. Rosenblum |

$ | 66,000 | $ | 66,270 | $ | 100 | $ | 132,370 | ||||||||||||||||

| Thomas J. Williams (1) |

$ | 32,500 | $ | 100 | $ | 32,600 | ||||||||||||||||||

| Michael Yang (1) |

$ | 54,550 | $ | 66,270 | $ | 100 | $ | 120,920 | ||||||||||||||||

| (1) | Directors Harry Chung and Michael Yang were each first appointed to the Board as of February 2, 2016. Director Thomas Williams was first appointed to the Board as of June 1, 2016. |

| (2) | Director John A. Hall retired effective the end of his term on May 24, 2016. Mr. Hall received $21,000 in monthly payments pursuant to the Director Emeritus Plan. |

| (3) | Each Director who is not an employee of Hanmi (an outside Director) is paid a monthly retainer fee of $3,000 and $1,000 for attendance at Board meetings ($500 for telephonic attendance). In addition, the Chairman of the Board receives an additional $3,000 each month. The Audit Committee Chairperson receives an additional $1,000 each month, and the Loan Committee Chairperson receives an additional $1,500 each month. The chairpersons of the remaining committees receive an additional $750 each month, and committee members receive an additional $200 each for attending committee meetings ($100 each for telephonic attendance). The amounts shown include fees for service on the board and the committees of the board of both the Company and the Bank. |

| (4) | The Company granted 3,000 restricted shares of the Company’s common stock to each non-employee director standing for re-election on March 23, 2016, with vesting over one year from the grant date. The grant date fair value is based on the number of shares granted and the closing price of the Company’s stock on the grant date. The closing price of the Company’s common stock was $22.09. |

| (5) | Chairman Rho received $4,380 for club membership to the City Club Los Angeles. |

12

The Company recognizes that retiring directors have a great deal of institutional knowledge and that it is in the best interests of the Company to have access to such knowledge. On May 20, 2015, the Company approved a Director Emeritus Plan (the “Plan”) for retiring directors. Shortly following a director’s decision to retire, the Board’s Compensation and Human Resources Compensation Committee may, at its sole discretion, nominate a retiring director for Emeritus status. Such recommendation will then be considered by the Board. If approved by the Board, and accepted by the retiring director, Emeritus status shall run as detailed in the schedule below.

A director must serve at least five years on the Board of Directors in order to be considered for the Plan. Each Director Emeritus will be entitled to 100% of the then current Board’s base cash retainer fee for Board membership. A Director Emeritus may choose to receive either a non-discounted, lump sum payment of the then current base cash compensation or monthly payments according to the schedule below. In addition, a Director Emeritus may choose to receive their lump sum payment in Company stock in lieu of a cash payment. If a Director Emeritus passes away during their term, any compensation rights accrued shall pass to the Director’s estate.

| Years of Service |

Director Emeritus Term (months) |

Percentage of Cash Compensation | ||||||

| 5 years |

6 | 100% | ||||||

| 6 – 10 years |

12 | 100% | ||||||

| 11-20 years |

24 | 100% | ||||||

| 21-30 years |

36 | 100% | ||||||

| 31+ years |

48 | 100% |

CHR COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

John J. Ahn, Christie K. Chu, Joon Hyung Lee, Joseph K. Rho, David L. Rosenblum and Michael Yang served as members of the CHR Committee during the last completed fiscal year. No member of the CHR Committee was an officer or employee of Hanmi or the Bank during the fiscal year ended December 31, 2016. No member of the CHR Committee is or was on the compensation committee of any other entity whose officers served either on our Board or on the CHR Committee.

13

ELECTION OF DIRECTORS

Stockholders are being asked to elect eight (8) Director nominees for a one-year term. Subject to their earlier resignation or retirement, Directors elected at the Annual Meeting will serve until the 2018 annual meeting of stockholders and until their successors are elected and qualified. Our Board believes that each Director nominee satisfies our director qualification standards and accordingly nominates: John J. Ahn, Christie K. Chu, Harry Chung, C. G. Kum, Joseph K. Rho, David L. Rosenblum, Thomas J. Williams and Michael Yang. The Board wishes to thank Messrs. Kim and Lee, who are not being re-nominated, for their many years of service to the company as directors.

