UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

HANMI FINANCIAL CORPORATION

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

HANMI FINANCIAL CORPORATION

900 Wilshire Boulevard, Suite 1250

Los Angeles, California 90017

(213) 382-2200

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS TO BE HELD ON MAY 26, 2021

TO THE STOCKHOLDERS OF HANMI FINANCIAL CORPORATION:

NOTICE IS HEREBY GIVEN that the 2021 annual meeting of stockholders (the “Annual Meeting”) of Hanmi Financial Corporation (“Hanmi,” the “Company,” “we,” “us” or “our”) will be held virtually, via live webcast, on Wednesday, May 26, 2021 at 10:30 a.m., Pacific Time, for the following purposes:

| 1. | To elect ten (10) directors to serve for terms expiring at the 2022 Annual Meeting of Stockholders and until their successors are elected and qualified; |

| 2. | To provide a non-binding advisory vote to approve the compensation of our Named Executive Officers (“Say-on-Pay” vote); |

| 3. | To approve the Hanmi Financial Corporation 2021 Equity Compensation Plan; |

| 4. | To ratify the appointment of Crowe LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021; and |

| 5. | To consider any other business properly brought before the meeting. |

Please note that this year’s meeting will be virtual in light of the continued restrictions on large gatherings. You will not be able to attend the Annual Meeting in person. A live webcast of the Annual Meeting will be available. Registration is required online at www.proxydocs.com/HAFC. Whether or not you plan to attend virtually, your vote is important and we encourage you to vote promptly by mail, telephone or via the Internet. If you attend the Annual Meeting virtually, you may vote online during the Annual Meeting if you so choose.

By Order of Our Board of Directors,

John J. Ahn

Chairman of the Board

Los Angeles, California

April 16, 2021

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 26, 2021:

This Proxy Statement and the 2020 Annual Report on Form 10-K are available electronically at www.hanmi.com by clicking on “Investor Relations” and then “Proxy Materials.”

|

VIRTUAL ANNUAL MEETING

The Annual Meeting will be held in a virtual-only meeting format, via live video webcast that will provide stockholders of record and beneficial owners as of the close of business on the March 31, 2021 record date with the ability to participate in the Annual Meeting, vote their shares electronically at the Annual Meeting via the virtual-only meeting platform and submit questions. The virtual-only meeting format this year is reflective of the continuing COVID-19 pandemic and current social distancing requirements, taking into consideration the concern for the health and safety of all stakeholders.

BENEFITS OF A VIRTUAL ANNUAL MEETING

The virtual-only meeting format will give stockholders the opportunity to exercise the same rights as if they had attended an in-person meeting and believe that these measures will enhance stockholder access and encourage participation and communication with our Board of Directors and management.

We believe a virtual-only meeting format facilitates stockholder attendance and participation by enabling all stockholders to participate fully and equally, and without cost, using an Internet-connected device from any location around the world. In addition, the virtual-only meeting format increases our ability to engage with all stockholders, regardless of size, resources or physical location.

ATTENDANCE AT THE VIRTUAL ANNUAL MEETING

Only stockholders of record and beneficial owners of shares of our common stock as of the close of business on March 31, 2021, the record date, may attend and participate in the Annual Meeting, including voting and asking questions during the virtual Annual Meeting. You will not be able to attend the Annual Meeting physically in person.

In order to attend the Annual Meeting, you must register at www.proxydocs.com/HAFC. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the Annual Meeting and to vote and submit questions during the Annual Meeting.

As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Notice of Internet Availability. If you are a beneficial owner of shares registered in the name of a broker, bank or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank or other nominee as part of the registration process.

On May 26, 2021, the day of the Annual Meeting, stockholders may begin to log in to the virtual-only Annual Meeting 15 minutes prior to the Annual Meeting. The Annual Meeting will begin promptly at 10:30 a.m., Pacific Time.

We will have technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting. If you encounter any difficulties accessing the virtual-only Annual Meeting platform, including any difficulties voting or submitting questions, you may call the technical support number that will be posted in your instructional email.

QUESTIONS AT THE VIRTUAL ANNUAL MEETING

Our virtual Annual Meeting will allow stockholders to submit questions before the Annual Meeting to be addressed during a designated question and answer period at the Annual Meeting. We will answer as many stockholder-submitted questions as time permits, and any questions that we are unable to address during the Annual Meeting will be answered following the meeting, with the exception of any questions that are irrelevant to the purpose of the Annual Meeting or our business or that contain inappropriate or derogatory references which are not in good taste. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

PLEASE NOTE YOU WILL NOT BE ABLE TO ATTEND THE ANNUAL MEETING IN PERSON.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 26, 2021

The Board of Directors (our “Board”) of Hanmi Financial Corporation is soliciting your proxy for use at the 2021 annual meeting of stockholders (the “Annual Meeting”) to be held virtually on Wednesday, May 26, 2021 at 10:30 a.m., Pacific Time, and at any adjournments or postponements thereof.

MATTERS TO BE CONSIDERED AND VOTE RECOMMENDATION

We are asking stockholders to vote on the following matters at the Annual Meeting of Stockholders:

| Proposal | Our Board’s Recommendation | |

| Item 1. Election of Directors (page 13) |

||

| The Board believes that the ten (10) director nominees possess the necessary qualifications to provide effective oversight of the Company’s business and quality advice and counsel to our management.

|

“FOR” each Director Nominee | |

| Item 2. Advisory Vote to Approve Executive Compensation (“Say-on-Pay” Vote) (page 47) |

||

| The Company seeks a non-binding advisory vote from its stockholders to approve the compensation of its Named Executive Officers (“NEOs”) as described in the Compensation Discussion and Analysis and Executive Compensation sections beginning on page 18. Your vote is advisory. Thus it will not be binding upon our Board and may not be construed as overruling any decision by our Board. However, the Compensation and Human Resources Committee will take into account the outcome when considering future executive compensation arrangements.

|

“FOR” | |

| Item 3. Approval of the 2021 Equity Compensation Plan

The Company seeks approval of the Hanmi Financial Corporation 2021 Equity Compensation Plan described under the Proposal No. 3, Approval of the Hanmi Financial Corporation 2021 Equity Compensation Plan section beginning on page 48, and as attached in its entirety as Annex A to this Proxy Statement. The Hanmi Financial Corporation 2021 Equity Compensation Plan provides flexibility to our Board to offer equity incentives to employees, consultants and non-employee directors as part of their recruitment and retention.

|

“FOR” | |

| Item 4. Ratification of Auditors (page 58) |

||

| The Audit Committee and the Board believe that the continued retention of Crowe LLP to serve as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2021 is in the best interests of the Company and its stockholders. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee’s selection of the independent registered public accounting firm. If the stockholders do not ratify the selection, the Audit Committee will reconsider whether to retain Crowe LLP. Even if the selection is ratified, the Audit Committee may, in its discretion, appoint a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our and our stockholders’ best interests.

|

“FOR” | |

|

|

Annual Meeting Proxy Statement 2021 |

1 |

PROXY STATEMENT SUMMARY

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND THE ANNUAL MEETING

| Q: | Why did I receive this Proxy Statement? |

| A: | You received this Proxy Statement and the enclosed proxy card because we are soliciting your vote at the Annual Meeting. As a stockholder of record of our common stock, you are invited to virtually attend the Annual Meeting, and are entitled and requested to vote on the proposals described in this Proxy Statement. This Proxy Statement summarizes the information you need to know to cast an informed vote at the Annual Meeting. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card by mail. You may also vote by telephone or via the Internet. |

We will begin posting this Proxy Statement, notice of the Annual Meeting, and the enclosed proxy card on or about April 16, 2021 to all stockholders entitled to vote.