BOARD OF DIRECTORS AND NOMINEES

Hanmi’s directors have a mix of experience and backgrounds, including those that started a business and grew it into a substantial entity to holding senior executive positions in large, complex organizations to those who held positions of importance within regulatory agencies. In those positions, they have also gained experience in core management skills, such as strategic and financial planning, public company financial reporting, corporate governance, risk management, leadership development and importantly a deep understanding of our customers.

In addition to each Director nominee’s professional experience outlined in the table below, our Board believes that each Director nominee has other key attributes that are important to an effective Board of Directors, such as, integrity and demonstrated high ethical standards; sound judgment; analytical skills; the ability to engage management and each other in a constructive and collaborative fashion; diversity of origin, background, experience, and thought; and the commitment to devote significant time and energy to service on our Board and its Committees.

None of the Director nominees was nominated pursuant to any arrangement or understanding. There are no family relationships among the Director nominees or the executive officers of Hanmi. As of the date hereof, no Director nominee holds a directorship with another company that has a class of securities registered pursuant to Section 12 of the Exchange Act, subject to the requirements of Section 15(d) of the Exchange Act, or registered as an investment company under the Investment Company Act of 1940, as amended.

The following tables set forth information with respect to the Director nominees.

| Name |

Age |

Experience and Qualifications | ||

| John J. Ahn Director since 2014

Board Committees: CHR, NCG, RCP |

52 | Mr. Ahn brings more than 27 years of experience in capital markets and financial advisory services to Hanmi. He is currently the President of Great American Capital Partners, LLC (GACP), an SEC Registered Investment Advisor that originates and underwrites senior secured loans across a wide array of industries. GACP is a wholly owned subsidiary of B. Riley Financial, Inc., a publicly traded, diversified financial services company. Prior to his role at GACP, Mr. Ahn served as President of another B. Riley Financial Inc. subsidiary, B. Riley & Co., a full-service investment banking firm that provides corporate finance, research, sales and trading services, and asset management to corporate and institutional clients. Prior to joining B. Riley, Mr. Ahn held numerous leadership positions in the investment banking and sales and trading sectors. Mr. Ahn earned his B.A. degree in economics from Williams College.

Our Board believes that Mr. Ahn should serve as a Director because of his extensive experience and background in investment banking, finance, strategic planning and his strong understanding of institutional investors. | ||

14

| Name |

Age |

Experience and Qualifications | ||

| Christie K. Chu Director since 2015

Board Committees: CHR, NCG |

52 | Ms. Chu currently serves as the President and CEO of CKC Accountancy Corporation, a tax, management and financial consulting firm. Ms. Chu brings 29 years of experience as a Certified Public Accountant, having served as a Supervising Audit Senior at KPMG, a Tax Senior Advisor at Ernst & Young, LLP, and a Staff Tax Accountant at Arthur Anderson & Co. She also served as a past President of the Korean American CPA Society of Southern California, where she has been a board member since 2004. She is currently the Treasurer of the national Korean American Society of CPAs. Ms. Chu earned her B.A. degree in business and economics from the University of California, Los Angeles.

Our Board believes that Ms. Chu should serve as a Director because of her extensive business and accounting background and experiences at several major accounting firms. Ms. Chu fully understands our core business customer and how to appeal to the next generation of business leaders. | ||

| Harry Chung Director since 2016

Board Committees: Audit |

47 | Mr. Chung brings nearly 25 years of experience in capital markets and financial services. He currently serves as the Chief Financial Officer of Breakwater Investment Management, a private investment firm based in Los Angeles, California specializing in direct debt and equity investments in leading lower middle market growth companies. Prior to his current role, Mr. Chung served as the Chief Financial Officer of Imperial Capital, a full-service investment bank offering comprehensive services to institutional investors and middle market companies. He also has held numerous leadership positions at Jefferies and Company, Inc., a global investment bank. Mr. Chung earned his B.S. degree in accounting from the University of Illinois in Champaign-Urbana.

Our Board believes that Mr. Chung should serve as a Director because Mr. Chung’s experience in capital markets and financial services is valuable to the Company. Mr. Chung’s experience as a Chief Financial Officer has provided him with financial expertise that is valuable in his role on the Audit and Asset Liability Management Committees. | ||

| C. G. Kum Director since 2013

Board Committees: RCP |

62 | Mr. Kum is the President and Chief Executive Officer of Hanmi and Hanmi Bank (June 2013 to present). Prior to his current role, he served as the President and Chief Executive Officer of First California Financial Group and its subsidiary First California Bank (September 1999 to May 2013), on the boards of First California Financial Group and First California Bank and as President of the board of directors of Community Bankers of California. He currently is a member of the board of directors of the California Bankers Association and has served on numerous boards of nonprofit organizations, including the United Way and Boys Scouts of America of Ventura County. Mr. Kum earned his undergraduate degree from the University of California, Berkeley and his M.B.A. degree from Pepperdine University.

Our Board believes that Mr. Kum should serve as a Director because Mr. Kum brings to the Board his extensive experience in the banking industry, his many successes in safely and profitably growing his organization, his business acumen and a good relationship with investors and regulators. Additionally, our Board felt that it is important to have the Chief Executive Officer of Hanmi serve as a Director in order to effectively execute our Board’s direction. | ||

15

| Name |

Age |

Experience and Qualifications | ||

| Joseph K. Rho Chairman of our Board; Director since 2000

Board Committees: Audit, CHR, NCG |

76 | Mr. Rho is retired and the current and former Chairman of the Boards of Hanmi and Hanmi Bank (2007 to present; 1999 to 2002). Prior to his current roles, he served as a Principal at J & S Investment (2002 to 2010), Partner at Korea Plaza LP (1987 to 2002), President and Owner of Joseph K. Rho Insurance Agency, board member of Finance Counsel of the Los Angeles Archdiocese and trustee of John of God Hospital. Mr. Rho received his bachelor’s degree from the College of Commerce, Seoul National University in South Korea.

In nominating Mr. Rho to serve as a Director and appointing him as Chairman of Hanmi and Hanmi Bank, our Board considered, in particular, the importance of the Chairman’s role in ensuring the effective role and operation of our Board. Our Board believes that Mr. Rho is an effective coordinator of multiple Hanmi Bank constituencies, including its stockholders, customers, officers, employees and regulators. In addition, our Board considered the critical role Mr. Rho played in assisting Hanmi in raising capital in 2009, 2010 and 2011. Lastly, in appointing Mr. Rho as Chairman, our Board considered that Mr. Rho is one of the largest individual stockholders, and as such, can speak to building long-term stockholder value and provide valuable insight into the concerns of stockholders and investors. | ||

| David L. Rosenblum Director since 2014

Board Committees: Audit, CHR, NCG, RCP |

64 | Mr. Rosenblum is retired and a former Senior Principal at Deloitte Consulting LLP (1979 to 2013), where he was the National Managing Director of Consulting Corporate Development and a key leader of the Strategy & Operations practice. Mr. Rosenblum currently serves as President of the Southern California Chapter of NACD, as a member of the board of the Library Foundation of Los Angeles, and as an advisor to a Los Angeles based private equity firm. Prior to his current roles, he served on the board of Deloitte Consulting LLP, was the Vice Chair of the Library Foundation of Los Angeles board, and was a member of the Wesleyan University board of trustees. Mr. Rosenblum earned his B.A. degree in economics from Wesleyan University and his M.B.A. degree in finance from the Wharton School at the University of Pennsylvania.

In nominating Mr. Rosenblum to serve as a Director, our Board considered Mr. Rosenblum’s strategic planning, mergers and acquisitions and corporate development experience in assisting financial institutions. In addition, as a board member of the Southern California Chapter of the NACD, we felt he could assist with best practices in running our Board. | ||

| Thomas J. Williams Director since 2016

Board Committees: Audit, RCP |

54 | Mr. Williams brings more than 30 years of experience in the bank regulatory and banking industry. Specifically, Mr. Williams brings extensive experience across a broad range of risk and lending activities. Prior to his retirement in May 2015, Mr. Williams served as Senior Vice President and Chief Risk Officer at BofI Federal Bank, overseeing all risk and control-related functions. Before that role, he served as Executive Director of Commercial Credit Review at Capital One and Director of Regulatory Relations at Silicon Valley Bank. Earlier in his career, Mr. Williams spent five years as Principal Examiner at the Federal Reserve Bank of San Francisco and ten years as a National Bank Examiner with the OCC. Mr. Williams earned his B.S. degree in economics from the University of South Dakota.