| Q: | Who is entitled to vote and how many votes do I have? |

| A: | All stockholders of our common stock as of the close of business on March 31, 2021, and only those stockholders, will be entitled to vote at the Annual Meeting. You have one vote for each share of our common stock you owned as of the close of business on the record date. |

| Q: | How many shares are eligible to be voted? |

| A: | As of March 31, 2021, 30,682,533 shares of our common stock were outstanding. Each outstanding share of our common stock will entitle its holder to one vote on each matter to be voted on at the Annual Meeting. |

| Q: | What is the difference between holding shares as a “record” holder and in “street name”? |

| A: | • |

Record Holders: If your shares of common stock are registered directly in your name on our stock records, you are considered the stockholder of record, or the “record holder” of those shares. As the record holder, you have the right to vote your shares online at the virtual Annual Meeting or by proxy at the Annual Meeting. |

| • |

Street Name Holders: If your shares of common stock are held in an account at a brokerage firm, bank, or other similar entity, then you are the beneficial owner of shares held in “street name.” The entity holding your account is considered the record holder for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct this entity on how to vote the shares held in your account. However, as described below, you may not vote these shares online at the virtual Annual Meeting unless you obtain a legal proxy from the entity that holds your shares giving you the right to vote the shares online at the virtual Annual Meeting. |

| Q: | What is a broker non-vote? |

| A: | Current regulations restrict the ability of your brokerage firm, bank or similar entity to vote your shares in the election of directors and other matters on a discretionary basis. Thus, if you hold your shares in street name and you do not instruct your bank or broker how to vote in the election of directors, for the advisory vote regarding the compensation of our NEOs or for the approval of the Hanmi Financial Corporation 2021 Equity Compensation Plan, no votes will be cast on your behalf. These are referred to as broker non-votes. Your bank or broker does, however, continue to have discretion to vote any shares for which you do not provide instructions on how to vote on the ratification of the appointment of our independent registered public accounting firm (Proposal 4 of this Proxy Statement). |

| Q: | What is the required quorum at the Annual Meeting? |

| A: | A quorum for the transaction of business at the Annual Meeting requires the presence, online or by proxy, of the holders of a majority of all shares entitled to vote at a meeting of stockholders. Abstentions and broker non-votes are treated as being present for purposes of establishing a quorum. |

|

2 |

|

Annual Meeting Proxy Statement 2021 |

PROXY STATEMENT SUMMARY

| Q: | What vote is required to approve each proposal at the Annual Meeting? |

| A: | 1. | Election of Directors. Directors are elected by a majority of votes cast in uncontested elections. In order to be elected to the Board, the votes cast “for” the nominee must exceed the number of votes cast “against” the nominee. |

| 2. | Advisory Vote on the Compensation of our NEOs. Approval, on an advisory basis, of the compensation of our NEOs requires the affirmative vote of a majority of the shares present online or represented by proxy. |

| 3. | Approval of Hanmi Financial Corporation 2021 Equity Compensation Plan. Approval of the Hanmi Financial Corporation 2021 Equity Compensation Plan requires the affirmative vote of a majority of the shares present online or represented by proxy. |

| 4. | Ratification of Selection of Auditors. Ratification of the selection of Crowe LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020 requires the affirmative vote of a majority of the shares present online or represented by proxy. |

| Q: | What is the effect of broker non-votes and abstentions? |

| A: | Abstentions and broker non-votes will be counted for determining a quorum. Your broker, however, will not be entitled to vote without your instruction on the election of directors, the advisory (non-binding) proposal to approve the compensation of our NEOs and the proposal to approve the Hanmi Financial Corporation 2021 Equity Compensation Plan. |

Your broker will be authorized to vote your shares on the ratification of our independent registered public accounting firm even if it does not receive instructions from you, and accordingly, broker non-votes will have no effect on this proposal.

Abstentions will have no effect on the election of directors in Proposal 1, but will have the effect of a vote “AGAINST” the advisory (non-binding) vote to approve the compensation of NEOs, the vote to approve the Hanmi Financial Corporation 2021 Equity Compensation Plan, and the ratification of our independent registered public accounting firm in Proposals 2, 3 and 4, respectively.

| Q: | How can I vote my shares? |

| A: | If you hold your shares of common stock in your own name and not through a broker or another nominee, you may vote your shares of common stock by the following methods, subject to compliance with the applicable cutoff times and deadlines described below: |

|

|

By Internet You can vote on the website using the internet address printed on your proxy card. Internet voting is available 24 hours a day until 11:59 p.m., Pacific Time, on May 25, 2021. If you vote via the Internet, you do not need to return your proxy card.

|

|

By Telephone You can vote by dialing the toll-free number printed on your proxy card. Telephone voting is available 24 hours a day until 11:59 p.m., Pacific Time, on May 25, 2021. If you vote by telephone, you do not need to return your proxy card.

| |||

|

|

By Mail You can vote by mail by signing, dating and returning the proxy card in the postage-paid envelope provided to you. Proxy cards sent by mail must be received by May 25, 2021.

|

|

In Person By attending the Annual Meeting virtually and voting through www.proxydocs.com/HAFC. To attend the Annual Meeting and vote your shares, you must register for the Annual Meeting and provide the control number located on your Notice or proxy card.

| |||

|

|

Annual Meeting Proxy Statement 2021 |

3 |

PROXY STATEMENT SUMMARY

| Whichever of these methods you select to transmit your instructions, the proxy holders will vote your shares of common stock in accordance with your instructions. If you give a proxy without specific voting instructions, your proxy will be voted by the proxy holders “FOR” each of the director nominees named in this Proxy Statement, “FOR” the approval, on an advisory basis, of the compensation of our NEOs, “FOR” the approval of our 2021 Equity Compensation Plan, “FOR” the ratification of our independent registered public accounting firm, and at the proxy holders’ discretion on such other matters, if any, as may properly come before the Annual Meeting (including any proposal to adjourn the Annual Meeting). |

| Q: | Can I change or revoke my vote after I return my proxy card? |

| A: | You may revoke a proxy at any time before the vote is taken at the Annual Meeting by advising our Corporate Secretary in writing before the vote at the Annual Meeting is taken, by submitting a properly executed proxy of a later date by mail, telephone or via the Internet, or by attending the Annual Meeting virtually and voting online. Attendance at the Annual Meeting will not by itself constitute revocation of a proxy. Any filing with the Corporate Secretary should be addressed to Hanmi Financial Corporation, 900 Wilshire Boulevard, Suite 1250, Los Angeles, California 90017. |

| Q: | How do I attend the virtual Annual Meeting? |

| A: | To ensure the health and well-being of our stockholders, employees and Board during the COVID-19 pandemic, we have determined that the Annual Meeting will be held solely in a virtual meeting format via the Internet. You will be able to attend and participate in the Annual Meeting online by visiting and registering at www.proxydocs.com/HAFC. See “Virtual Annual Meeting” above following the Notice of 2021 Annual Meeting of Stockholders for further information. |

| Q: | How will proxies be solicited? |

| A: | In addition to soliciting proxies by mail, our officers, directors, and employees, without receiving any additional compensation, may solicit proxies by telephone, fax, in person, or by other means. Arrangements may also be made with brokerage firms and other custodians, nominees, and fiduciaries to forward proxy solicitation materials to the beneficial owners of our common stock held of record by such persons, and we will reimburse such brokerage firms, custodians, nominees, and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection therewith. |

| Q: | Will any other matters be considered at the Annual Meeting? |

| A: | We are not aware of any matter to be presented at the Annual Meeting other than the proposals discussed in this Proxy Statement. If other matters are properly presented at the Annual Meeting, then the persons named as proxies will have the authority to vote all properly executed proxies in accordance with the direction of our Board, or, if no such direction is given, in accordance with the judgment of the persons holding such proxies on any such matter, including any proposal to adjourn or postpone the Annual Meeting. |

| Q: | Are there any rules regarding admission to the Annual Meeting? |

| A: | Yes. You are entitled to attend the Annual Meeting only if you were a stockholder as of the record date, or you hold a valid legal proxy naming you to act for one of our stockholders on the record date. To attend the virtual, live webcast, please follow the directions regarding registering online at www.proxydocs.com/HAFC. |

| Q: | Is my vote confidential? |

| A: | Your vote will not be disclosed either within the Company or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation and certification of the vote, or to facilitate a successful proxy solicitation. |

| Q: | Where can I find the voting results of the Annual Meeting? |

| A: | We intend to disclose voting results on a Current Report on Form 8-K to be filed with the U.S. Securities and Exchange Commission (the “SEC”) within four business days after the Annual Meeting. |

|

4 |

|

Annual Meeting Proxy Statement 2021 |

CORPORATE GOVERNANCE AND BOARD MATTERS

The following table provides summary information about our directors as of March 31, 2021.

|

|

|

|

|

Committee Memberships | ||||||||||

| Name | Age | Director Since |

Principal Occupation | A | CHR | NCG | RCP | |||||||

| John J. Ahn* (Chairman) |

56 | 2014 | CEO of WhiteHawk Capital Partners |

|

| |||||||||

| Kiho Choi* |

65 | 2018 | Managing Partner of CKP, LLP |

|

|

| ||||||||

| Christie K. Chu* |

56 | 2015 | President & CEO of CKC Accountancy Corporation |

|

|

|

||||||||

| Harry H. Chung*FE |

51 | 2016 | Chief Operating Officer &

Chief Financial Officer of |

|

|

|||||||||

| Scott R. Diehl* |

59 | 2018 | Retired (former Group Head of Global

Capital Solutions |

|

|

| ||||||||

| Bonita I. Lee |

58 | 2019 | President & CEO of Hanmi and Hanmi Bank |

| ||||||||||

| David L. Rosenblum*FE (Vice Chairman) |

68 | 2014 | Retired (former Senior Principal of Deloitte Consulting LLP) |

|

|

| ||||||||

| Thomas J. Williams* |

58 | 2016 | Retired (former Senior Vice President & Chief Risk Officer of BofI Federal Bank) |

|

| |||||||||

| Michael M. Yang* |

59 | 2016 | Founder & CEO of Michael Yang Capital Management, LLC |

|

|

|||||||||

| Gideon Yu* |

50 | 2021 |

Co-owner of San Francisco 49ers |

|

| |||||||||

Chairperson

Chairperson

Member

Member

Committees: A = Audit; CHR = Compensation and Human Resources; NCG = Nominating and Corporate Governance;

RCP = Risk, Compliance and Planning

* = Independent Director; FE = Audit Committee Financial Expert

Hanmi is committed to sound corporate governance principles and maintains formal Corporate Governance Guidelines and a Code of Business Conduct and Ethics for employees, executive officers and directors. These Corporate Governance Guidelines, as well as Hanmi’s Code of Business Conduct and Ethics and other governance matters of interest to investors, are available through Hanmi’s website at www.hanmi.com on the “Investor Relations” page. Any amendments or waivers applicable to an executive officer or director to the Code of Business Conduct and Ethics will also be posted on Hanmi’s website.

The NCG Committee has primary oversight of our efforts to be a responsible corporate citizen in our communities. In order to address opportunities and challenges arising from Environmental, Social and Governance (“ESG”) matters, the NCG Committee has designated an interdisciplinary subcommittee of directors and officers to thoughtfully discuss how Hanmi directly impacts our stakeholders – our valued employees, customers, and communities. The ESG Subcommittee has published an Environmental, Social and Governance Report, available on our “Investor Relations” page, which seeks to provide insight into our continuing efforts to stand in partnership with our various stakeholders.

Our common stock is listed on the Nasdaq Global Select Market (“Nasdaq”). Under Nasdaq rules, independent directors must comprise a majority of a listed company’s board of directors. In addition, Nasdaq requires that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees must be independent. Under these rules, a director is independent only if the board of directors of a company makes an affirmative determination that the director has no material relationship with the company that would impair his or her independence.

|

|

Annual Meeting Proxy Statement 2021 |

5 |

CORPORATE GOVERNANCE AND BOARD MATTERS

Our Board has undertaken a review of the independence of each director in accordance with Nasdaq rules and the requirements of the Securities and Exchange Commission (the “SEC”). Based on this review, our Board has determined that all of its directors are independent under the applicable listing standards of Nasdaq, except for Bonita I. Lee, our President and Chief Executive Officer. In making this determination, our Board considered the relationships that each non-employee director has with us and all other facts and circumstances that the Board deemed relevant in determining their independence.

During the fiscal year ended December 31, 2020, our Board held ten (10) joint board meetings with the Board of Hanmi Bank (the “Bank”), the wholly-owned subsidiary of Hanmi, and one (1) special board meeting, for a total of eleven (11) board meetings. All Board members were present for more than 75% of the aggregate number of meetings of our Board and the committees on which he or she served. Hanmi’s policy is to encourage all directors to attend all Annual and Special Meetings of Stockholders. Hanmi’s 2020 Annual Meeting of Stockholders was attended by all directors.

Our Board has four (4) standing committees: the Audit Committee, the Compensation and Human Resources Committee (the “CHR Committee”), the Nominating and Corporate Governance Committee (the “NCG Committee”), and the Risk, Compliance and Planning Committee (the “RCP Committee”). Each committee is governed by a charter, each of which is available through Hanmi’s website at www.hanmi.com on the “Investor Relations” page. All members of each committee are independent in accordance with applicable Nasdaq listing requirements.

Audit Committee

The Audit Committee reports to the Board and is responsible for overseeing and monitoring financial accounting and reporting, the system of internal controls established by management, and our audit process and policies. Through its oversight of the audit function, the Audit Committee ensures compliance with laws and regulations.

As outlined in its charter, the Audit Committee has the following responsibilities, among others:

| • | Assist the Board in fulfilling its oversight responsibilities for the financial reporting process, the system of internal controls, the audit process, and Hanmi’s process for monitoring compliance with laws and regulations and the code of conduct; |

| • | Review the unaudited quarterly and audited annual financial statements; |

| • | Review the adequacy of internal control systems and financial reporting procedures with management and the independent auditor; |

| • | Review and approve the general scope of the annual audit and the fees charged by the independent registered public accounting firm; |

| • | Appoint the independent registered public accounting firm and meet with them to discuss the results of the annual audit and the independence of the independent registered public accounting firm; and |

| • | Review and approve the general scope of the annual internal audit plan and associated fees. |

The Audit Committee held eleven (11) meetings during the fiscal year ended December 31, 2020.

Compensation and Human Resources Committee

The CHR Committee assists the Board by overseeing the compensation of Hanmi’s executive officers, including Hanmi’s Chief Executive Officer, as well as administering Hanmi’s compensation plans. As outlined in its charter, the CHR Committee has the following responsibilities, among others:

| • | Review and approve the Company’s overall compensation philosophy, plans, policies and programs as it relates to directors, the Chief Executive Officer and executive officers; |

|

6 |

|

Annual Meeting Proxy Statement 2021 |

CORPORATE GOVERNANCE AND BOARD MATTERS

| • | Approve directors overall compensation, policies and programs; |

| • | Oversee management development and management succession planning; |

| • | Review and approve executive officers’ separation plan and employment and severance agreements; and |

| • | Lead the Board in its annual review of executive management’s performance as it relates to metrics for bonus payouts. |

The CHR Committee also sets the compensation policy of the Company as more fully described below under Executive Compensation – Compensation Discussion and Analysis. To evaluate and administer the compensation programs of our NEOs, the CHR Committee meets at least four times a year or more frequently as necessary. The CHR Committee is also authorized to retain outside consultants to assist it in determining executive officer compensation.