In nominating Mr. Williams to serve as a Director, our Board considered Mr. Williams’ broad based regulatory experience and expertise. In the present regulatory environment, we believe Mr. Williams’ strength in risk management is critical to assisting with the safe and sound operation of the Bank. | ||

16

| Name |

Age |

Experience and Qualifications | ||

| Michael Yang Director since 2016

Board Committees: CHR, NCG, RCP |

55 | Mr. Yang brings more than 30 years of experience as a successful entrepreneur and corporate executive. He currently is the Founder and CEO of MSY LLC, a private investment company with holdings in real estate and equities. Prior to his current role, Mr. Yang was Co-Founder and CEO of three technology start-ups that were sold to larger enterprises at significant premiums, including mySimon, Inc., which was acquired by CNET. Mr. Yang began his career at Xerox Corporation and Samsung Electronics, Co. Ltd., where he held positions of increasing responsibility in engineering, marketing and corporate development. Mr. Yang earned his B.S. degree in electrical engineering from the University of California, Berkeley, his M.S. degree in computer science from Columbia University and his M.B.A. degree from the Haas School of Business, University of California, Berkeley.

In nominating Mr. Yang to serve as a Director, our Board considered Mr. Yang’s executive experience in growing companies, as well as his strategic planning, mergers and acquisitions, corporate development and technological knowledge. | ||

The Director nominees receiving a majority of the votes cast, in uncontested elections, will be elected. In contested elections, the Company will use plurality voting with a resignation requirement. Each Director nominee has indicated their willingness to serve on our Board. Each proxy will be voted “for” the election of such Director nominees unless instructions are given on the proxy to vote “against” such Director nominees. In the event a Director nominee is unable to serve, your proxy will be voted for an alternative Director nominee as determined by our Board.

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE

“FOR” EACH OF THE EIGHT DIRECTOR NOMINEES

17

The following tables set forth information with respect to the executive officers of Company. All persons named below except Greg D. Kim, are considered named executive officers of Hanmi (our “NEOs”). None of the NEOs was hired pursuant to any arrangement or understanding. There are no family relationships among the Directors or the NEOs.

| Name |

Age |

Experience and Qualifications | ||

| C. G. Kum President and Chief Executive Officer; Director |

62 | For Mr. Kum’s experience and qualifications, see Board of Directors and Nominees on page 13. | ||

| Bonita Lee Senior Executive Vice President and Chief Operating Officer |

54 | Ms. Lee has served as Senior Executive Vice President and Chief Operating Officer of Hanmi and Hanmi Bank since August 2013. She was most recently the Senior Executive Vice President and Chief Operating Officer of BBCN Bank and BBCN Bancorp, Inc., where she was named Acting President and Chief Operating Officer from February 2013 to April 2013 and led an Executive Council carrying out the duties of the Chief Executive Officer during a management transition period at BBCN Bank. Prior to this, Ms. Lee served as director and Regional President of the Western Region for Shinhan Bank America from September 2008 to March 2009. Prior to joining Shinhan Bank America, she served as Executive Vice President and Chief Credit Officer at Nara Bank from April 2005 to September 2008, and as a Member of the Office of the President from March 2006 to September 2008. Ms. Lee also served Nara Bank as Senior Vice President and Chief Credit Officer from November 2003 to April 2005, Senior Vice President and Credit Administrator from February 2000 to October 2003 and Vice President and Credit Administrator from 1993 to 2000. Prior to joining Nara Bank, Ms. Lee held various lending positions with the former California Center Bank in Los Angeles from 1989 to 1993. | ||

| Romolo C. Santarosa Senior Executive Vice President and Chief Financial Officer |

60 | Mr. Santarosa has served as Senior Executive Vice President and Chief Financial Officer of Hanmi and Hanmi Bank since November 2015 and brings more than 26 years of experience in banking and financial services. Over his career, he has been responsible for leading and directing growth strategies, cost reduction and process improvement initiatives, technology implementations and capital management. Most recently, since June 2013, he was Executive Vice President and Chief Operating Officer at Opus Bank, where he was responsible for operational and support functions. Prior to this, Mr. Santarosa served as the Senior Executive Vice President, Chief Financial Officer and Chief Operating Officer at First California Financial Group, Inc. and its bank subsidiary, First California Bank (November 2002 to May 2013). Before 2002, Mr. Santarosa served in leadership positions with several financial institutions and was an Audit Senior Manager with Price Waterhouse. Mr. Santarosa earned his B.S. degree in accounting and a minor in mathematics from Ithaca College. | ||

18

| Name |

Age |

Experience and Qualifications | ||

| Min “Mike” Park Executive Vice President and Chief Credit Risk Officer |

54 | Mr. Park has served as Executive Vice President and Chief Credit Officer of Hanmi and Hanmi Bank since April 2015. In March 2107, Mr. Park’s title was changed to Chief Credit Risk Officer as a result of an organizational change to the credit administration division. He previously served as Executive Vice President and Deputy Chief Credit Officer of Hanmi Bank since August 2014 until his promotion. Prior to his tenure with Hanmi Bank, he was Senior Vice President and Manager of Commercial Business Credit at East West Bank for four years. Mr. Park has thirty years of banking experience. In the area of credit administration, Mr. Park served as a Senior Credit Administrator at Nara Bank from 2001 to October 2006 and at Hanmi Bank from July 2007 to December 2009. Mr. Park also held a Senior Corporate Banking Officer position at Sanwa Bank from 1997 to 2001. | ||

| Jean Lim Executive Vice President and Chief Risk Officer |

54 | Ms. Lim has served as Executive Vice President and Chief Risk Officer of Hanmi Bank since August 2013. She previously served as Senior Vice President and Chief Risk Officer of Hanmi Bank from August 2008 until her promotion. Prior to her role as Chief Risk Officer, she served as the Chief Compliance Officer of Hanmi Bank since August 2006 with oversight responsibility for compliance, BSA, as well as operations administration and human resources. From February 2002 to July 2006, Ms. Lim served as Senior Vice President and Chief Compliance Officer of Wilshire State Bank, where she built the BSA and Compliance Departments. Ms. Lim began her banking career at Hanmi Bank in 1984 after receiving her bachelor’s degree from Stanford University. | ||

| Greg D. Kim Executive Vice President and Chief Administrative Officer |

56 | Mr. Kim has served as Executive Vice President and Chief Administrative Officer of Hanmi Bank since August 2013. He previously served as Senior Vice President and Chief Administrative Officer since May 2005 until his promotion. From December 2000 to May 2005, Mr. Kim was Senior Vice President and Chief Operations Administrator for Wilshire State Bank, where he managed bank-wide operations for thirteen branches and was responsible for the bank’s successful core data processing conversion. Mr. Kim has over thirty years of experience in bank operations, having started his career as an operations supervisor in 1985 at Far West Savings and Loan Association. | ||

19

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis (“CD&A”) describes our compensation philosophy, methodologies and our current practices with respect to the remuneration programs for our NEOs. The compensation programs of our NEOs are established, evaluated and maintained by the CHR Committee of Hanmi’s Board of Directors (“CHRC”). The CHRC is comprised entirely of outside Directors that satisfy the NASDAQ listing requirements and relevant Code and SEC regulations on independence. The NEOs for the fiscal year ended December 31, 2016 are:

| • | C. G. Kum: President & Chief Executive Officer |

| • | Bonita Lee: Sr. Executive Vice President & Chief Operating Officer |

| • | Romolo C. Santarosa: Sr. Executive Vice President & Chief Financial Officer |

| • | Min “Mike” Park: Executive Vice President & Chief Credit Risk Officer |

| • | Jean Lim: Executive Vice President & Chief Risk Officer |

Executive Summary

2016 Financial and Strategic Highlights

Hanmi Financial Corporation completed another successful year in 2016 with meaningful increases in net income, expense reductions, growth in loans, along with a significant return to shareholders during the year. The Company also diversified through the acquisition of the Commercial Equipment Leasing division. Performance highlights are listed below.

|

Operating Results and Profitability(1) |

◾ Net Income was $56.5 million, up 5% from 2015 ◾ ROAA was 1.29% and ROAE was 10.89% ◾ Efficiency ratio was 55.83% in 2016 (excluding M&A costs)* compared to 57.92% in 2015 ◾ Deposits grew 8.5% to $3.81 billion in 2016 ◾ NPAs/Assets declined from 0.65% to 0.40% ◾ Completed acquisition and commencement of the new Commercial Equipment Leasing division

|

| Total Shareholder Return and Value Creation |

◾ Total Shareholder Return of 51.3% during 2016 ◾ Annual 2016 dividend of $0.66 per share, up 40% from $0.47 per share in 2015 ◾ Market Capitalization exceeded $1.0 Billion

|

(1) A reconciliation from GAAP to non-GAAP financial measures and other related information is included in Item 6 of the Company’s Annual Report on Form 10-K for the fiscal year-ended December 31, 2016.