Each member of the CHR Committee is a “non-employee director” (as defined in Section 16 of the Securities Exchange Act of 1934 (the “Exchange Act”)). The CHR Committee held eight (8) meetings during the fiscal year ended December 31, 2020.

Nominating and Corporate Governance Committee

As described in its charter, the NCG Committee assists the Board as follows:

| • | Identify individuals qualified to become directors; |

| • | Recommend to the Board nominees for the Board and its committees; |

| • | Develop, recommend, implement and monitor adherence to a set of corporate governance principles applicable to Hanmi; |

| • | Monitor the process to determine the effectiveness of the Board and its committees; and |

| • | Monitor the activities of the ESG Sub-Committee regarding its efforts to oversee the Company’s ongoing commitment to environmental performance, health and safety, corporate social responsibility, corporate governance, sustainability, and other public policy matters relevant to the Company. |

See Consideration of Director Nominees below for additional information regarding the director nomination process. The NCG Committee is authorized to retain outside consultants to assist it in fulfilling any of its duties, including Board and director assessment and Board evaluation.

The NCG Committee held five (5) meetings during the fiscal year ended December 31, 2020.

Risk, Compliance and Planning Committee

As outlined in its charter, the RCP Committee provides oversight of the enterprise risk management framework, including the strategies, policies, procedures and systems established by management to identify, assess, measure and manage the significant risks facing the Company. It also oversees strategic planning generally and recommends new lines of business and the budget to our Board.

The RCP Committee held six (6) meetings during the fiscal year ended December 31, 2020.

The Board is committed to having a sound governance structure that promotes the best interest of all Hanmi stockholders. Our leadership structure includes the following principles:

| • | We believe that yearly elections hold the directors of the Board more accountable to our stockholders. |

| • | All of the directors are independent, except for Bonita I. Lee, our President and Chief Executive Officer. The Board has affirmatively determined that the other nine (9) directors nominated for re-election are independent under applicable SEC and Nasdaq corporate governance rules. |

|

|

Annual Meeting Proxy Statement 2021 |

7 |

CORPORATE GOVERNANCE AND BOARD MATTERS

| • | We have separated the positions of the Chairman of the Board and Chief Executive Officer in the Company’s Bylaws to ensure the independence of the Chairman. The Chairman focuses on board oversight responsibilities, strategic planning and mentoring company officers. The Chairman also periodically represents the Bank at public functions. The Chief Executive Officer focuses on the development and execution of Company strategies. |

| • | We also maintain a Vice Chairman of the Board, who is an independent director exercising all the powers and discharging all the duties of the Chairman of the Board in such circumstances before a Chairman is appointed or a sitting Chairman is absent or becomes disabled. Director David L. Rosenblum serves as Vice Chairman. |

| • | We believe the Board structure serves the interests of the stockholders by balancing the practicalities of running the Company with the need for director accountability. |

BOARD’S ROLE IN RISK OVERSIGHT

The Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organization objectives in the areas of strategy, operations, reporting and compliance. The Board recognizes that these objectives are important to improve and sustain long-term performance and stockholder value. A fundamental part of risk management is not only identifying the risks the Company faces and the steps management is taking to manage those risks, but also determining what constitutes the appropriate level of risk based upon the Company’s activities and risk appetite.

The RCP Committee goes through an extensive review of the enterprise risk assessment on a quarterly basis with the guidance of the RCP Committee Chairperson and the Bank’s Chief Risk Officer. The risk assessment is also reviewed by the Board quarterly. In this process, risk is assessed throughout the Company by focusing on the following ten (10) areas: credit, liquidity, market, operations, compliance, human resources / legal, reputational, strategic, information technology and security, and capital. Risks that simultaneously affect different parts of the Company are identified, and an interrelated assessment is made.

While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the RCP Committee assists the Board in fulfilling its oversight responsibility with respect to regulatory, compliance, operational risk and enterprise risk management issues that affect the Company and works closely with the Company’s legal and risk departments. The RCP Committee also oversees risks associated with the short- and long-term direction of the Company and ensures ongoing Board involvement and oversight of the Company’s strategic plan. The Audit Committee helps the Board monitor financial risk and internal controls from a risk-based perspective, and oversees compliance and the annual audit plan. Reports from the Company’s internal audit department are also reviewed by the Audit Committee.

In overseeing compensation, the CHR Committee ensures that incentives encourage a conservative level of risk-taking behavior consistent with the Company’s business strategy and in compliance with all laws and the Interagency Guidance on Incentive Compensation. The NCG Committee oversees the Code of Business Conduct and Ethics and conducts an annual assessment of corporate governance policies and any potential risk associated with governance and related party matters.

The Bank also has two board committees that oversee risk. The Loan and Credit Policy Committee (the “LCP Committee”) oversees credit risk by identifying, monitoring, and controlling repayment risk associated with the Bank’s lending activities. The Asset Liability Management Committee oversees the implementation of an effective process for managing the Bank’s interest rate, liquidity, and similar market risks relating to the Bank’s balance sheet and associated activities.

The Board is committed to protecting personal and financial information, and devotes a significant amount of time to information security and cybersecurity risks. Members of the RCP Committee receive regular reports from the Chief Risk Officer related to information technology and information security to fulfill its role of assisting management in identifying, assessing, measuring and managing certain risks facing the Company.

The Bank’s Information Security Officer meets at least quarterly with the RCP Committee to provide updates on cybersecurity and information security risk, and the Board annually reviews and approves our Information

|

8 |

|

Annual Meeting Proxy Statement 2021 |

CORPORATE GOVERNANCE AND BOARD MATTERS

Security Program and Information Security Policy. The RCP Committee engages in key decisions to help set the direction for information security strategy, as well as to understand and prioritize information security capabilities and associated risk remediation. The Executive IT Steering Committee is an internal Bank committee created to ensure that members of executive management overseeing multiple business units actively understand information security protections and associated risks. The Information Security Officer presents quarterly cybersecurity reports to the Executive IT Steering Committee. In addition, the Bank purchases cyber liability and other insurance to protect against cyber security risks.

CONSIDERATION OF DIRECTOR NOMINEES

The NCG Committee believes that the Board should encompass a broad range of talent, skill, knowledge, experience, diversity and expertise enabling it to provide sound guidance with respect to Hanmi’s operations and interests. In addition to considering a candidate’s background and accomplishments, candidates are reviewed in the context of the current composition of the Board and the evolving needs of Hanmi’s business. Our Board has identified certain core competencies that its directors should possess, including: broad experience in business, finance, accounting, risk management, strategic planning, marketing or administration; familiarity with national and international business matters; familiarity with the Company’s industry; and the ability to understand the Company’s business. In addition to possessing one or more of these core competencies, the members of our Board should have and demonstrate personal qualities such as integrity, leadership, community prominence and a strong reputation. The experience, skills and qualifications contributed by each of our directors should diversify and complement the core competencies of our collective Board.

The NCG Committee seeks directors with a strong reputation and experience in areas relevant to the strategy and operation of Hanmi’s business, particularly industries and growth segments that Hanmi operates in, such as the banking and financial services industry, as well as key geographic markets and customer segments. The NCG Committee annually reviews the individual skills and characteristics of the directors, as well as the composition of the Board as a whole. This assessment includes a consideration of independence, diversity, age, skills, expertise and industry background in the context of the needs of the Board and Hanmi.

The Board conducts an annual evaluation to determine whether the Board and its committees are functioning effectively. The NCG Committee oversees the evaluation method and criteria for the Board’s annual evaluation of the composition, competence and performance of the Board and its committees. The NCG Committee may retain consultants or advisors to assess the performance and effectiveness of the Board, its committees and each individual director.

The results of any self-evaluations, peer evaluations or evaluations by any consultant or advisor are submitted to the Board. The Board then takes appropriate action based on the Board’s assessment and performance evaluations. The Board and director evaluation process considers the best interests of Hanmi, its Board, employees, customers and stockholders. The assessment includes director succession planning and expected future needs of the Board and the Company, so as to ensure that Board effectiveness is not diminished during periods of transition.

Board Diversity

The Corporate Governance Guidelines require the NCG Committee to consider diversity when reviewing the qualifications of candidates to the Board. The NCG Committee seeks to nominate members with diverse backgrounds, skills, professional and industry experience, and other personal qualities, attributes and perspectives that will help ensure a strong and effective governing body that, as a whole, reflects the current and anticipated needs of our Board and Company and can provide oversight responsibility to our stockholders.

Stockholder Recommendations

The NCG Committee will consider stockholder recommendations for director nominees. Such notices must be submitted in writing to Hanmi Financial Corporation, 900 Wilshire Boulevard, Suite 1250, Los Angeles, California 90017, Attention: Corporate Secretary. Such notices also must comply with other requirements set

|

|

Annual Meeting Proxy Statement 2021 |

9 |

CORPORATE GOVERNANCE AND BOARD MATTERS

forth in the Company’s Bylaws and be received by the Corporate Secretary within the deadlines provided below under Stockholder Proposals for the 2022 Annual Meeting.

In identifying and evaluating director candidates, the NCG Committee will solicit and receive recommendations, and review qualifications of potential director candidates. The NCG Committee may also use search firms to identify director candidates when necessary. To enable the NCG Committee to effectively evaluate director candidates, the NCG Committee may also conduct appropriate inquiries into the backgrounds and qualifications of director candidates, including reference checks. As stated above, the NCG Committee will consider director candidates recommended by stockholders utilizing the same criteria as candidates identified by the NCG Committee.

Our Board has a process for stockholders to send communications to directors. Hanmi’s stockholders and interested parties may send communications to our Board by writing to our Board at Hanmi Financial Corporation, 900 Wilshire Boulevard, Suite 1250, Los Angeles, California 90017, Attention: Board of Directors. All such communications will be relayed directly to our Board. Any interested party wishing to communicate directly with Hanmi’s independent directors regarding any matter may send such communication in writing to Hanmi’s independent directors at Hanmi Financial Corporation, 900 Wilshire Boulevard, Suite 1250, Los Angeles, California 90017, Attention: Chairman of the Board. Any interested party wishing to communicate directly with the Audit Committee regarding any matter, including any accounting, internal accounting controls, or auditing matter, may submit such communication in writing to Hanmi Financial Corporation, 900 Wilshire Boulevard, Suite 1250, Los Angeles, California 90017, Attention: Chairperson of the Audit Committee.

Correspondence may be submitted on an anonymous basis and submissions of complaints or concerns will not be traced. Confidentiality is a priority, and all communications will be treated confidentially to the fullest extent possible. For submissions that are not anonymous, the sender may be contacted in order to confirm information or to obtain additional information. The Company reserves the right not to forward to Board members any abusive, threatening or otherwise inappropriate materials.

The following table sets forth certain information regarding compensation paid to persons who served as outside (or non-employee) directors of Hanmi for the fiscal year ended December 31, 2020:

| Name | Fees Earned or Paid in Cash(2) |

|

Stock Awards(3) |

|

Total | |||||||||||||||

| John J. Ahn |

$ | 91,416 |

|

|

|

$ | 38,504 |

|

|

|

$ | 129,920 | ||||||||

| Kiho Choi |

$ | 68,751 |

|

|

|

$ | 38,504 |

|

|

|

$ | 107,255 | ||||||||

| Christie K. Chu |

$ | 67,749 |

|

|

|

$ | 38,504 |

|

|

|

$ | 106,253 | ||||||||

| Harry H. Chung |

$ | 69,583 |

|

|

|

$ | 38,504 |

|

|

|

$ | 108,087 | ||||||||

| Scott R. Diehl |

$ | 71,749 |

|

|

|

$ | 38,504 |

|

|

|

$ | 110,253 | ||||||||

| David L. Rosenblum |

$ | 70,250 |

|

|

|

$ | 38,504 |

|

|

|

$ | 108,754 | ||||||||

| Thomas J. Williams |

$ | 71,251 |

|

|

|

$ | 38,504 |

|

|

|

$ | 109,755 | ||||||||

| Michael M. Yang |

$ | 60,417 |

|

|

|

$ | 38,504 |

|

|

|

$ | 98,921 | ||||||||

| Gideon Yu(1) |

$ | — |

|

|

|

$ | — |

|

|

|

$ | — | ||||||||

| (1) | Mr. Yu joined the Boards in 2021 and thus did not receive any compensation in 2020. |

| (2) | Until September 2020, each director who is not an employee of Hanmi (an outside director) was paid a base cash retainer of $48,000 per year for service on the Board, with additional annual committee service retainers of $5,000 (for Audit and LCP Committees), $4,000 (for CHR Committee), and $2,500 (for NCG, RCP and Asset Liability Management Committees). Chairs |

|

10 |

|

Annual Meeting Proxy Statement 2021 |

CORPORATE GOVERNANCE AND BOARD MATTERS

| received an additional annual fee of $24,000 (Chairman of the Board), $12,000 (for Audit and LCP Committees), and $10,000 (for CHR, NCG, RCPC and Asset Liability Management Committees). Since October 2020, each outside director is paid a cash base retainer of $38,500, with annual committee service retainers of $5,000 (for Audit, and LCP Committees), $4,000 (for CHR Committee), and $2,500 (for NCG, RCP and Asset Liability Management Committees). Chairs receive an additional annual fee of $24,000 (Chairman of the Board), $10,000 (for Audit Committee), $8,000 (for LCP Committee), and $9,000 (for CHR, NCG, RCPC and Asset Liability Management Committees). Fees are paid on a monthly basis. |

| (3) | On September 23, 2020, the Company granted 5,053 shares of restricted stock to each non-employee director, which vest one year from the grant date. The grant date fair value is based on the number of shares granted and the closing price of the Company’s stock on the grant date, which was $7.62 in accordance with FASB ASC Topic 718. At December 31, 2020, each of the directors had 5,053 restricted shares outstanding and no stock options outstanding. |

NON-EMPLOYEE DIRECTOR COMPENSATION POLICY

Following the annual review of the results of the 2020 director compensation review conducted by the Company’s independent compensation consultants, the Board of Directors unanimously approved a reduction of their compensation to better align with the new peer group.

Commencing in October 2020, the Company reduced its non-employee director annual cash retainer from $48,000 to $38,500 per year for service on the Board. In addition, members of committees receive additional annual cash retainers as follows:

| Audit Committee |

$ |

5,000 |

| |

| LCP Committee |

$ |

5,000 |

| |

| CHR Committee |

$ |

4,000 |

| |

| NCG Committee |

$ |

2,500 |

| |

| RCP Committee |

$ |

2,500 |

| |

| Asset Liability Management Committee |

$ |

2,500 |

|

The Chairman of the Board receives an additional annual cash retainer of $24,000, and the chairs of each committee receive an additional annual cash retainer, which was adjusted in October 2020 as follows:

|

|

Adjusted |

| ||||||

| Audit Committee |

$ |

12,000 |

|

$ |

10,000 |

| ||

| LCP Committee |

$ |

12,000 |

|

$ |

8,000 |

| ||

| CHR Committee |

$ |

10,000 |

|

$ |

9,000 |

| ||

| NCG Committee |

$ |

10,000 |

|

$ |

9,000 |

| ||

| RCP Committee |

$ |

10,000 |

|

$ |

9,000 |

| ||

| Asset Liability Management Committee |

$ |

10,000 |

|

$ |

9,000 |

|

In addition, the directors receive an annual grant of restricted stock in the second quarter of the year. For 2020, the value of the restricted stock grant was reduced to approximately $38,500, in line with market compensation data.