20

Pay Program and 2016 Compensation Overview

The CHRC, composed entirely of independent directors, establishes and oversees the policies that create the foundation from which compensation practices are derived, including base salary, annual and long term incentives. Compensation plans are designed to encourage the achievement of strategic objectives and the creation of shareholder value, recognize individual performance, and allow the Company to effectively compete for, retain, and motivate talented executives critical to its success.

| Element

|

Type

|

2016 Highlights

| ||||||||||

| Base Salary | Fixed | When setting base salaries, the CHRC considers factors, such as, experience, responsibilities, job performance, and market compensation information. • The Company’s CEO, Mr. Kum, received a salary increase of 10.9% in 2016 after a review of his performance and in the context of his total compensation compared to the market. • Increases for the other NEOs ranged from 1.5% to 4.5%, with the exception of a 12.5% increase for Mr. Park related to accomplishments and his expanded role following his promotion to CCO in 2015. | ||||||||||

| Short-Term Cash Incentive Compensation |

Variable |

The Company maintains a performance-based annual cash incentive plan for the NEOs which is payable only if pre-established Company and individual performance objectives are achieved. For 2016, the CHRC established target incentive award opportunities for each NEO and assessed performance relative to established Company and individual goals to determined final awards. Resulting incentive payouts for each NEO are summarized in the table below, which reflect the Company’s strong performance for 2016.

| ||||||||||

|

Executive Level

|

Annual Cash Incentive (% of target)

|

Annual Cash Incentive (% of salary)

|

||||||||||

| CEO

|

93%

|

93%

|

||||||||||

| SEVPs

|

90% - 92%

|

45% - 46%

|

||||||||||

| EVPs

|

70% - 75%

|

21% - 23%

|

||||||||||

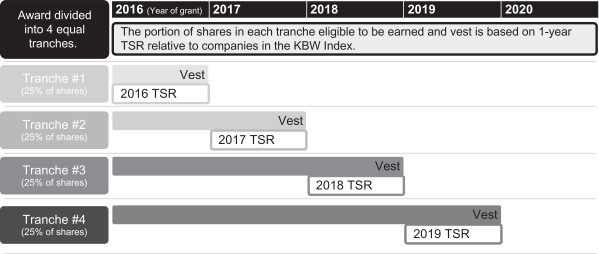

| Long-Term Incentive Awards (Equity) | The CHRC, in its discretion, determines equity grants for the NEOs after considering each executive’s performance, previous grant history, ownership level, comparison to our peer group, and retention needs. Four NEOs were granted equity in 2016. • Each of Mr. Kum and Ms. Lee received a performance-based restricted stock grant of 99,010 and 49,505 shares, respectively, with annual vesting of up to 25% in each of our 2016, 2017, 2018 and 2019 fiscal years, subject to the Company’s TSR performance relative to companies in the KBW Regional Banking Index for each respective year. No shares can be earned in any given year unless the Company’s TSR is positioned at or above the 50th percentile. • Mr. Park received 10,000 restricted shares in recognition of his performance in the CCO position since his promotion in 2015 and to more closely reflect the equity ownership of other NEOs. Shares vest in equal installments over three years. • Ms. Lim received 1,000 restricted shares in recognition of significant progress made in areas under her supervision. Shares vest in full in April 2017. | |||||||||||

Good Governance

The Company is committed to pay for performance and sound compensation and governance practices, including the following:

| • | A focus on variable compensation, evidenced by the fact that variable, performance-based compensation comprises a majority of our CEO’s pay. |