DIRECTOR STOCK OWNERSHIP GUIDELINES

Each director is encouraged to own shares of common stock of the Company at a level that demonstrates a meaningful commitment to the Company and the Bank, and to better align the director’s interests with the Company’s stockholders. A director’s stock ownership will be one of the factors considered in deciding whether to nominate or appoint a director to the Board of Directors of the Company.

All directors should acquire shares of the Company’s common stock valued at three times (3x) the yearly retainer. Directors are expected to meet the ownership standards set forth herein within five years from April 25, 2018, the date the guidelines were approved by the CHR Committee, or from their first day as a

|

|

Annual Meeting Proxy Statement 2021 |

11 |

CORPORATE GOVERNANCE AND BOARD MATTERS

director, whichever is later. Once the guidelines are met, if the stock price decreases, the director will not be required to acquire additional shares. In addition to the stock ownership guidelines described above, each director who acquires shares of Company common stock through the exercise or vesting of a stock option, stock appreciation right or restricted stock will be required to retain fifty percent (50%) of the “net” shares acquired (net of tax impact that the exercise or vesting has on the individual) for at least twelve (12) months following the date of exercise or vesting, or such earlier time if the individual ceases to be a member of the Board as a result of death, disability, illness, resignation, termination or other reason.

As of December 31, 2020, all directors have met the stock ownership guidelines with the exception of Director Gideon Yu, who joined our Board in 2021 and has until January 27, 2026 to meet this requirement.

|

12 |

|

Annual Meeting Proxy Statement 2021 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

Stockholders are being asked to elect ten (10) director nominees for a one-year term. Subject to their earlier resignation or retirement, directors elected at the Annual Meeting will serve until the 2022 annual meeting of stockholders and until their successors are elected and qualified. Our Board believes that each director nominee satisfies our director qualification standards and accordingly nominates: John J. Ahn, Kiho Choi, Christie K. Chu, Harry H. Chung, Scott R. Diehl, Bonita I. Lee, David L. Rosenblum, Thomas J. Williams, Michael M. Yang and Gideon Yu.

BOARD OF DIRECTORS AND NOMINEES

Hanmi’s directors have a mix of experience and backgrounds, including those that started a business and grew it into a substantial entity, to holding senior executive positions in large, complex organizations to those who held positions of importance within regulatory agencies. In those positions, they have also gained experience in core management skills, such as strategic and financial planning, public company financial reporting, corporate governance, risk management, leadership development and, importantly, a deep understanding of our customers.

In addition to each director nominee’s professional experience summarized in the table below, our Board believes that each director nominee has other key attributes that are important to an effective Board of Directors, such as, integrity and demonstrated high ethical standards; sound judgment; analytical skills; the ability to engage management and each other in a constructive and collaborative fashion; diversity of origin, background, experience, and thought; and the commitment to devote significant time and energy to service on our Board and its committees.

None of the director nominees was nominated pursuant to any arrangement or understanding. There are no family relationships among the director nominees or the executive officers of Hanmi.

The following tables set forth information with respect to the director nominees.

| John J. Ahn

Director since: 2014

Age: 56

Chairman of our Board

Board Committees: NCG, RCP

|

Experience Mr. Ahn brings more than 30 years of experience in capital markets and financial advisory services to Hanmi. He is currently the founder and Chief Executive Officer of WhiteHawk Capital Partners, a middle market direct lending fund and SEC Registered Investment Advisor. Prior to his role at WhiteHawk, Mr. Ahn served as Chief Executive Officer of Great American Capital Partners, LLC, an SEC Registered Investment Advisor that originated and underwrote senior secured loans across a wide array of industries from 2015 to 2020. From 2004 to 2015, Mr. Ahn served as President of B. Riley & Co., a full-service investment banking firm providing corporate finance, research, sales and trading services, and asset management to corporate and institutional clients. Prior to joining B. Riley, Mr. Ahn held numerous leadership positions in the investment banking and sales and trading sectors. He currently serves on the Board of Directors of Keppel Pacific Oak, an office REIT with properties located in key growth markets in the U.S. and traded on the Singapore Exchange (SGX: CMOU). Mr. Ahn earned his B.A. degree in economics from Williams College.

Qualifications Our Board believes that Mr. Ahn should serve as a director because of his extensive experience and background in investment banking, finance, strategic planning and his strong understanding of institutional investors. | |||||

|

|

Annual Meeting Proxy Statement 2021 |

13 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

| Kiho Choi

Director since: 2018

Age: 65

Board Committees: Audit, NCG, RCP

|

Experience Mr. Choi currently serves as the Managing Partner and is a Founding Partner of CKP, LLP, the largest Korean-American full-service accounting firm in the U.S., providing services to private companies and U.S. subsidiaries of Korean companies. Mr. Choi has more than 30 years of assurance and business advisory experience and specializes in serving middle-market companies in banking, health care, manufacturing and wholesale distribution. He also served as a past President of the Korean American CPA Society of Southern California, and as an Advisory Member to the Korea Trade Investment Promotion Agency of Los Angeles. He is a member of the American Institute of Certified Public Accountants and a member of the California Society of Certified Public Accountants. Mr. Choi is currently an independent director of the Board of Directors of Netlist, Inc., an information technology company, and was formerly a member of the Board of Directors of BBCN Bancorp, Inc. and BBCN Bank. Mr. Choi earned his B.S. and M.S. degrees in accounting from the University of Illinois at Chicago.

Qualifications Our Board believes that Mr. Choi should serve as a director because of his significant accounting and financial expertise, as well as executive leadership experience and strong relationships within the Korean-American business community. | |||||

| Christie K. Chu

Director since: 2015

Age: 56

Board Committees: Audit, CHR, NCG

|

Experience Ms. Chu currently serves as the founder, President and CEO of CKC Accountancy Corporation, a tax management and financial consulting firm. Ms. Chu brings over 30 years of experience as a Certified Public Accountant, the last 24 years at CKC Accountancy Corp, and previous to that at KPMG, Ernst & Young, LLP, and Arthur Anderson & Co. She also served as a past President of the Korean American CPA Society of Southern California, where she has been a board member since 2004. Ms. Chu is a member and past Treasurer of the National Korean American Society of CPAs. She is also a current member of the California Society of Certified Public Accountants. She is a board member and Treasurer of the National Association of Corporate Directors .. Ms. Chu earned her B.A. degree in business and economics from the University of California, Los Angeles. She also completed the Director Education and Certification Program at the UCLA Anderson School of Management.

Qualifications Our Board believes that Ms. Chu should serve as a director because of her extensive business and accounting background and experiences at several major accounting firms. Ms. Chu fully understands our core business customer and how to appeal to the next generation of business leaders and the Korean-American business community. | |||||

| Harry H. Chung

Director since: 2016

Age: 51

Board Committees: Audit, CHR

|

Experience Mr. Chung brings over 25 years of experience in capital markets and financial services. He has served as the Chief Operating Officer and Chief Financial Officer of WhiteHawk Capital Partners since 2020. Previously, Mr. Chung served as Chief Operating Officer and Chief Financial Officer of Great American Capital Partners, LLC from 2017 to 2020. Prior to that role, Mr. Chung served as Chief Financial Officer of Breakwater Investment Management, a private investment firm based in Los Angeles, California specializing in direct debt and equity investments in leading lower middle market growth companies. Mr. Chung also served as the Chief Financial Officer of Imperial Capital, a full-service investment bank offering comprehensive services to institutional investors and middle market companies. He also has held numerous leadership positions at Jefferies and Company, Inc., a global investment bank. Mr. Chung earned his B.S. degree in accounting from the University of Illinois at Urbana-Champaign.

Qualifications Our Board believes that Mr. Chung should serve as a director because of his experience in capital markets and financial services, including strategic planning and corporate development. Mr. Chung’s experience as a Chief Financial Officer has provided him with financial expertise that is valuable in his role as chair of the Audit Committee. | |||||

|

14 |

|

Annual Meeting Proxy Statement 2021 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

| Scott R. Diehl

Director since: 2018

Age: 59

Board Committees: CHR, NCG, RCP

|

Experience Mr. Diehl brings over 30 years of experience from the banking and financial industry, having spent his entire career at Wells Fargo Capital Finance and its predecessor corporation, Foothill Capital Corporation. Prior to his retirement in 2017, Mr. Diehl was a Group Head overseeing the Factoring, Receivable Securitization and Supply Chain Finance lending units. Prior to this role, his Industries Group oversaw the Lender Finance, Technology Finance, Healthcare Finance and Supply Chain Finance business units. Mr. Diehl also served in various other leadership positions related to asset-based lending and commercial finance for Wells Fargo Finance and Foothill Capital Corporation. Mr. Diehl earned his B.A. degree in history from Brown University.

Qualifications Our Board believes that Mr. Diehl should serve as a director because his experience in specialty lending is valuable to the Company. Mr. Diehl’s broad banking experience as an executive at Wells Fargo, and its predecessor, will enable him to positively contribute to the growth of Hanmi and its product lines. | |||||

| Bonita I. Lee

Director since: April 2019

Age: 58

Board Committees: RCP

|

Experience Ms. Lee has served as the President and Chief Executive Officer since May 2019. Prior to her promotion to Chief Executive Officer, she served as Senior Executive Vice President and Chief Operating Officer of Hanmi and Hanmi Bank since August 2013. She was promoted to serve as our President on June 15, 2018. She was previously the Senior Executive Vice President and Chief Operating Officer of BBCN Bank and BBCN Bancorp, Inc., where she was named Acting President and Chief Operating Officer from February 2013 to April 2013 and led an Executive Council carrying out the duties of the Chief Executive Officer during a management transition period at BBCN Bank. Prior to this, Ms. Lee served as director and Regional President of the Western Region for Shinhan Bank America from September 2008 to March 2009. Prior to joining Shinhan Bank America, she served as Executive Vice President and Chief Credit Officer at Nara Bank from April 2005 to September 2008, and as a Member of the Office of the President from March 2006 to September 2008. Ms. Lee earned her B.S. degree in business administration from the University of Illinois at Chicago and completed an executive program in corporate strategy from the University of Chicago Booth School of Business.

Qualifications Our Board believes that Ms. Lee should serve as a director because she brings to the Board her extensive experience in the Korean-American banking industry, her many successes in safely and profitably growing her organization, her business acumen and good relationship with the investors in the Korean-American community. | |||||

| David L. Rosenblum

Director since: 2014

Age: 68

Vice Chairman of our Board

Board Committees: Audit, CHR, RCP

|

Experience Mr. Rosenblum is retired and a former Senior Principal at Deloitte Consulting LLP (1979 to 2013), where he was the National Managing Director of Consulting Corporate Development and a key leader of the Strategy and Operations practice. Mr. Rosenblum is a member of Sage Partners, LLC, a strategic advisory firm, and is also an operating partner of Interlock Equity LP, a new private equity firm focused on mid- and lower-mid market business, technology services and healthcare firms. Mr. Rosenblum currently serves as Chairman of the Pacific Southwest Chapter of National Association of Corporate Directors (“NACD”) and serves as a director of the Library Foundation of Los Angeles. Prior to his current roles, he served on the board of Deloitte Consulting LLP and was a member of the Wesleyan University board of trustees. Mr. Rosenblum earned his B.A. degree in economics from Wesleyan University and his M.B.A. degree in finance from the Wharton School at the University of Pennsylvania.

Qualifications Our Board believes that Mr. Rosenblum should serve as a director because of his strategic planning, mergers and acquisitions, and corporate development experience in assisting financial institutions. In addition, as the Chairman of the Pacific Southwest Chapter of the NACD, he brings deep knowledge regarding best practices in running our Board. | |||||

|

|

Annual Meeting Proxy Statement 2021 |

15 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

| Thomas J. Williams

Director since: 2016

Age: 58

Board Committees: Audit, RCP

|

Experience Mr. Williams brings over 30 years of experience in bank regulation and the broader banking industry. Specifically, Mr. Williams brings extensive experience across a broad range of risk and lending activities. Prior to his retirement in May 2015, Mr. Williams served as Senior Vice President and Chief Risk Officer at BofI Federal Bank, overseeing all risk and control-related functions. Before that role, he served as Executive Director of Commercial Credit Review at Capital One and Director of Regulatory Relations at Silicon Valley Bank. Earlier in his career, Mr. Williams spent five years as Principal Examiner at the Federal Reserve Bank of San Francisco and ten years as a National Bank Examiner with the Office of the Comptroller of the Currency. Mr. Williams earned his B.S. degree in economics from the University of South Dakota.

Qualifications Our Board believes that Mr. Williams should serve as a director because of his broad-based regulatory experience and expertise. In the present regulatory environment, we believe Mr. Williams’ strength in risk management is critical to assisting with the safe and sound operation of the Bank. | |||||

| Michael M. Yang

Director since: 2016

Age: 59

Board Committees: CHR, NCG

|

Experience Mr. Yang brings over 30 years of experience as a successful technology entrepreneur and investor. He is currently the Founder and CEO of Michael Yang Capital Management, LLC, an investment management company that invests in public equities of disruptive technology companies. Prior to his current role, Mr. Yang was Co-Founder and CEO of three technology start-ups that were sold to larger enterprises at significant premiums, including mySimon.com Inc., which was acquired by CNET. Mr. Yang began his career at Xerox Corporation and Samsung Electronics Co., Ltd., where he held positions of increasing responsibility in engineering, marketing and corporate development. Mr. Yang earned his B.S. degree in electrical engineering from the University of California, Berkeley, his M.S. degree in computer science from Columbia University and his M.B.A. degree from the Haas School of Business, University of California, Berkeley.

Qualifications Our Board believes that Mr. Yang should serve as a director because of his executive experience in growing companies, as well as his strategic planning, mergers and acquisitions, corporate development and technological knowledge. | |||||

| Gideon Yu

Director since: 2021

Age: 50

Board Committees: CHR, RCP

|

Experience Mr. Yu has more than 20 years of experience as a finance executive, investor and advisor specializing in venture capital, technology and media companies. Mr. Yu is currently a co-owner and the former president of the San Francisco 49ers. Mr. Yu holds the distinction of being the first President of color of any team in the history of the National Football League. Mr. Yu previously served as the Chief Financial Officer of both Facebook and YouTube. Mr. Yu was also a General Partner at Khosla Ventures, a venture capital firm focused on early-stage technology companies, where he led the firm’s investment in Square, Inc., a leading fintech company, and was its first outside board member. Mr. Yu currently serves on the Board of Trustees of the Monterey Bay Aquarium and the Council of Korean Americans and is on the National Leadership Council of the Navy SEAL Foundation. Mr. Yu earned his B.S. degree in Industrial Engineering and Engineering Management from Stanford University and received his M.B.A. degree from Harvard Business School.

Qualifications Our Board believes that Mr. Yu should serve as a director because of his executive experience in the finance and technology sectors, as well as his strategic views on digital growth opportunities. We believe Mr. Yu’s experience with managing strategy and risk in a high-growth environment will positively contribute to the development of Hanmi as a leader among regional community banks. | |||||

|

16 |

|

Annual Meeting Proxy Statement 2021 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

The director nominees receiving a majority of the votes cast, in uncontested elections, will be elected. If an incumbent director is not elected by a majority of votes cast, in an uncontested election, the incumbent director will tender his or her resignation to the Board for consideration. In contested elections, the Company will use plurality voting. Each director nominee has indicated their willingness to serve on our Board. Each proxy will be voted “FOR” the election of such director nominees unless instructions are given on the proxy to vote “AGAINST” such director nominees. In the event a director nominee is unable to serve, your proxy will be voted for an alternative director nominee as determined by our Board. Alternatively, the Board of Directors may adopt a resolution to reduce the size of the Board of Directors. At this time, our Board knows of no reason why any of the nominees might be unable to serve.