21

| • | Clawback policy applicable to all executive officers. |

| • | No excise tax gross-up payments. |

| • | Dividends on unvested shares of Performance Restricted Stock are subject to the same terms and vesting conditions as the Performance Restricted Stock. |

| • | No hedging or pledging transactions. |

| • | Annual compensation risk assessment. |

Compensation Objective and Philosophy

Based on our philosophy, the CHRC has instituted a compensation program for the Company’s NEOs which aims to align pay with performance. While the Company does not manage exclusively to market compensation data, market pay practices are considered alongside other factors, such as personal performance and experience. As pay varies with performance, we expect to pay near the 50th percentile of the peer group when performance is near the 50th percentile, near the 75th percentile compensation when performance is near the 75th percentile and below median when performance fails to meet minimum expectations or thresholds. As an example, the target award level associated with the 2016 grant of Performance Restricted Stock is earned when the Company’s TSR equals or exceeds the 75th percentile of the KBW Regional Banking Index.

The policies and underlying philosophy governing the Company’s executive compensation program, as endorsed by the CHRC and the Board of Directors, are designed to accomplish the following:

| • | Maintain a compensation program that is equitable in a competitive marketplace. |

| • | Provide opportunities that integrate pay with the Company’s annual and long-term performance goals. |

| • | Manage the risk profile of the Company by aligning risk mitigation within the performance of individual and Bank-wide goals. |

| • | Encourage achievement of strategic objectives and creation of shareholder value. |

| • | Recognize and reward individual initiative and achievements while managing risk. |

| • | Maintain an appropriate balance between base salary and short- and long-term incentive opportunities. |

| • | Allow the Company to compete for, retain, and motivate talented executives critical to its success consistent with its compensation philosophy. |

| • | Allow the Company to effectively engage institutional shareholders. Hanmi values our shareholders and works to have open two-way communication on all matters of importance. We proactively seek out our shareholders’ opinions, as appropriate. |

| • | Establish bonus structures subject to ‘clawback’ in the event of material misstatement on the part of the participating executives. |

Management Say-On-Pay Results

The CHRC evaluates the Company’s executive compensation programs in light of market conditions, shareholder views, and governance considerations, and makes changes as appropriate. As required by the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Company is required to permit a separate non-binding advisory shareholder vote to approve the compensation of its executives. At the 2016 annual meeting, shareholders approved the compensation of executive, with 97.2% of shareholder vote cast in favor of the advisory say-on-pay proposal. The CHRC considered this result to be a positive endorsement of the Company’s pay programs and practices. The Company will continue to monitor the level of support for each say-on-pay proposal.

Compensation Determination Process

Role of CHRC

The CHRC is responsible for the creation, implementation, and administration of the overall compensation program for the CEO and other senior executive officers. The CHRC takes into consideration the recommendations of the CEO for executives other than the CEO, as well as considering and making recommendations concerning compensation, benefit plans, and implementation of sound personnel policies and practices bank wide. The CHRC has responsibilities for, but not limited to, the following:

| • | Review the overall human resource development and compensation strategy for directors, the CEO, and senior officers. |

22

| • | Lead the Board in its annual review of executive management’s performance. |

| • | Evaluate CEO performance, set annual goals, and evaluate total compensation. |

| • | Evaluate compensation recommendations from the CEO for other NEOs. |

| • | Evaluate the annual executive incentive compensation plan regarding participation, goals, and budgetary considerations. |

| • | Review broad based incentive compensation plans to ensure compliance with regulations and laws. |

| • | Administer the Company’s long-term incentive program. |

The CHRC approves compensation for all NEOs other than the CEO. The CHRC discloses all compensation decisions related to the CEO to the full Board of Directors. The full Board has ultimate responsibility for determining the compensation of our CEO after considering the recommendation from the CHRC.

Role of Compensation Consultant

The Company retained the services of Compensation Advisors and McLagan in 2016 to assist the CHRC in performing its various duties within industry practice. Compensation Advisors helped facilitate the executive officer compensation process, including the creation of a compensation peer group for the purposes of comparing our CEO’s compensation to the market. Later in 2016, the CHRC retained McLagan to further assist in the evaluation of the Company’s compensation structure, which included a review of the peer group and the provision of market compensation information. Compensation Advisors and McLagan reported directly to the CHRC, who has the authority, in its sole discretion, to retain and terminate any adviser to assist in the performance of its duties. The CHRC determined that each of Compensation Advisors and McLagan are independent and that there is no conflict of interest resulting from retaining Compensation Advisors or McLagan during 2016 after taking into account the factors set forth in the SEC rules.

Role of Management