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE

“FOR” EACH OF THE TEN DIRECTOR NOMINEES

|

|

Annual Meeting Proxy Statement 2021 |

17 |

The following tables set forth information with respect to the executive officers of the Company. None of the executive officers of the Company were hired pursuant to any arrangement or understanding. There are no family relationships among the directors or the executive officers.

|

Name

|

Age

|

Experience and Qualifications

| ||||

| Bonita I. Lee President and Chief Executive Officer (“CEO”); Director

|

|

58 |

|

For Ms. Lee’s experience and qualifications, see Board of Directors and Nominees on page 15. | ||

|

Romolo C. Santarosa Senior Executive Vice President and Chief Financial Officer (“CFO”) |

|

64 |

|

Mr. Santarosa has served as Senior Executive Vice President and Chief Financial Officer of Hanmi and Hanmi Bank since November 2015, after joining in June 2015, and brings more than 28 years of experience in banking and financial services. Over his career, he has been responsible for leading and directing growth strategies, cost reduction and process improvement initiatives, technology implementations and capital management. Prior to his tenure with the Hanmi and Hanmi Bank, he was Executive Vice President and Chief Operating Officer at Opus Bank for three years, Senior Executive Vice President and Chief Financial Officer and Chief Operating Officer at First California Financial Group, Inc. and its bank subsidiary for eleven years, and served in leadership positions with several West Coast and East Coast financial institutions. Mr. Santarosa is a Certified Public Accountant (inactive) in New York and Connecticut and was an Audit Senior Manager with Price Waterhouse. Mr. Santarosa earned his B.S. degree in accounting and a minor in mathematics from Ithaca College.

| ||

|

Anthony Kim Executive Vice President and Chief Banking Officer (“CBO”)

|

|

53 |

|

Mr. Kim has served as Executive Vice President and Chief Banking Officer of Hanmi Bank since June 2019. He joined Hanmi Bank as Executive Vice President and Chief Lending Officer in September 2013, and served in that capacity until his promotion. Prior to his tenure with Hanmi Bank, he was Senior Vice President and District Manager at BBCN Bank for five years. Mr. Kim has over 25 years of banking experience, with significant expertise in commercial and retail banking. Mr. Kim earned his B.A. degree in business administration from California State University and is a graduate of Pacific Coast Banking School. | ||

|

18 |

|

Annual Meeting Proxy Statement 2021 |

EXECUTIVE OFFICERS

|

Name

|

Age

|

Experience and Qualifications

| ||||

|

Matthew D. Fuhr Executive Vice President and Chief Credit Administration Officer (“CCAO”)

|

|

58 |

|

Mr. Fuhr has served as Executive Vice President and Chief Credit Administration Officer of Hanmi Bank since March 2017. He previously served as Senior Vice President and Deputy Chief Credit Officer from June 2015 until his promotion. Prior to his tenure with Hanmi Bank, he was Senior Vice President and Credit Administrator at Pacific Western Bank for 13 years. Earlier in his career, Mr. Fuhr served as a Commissioned Bank Examiner with the Federal Deposit Insurance Corporation. Mr. Fuhr earned his B.A. degree in business administration with emphasis in finance from the University of Northern Colorado. | ||

|

Min Park Executive Vice President and Chief Credit Risk Officer (“CCRO”)

|

|

58 |

|

Mr. Park has served as Executive Vice President and Chief Credit Risk Officer of Hanmi Bank since March 2017. He previously served as Executive Vice President and Chief Credit Officer from April 2015 until the organizational change of the credit administration division. Mr. Park joined Hanmi Bank as Executive Vice President and Deputy Chief Credit Officer in August 2014. Prior to his tenure with Hanmi Bank, he was Senior Vice President and Manager of Commercial Business Credit at East West Bank for four years. Mr. Park has over 35 years of banking experience. Mr. Park earned his B.A. degree in business administration from Kansas State University.

| ||

|

Michael Du Senior Vice President and Chief Risk Officer (“CRO”)

|

|

48 |

|

Mr. Du has served as Chief Risk Officer of Hanmi Bank since November 2019. He previously served as the Director of Internal Audit for Pacific Western Bank from June 2017 to November 2019 and Vice President of Risk Management for Unify Federal Financial Credit Union from May 2015 to June 2017. Mr. Du served in the United States Air Force/Reserves for over 25 years, and retired with the rank of Command Chief Master Sergeant. He is a Certified Public Accountant and holds certifications in multiple risk and audit disciplines. Mr. Du earned his B.S. degree in accounting and a M.S. in business administration from California State Universities, and completed an executive management program at the University of California, Los Angeles. | ||

|

Patrick Carr Senior Vice President and Chief Accounting Officer

|

|

48 |

|

Mr. Carr has served as Chief Accounting Officer of Hanmi Bank since September 2020. He previously worked for over 13 years at JP Morgan Chase, most recently serving as Managing Director, Consumer Risk Analytics. In that role, he focused on consumer financial planning and analysis. Mr. Carr is a certified public accountant and previously worked for Arthur Anderson and Ernst & Young for nine years. Mr. Carr earned his B.S. degree in business administration in accountancy from John Carroll University. | ||

|

|

Annual Meeting Proxy Statement 2021 |

19 |

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis (“CD&A”) describes our compensation philosophy, methodologies and our current practices with respect to the remuneration programs for our NEOs. The compensation programs of our NEOs are established, evaluated and maintained by the CHR Committee. The CHR Committee is comprised entirely of outside directors that satisfy the Nasdaq listing requirements and SEC regulations on independence. The NEOs for the fiscal year ended December 31, 2020 are:

| • | Bonita I. Lee: President & Chief Executive Officer |

| • | Romolo C. Santarosa: Senior EVP & Chief Financial Officer |

| • | Anthony Kim: EVP & Chief Banking Officer |

| • | Matthew D. Fuhr: EVP & Chief Credit Administration Officer |

| • | Min Park: EVP & Chief Credit Risk Officer |

2020 Financial and Strategic Highlights

2020 was an unprecedented year because of the COVID-19 pandemic and its impact on the overall business and economic environment. Despite these significant headwinds, the management team was still able to achieve key operational metrics and performance achievements highlighted below.

| Operating Results, Profitability and Value Creation |

• Net income was $42.2 million, which included $45.5 million of credit loss expense primarily attributed to the pandemic

• Loans and leases receivable were $4.88 billion, which included $308 million of loans under the Paycheck Protection Program (PPP)

• Deposits were $5.28 billion, up 12.3% from 2019, reflecting depositors seeking safety for their funds as well as proceeds from PPP loans and other government assistance programs

• Efficiency ratio of 53.1%

• Nonperforming loans and leases were $83.0 million, and the allowance to loans and leases was 1.85%, which reflect the effect of the pandemic

• Annual 2020 dividend of $0.52 per share, down from $0.96 per share in 2019 due to efforts to conserve capital during the pandemic

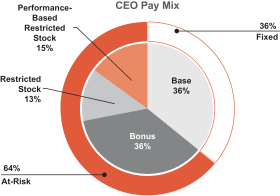

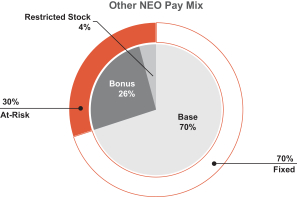

|